I HATE THIS GAME!

As you can see from my plays below, I'm positioned neutral-bearish. I'm currently short a bunch of call premium, which means these back-to-back bullish days have been particularly painful for me. My reasoning for selling so much call premium is multifaceted: bearish seasonality, bearish price action since Feb 15th & hawkish economic reports. With all the being said, the kitchen is starting to get a bit hot.

The overall market has been ripping higher in the recent sessions as shown above. To make things worse, the SPY has also had some nice technical breakouts. It appears as if $408 is the next target (if $405 can hold). I will most likely have to create some defensive positions this week, but I very much hope the Unemployment Report (Friday, March 10th @ 8:30am ET) goes my way.

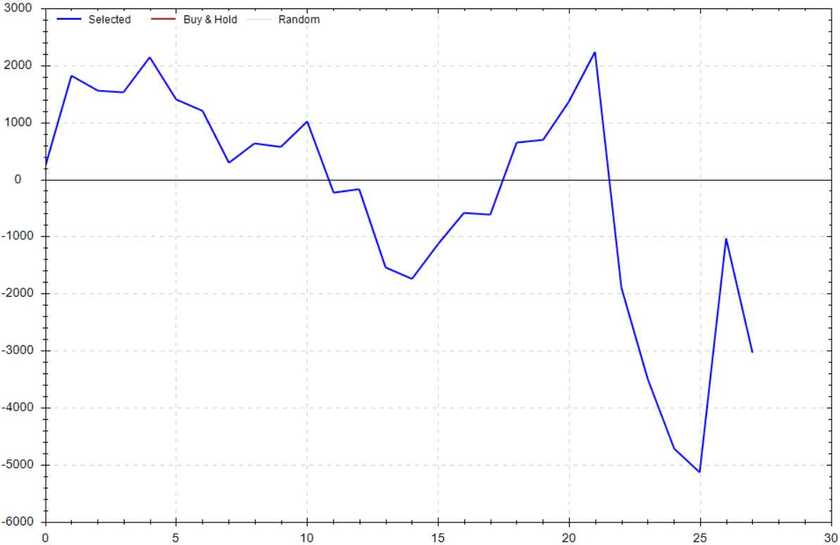

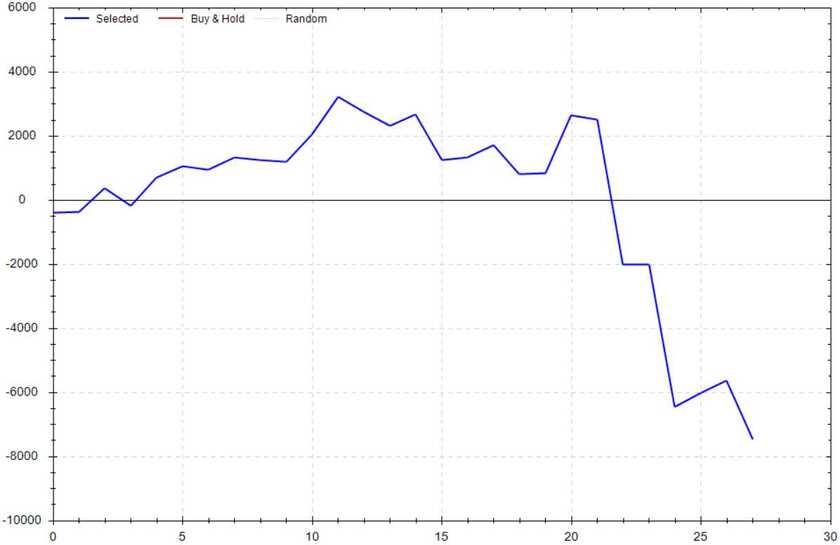

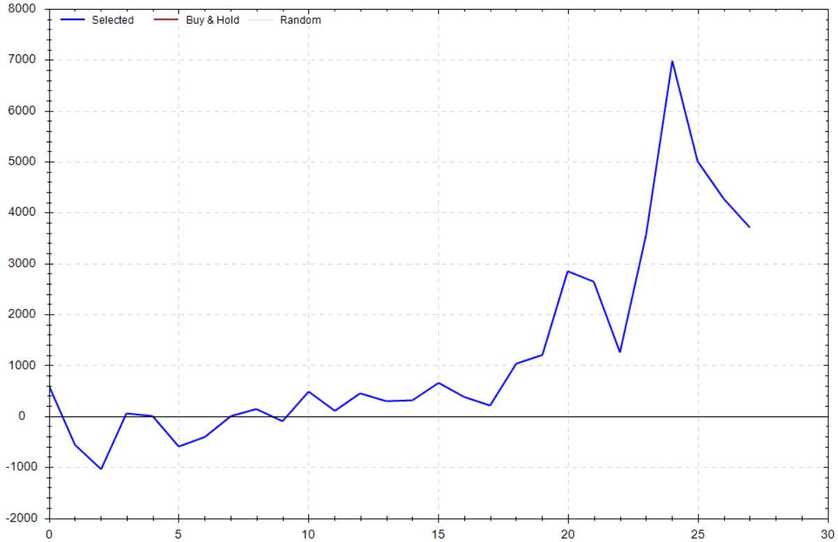

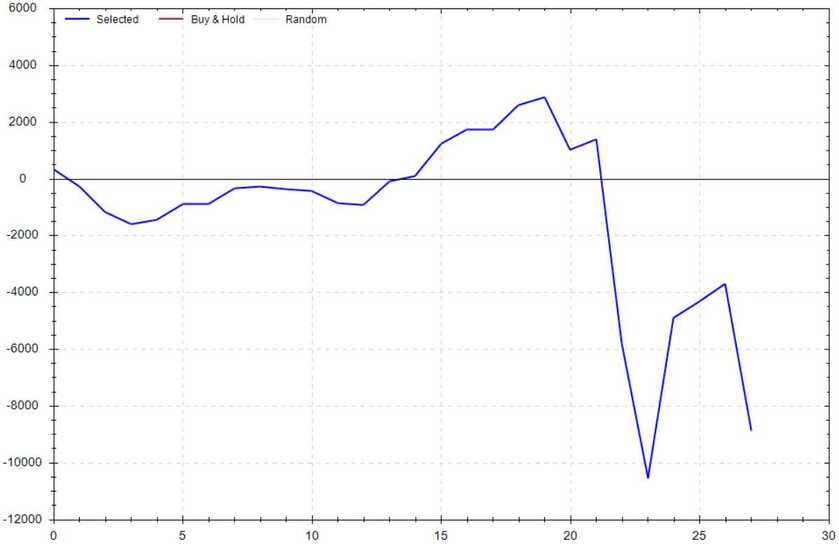

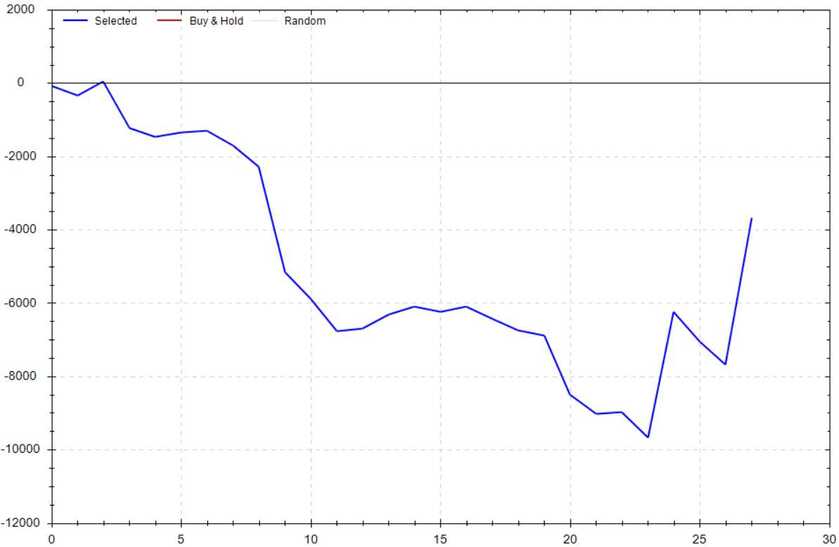

Seasonality Update

S&P 500 Seasonal Bias (March 6th)

- Trades (Years Tested): 25

- Bull Win Percentage: 44%

- Profit Factor: 0.32

- Bias: Bearish

Equity Curve -->

Current Account Value (March 5th)

$9,996.57

Daily Realized P&L: +$114.48

YTD Realized P&L: +$570.88

Closed Position(s) +$115

NFLX $347.50/$350 CCS (5) March 17th

- Original Credit: $0.38/ea

- Closed Debit: $0.15/ea

- P&L: +$115 (+60%)

New Position(s)

None

Current Position(s)

COIN Call Credit Spread (5) March 17th

- Sold: $72 & Bought: $77 --> Credit: $0.50/ea

- Max Return: $50/ea & Max Risk: $250/ea

- Current Value: $0.98/ea

- Profit Target: $0.20/ea

- Profit Odds: 75%

META Call Credit Spread (5) March 17th

- Sold: $190 & Bought: $192.5 --> Credit: $0.33/ea

- Max Return: $33/ea & Max Risk: $217/ea

- Current Value: $0.82/ea

- Profit Target: $0.15/ea

- Profit Odds: 63%

SPY Call Credit Spread (3) March 17th

- Sold: $409 & Bought: $412 --> Credit: $0.56/ea

- Max Return: $56/ea & Max Risk: $244/ea

- Current Value: $1.10/ea

- Profit Target: $0.25/ea

- Profit Odds: 63%

QQQ Call Credit Spread (5) March 24th

- Sold: $313 & Bought: $315 --> Credit: $0.38/ea

- Max Return: $38/ea & Max Risk: $162/ea

- Current Value: $0.43/ea

- Profit Target: $0.15/ea

- Profit Odds: 79%

SPY #2 Call Credit Spread (4) March 31st

- Sold: $415 & Bought: $417 --> Credit: $0.42/ea

- Max Return: $42/ea & Max Risk: $158/ea

- Current Value: $0.58/ea

- Profit Target: $0.20/ea

- Profit Odds: 72%

TSLA Call Credit Spread (3) March 31st

- Sold: $245 & Bought: $250 --> Credit: $0.70/ea

- Max Return: $70/ea & Max Risk: $430/ea

- Current Value: $0.30/ea

- Profit Target: $0.20/ea

- Profit Odds: 92%

TSLA #2 Call Credit Spread (5) March 31st

- Sold: $220 & Bought: $222.50 --> Credit: $0.37/ea

- Max Return: $37/ea & Max Risk: $213/ea

- Current Value: $0.48/ea

- Profit Target: $0.15/ea

- Profit Odds: 77%

SPY #3 Call Credit Spread (5) April 6th

- Sold: $414 & Bought: $417 --> Credit: $0.55/ea

- Max Return: $55/ea & Max Risk: $245/ea

- Current Value: $0.98/ea

- Profit Target: $0.20/ea

- Profit Odds: 68%

My Thoughts

I have two main concerns at the current moment: META $190/$192.50 & SPY $409/$412. Zuckerberg pulled off a very impressive day to finish out the week. If META doesn't quickly revert, I'll need to transform my current position into an iron condor or a collar. This could very well still be a loss, but it would help lessen the impact.

For the SPY $409/$412 play, my fate is in the hands of the Fed speeches this week & Friday's Unemployment Report. It may not help me, but I do want to remind everyone that the first half of March is seasonally bearish. If things continue to push against me, I will use the same defensive measures as stated above with META -- I will also cry an extra amount in the shower.

As I'm review everything, there are two major ways I would critique myself. My positions are highly correlated. This is obviously nice if things are going in your favor, but it's uniquely painful if things turn against you. Moving forward I'll be attempting to lessen the correlation between all of my plays. Additionally, I want to use less of my available capital for my core positions. I'm concerned I don't have enough free capital for my defensive maneuvers because I went "too big" with the initial spreads.

Make sure to check back throughout the week to see how I defend myself from the market overlords screwing me.

(This is why I'm not worried about my COIN play:

As always, thanks for reading! If you have any questions, comments or concerns, don't hesitate to reach out to me. Much love!

Notes

Max Return (Credit Spreads): The credit received when creating the position. This is achieved when you get to the expiration date and the price is below the sold contract for a Call Credit Spread and above the sold contract for a Put Credit Spread.

Max Risk (Credit Spreads): The difference between the spread's two strikes minus the credit received when the position was created.

Breakeven (Credit Spreads): The sold strike plus the credit for CCS and the strike minus the credit for PCS.

RISK WARNING: Trading involves HIGH RISK and YOU CAN LOSE a lot of money. Do not risk any money you cannot afford to lose. Trading is not suitable for all investors. We are not registered investment advisors. We do not provide trading or investment advice. We provide research and education through the issuance of statistical information containing no expression of opinion as to the investment merits of a particular security. Information contained herein should not be considered a solicitation to buy or sell any security or engage in a particular investment strategy. Past performance is not necessarily indicative of future results. Links above include affiliate commission or referrals. I'm part of an affiliate network and I receive compensation from partnering websites. The video is accurate as of the posting date but may not be accurate in the future.

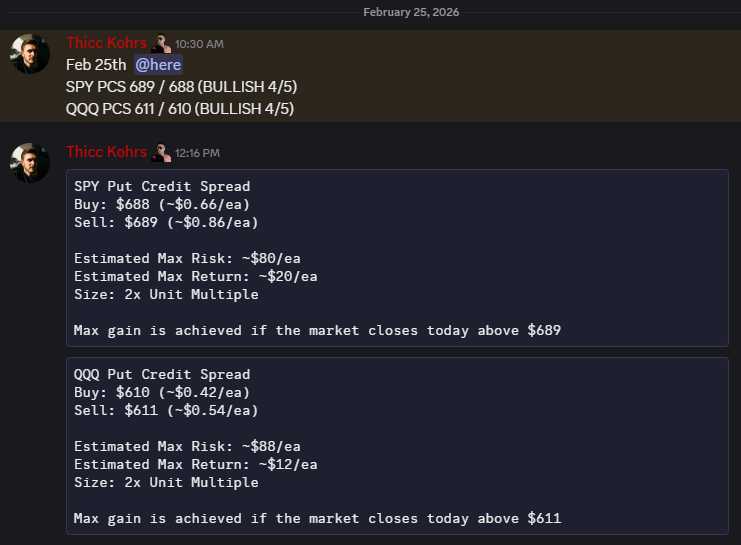

Both of these trades missed. Both of these trades hit if held until close -- 4 total units!

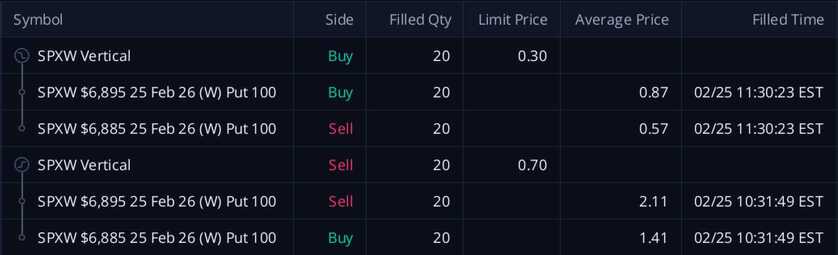

Both of these trades missed. Both of these trades hit if held until close -- 4 total units! These PCS's were sold at $0.70/ea and were bought back at $0.30/ea -- THIS MEANS MY REALIZED GAIN WAS $800!

These PCS's were sold at $0.70/ea and were bought back at $0.30/ea -- THIS MEANS MY REALIZED GAIN WAS $800!

Both of these trades missed. Both of these trades hit if held until close -- 4 total units!

Both of these trades missed. Both of these trades hit if held until close -- 4 total units!