Hear ye, hear ye!

The markets have decided the banking crisis is stable, so we are naturally ripping to kingdom come. The exact levels I'm watching, and my concerns for what could screw things up, are detailed below.

There were a few major Market Events today. The second GDP revision was report (2.6% vs 2.7%), jobless claims were posted (198k vs 195k) & various Fed members spoke. One of the Fed members shared the opinion that there will be one more rate hike and then we will be done for the year. This statement paired with the banking issues simmering down is most likely why the bulls were able to represent so much strength.

I don't want to be a negative nancy, but a lot could change tomorrow. One hour before the market opens, the PCE Inflation data will be made public. This will most likely prompt a volatile reaction. There is no way to know if the bull or bears will end up winning, so make sure you're paying attention.

As a little bonus, the seasonality of April is very much pointing to the upside. Time to see if this party will continue!!!

Market Events: Tuesday, March 31st

08:30 AM Personal Income (Nominal)

08:30 AM Personal Spending (Nominal)

08:30 AM PCE Index

08:30 AM Core PCE Index

08:30 AM PCE (YoY)

08:30 AM Core PCE (YoY)

09:45 AM Chicago Business Barometer

10:00 AM U Mich Consumer Sentiment (Final)

03:05 PM New York Fed President Williams Speaks

04:15 PM Fed H.8 Report on Bank Assets & Deposits

05:45 PM Fed Gov. Cook Speaks

10:00 PM Fed Gov. Waller Speaks

Seasonality Update

S&P 500 Seasonal Bias (March 31st)

- Bull Win Percentage: 38.9%

- Profit Factor: 0.30

- Bias: Bearish

Equity Curve -->

Current Account Value (March 30th) +$300

$9,842

Daily Realized P&L: +$300

YTD Realized P&L: +$856

Closed Position(s) +$300

JPM $125/$120 Put Credit Spread (5) April 6th

- Original Credit: $100

- Closed Debit: $40

- P&L: +$300 (+60%)

New Position(s)

QQQ CALL Credit Spread (25) March 31st

- Sold: $318 & Bought: $319 --> Credit: $22

- Max Return: $22 & Max Risk: $78

- Current Value: $18

- Profit Target: $0

- Profit Odds: 75%

Reasoning: This is a hedge to help mitigate the potential loss from the QQQ 312/313 CCS. I'm using the term hedge loosely here. If the market continues to rip, I'll be double screwed. The odds of such a continuation are low, but not zero.

Current Position(s)

NVDA Call Credit Spread (2) March 31st

- Sold: $270 & Bought: $275 --> Credit: $71

- Max Return: $71 & Max Risk: $429

- Current Value: $305

- Profit Target: $25

- Profit Odds: 22%

QQQ Call Credit Spread (10) March 31st

- Sold: $312 & Bought: $313 --> Credit: $0.20

- Max Return: $20 & Max Risk: $80

- Current Value: $86

- Profit Target: $8

- Profit Odds: 15%

TSLA Call Credit Spread (4) March 31st

- Sold: $200 & Bought: $202.50 --> Credit: $37

- Max Return: $37 & Max Risk: $213

- Current Value: $35

- Profit Target: $15

- Profit Odds: 61%

SPY Call Credit Spread (5) April 6th

- Sold: $406 & Bought: $407 --> Credit: $12

- Max Return: $23 & Max Risk: $77

- Current Value: $44

- Profit Target: $10

- Profit Odds: 59%

SPY Iron Condor (3) April 6th

- $411/$412 Call Spread --> Credit: $18

- $386/$385 Put Spread --> Credit: $19

- Max Return: $37 & Max Risk: $63

- Current Value: $21

- Profit Target: $15

- Profit Odds: 82%

TSLA Call Credit Spread (5) April 6th

- Sold: $207.50 & Bought: $210 --> Credit: $40

- Max Return: $40 & Max Risk: $210

- Current Value: $56

- Profit Target: $15

- Profit Odds: 75%

SPY Iron Condor (3) April 10th

- $407/$408 Call Spread --> Credit: $23

- $387/$386 Put Spread --> Credit: $16

- Max Return: $39 & Max Risk: $61

- Current Value: $48

- Profit Target: $15

- Profit Odds: 61%

SPY Iron Condor (3) April 10th

- $405/$406 Call Spread --> Credit: $22

- $384/$383 Put Spread --> Credit: $16

- Max Return: $38 & Max Risk: $62

- Current Value: $57

- Profit Target: $15

- Profit Odds: 52%

SPY Iron Condor (5) April 14th

- $411/$412 Call Spread --> Credit: $20

- $375/$374 Put Spread --> Credit: $17

- Max Return: $37 & Max Risk: $63

- Current Value: $37

- Profit Target: $15

- Profit Odds: 70%

SPY Iron Condor (5) April 14th

- $413/$414 Call Spread --> Credit: $18

- $380/$379 Put Spread --> Credit: $16

- Max Return: $34 & Max Risk: $66

- Current Value: $34

- Profit Target: $15

- Profit Odds: 76%

TLT Put Credit Spread (10) April 21st

- Sold: $101 & Bought: $100 --> Credit: $27

- Max Return: $27 & Max Risk: $73

- Current Value: $17

- Profit Target: $10

- Profit Odds: 79%

My Thoughts

They came, they saw, the conquered.

We are setting up for quite the conclusion to the week, month and quarter. If you've been holding on to a bullish position, a massive congrats to you! As many of you know, I've been keenly watching the $400-$402 region for an official breakout. Various developments have been favoring the bull camp, but today really sealed the deal. The breakout came, and more importantly, it held.

I personally believe the odds now greatly favor a follow through, but it's not guaranteed. When it comes to end-of-month and end-of-quarter trading, weird things can definitely happen. You never know how the big guys are going to position themselves. It's tough to predict how things will perform in a singular day, so tomorrow is a bit of a crap shoot. However, I strongly believe early April will be favoring the bulls.

The concerns related to the banking sector seem to be dying off, the technicals are firing off bullish signals & the seasonality is favoring the upside. In the game of trading, nothing is certain, but I'm really liking how much the deck is stacked.

I'll see you on the other side of Friday. Godspeed.

Thanks for reading -- Much Love!

Notes

Max Return (Credit Spreads): The credit received when creating the position. This is achieved when you get to the expiration date and the price is below the sold contract for a Call Credit Spread and above the sold contract for a Put Credit Spread.

Max Risk (Credit Spreads): The difference between the spread's two strikes minus the credit received when the position was created.

Breakeven (Credit Spreads): The sold strike plus the credit for CCS and the strike minus the credit for PCS.

RISK WARNING: Trading involves HIGH RISK and YOU CAN LOSE a lot of money. Do not risk any money you cannot afford to lose. Trading is not suitable for all investors. We are not registered investment advisors. We do not provide trading or investment advice. We provide research and education through the issuance of statistical information containing no expression of opinion as to the investment merits of a particular security. Information contained herein should not be considered a solicitation to buy or sell any security or engage in a particular investment strategy. Past performance is not necessarily indicative of future results. Links above include affiliate commission or referrals. I'm part of an affiliate network and I receive compensation from partnering websites.

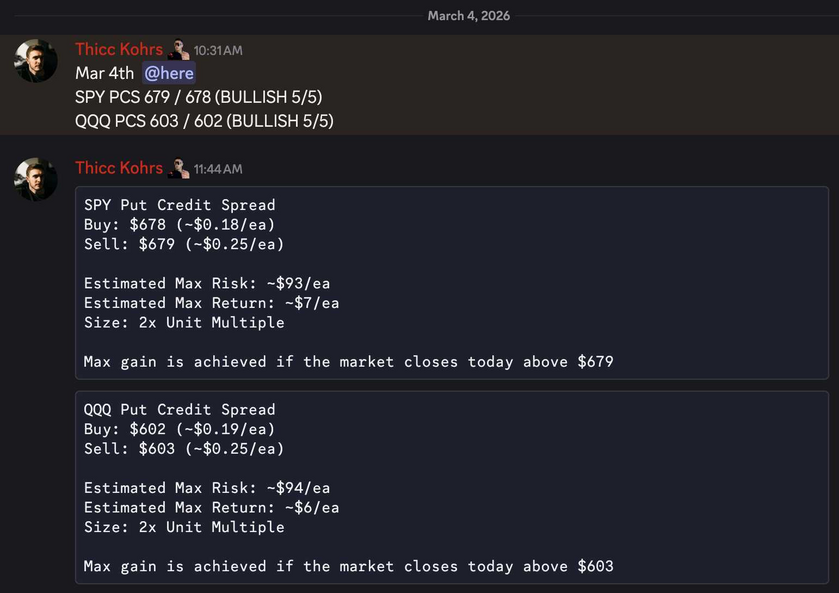

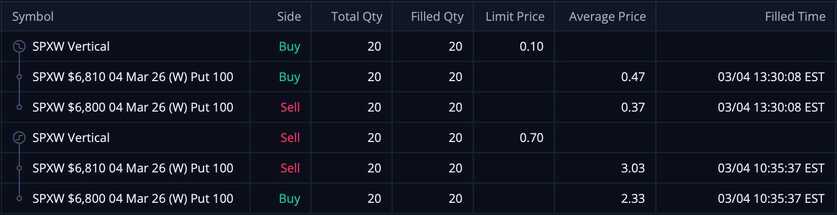

Both of these trades missed. Both of these trades hit if held until close -- 6 total units!

Both of these trades missed. Both of these trades hit if held until close -- 6 total units! These PCS's were sold at $0.70/ea and were bought back at $0.10/ea -- THIS MEANS MY REALIZED GAIN WAS $1,200!

These PCS's were sold at $0.70/ea and were bought back at $0.10/ea -- THIS MEANS MY REALIZED GAIN WAS $1,200!