Well, golly...

What a day, what a day! For those of you who missed it, the premarket action was looking horrifically bearish across the entire market. I didn't find this too surprising. Inflation is high, yields are rising and the dollar is showing strength. In my mind, this all adds up the market being under considerable pressure. However, the bulls were not messing around today. They were late getting out of bed, but they fought like a mother fucker. Tons of bullish engulfing candles (start below the previous low and end above the previous high) were created throughout the entire market. Based on this technical development and the seasonality (posted below), I would wager tomorrow will statistically favor the bulls.

Seasonality Update

S&P 500 Seasonal Bias (March 3rd)

- Trades (Years Tested): 25

- Bull Win Percentage: 68%

- Profit Factor: 2.64

- Bias: Bullish

Equity Curve -->

Current Account Value

$10,600.14 (Daily +1.10% [+$115.91] & YTD +6.33% [+$613.40])

Closed Position(s) +$324

COIN $85/$90 CCS (5) March 17th

- Original Credit: $0.55/ea

- Closed Debit: $0.18/ea

- P&L: +$185 (+67.3%)

TSLA $215/$216.67 CCS (2) March 17th

- Original Credit: $0.50/ea

- Closed Debit: $0.23/ea

- P&L: +$54 (+54%)

TSLA #2 $230/$231.67 CCS (5) March 17th

- Original Credit: $0.27/ea

- Closed Debit: $0.10/ea

- P&L: +$85 (+63%)

New Position(s)

COIN Call Credit Spread (5) March 17th

- Sold: $72 & Bought: $77 --> Credit: $0.50/ea

- Max Return: $50/ea & Max Risk: $250/ea

- Profit Target: $0.20/ea

- Profit Odds: 75%

Reasoning: COIN took a large hit early in the morning because of the developments with SI. From a technical perspective, COIN has been range bound since early February. Overall, Crypto ran recently and now seems to be cooling off.

TSLA Call Credit Spread (5) March 31st

- Sold: $220 & Bought: $222.50 --> Credit: $0.37/ea

- Max Return: $37/ea & Max Risk: $213/ea

- Profit Target: $0.15/ea

- Profit Odds: 88%

Reasoning: TSLA had a lackluster "Investor Day". Additionally, the overall market doesn't seem to bullish imo. It's tough to see TSLA continuing it's +100% run at this moment in time.

Current Position(s)

NFLX Call Credit Spread (5) March 17th

- Sold: $347.50 & Bought: $350 --> Credit: $0.38/ea

- Max Return: $38/ea & Max Risk: $212/ea

- Profit Target: $0.15/ea

- Profit Odds: 92%

META Call Credit Spread (5) March 17th

- Sold: $190 & Bought: $192.5 --> Credit: $0.33/ea

- Max Return: $33/ea & Max Risk: $217/ea

- Profit Target: $0.15/ea

- Profit Odds: 87%

SPY Call Credit Spread (3) March 17th

- Sold: $409 & Bought: $412 --> Credit: $0.56/ea

- Max Return: $56/ea & Max Risk: $244/ea

- Profit Target: $0.25/ea

- Profit Odds: 79%

QQQ Call Credit Spread (5) March 24th

- Sold: $313 & Bought: $315 --> Credit: $0.38/ea

- Max Return: $38/ea & Max Risk: $162/ea

- Profit Target: $0.15/ea

- Profit Odds: 88%

SPY #2 Call Credit Spread (4) March 31st

- Sold: $415 & Bought: $417 --> Credit: $0.42/ea

- Max Return: $42/ea & Max Risk: $158/ea

- Profit Target: $0.20/ea

- Profit Odds: 83%

TSLA Call Credit Spread (3) March 31th

- Sold: $245 & Bought: $250 --> Credit: $0.70/ea

- Max Return: $70/ea & Max Risk: $430/ea

- Profit Target: $0.20/ea

- Profit Odds: 94%

Overall, I'm happy with today. I made money -- I'm the best trader on this side of the Mississippi. I wish I closed my QQQ & TSLA puts today (not detailed in this newsletter). I truly didn't expect the bullish recovery to be as strong as it was. The seasonlity tomorrow favors the bulls, so I might be in for a bit more pain. This truly reinforces the concept that I should simply stop doing stupid shit, aka speculating. High odds plays are the way to go. Defined math == Defined results. I need to talk myself into sticking to selling premium and my future's robot (+$64 today). If you have any questions or comments, don't hesitate to reach out to me.

Thanks for reading! I appreciate all you beautiful bastards.

Notes

Max Return (Credit Spreads): The credit recieved when creating the positon. This is achieved when you get to the expiration date and the price is below the sold contract for a Call Credit Spread and above the sold contract for a Put Credit Spread.

Max Risk (Credit Spreads): The difference between the spread's two strikes minus the credit recieved when the position was created.

Breakeven (Credit Spreads): The sold strike plus the credit for CCS and the strike minus the credit for PCS.

RISK WARNING: Trading involves HIGH RISK and YOU CAN LOSE a lot of money. Do not risk any money you cannot afford to lose. Trading is not suitable for all investors. We are not registered investment advisors. We do not provide trading or investment advice. We provide research and education through the issuance of statistical information containing no expression of opinion as to the investment merits of a particular security. Information contained herein should not be considered a solicitation to buy or sell any security or engage in a particular investment strategy. Past performance is not necessarily indicative of future results. Links above include affiliate commission or referrals. I'm part of an affiliate network and I receive compensation from partnering websites. The video is accurate as of the posting date but may not be accurate in the future.

Both of these trades hit if held until close -- 4 total units!

Both of these trades hit if held until close -- 4 total units! These CCS's were sold at an average of $0.62/ea and were bought back at an average $0.15/ea -- THIS MEANS MY REALIZED GAIN WAS $1,400!

These CCS's were sold at an average of $0.62/ea and were bought back at an average $0.15/ea -- THIS MEANS MY REALIZED GAIN WAS $1,400!

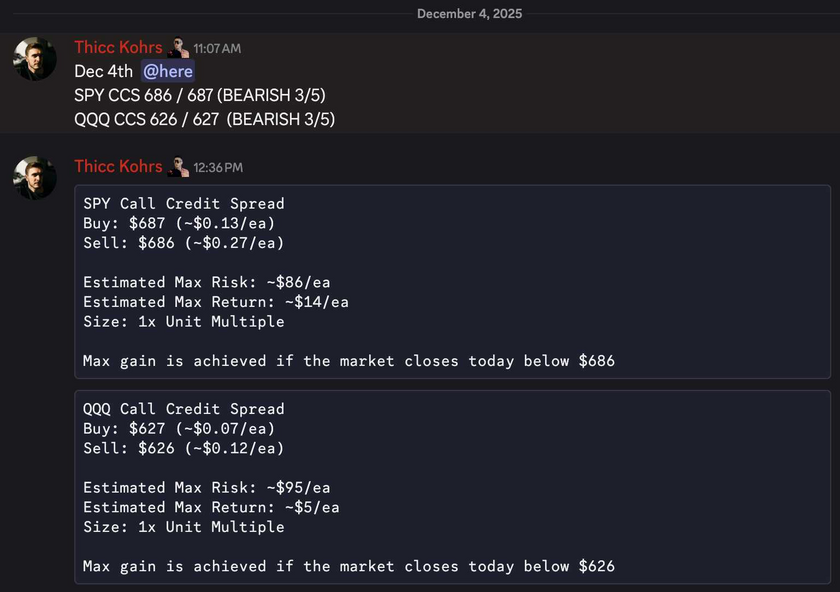

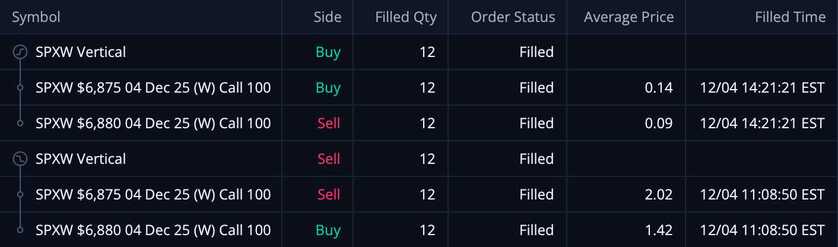

Both of these trades hit if held until close -- 2 total units!

Both of these trades hit if held until close -- 2 total units! These CCS's were sold at $0.60/ea and were bought back at $0.05/ea -- THIS MEANS MY REALIZED GAIN WAS $660!

These CCS's were sold at $0.60/ea and were bought back at $0.05/ea -- THIS MEANS MY REALIZED GAIN WAS $660!

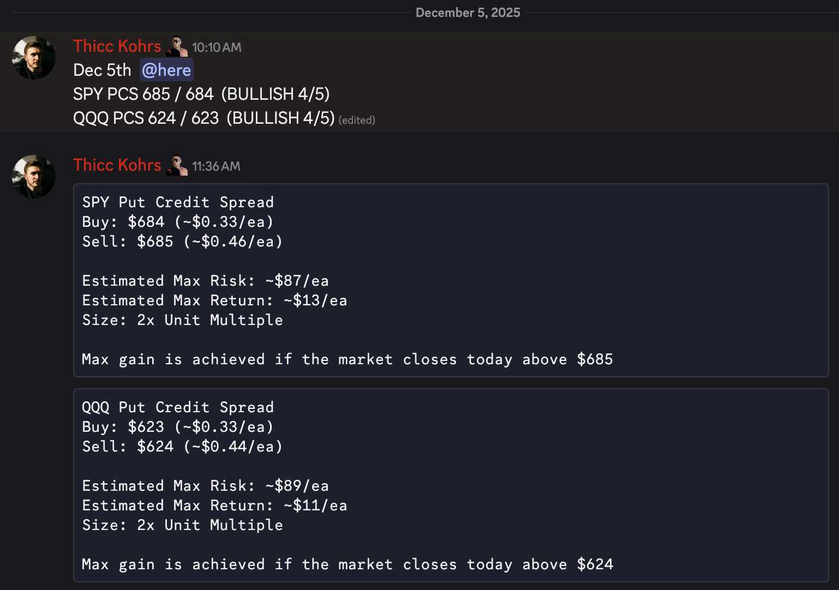

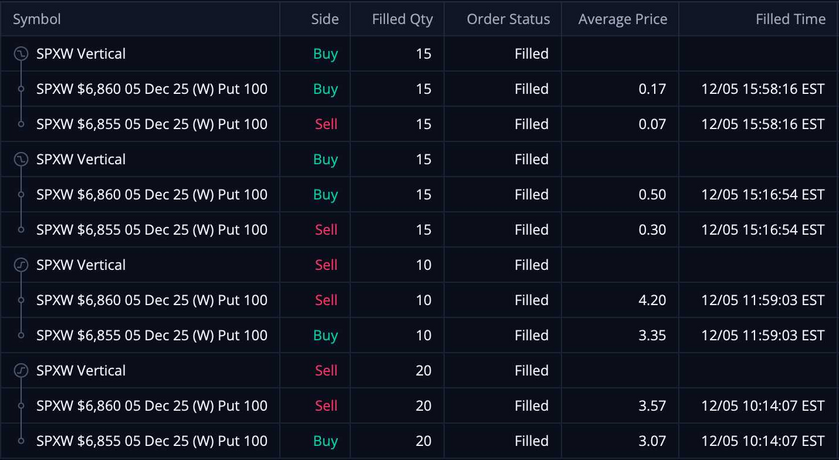

Both of these trades hit if held until close -- 4 total units!

Both of these trades hit if held until close -- 4 total units! These PCS's were sold at $0.65/ea and were bought back at $0.05/ea -- THIS MEANS MY REALIZED GAIN WAS $600!

These PCS's were sold at $0.65/ea and were bought back at $0.05/ea -- THIS MEANS MY REALIZED GAIN WAS $600!