New Highs!!!

Key Weekly Performance Stats:

- S&P 500: +1.57% (New High)

- Nasdaq 100: +2.22%

- Russel 2000: +4.63% (New High)

- Bitcoin: +0.62%

Stocks came out swinging the first full week of the year. Last week, the major indexes pushed higher all week and wrapped things up near record levels, with small-caps stealing the spotlight. Bond yields bounced around but didn’t derail the rally, and the overall tone stayed comfortably risk-on as traders leaned into the “growth is slowing, but not breaking” narrative.

It was a busy stretch of data. ISM Manufacturing kicked things off Monday, followed by ISM Services and JOLTS midweek, which showed job openings continuing to cool. Weekly jobless claims stayed relatively steady, and Friday’s December jobs report landed right down the middle. Payroll growth was modest, the unemployment rate held at 4.4%, and consumer sentiment ticked slightly higher. Enough to keep soft-landing hopes alive without forcing the Fed’s hand.

Looking ahead to next week, the pressure on inflation and the consumer. CPI drops Tuesday, then Wednesday stacks Retail Sales, PPI, and the Fed’s Beige Book. Import and export prices follow Thursday, with more labor-market detail from BLS on Friday. No market holidays, no breaks — Just another week where rates, inflation data, and the consumer will decide how much fuel this rally really has. As always, stick to your trading plan and respect your risk. Godspeed.

Thicc Kohrs

P.S. The official Goonie Discord is live! (FREE Access w/ code GOONIE: https://bit.ly/GoonieGroup)

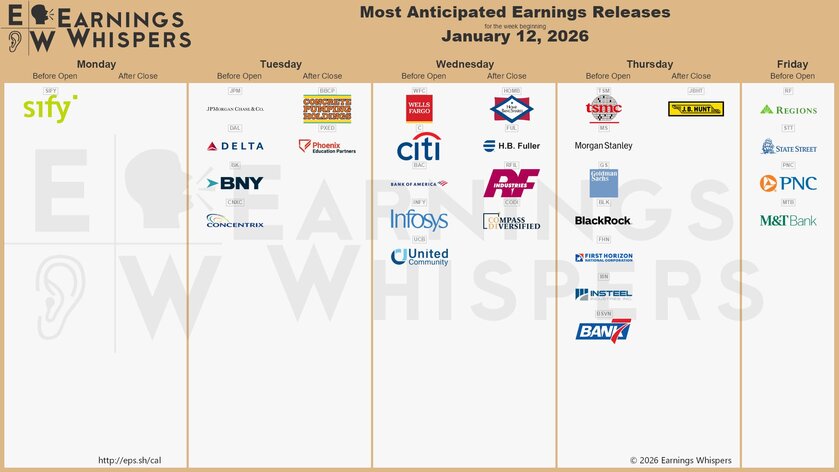

Earnings

Monday, Jan 12th

None

Tuesday, Jan 13th

Morning: Delta & JPMorgan

Wednesday, Jan 14th

Morning: Citi, Bank of America & Wells Fargo

Thursday, Jan 15th

Morning: BlackRock, Goldman Sachs, Morgan Stanley & TSMC

Friday, Jan 16th

Morning: PNC

Market Events

Monday, Jan 12th

01:00 PM ET 10-Year Note Auction

Tuesday, Jan 13th

08:30 AM ET CPI MoM & YoY (Dec)

10:00 AM ET New Home Sales (Oct)

01:00 PM ET 30-Year Bond Auction

Wednesday, Jan 14th

08:30 AM ET PPI MoM & YoY (Nov)

08:30 AM ET Retail Sales MoM & YoY (Nov)

10:00 AM ET Existing Home Sales (Dec)

Thursday, Jan 15th

08:30 AM ET Philadelphia Fed Manufacturing Index (Jan)

08:30 AM ET Initial Jobless Claims

Friday, Jan 16th

None

Seasonality Update

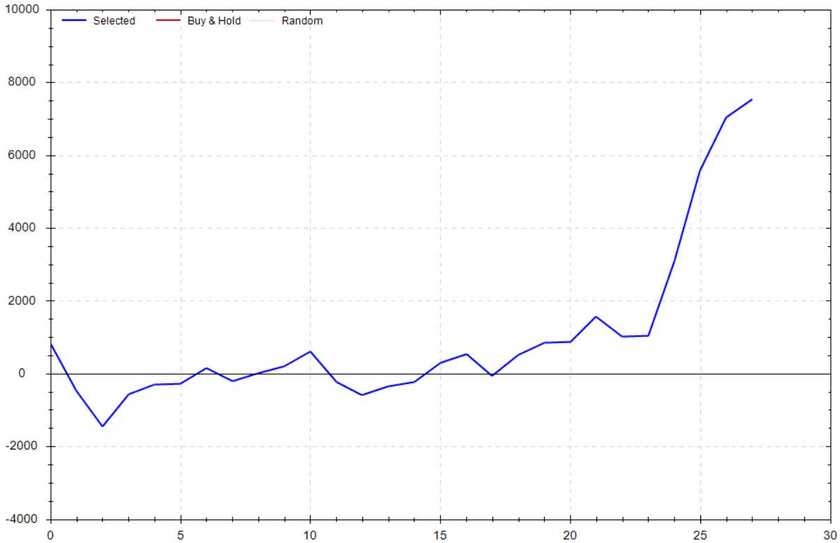

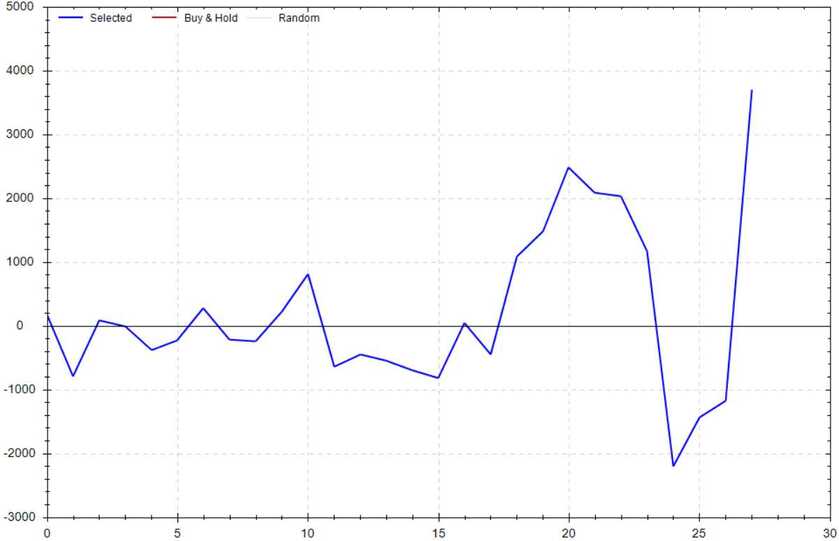

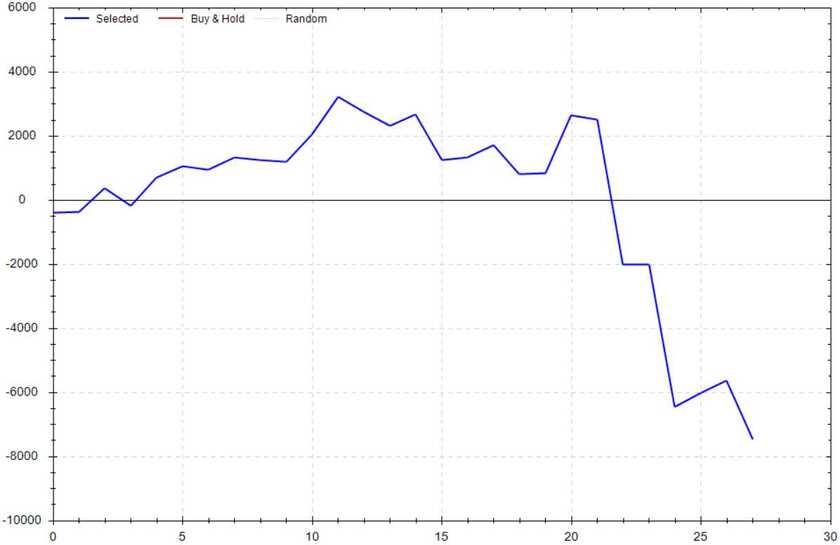

S&P 500 Seasonal Bias (Monday, Jan 12th)

- Bull Win Percentage: 75%

- Profit Factor: 2.51

- Bias: Bullish

Equity Curve -->

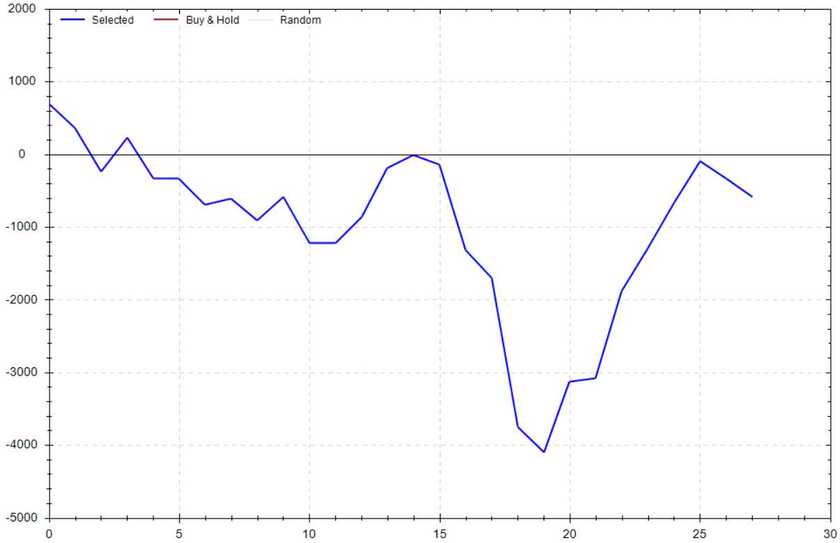

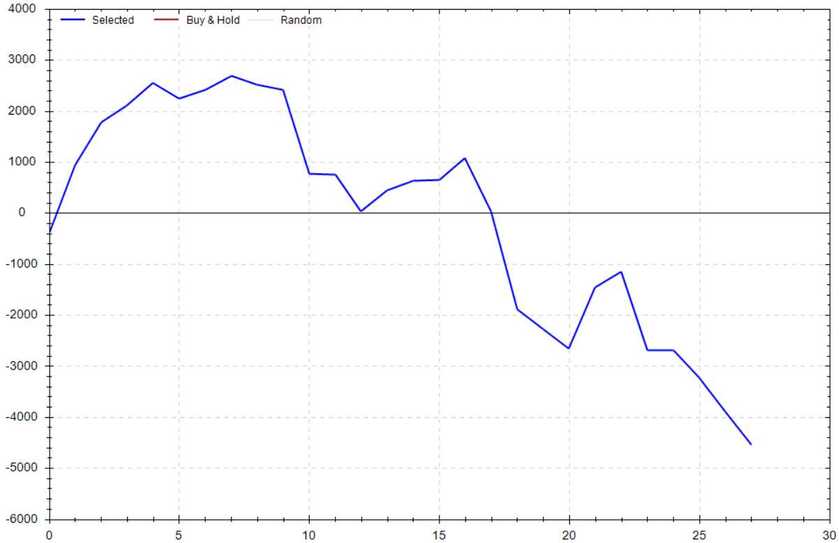

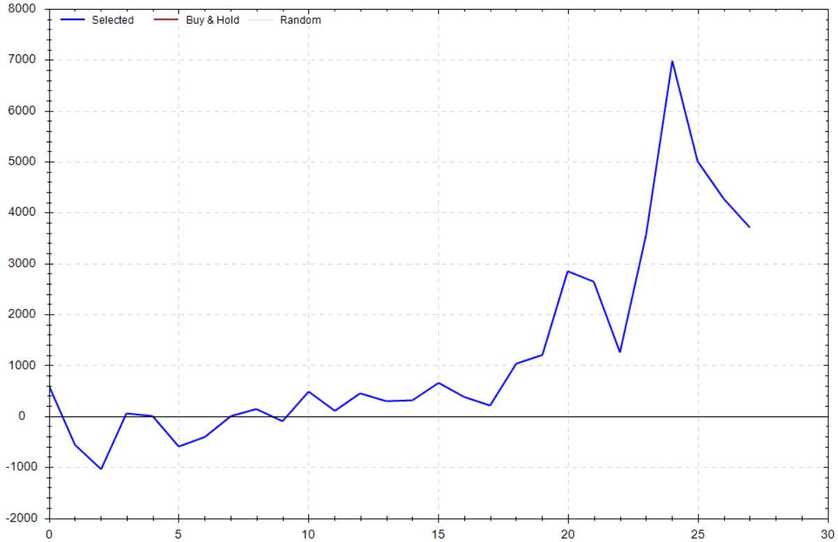

S&P 500 Seasonal Bias (Tuesday, Jan 13th)

- Bull Win Percentage: 46%

- Profit Factor: 0.92

- Bias: Leaning Bearish

Equity Curve -->

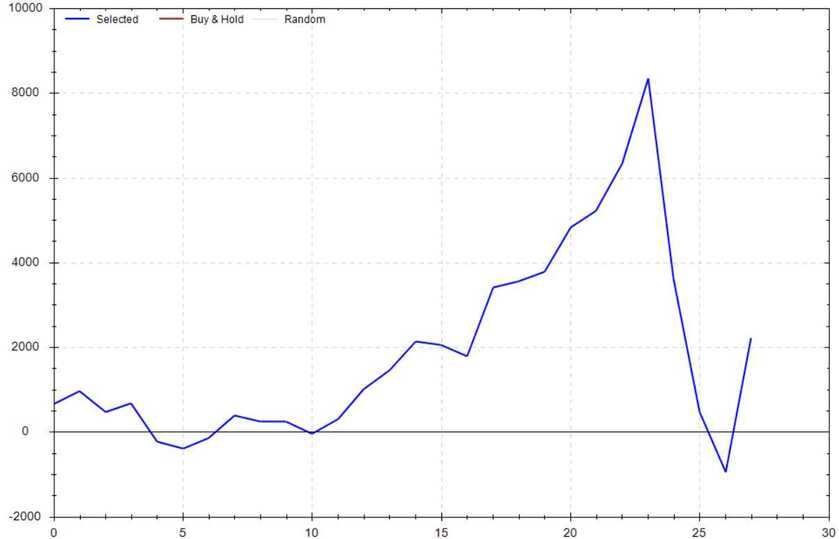

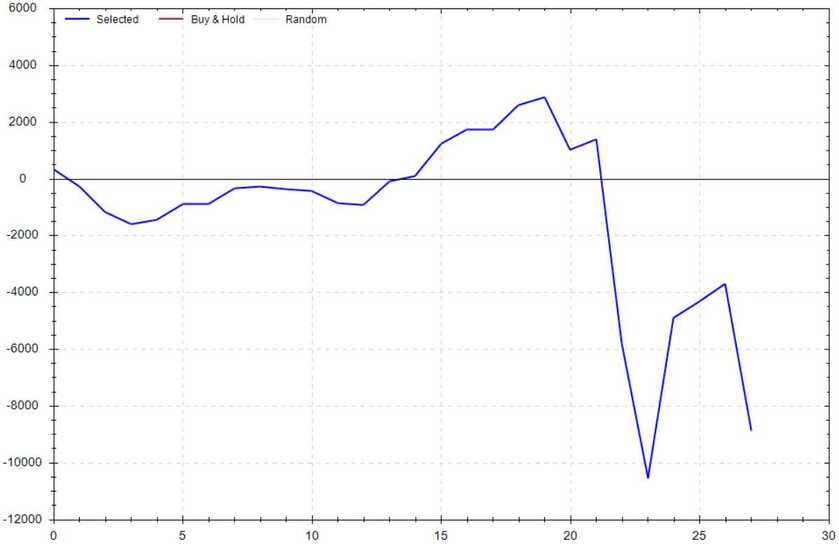

S&P 500 Seasonal Bias (Wednesday, Jan 14th)

- Bull Win Percentage: 50%

- Profit Factor: 1.41

- Bias: Leaning Bullish

Equity Curve -->

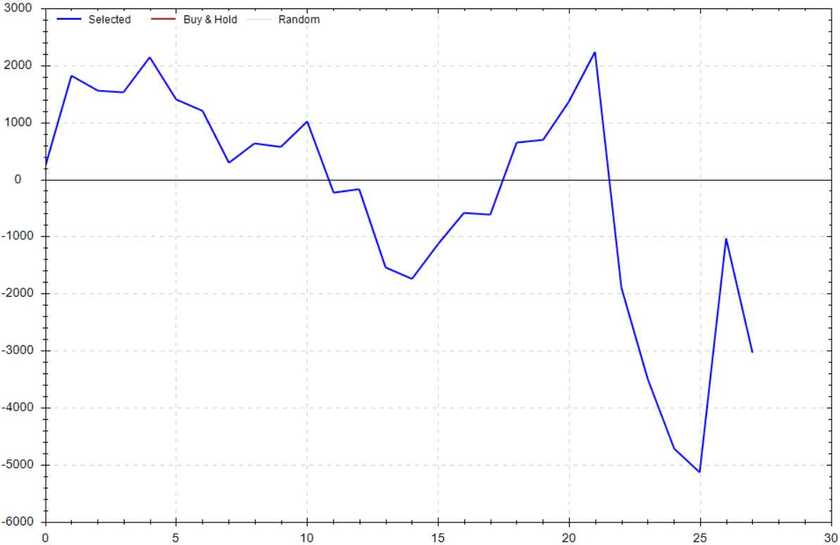

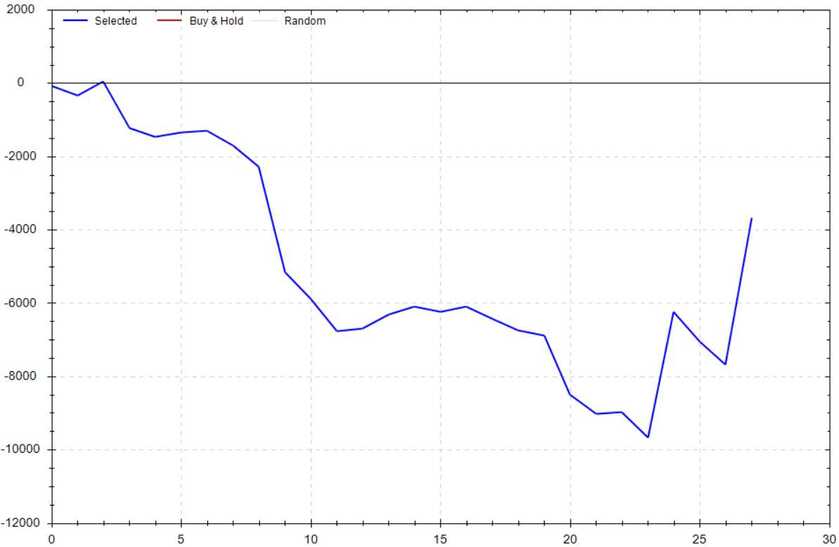

S&P 500 Seasonal Bias (Thursday, Jan 15th)

- Bull Win Percentage: 43%

- Profit Factor: 0.57

- Bias: Bearish

Equity Curve -->

S&P 500 Seasonal Bias (Friday, Jan 16th)

- Bull Win Percentage: 64%

- Profit Factor: 1.19

- Bias: Leaning Bullish

Equity Curve -->

Notes: These analytics are derived from the performance of the S&P 500 futures contract over the past +25 years. Additionally, results are computed from the futures market open and close.

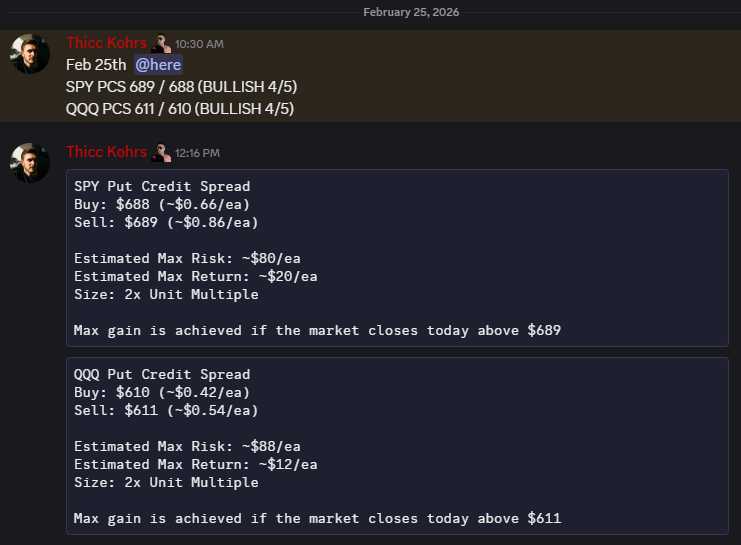

Options Strategy Update

The 0 DTE signal hit 7 for 8 times (14 for 16 total units) this past week.

Signal Accuracy: ~87.5%

Note: These signals are posted in real-time in the Goonie Trading Discord. You can join the Goonie Discord for FREE w/ code GOONIE (Click Here!)!!!

Piper's Current Signal Streak: 3 Trades

January Record: 18/20 Units

Monday, Jan 5th

SPY Put Credit Spread (2x Multiple @ $686 / $685) 🟢

QQQ Put Credit Spread (2x Multiple @ $616 / $615) 🟢

Tuesday, Jan 6th

SPY Put Credit Spread (2x Multiple @ $687 / $686) 🟢

QQQ Put Credit Spread (2x Multiple @ $618 / $617) 🟢

Wednesday, Jan 7th

SPY Put Credit Spread (2x Multiple @ $690 / $689) 🔴

QQQ Put Credit Spread (2x Multiple @ $622 / $621) 🟢

Thursday, Jan 8th

No Signal Produced

Friday, Jan 9th

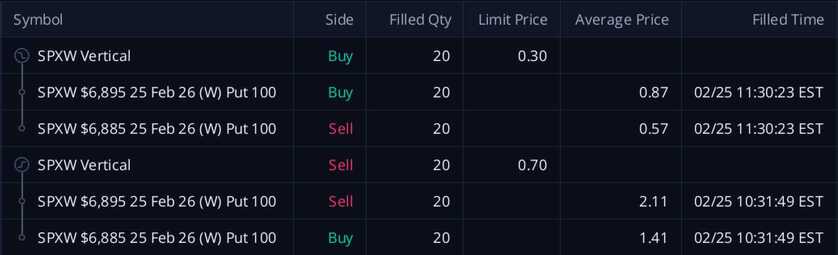

SPY Put Credit Spread (2x Multiple @ $689 / $688) 🟢

QQQ Put Credit Spread (2x Multiple @ $619 / $618) 🟢

Times Chat Made Fun of Me

8 (very hurtful)*

* This data point is from readings over the past week. The reported information should not be taken as an aggregate or cumulative value for any period beyond the most recent week (Sunday through Saturday). Appropriate alterations were made to account for both travel and time zone shifts.

Notes

RISK WARNING: Trading involves HIGH RISK and YOU CAN LOSE a lot of money. Do not risk any money you cannot afford to lose. Trading is not suitable for all investors. We are not registered investment advisors. We do not provide trading or investment advice. We provide research and education through the issuance of statistical information containing no expression of opinion as to the investment merits of a particular security. Information contained herein should not be considered a solicitation to buy or sell any security or engage in a particular investment strategy. Past performance is not necessarily indicative of future results. Links above include affiliate commission or referrals. I'm part of an affiliate network and I receive compensation from partnering websites.

Both of these trades missed. Both of these trades hit if held until close -- 4 total units!

Both of these trades missed. Both of these trades hit if held until close -- 4 total units! These PCS's were sold at $0.70/ea and were bought back at $0.30/ea -- THIS MEANS MY REALIZED GAIN WAS $800!

These PCS's were sold at $0.70/ea and were bought back at $0.30/ea -- THIS MEANS MY REALIZED GAIN WAS $800!

Both of these trades missed. Both of these trades hit if held until close -- 4 total units!

Both of these trades missed. Both of these trades hit if held until close -- 4 total units!