The Bulls Score!!!

Key Weekly Performance Stats:

- S&P 500: +1.59% (New High)

- Nasdaq 100: +1.86% (New High)

- Russel 2000: +0.24%

- Bitcoin: +4.91%

Last week, makets rallied hard to new all-time highs. Investors gain confidence by leaning into the Fed’s expected rate cuts. The S&P 500 gained about 1.6%, marking steady weekly gains for the th straight time. The Nasdaq tacked on 1.9%, mainly being lifted by the Mag 7. Both indices hit new record highs -- Congrats too all who played!

Under the surface, the economic backdrop was less rosy. August CPI showed a 0.4% monthly jump, pushing annual inflation to 2.7% and stirring early stagflation worries. Labor data revisions erased more than 900,000 jobs from prior estimates, and consumer sentiment soured in September as layoff fears grew. While recession chatter picked up, most analysts still see 2025 avoiding a deep downturn, with easier Fed policy expected to cushion growth.

Looking ahead to next well, all eyes are on the Fed’s FOMC meeting, where a 25-basis-point cut is already priced in, with hints of two more by year-end. Retail sales and housing data will help gauge consumer health, while rate decisions out of Japan and the U.K. could sway global sentiment. On the earnings front, Kroger and other names will give fresh reads on household spending. Lower rates may keep stocks climbing, but soft labor signals remain the wild card. As always, stick to your trading plan and respet your risk. Godspeed.

Thicc Kohrs

P.S. The official Goonie Discord is live! (FREE Access w/ code GOONIE: https://bit.ly/GoonieGroup)

Earnings

Monday, Sept 15th

Evening: Dave & Buster's

Tuesday, Sept 16th

None

Wednesday, Sept 17th

Evening: Cracker Barrel

Thursday, Sept 18th

Morning: Darden Restaurants

Evening: FedEx

Friday, Sept 19th

None

Market Events

Monday, Sept 15th

None

Tuesday, Sept 16th

08:30 AM ET Retail Sales MoM & YoY (Aug)

Wednesday, Sept 17th

05:00 AM ET Eurozone CPI MoM & YoY (Aug)

02:00 PM ET Fed Interest Rate Decision

02:30 PM ET Fed Chair Powell Speech

Thursday, Sept 18th

08:30 AM ET Initial Jobless Claims

08:30 AM ET Philadelphia Fed Manufacturing Index (Sep)

10:00 AM ET US Leading Economic Indicators

Friday, Sept 19th

ALL DAY Monthly OPEX

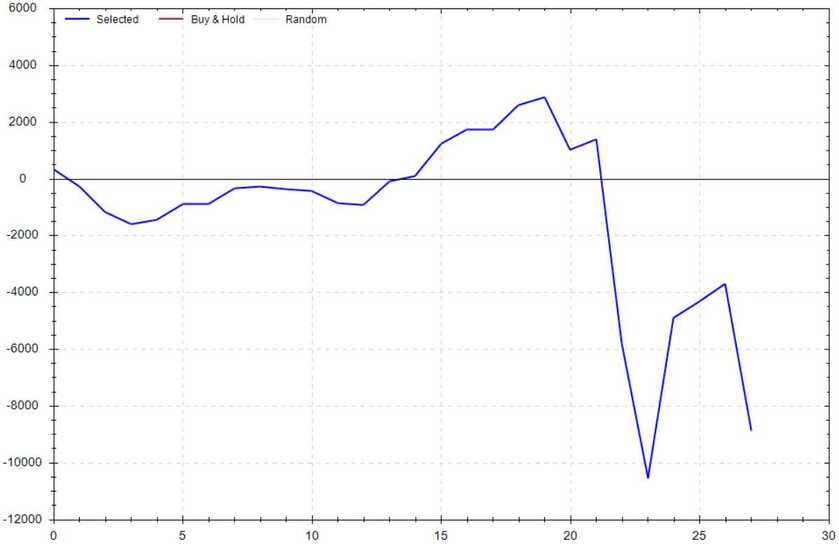

Seasonality Update

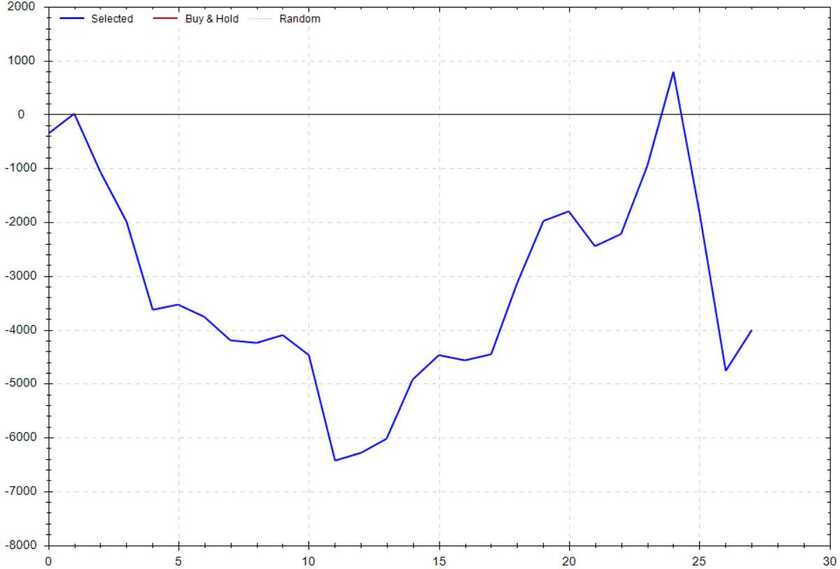

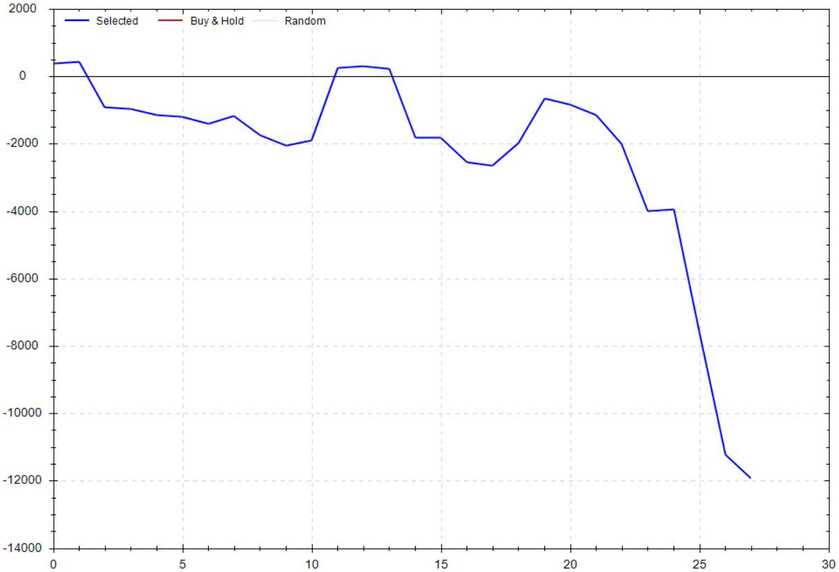

S&P 500 Seasonal Bias (Monday, Sept 15th)

- Bull Win Percentage: 54%

- Profit Factor: 0.70

- Bias: Neutral

Equity Curve -->

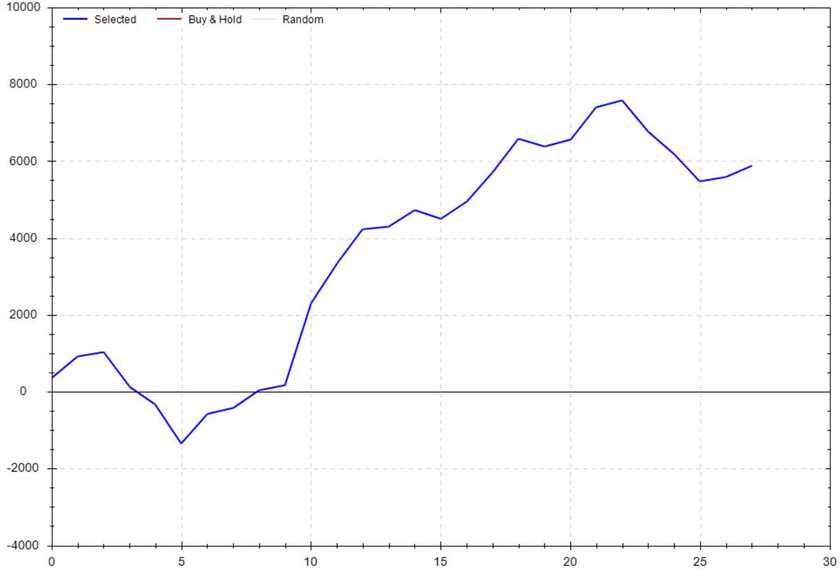

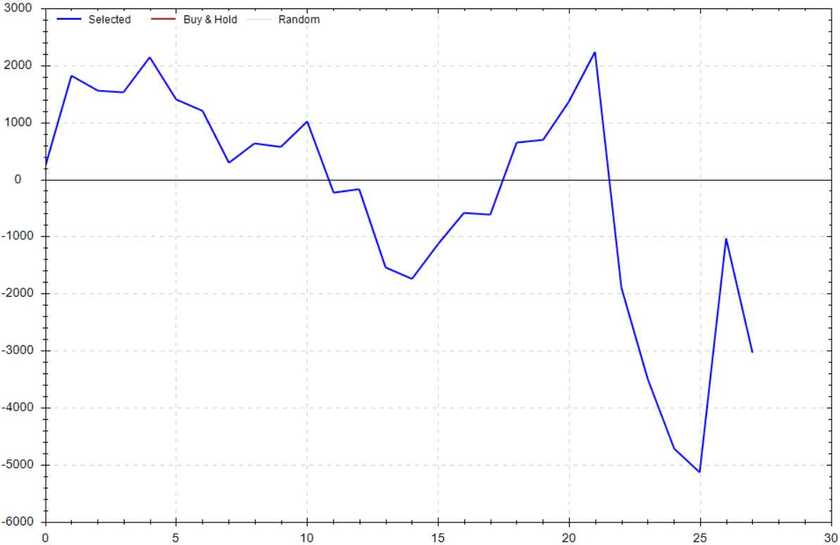

S&P 500 Seasonal Bias (Tuesday, Sept 16th)

- Bull Win Percentage: 72%

- Profit Factor: 2.20

- Bias: Bullish

Equity Curve -->

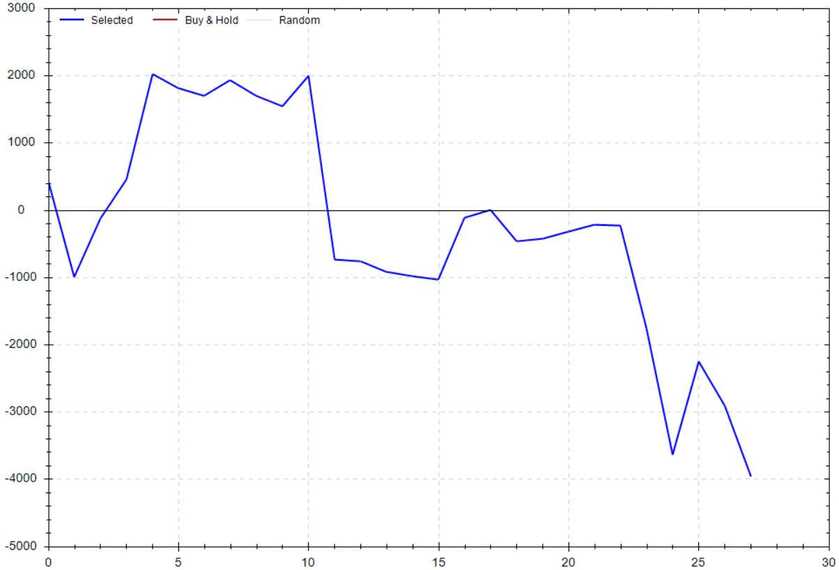

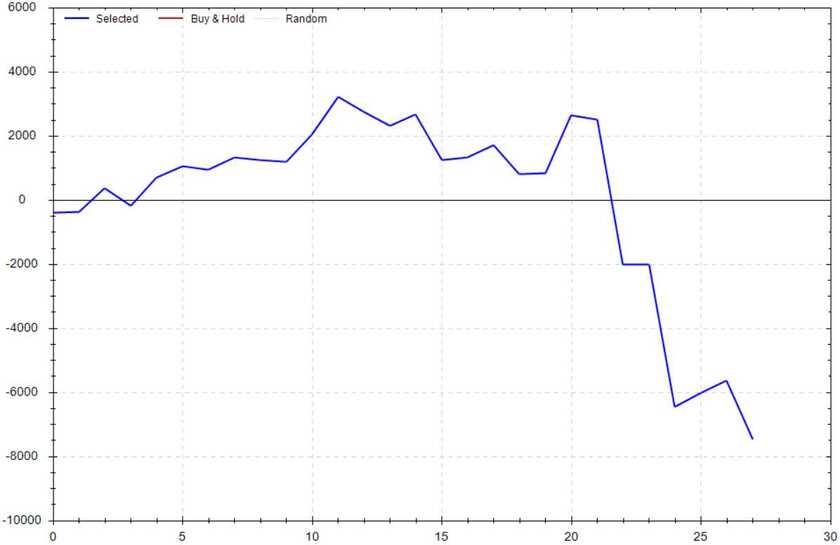

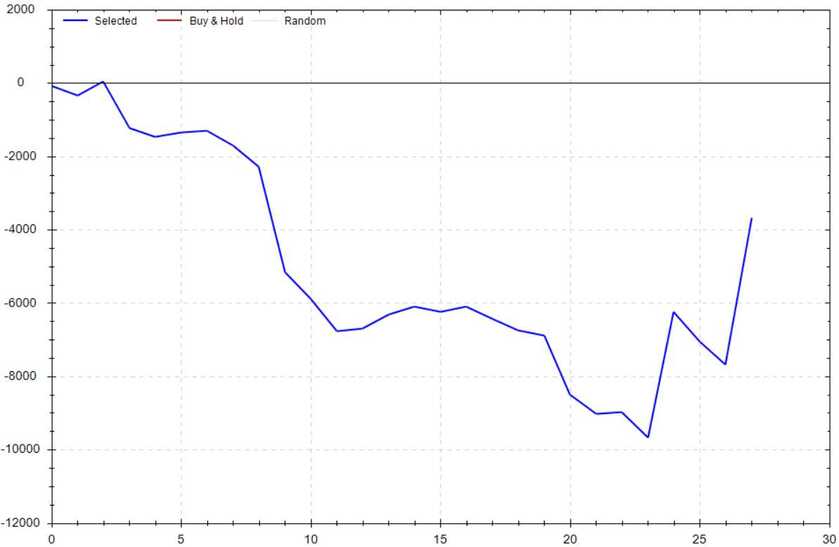

S&P 500 Seasonal Bias (Wednesday, Sept 17th)

- Bull Win Percentage: 43%

- Profit Factor: 0.63

- Bias: Bearish

Equity Curve -->

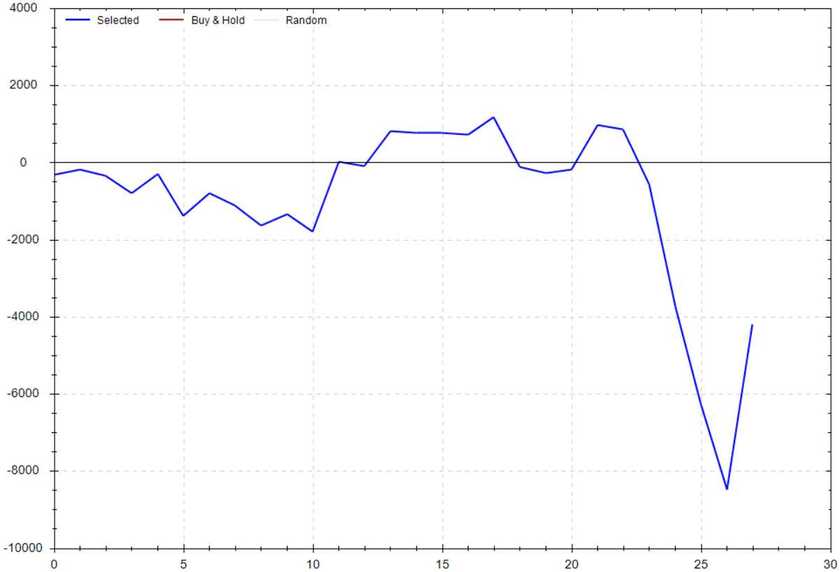

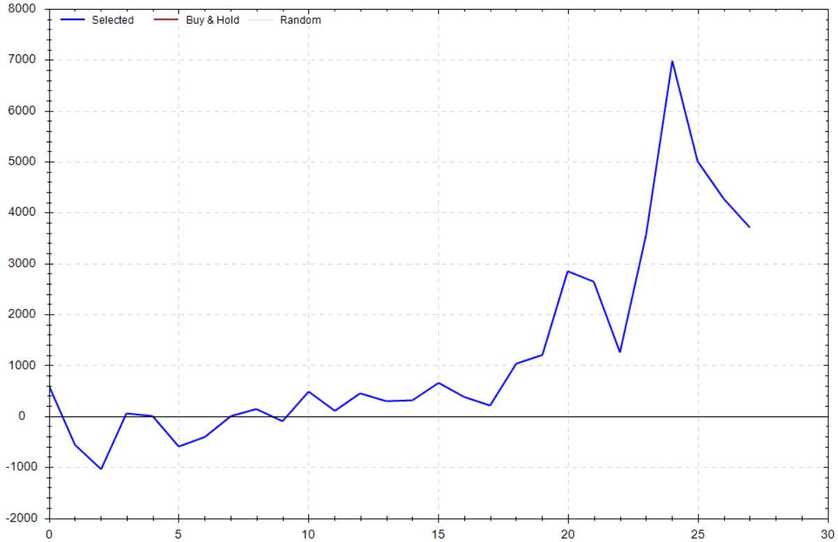

S&P 500 Seasonal Bias (Thursday, Sept 18th)

- Bull Win Percentage: 36%

- Profit Factor: 0.71

- Bias: Leaning Bearish

Equity Curve -->

S&P 500 Seasonal Bias (Friday, Sept 19th)

- Bull Win Percentage: 36%

- Profit Factor: 0.30

- Bias: Bearish

Equity Curve -->

Notes: These analytics are derived from the performance of the S&P 500 futures contract over the past +25 years. Additionally, results are computed from the futures market open and close.

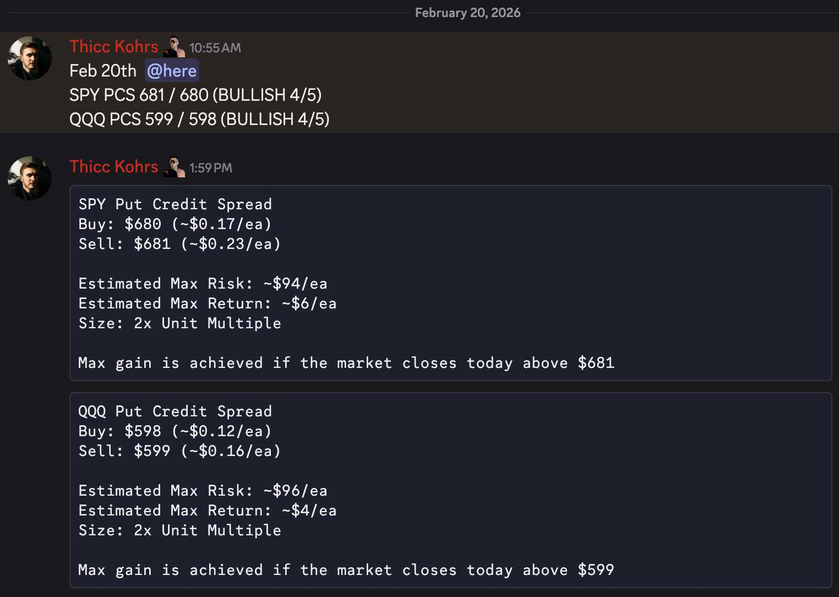

Options Strategy Update

The 0 DTE signal hit 10 for 10 times (20 for 20 total units) this past week.

Signal Accuracy: ~100%

Note: These signals are posted in real-time in the Goonie Trading Discord. You can join the Goonie Discord for FREE w/ code GOONIE (Click Here!)!!!

Piper's Current Signal Streak: 25 Trades

September Record: 36/36 Units

Monday, Sept 8th

SPY Put Credit Spread (2x Multiple @ $647 / $646) 🟢

QQQ Put Credit Spread (2x Multiple @ $577 / $576) 🟢

Tuesday, Sept 9th

SPY Put Credit Spread (1x Multiple @ $647 / $646) 🟢

QQQ Put Credit Spread (1x Multiple @ $577 / $576) 🟢

Wednesday, Sept 10th

SPY Put Credit Spread (2x Multiple @ $651 / $650) 🟢

QQQ Put Credit Spread (2x Multiple @ $580 / $579) 🟢

Thursday, Sept 11th

SPY Put Credit Spread (3x Multiple @ $653 / $652) 🟢

QQQ Put Credit Spread (3x Multiple @ $581 / $580) 🟢

Friday, Sept 12th

SPY Put Credit Spread (2x Multiple @ $656 / $655) 🟢

QQQ Put Credit Spread (2x Multiple @ $584 / $583) 🟢

Times I Broke My Trading System & Lost

849 *

* This data point is from readings over the past week. The reported information should not be taken as an aggregate or cumulative value for any period beyond the most recent week (Sunday through Saturday). Appropriate alterations were made to account for both travel and time zone shifts.

Notes

RISK WARNING: Trading involves HIGH RISK and YOU CAN LOSE a lot of money. Do not risk any money you cannot afford to lose. Trading is not suitable for all investors. We are not registered investment advisors. We do not provide trading or investment advice. We provide research and education through the issuance of statistical information containing no expression of opinion as to the investment merits of a particular security. Information contained herein should not be considered a solicitation to buy or sell any security or engage in a particular investment strategy. Past performance is not necessarily indicative of future results. Links above include affiliate commission or referrals. I'm part of an affiliate network and I receive compensation from partnering websites.

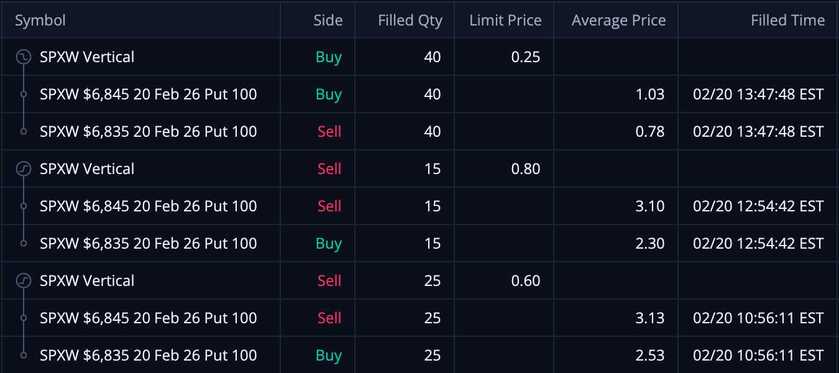

Both of these trades missed. Both of these trades hit if held until close -- 4 total units!

Both of these trades missed. Both of these trades hit if held until close -- 4 total units! These PCS's were sold at $0.70/ea (average) and were bought back at $0.675/ea -- THIS MEANS MY REALIZED GAIN WAS $1,700!

These PCS's were sold at $0.70/ea (average) and were bought back at $0.675/ea -- THIS MEANS MY REALIZED GAIN WAS $1,700!

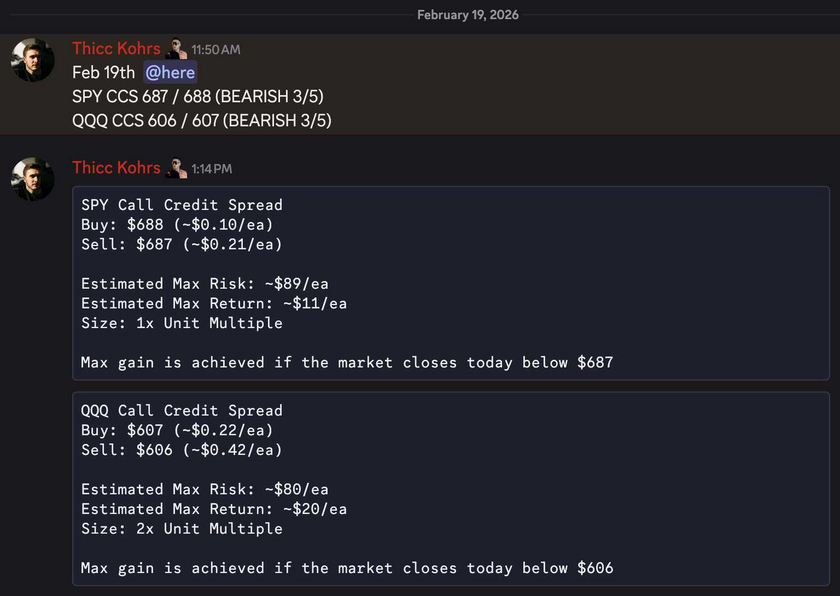

Both of these trades missed. Both of these trades hit if held until close -- 2 total units!

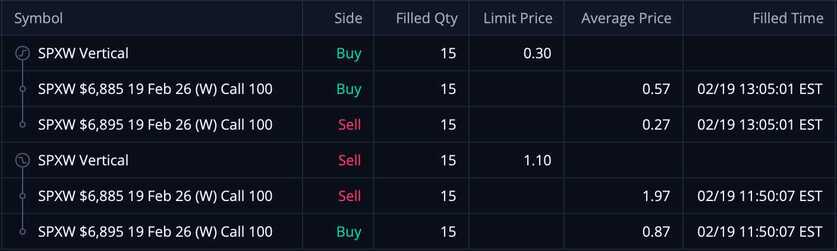

Both of these trades missed. Both of these trades hit if held until close -- 2 total units! These CCS's were sold at $1.10/ea (average) and were bought back at $0.30/ea (average) -- THIS MEANS MY REALIZED GAIN WAS $1,200!

These CCS's were sold at $1.10/ea (average) and were bought back at $0.30/ea (average) -- THIS MEANS MY REALIZED GAIN WAS $1,200!