Goodbye November, Hello December

Key Weekly Performance Stats:

- S&P 500: +3.73%

- Nasdaq 100: +4.93%

- Russel 2000: +5.14%

- Bitcoin: +6.86%

Stocks drifted higher during the shortened Thanksgiving week, with momentum carrying over from the month-long rally powered by expectations of a December rate cut. Trading volume was light, but the S&P 500 and Nasdaq still managed modest gains as investors leaned into tech strength while the Dow moved more cautiously. With markets closed on Thursday for the holiday and operating a half-day on Friday, the tone stayed upbeat even without fresh catalysts.

Economic data was almost nonexistent because several agencies are still catching up from earlier reporting delays, leaving traders without the usual stream of releases like inflation or income numbers. That absence kept the focus on sentiment instead of fundamentals, and the market didn’t seem to mind. Equities held their ground, volatility stayed contained, and the bullish bias that’s defined November stayed intact.

Looking to next week, the calendar should start normalizing as delayed reports are expected to flow again, potentially including key inflation and spending updates plus a fresh wave of early Q4 earnings. That mix of data and corporate results will matter far more than anything we got this week, and it’ll give traders a clearer read on whether November’s strength can carry into December — or if caution starts to creep back in. As always, stick to your trading and respect your risk. Godspeed.

Thicc Kohrs

P.S. The official Goonie Discord is live! (FREE Access w/ code GOONIE: https://bit.ly/GoonieGroup)

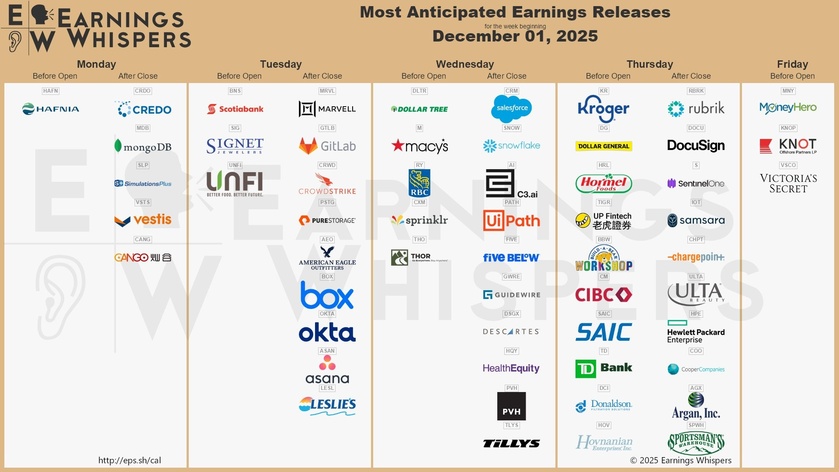

Earnings

Monday, Dec 1st

Evening: MongoDB

Tuesday, Dec 2nd

Evening: CrowdStrike & GitLab

Wednesday, Dec 3rd

Morning: Dollar Tree & Macy's

Evening: C3.AI, Salesforce & Snowflake

Thursday, Dec 4th

Morning: Dollar General & Kroger

Evening: DocuSign & ULTA Beauty

Friday, Dec 5th

None

Market Events

Monday, Dec 1st

09:45 AM ET Chicago PMI (Dec)

09:45 AM ET S&P Global Manufacturing PMI (Nov)

10:00 AM ET ISM Manufacturing PMI & Prices (Nov)

08:00 PM ET Fed Chair Powell Speaks

Tuesday, Dec 2nd

05:00 AM ET Eurozone CPI MoM & YoY (Nov)

10:00 AM ET JOLTs Job Openings (Sep)

Wednesday, Dec 3rd

08:15 AM ET ADP Nonfarm Employment Change (Nov)

09:45 AM ET S&P Global Services PMI (Nov)

10:00 AM ET ISM Non-Manufacturing PMI & Prices (Nov)

Thursday, Dec 4th

08:30 AM ET Initial Jobless Claims

Friday, Dec 5th

10:00 AM ET PCE Price Index MoM & YoY (Sep)

Seasonality Update

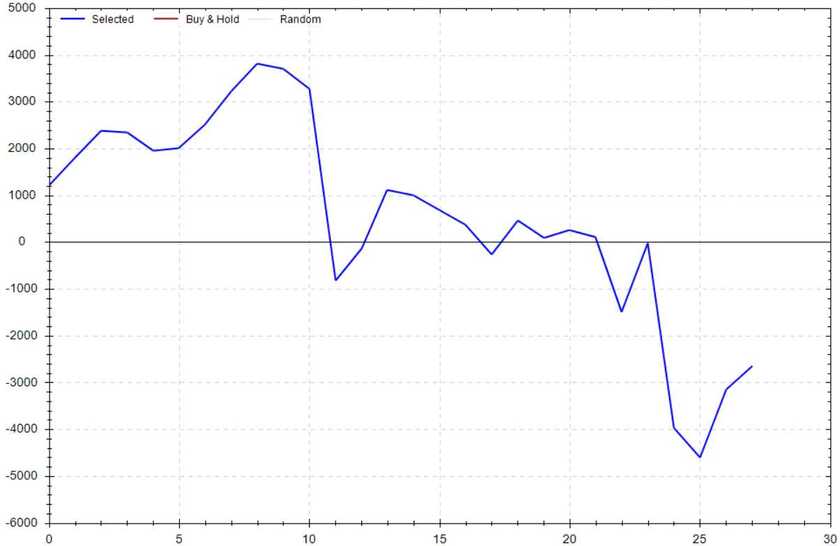

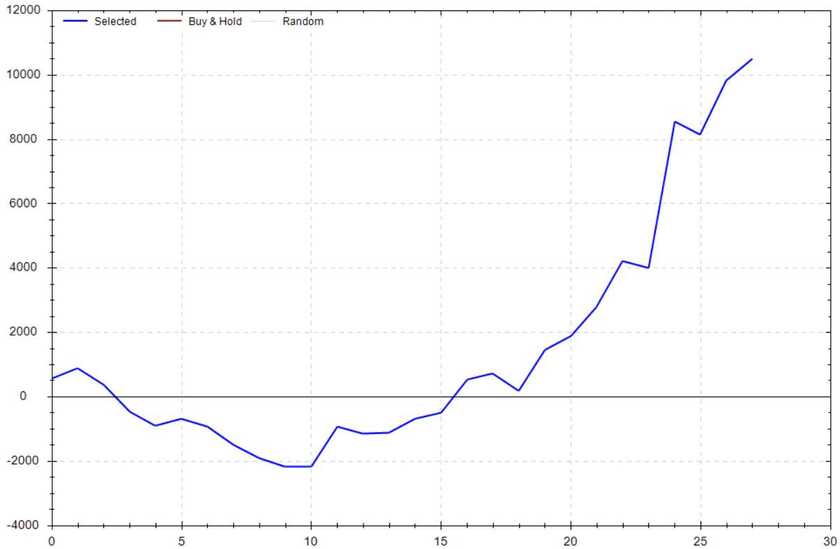

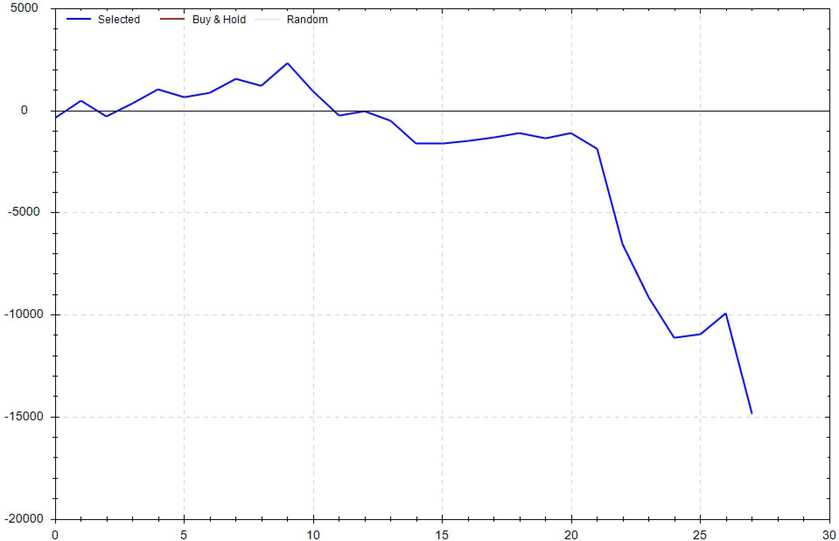

S&P 500 Seasonal Bias (Monday, Dec 1st)

- Bull Win Percentage: 50%

- Profit Factor: 0.80

- Bias: Leaning Bearish

Equity Curve -->

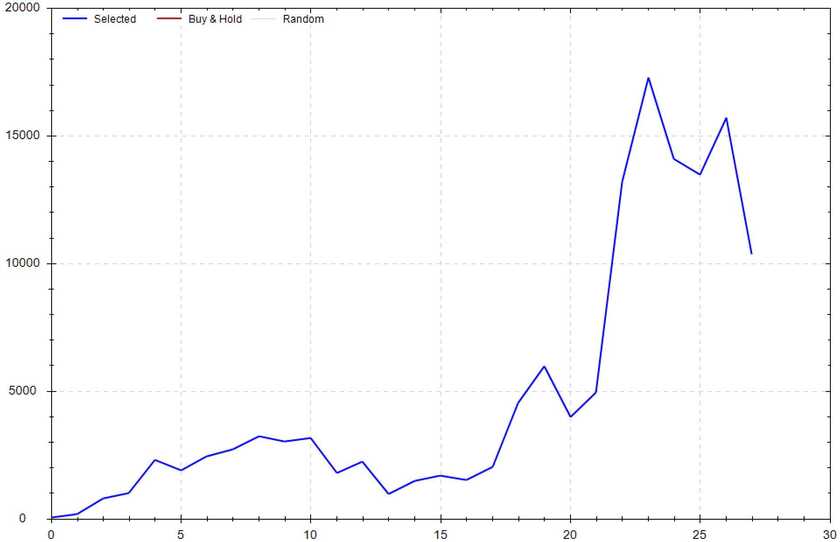

S&P 500 Seasonal Bias (Tuesday, Dec 2nd)

- Bull Win Percentage: 43%

- Profit Factor: 0.84

- Bias: Leaning Bearish

Equity Curve -->

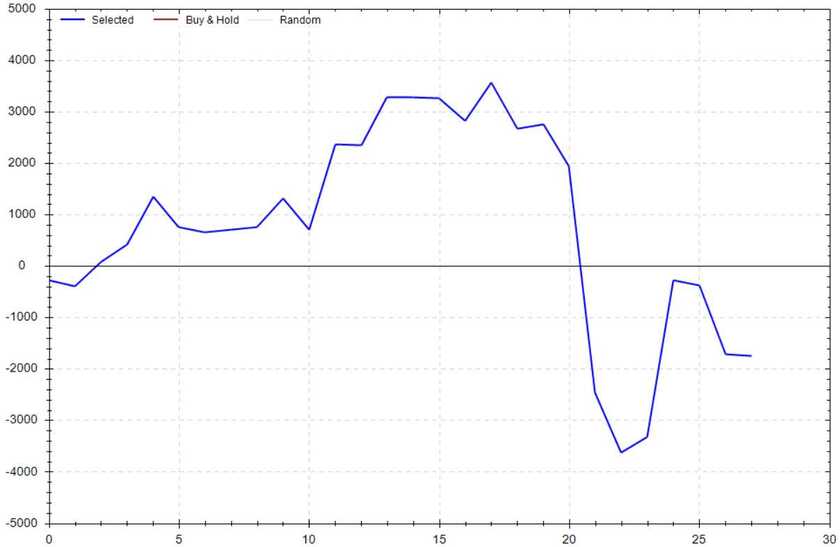

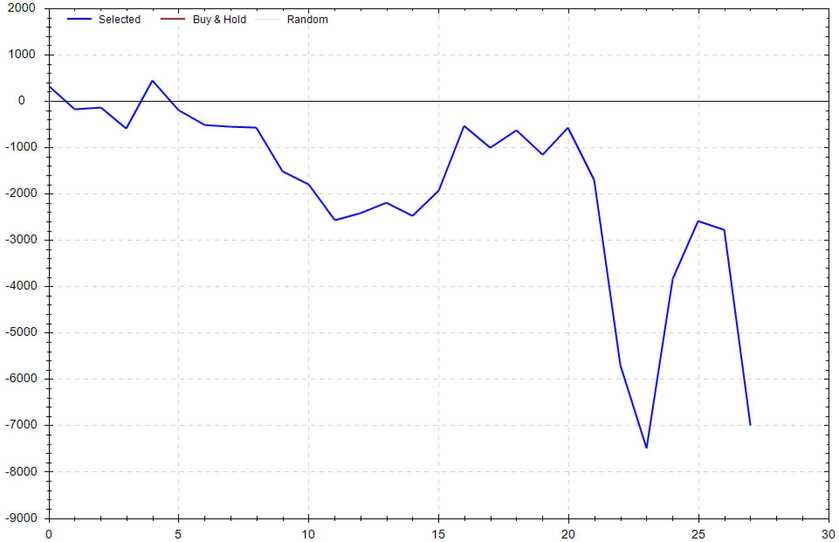

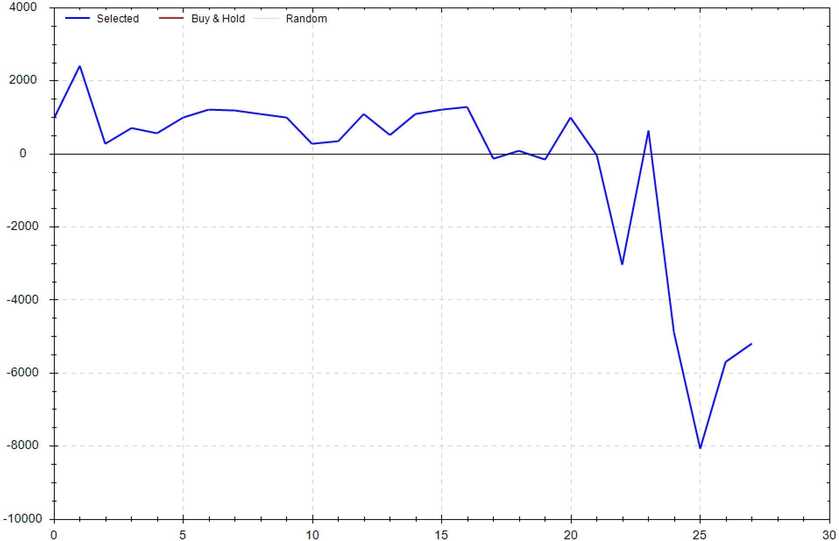

S&P 500 Seasonal Bias (Wednesday, Dec 3rd)

- Bull Win Percentage: 54%

- Profit Factor: 1.08

- Bias: Neutral

Equity Curve -->

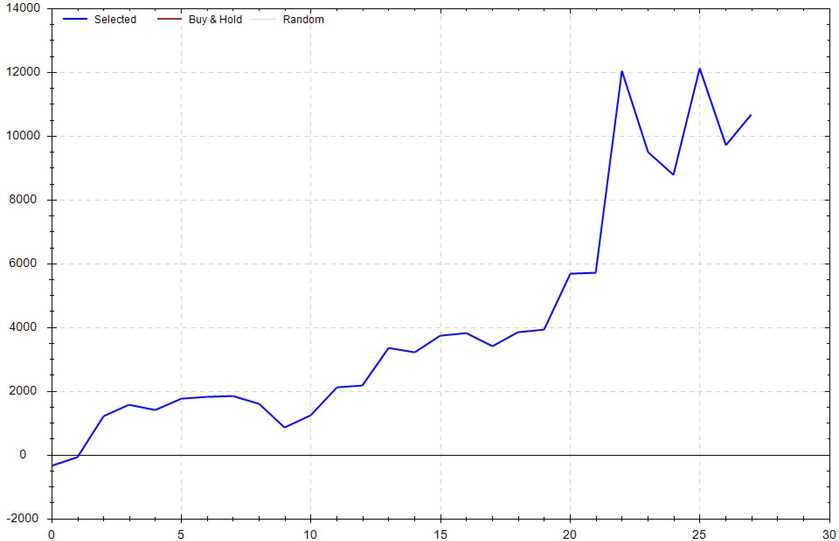

S&P 500 Seasonal Bias (Thursday, Dec 4th)

- Bull Win Percentage: 46%

- Profit Factor: 0.92

- Bias: Neutral

Equity Curve -->

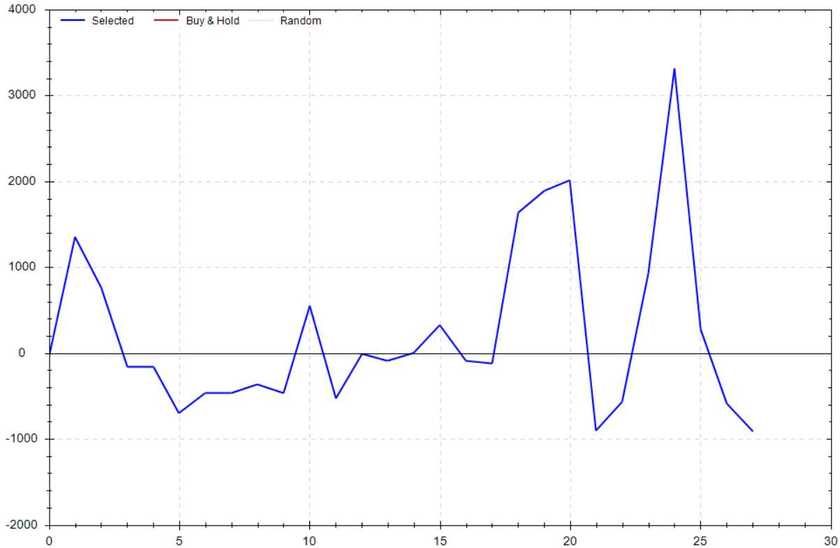

S&P 500 Seasonal Bias (Friday, Dec 5th)

- Bull Win Percentage: 57%

- Profit Factor: 3.26

- Bias: Bullish

Equity Curve -->

Notes: These analytics are derived from the performance of the S&P 500 futures contract over the past +25 years. Additionally, results are computed from the futures market open and close.

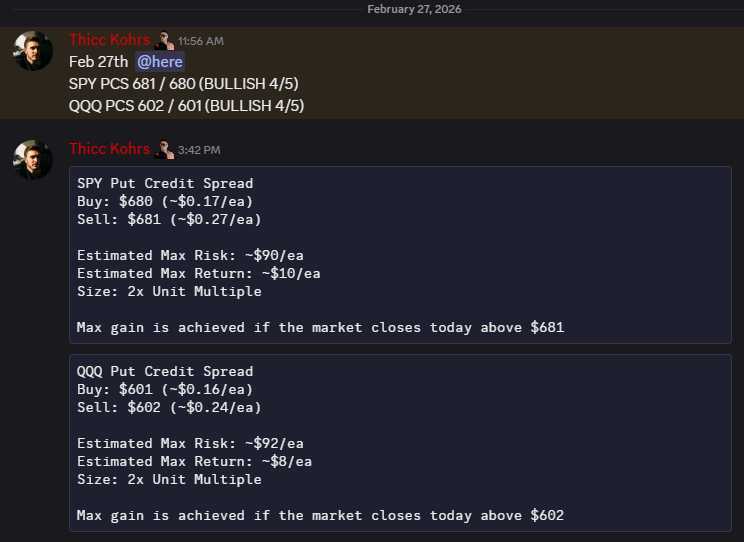

Options Strategy Update

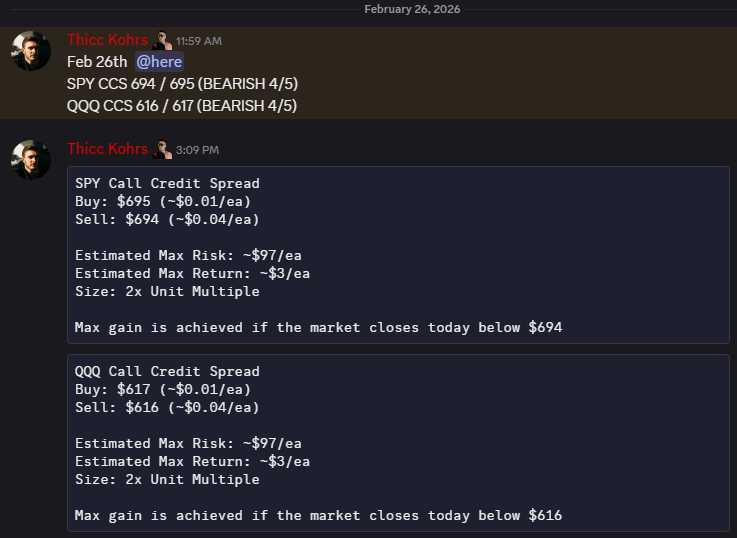

The 0 DTE signal hit 2 for 2 times (4 for 4 total units) this past week.

Signal Accuracy: ~100%

Note: These signals are posted in real-time in the Goonie Trading Discord. You can join the Goonie Discord for FREE w/ code GOONIE (Click Here!)!!!

Piper's Current Signal Streak: 15 Trades

November Record: 24/24 Units

Monday, Nov 24th

No Signal Produced

Tuesday, Nov 25th

No Signal Produced

Wednesday, Nov 26th

SPY Put Credit Spread (2x Multiple @ $676 / $675) 🟢

QQQ Put Credit Spread (2x Multiple @ $610 / $609) 🟢

Thursday, Nov 27th

No Signal Produced -- Market Closed (Thanksgiving)

Friday, Nov 28th

No Signal Produced -- Market Half Day

Pie Consumed

4.6 Slices *

* This data point is from readings over the past week. The reported information should not be taken as an aggregate or cumulative value for any period beyond the most recent week (Sunday through Saturday). Appropriate alterations were made to account for both travel and time zone shifts.

Notes

RISK WARNING: Trading involves HIGH RISK and YOU CAN LOSE a lot of money. Do not risk any money you cannot afford to lose. Trading is not suitable for all investors. We are not registered investment advisors. We do not provide trading or investment advice. We provide research and education through the issuance of statistical information containing no expression of opinion as to the investment merits of a particular security. Information contained herein should not be considered a solicitation to buy or sell any security or engage in a particular investment strategy. Past performance is not necessarily indicative of future results. Links above include affiliate commission or referrals. I'm part of an affiliate network and I receive compensation from partnering websites.

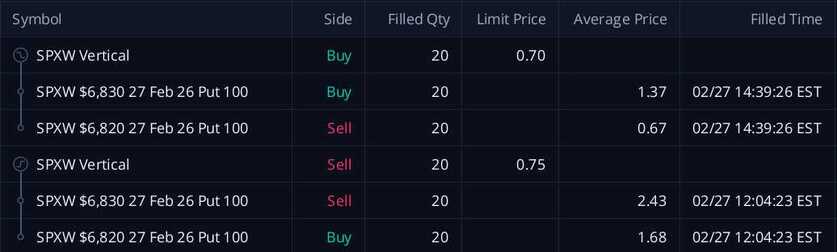

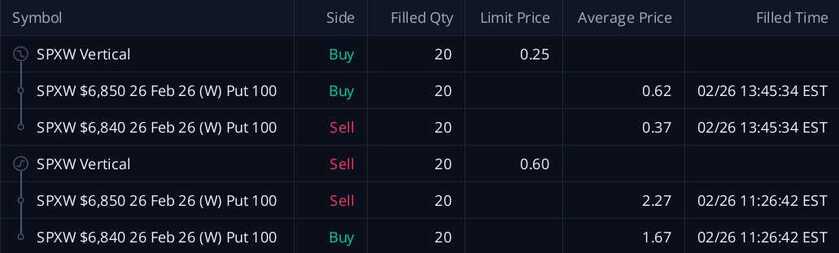

Both of these trades missed. Both of these trades hit if held until close -- 4 total units!

Both of these trades missed. Both of these trades hit if held until close -- 4 total units! These PCS's were sold at $0.75/ea and were bought back at $0.70/ea -- THIS MEANS MY REALIZED GAIN WAS $0!

These PCS's were sold at $0.75/ea and were bought back at $0.70/ea -- THIS MEANS MY REALIZED GAIN WAS $0!

Both of these trades missed. Both of these trades hit if held until close -- 4 total units!

Both of these trades missed. Both of these trades hit if held until close -- 4 total units! These PCS's were sold at $0.60/ea and were bought back at $0.25/ea -- THIS MEANS MY REALIZED GAIN WAS $700!

These PCS's were sold at $0.60/ea and were bought back at $0.25/ea -- THIS MEANS MY REALIZED GAIN WAS $700!