Whiplash Galore!!!

Things popped. Things dropped. Things then really popped?!

The Jobs Report & Housing Data prompted volatility this morning, but the ECB really got things hot & bothered. The European Central Bank decided to raise their rate by 50bps this morning. At first, this seemed be bearish. I mean after all, they did take steps to lessen demand and stated various European banks could be vulnerable in the current economic environment.

That might sound pretty gnarly upon your first read -- I fully agree. But let's think about it another way. The fact that the ECB felt comfortable with a sizeable rate hike could mean that they believe the current situation isn't that disastrous. To put it another way, their willingness to push down on the economy means they don't think the economy is that bad.

I have no clue if they are right or wrong, but the bulls in the market are enjoying the decision. I made some smart moves, some dumb moves, and think something exciting is on the horizon (all detailed below).

Market Events: Thursday, March 17th

09:15 AM Industrial Production

09:15 AM Capacity Utilization

10:00 AM U.S. Leading Economic Index

10:00 AM Consumer Sentiment

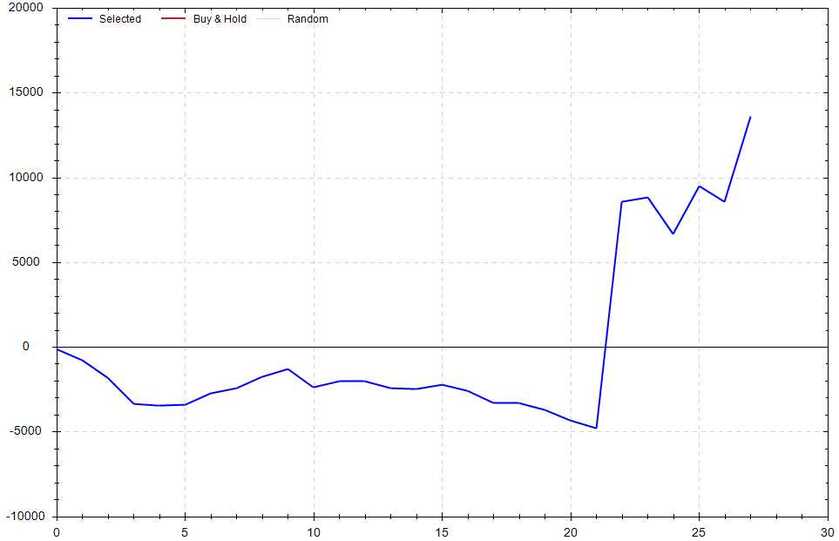

Seasonality Update

S&P 500 Seasonal Bias (March 17th)

- Bull Win Percentage: 68%

- Profit Factor: 1.23

- Bias: Leaning Bullish

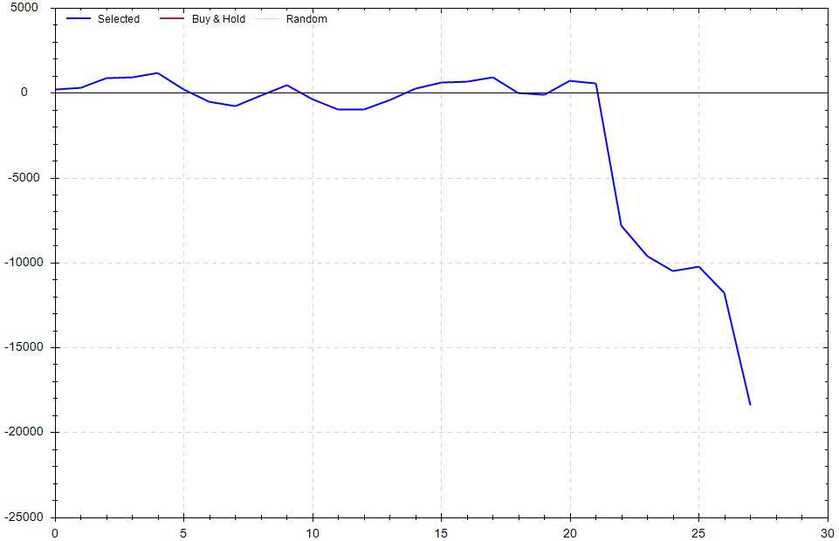

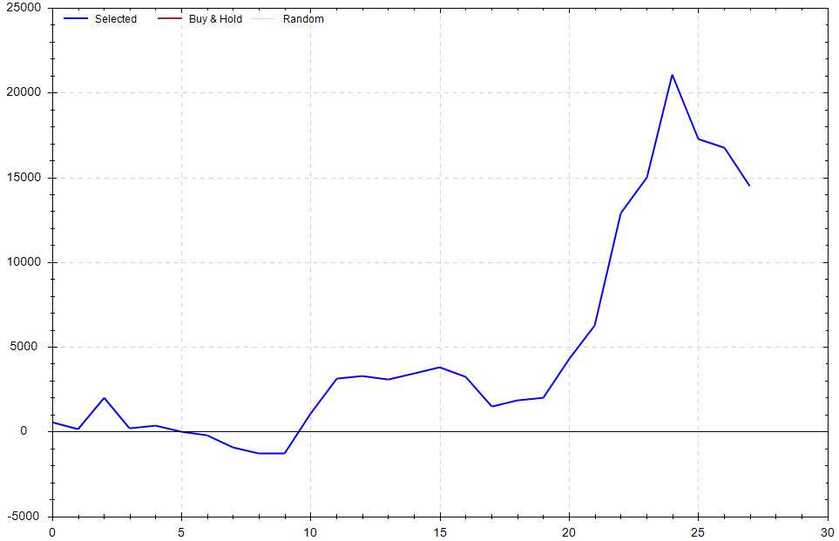

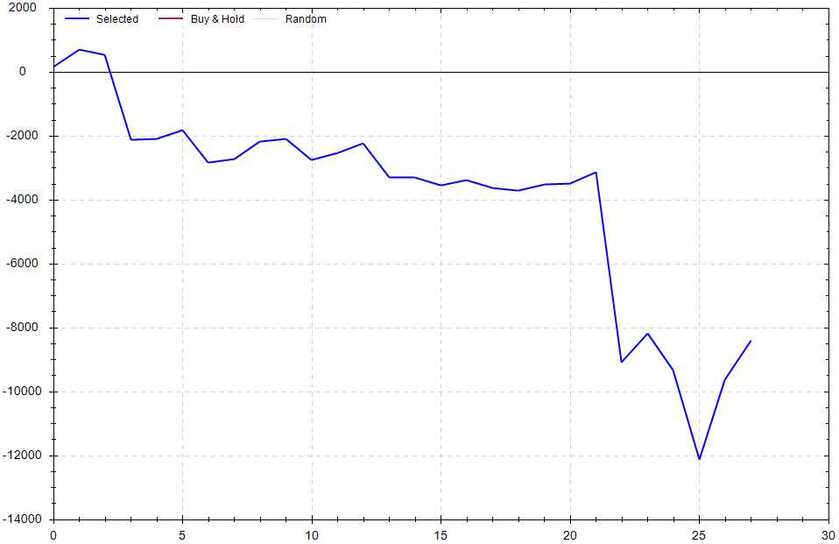

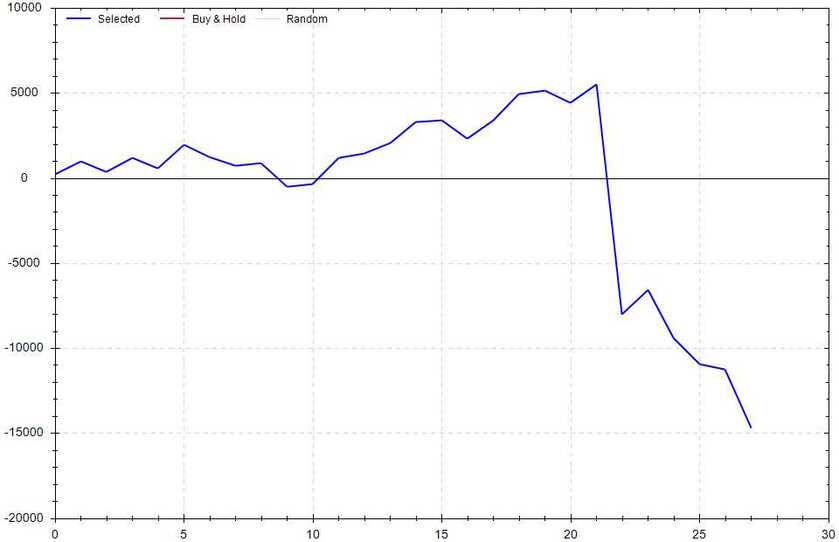

Equity Curve -->

Current Account Value (March 16th) +$168

$9,395

Daily Realized P&L: +$168

YTD Realized P&L: +$1,855

Closed Position(s) +$168

META $187.50/$185 Put Credit Spread (7) March 17th

- Original Credit: $28

- Closed Debit: $4

- P&L: +$168 (+85.7%)

New Position(s)

META PUT Credit Spread (8) March 17th

- Sold: $202.5 & Bought: $200 --> Credit: $108

- Max Return: $108 & Max Risk: $142

- Current Value: $59

- Profit Target: $0 (Max)

- Profit Odds: 47%

Reasoning: I'm essentially on tilt. My plan is apparently throwing whatever I can at the wall to save this position. Godspeed.

Current Position(s)

META Call Credit Spread (5) March 17th

- Sold: $190 & Bought: $192.5 --> Credit: $33

- Max Return: $33 & Max Risk: $217

- Current Value: $250

- Profit Target: $0 (Max)

- Profit Odds: 22%

META CALL Credit Spread (8) March 17th

- Sold: $200 & Bought: $202.50 --> Credit: $38

- Max Return: $38 & Max Risk: $212

- Current Value: $198

- Profit Target: $0 (Max)

- Profit Odds: 37%

NVDA Call Credit Spread (2) March 31st

- Sold: $270 & Bought: $275 --> Credit: $71

- Max Return: $71 & Max Risk: $429

- Current Value: $125

- Profit Target: $25

- Profit Odds: 71%

OXY Put Credit Spread (10) March 31st

- Sold: $58 & Bought: $57 --> Credit: $20

- Max Return: $20 & Max Risk: $80

- Current Value: $37

- Profit Target: $8

- Profit Odds: 57%

QQQ Call Credit Spread (10) March 31st

- Sold: $312 & Bought: $313 --> Credit: $0.20

- Max Return: $20 & Max Risk: $80

- Current Value: $40

- Profit Target: $8

- Profit Odds: 64%

TSLA Call Credit Spread (4) March 31st

- Sold: $200 & Bought: $202.50 --> Credit: $37

- Max Return: $37 & Max Risk: $213

- Current Value: $52

- Profit Target: $15

- Profit Odds: 78%

JPM Put Credit Spread (5) April 6th

- Sold: $125 & Bought: $120 --> Credit: $100

- Max Return: $100 & Max Risk: $400

- Current Value: $103

- Profit Target: $40

- Profit Odds: 67%

TSLA Call Credit Spread (5) April 6th

- Sold: $207.50 & Bought: $210 --> Credit: $40

- Max Return: $40 & Max Risk: $210

- Current Value: $51

- Profit Target: $15

- Profit Odds: 81%

TLT Put Credit Spread (10) April 21st

- Sold: $101 & Bought: $100 --> Credit: $27

- Max Return: $27 & Max Risk: $73

- Current Value: $24

- Profit Target: $40

- Profit Odds: 72%

My Thoughts

Oh brother... I had quite the interesting day.

Both of these trades missed. Both of these trades hit if held until close -- 4 total units!

Both of these trades missed. Both of these trades hit if held until close -- 4 total units! These PCS's were sold at $1.30/ea and were bought back at $0.30/ea -- THIS MEANS MY REALIZED GAIN WAS $2,000!!!

These PCS's were sold at $1.30/ea and were bought back at $0.30/ea -- THIS MEANS MY REALIZED GAIN WAS $2,000!!!