The Day Before

To all my readers who have bearish positions, congrats! The only thing more impressive than your gains is how physically attractive you are. To all my readers who have bullish positions, ...yea.

You're still your mom's favorite (maybe?).

The equities market got absolutely rocked today. Even though today had a seasonal bullish bias, it wasn't enough. There is an extreme amount of uncertainty in the market heading into the Unemployment Report tomorrow morning. At the risk of assaulting a previously alive horse, markets hate uncertainty. Big money players hate uncertainty more than I hate being asked "do you still own AMC?".

Today's action was notably bearish (i.e. The SPY broke the $392 support). Shown below are the major levels I'll be watching tomorrow. Be prepared for large swings -- Things are about to get spicy.

Market Events: March 10th

08:30 AM Employment Report

08:30 AM U.S. Unemployment Rate

08:30 AM Average Hourly Wages

08:30 AM Average Hourly Wages (YoY)

02:00 PM Federal Budget

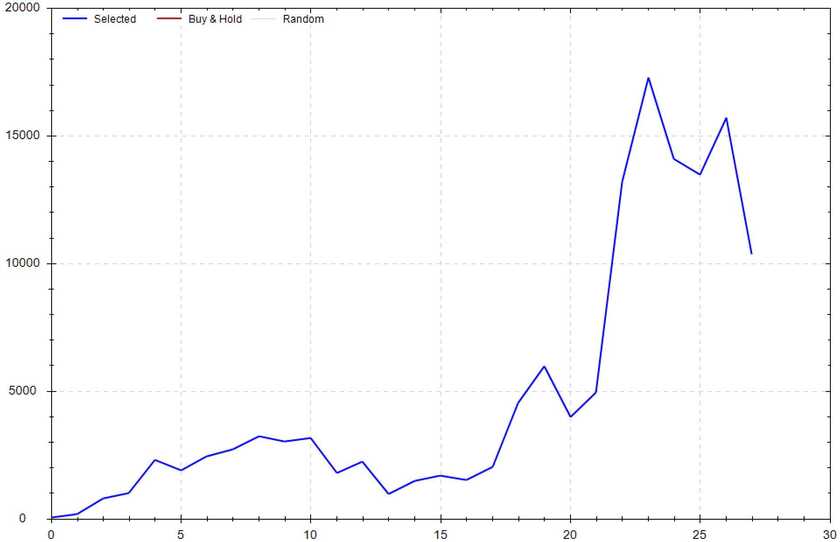

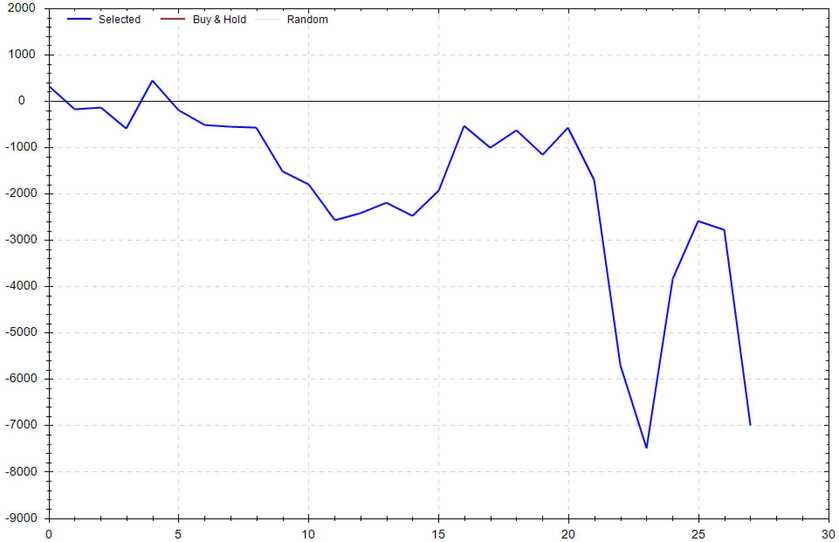

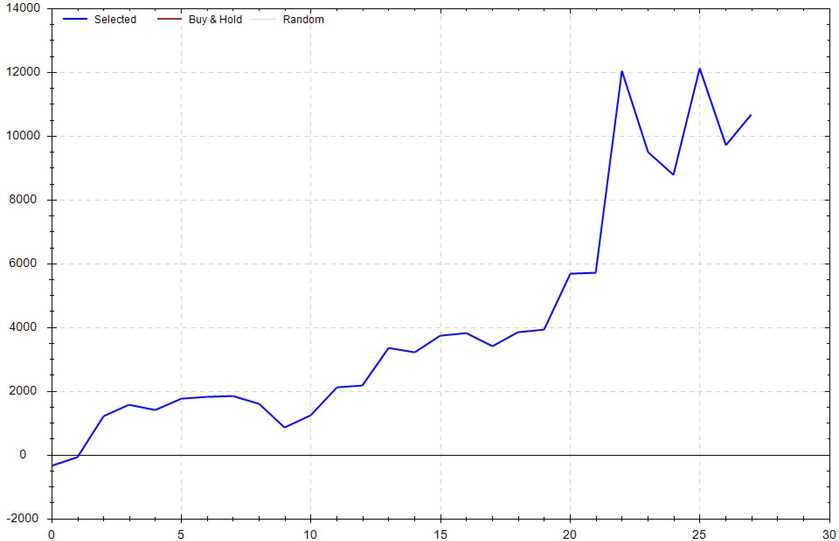

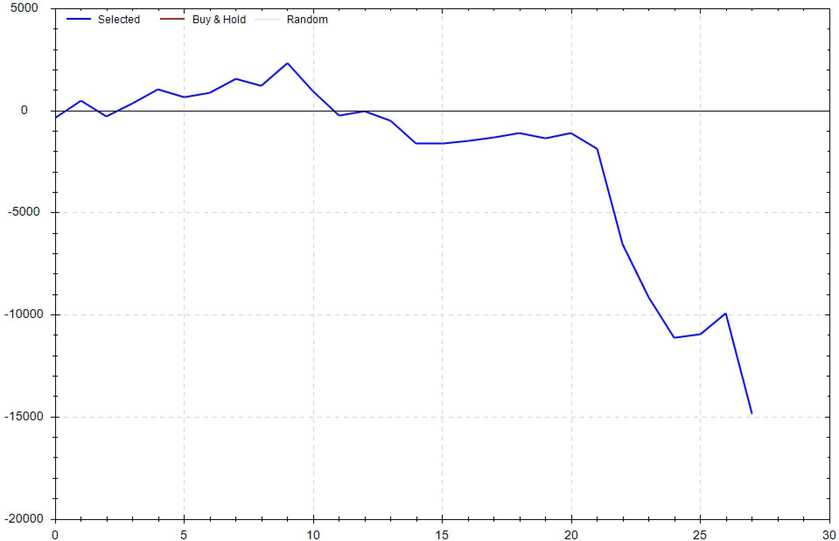

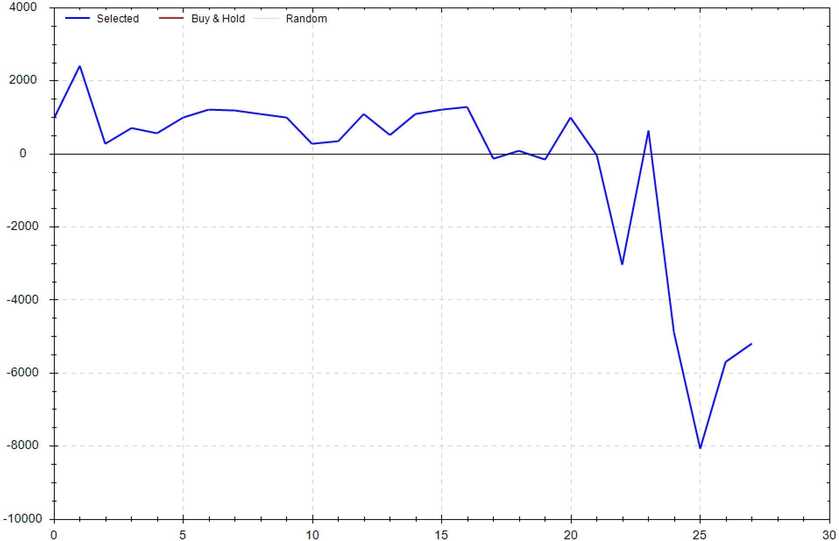

Seasonality Update

S&P 500 Seasonal Bias (March 10th)

- Bull Win Percentage: 0.29

- Profit Factor: 56%

- Bias: Bearish

Equity Curve -->

Current Account Value (March 9th) +$173

$11,375.08

Daily Realized P&L: +$173

YTD Realized P&L: +$957

Closed Position(s) +$173

SPY Call Credit Spread (3) March 17th

- Original Credit: $56

- Closed Debit: $25

- P&L: +$93 (+55.4%)

SPY #2 Call Credit Spread (4) March 31st

- Original Credit: $42

- Closed Debit: $20

- P&L: +$80 (+52.8%)

New Position(s)

None

Current Position(s)

COIN Call Credit Spread (5) March 17th

- Sold: $72 & Bought: $77 --> Credit: $50

- Max Return: $50 & Max Risk: $250

- Current Value: $26

- Profit Target: $20

- Profit Odds: 91%

META Call Credit Spread (5) March 17th

- Sold: $190 & Bought: $192.5 --> Credit: $33

- Max Return: $33 & Max Risk: $217

- Current Value: $51

- Profit Target: $15

- Profit Odds: 76%

META Put Credit Spread (10) March 17th

- Sold: $170 & Bought: $167.50 --> Credit: $18

- Max Return: $18 & Max Risk: $232

- Current Value: $31

- Profit Target: Undecided

- Profit Odds: 83%

QQQ Call Credit Spread (5) March 24th

- Sold: $313 & Bought: $315 --> Credit: $38

- Max Return: $38 & Max Risk: $162

- Current Value: $16

- Profit Target: $15

- Profit Odds: 91%

NVDA Call Credit Spread (2) March 31st

- Sold: $270 & Bought: $275 --> Credit: $71

- Max Return: $71 & Max Risk: $429

- Current Value: $51

- Profit Target: $25

- Profit Odds: 89%

OXY Put Credit Spread (10) March 31st

- Sold: $58 & Bought: $57 --> Credit: $20

- Max Return: $20 & Max Risk: $80

- Current Value: $28

- Profit Target: $8

- Profit Odds: 66%

QQQ Call Credit Spread (10) March 31st

- Sold: $312 & Bought: $313 --> Credit: $0.20

- Max Return: $20 & Max Risk: $80

- Current Value: $13

- Profit Target: $8

- Profit Odds: 87%

WMT Call Credit Spread (10) March 31st

- Sold: $145 & Bought: $146 --> Credit: $20

- Max Return: $20 & Max Risk: $80

- Current Value: $9

- Profit Target: $8

- Profit Odds: 90%

SPY Call Credit Spread (5) April 6th

- Sold: $414 & Bought: $417 --> Credit: $55

- Max Return: $55 & Max Risk: $245

- Current Value: $35

- Profit Target: $20

- Profit Odds: 88%

My Thoughts

Tomorrow is essentially the flip of a coin in my mind. If the Unemployment Report is "good", I'm expecting the market to continue to bearish path downward. However, if the Unemployment Report is "bad", there is a good chance I'll having an extra bottle of sangria. The seemingly illogical inverse is because of the Fed. Inflation is high, and the Fed's job is to control it. In the event that the Unemployment Report holds strong or drops, there is no reason for the Fed to not be more aggressive in their hawkish ways. This would essentially guarantee a 50bps rate hike on March 22nd, which would put even more downward pressure on stocks. The inverse is also true. If unemployment jumps, the economy would be showing signs of weakness. This could force the Fed to go with a 25bps rate hike, which would put less downward pressure on stonks. Pay close attention to the dollar (DXY) breaking out or getting rejected.

As things currently stand, I'm really happy with my positions. Yes, the high correlation could be improved. But honestly, what kind of journey would we be on if I started out as being a perfect trader?

Thanks for reading -- You're a beautiful mother fucker!

Notes

Max Return (Credit Spreads): The credit received when creating the position. This is achieved when you get to the expiration date and the price is below the sold contract for a Call Credit Spread and above the sold contract for a Put Credit Spread.

Max Risk (Credit Spreads): The difference between the spread's two strikes minus the credit received when the position was created.

Breakeven (Credit Spreads): The sold strike plus the credit for CCS and the strike minus the credit for PCS.

RISK WARNING: Trading involves HIGH RISK and YOU CAN LOSE a lot of money. Do not risk any money you cannot afford to lose. Trading is not suitable for all investors. We are not registered investment advisors. We do not provide trading or investment advice. We provide research and education through the issuance of statistical information containing no expression of opinion as to the investment merits of a particular security. Information contained herein should not be considered a solicitation to buy or sell any security or engage in a particular investment strategy. Past performance is not necessarily indicative of future results. Links above include affiliate commission or referrals. I'm part of an affiliate network and I receive compensation from partnering websites. The video is accurate as of the posting date but may not be accurate in the future.