Moon Bound

Patience has paid!

We waited for things to properly set up, and it greatly paid off. For a couple weeks, I wrote about waiting for the break and hold of the $400-$402 region. The bullish follow through was better than I expected. The upside gap fill to $408.14 came very quickly. I should also probably note that there are now three downside gap fills in the SPY's chart: $404.35, $401.60 & $396.49. I strongly believe these gaps will eventually be filled. As always, it's a matter of patience and time.

The concern in the banking sector seems to be dissipating, April is historically a strong month, and last but not least, the current technical setup evidently favors the bulls. The writing was on the wall -- None of us should be surprised we are currently moon bound.

PSA: This upcoming week is a shortened trading week. The market will be closed on Friday in observation of Good Friday. The Unemployment Report will also be coming out that morning (8:30am ET).

Market Events: Monday, April 3rd

08:30 AM St. Louis Fed President Bullard Speaks

09:45 AM S&P Final U.S. Manufacturing PMI

10:00 AM ISM Manufacturing

10:00 AM Construction Spending

04:15 PM Fed Gov. Cook Speaks

Seasonality Update

S&P 500 Seasonal Bias (April 3rd)

- Bull Win Percentage: 57.9%

- Profit Factor: 0.93

- Bias: Neutral

Equity Curve -->

Current Account Value (April 2nd)

$9,158

Daily Realized P&L: -$510

YTD Realized P&L: +$346

Closed Position(s)

NVDA $270/$275 Put Credit Spread (2) March 31st

- Original Credit: $71

- Closed Debit: $500

- P&L: -$858 (-86%)

QQQ $312/$313 Put Credit Spread (10) March 31st

- Original Credit: $20

- Closed Debit: $100

- P&L: -$800 (-80%)

TSLA $200/$202.50 Put Credit Spread (4) March 31st

- Original Credit: $37

- Closed Debit: $250

- P&L: -$852 (-85%)

Notes: To hedge my bearish exposure, I made a degenerate play that ended up paying off. I dipped my toes into some 0 DTE QQQ calls. My target profit of +$2k hit relatively quickly, which really helped mitigate my overall losses. When it comes to trading, I'd rather be lucky than skillful. #DegenForLife

New Position(s)

None

Current Position(s)

SPY Call Credit Spread (5) April 6th

- Sold: $406 & Bought: $407 --> Credit: $12

- Max Return: $23 & Max Risk: $77

- Current Value: $71

- Profit Target: $10

- Profit Odds: 40%

SPY Iron Condor (3) April 6th

- $411/$412 Call Spread --> Credit: $18

- $386/$385 Put Spread --> Credit: $19

- Max Return: $37 & Max Risk: $63

- Current Value: $44

- Profit Target: $15

- Profit Odds: 62%

TSLA Call Credit Spread (5) April 6th

- Sold: $207.50 & Bought: $210 --> Credit: $40

- Max Return: $40 & Max Risk: $210

- Current Value: $118

- Profit Target: $15

- Profit Odds: 51%

SPY Iron Condor (3) April 10th

- $407/$408 Call Spread --> Credit: $23

- $387/$386 Put Spread --> Credit: $16

- Max Return: $39 & Max Risk: $61

- Current Value: $64

- Profit Target: $15

- Profit Odds: 46%

SPY Iron Condor (3) April 10th

- $405/$406 Call Spread --> Credit: $22

- $384/$383 Put Spread --> Credit: $16

- Max Return: $38 & Max Risk: $62

- Current Value: $74

- Profit Target: $15

- Profit Odds: 40%

SPY Iron Condor (5) April 14th

- $411/$412 Call Spread --> Credit: $20

- $375/$374 Put Spread --> Credit: $17

- Max Return: $37 & Max Risk: $63

- Current Value: $52

- Profit Target: $15

- Profit Odds: 57%

SPY Iron Condor (5) April 14th

- $413/$414 Call Spread --> Credit: $18

- $380/$379 Put Spread --> Credit: $16

- Max Return: $34 & Max Risk: $66

- Current Value: $47

- Profit Target: $15

- Profit Odds: 62%

TLT Put Credit Spread (10) April 21st

- Sold: $101 & Bought: $100 --> Credit: $27

- Max Return: $27 & Max Risk: $73

- Current Value: $10

- Profit Target: $5

- Profit Odds: 86%

My Thoughts

Woot, woot!

I hope you're enjoying the beautiful trend. Markets expand and they contract. The contraction phases can be boring, but they are worth the wait. This isn't always the case, but waiting for the ideal setup commonly leads to a phenomenal money-making opportunity.

Let's talk shop. If you didn't already have a position, should you be buying now? In my opinion, no. I would consider the risk to reward setup right now to be chasing. Could the bullish momentum continue? Absolutely. But, at what cost? What risk? We are in this marathon for the long haul. One trade won't make you, but one trade could definitely break you.

As always, I'll happily share the next setup with all of you as soon as it starts to show itself.

Thanks for reading -- Much Love!

Notes

Max Return (Credit Spreads): The credit received when creating the position. This is achieved when you get to the expiration date and the price is below the sold contract for a Call Credit Spread and above the sold contract for a Put Credit Spread.

Max Risk (Credit Spreads): The difference between the spread's two strikes minus the credit received when the position was created.

Breakeven (Credit Spreads): The sold strike plus the credit for CCS and the strike minus the credit for PCS.

RISK WARNING: Trading involves HIGH RISK and YOU CAN LOSE a lot of money. Do not risk any money you cannot afford to lose. Trading is not suitable for all investors. We are not registered investment advisors. We do not provide trading or investment advice. We provide research and education through the issuance of statistical information containing no expression of opinion as to the investment merits of a particular security. Information contained herein should not be considered a solicitation to buy or sell any security or engage in a particular investment strategy. Past performance is not necessarily indicative of future results. Links above include affiliate commission or referrals. I'm part of an affiliate network and I receive compensation from partnering websites.

Both of these trades hit if held until close -- 4 total units!

Both of these trades hit if held until close -- 4 total units! These CCS's were sold at an average of $0.62/ea and were bought back at an average $0.15/ea -- THIS MEANS MY REALIZED GAIN WAS $1,400!

These CCS's were sold at an average of $0.62/ea and were bought back at an average $0.15/ea -- THIS MEANS MY REALIZED GAIN WAS $1,400!

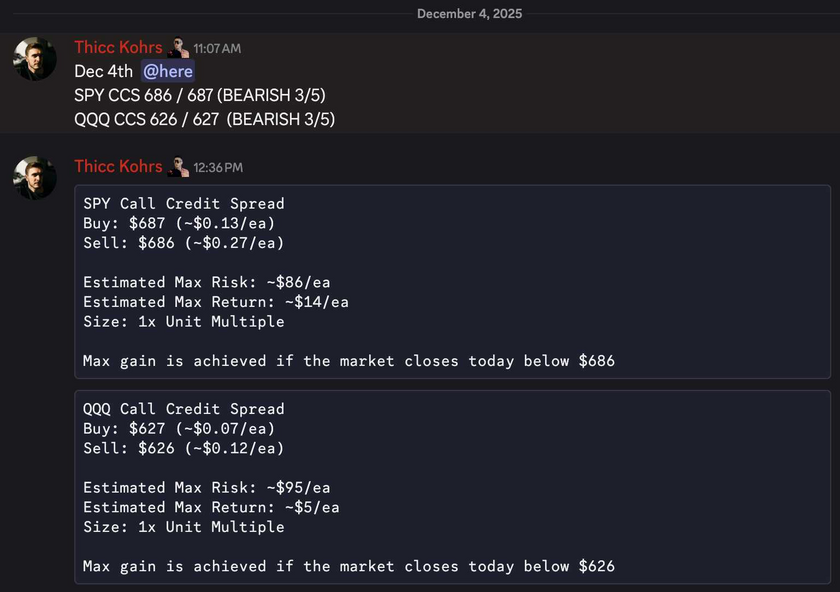

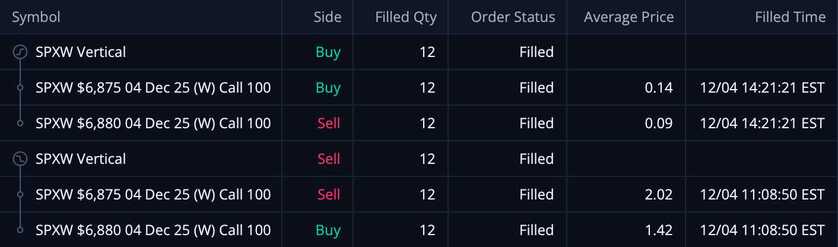

Both of these trades hit if held until close -- 2 total units!

Both of these trades hit if held until close -- 2 total units! These CCS's were sold at $0.60/ea and were bought back at $0.05/ea -- THIS MEANS MY REALIZED GAIN WAS $660!

These CCS's were sold at $0.60/ea and were bought back at $0.05/ea -- THIS MEANS MY REALIZED GAIN WAS $660!

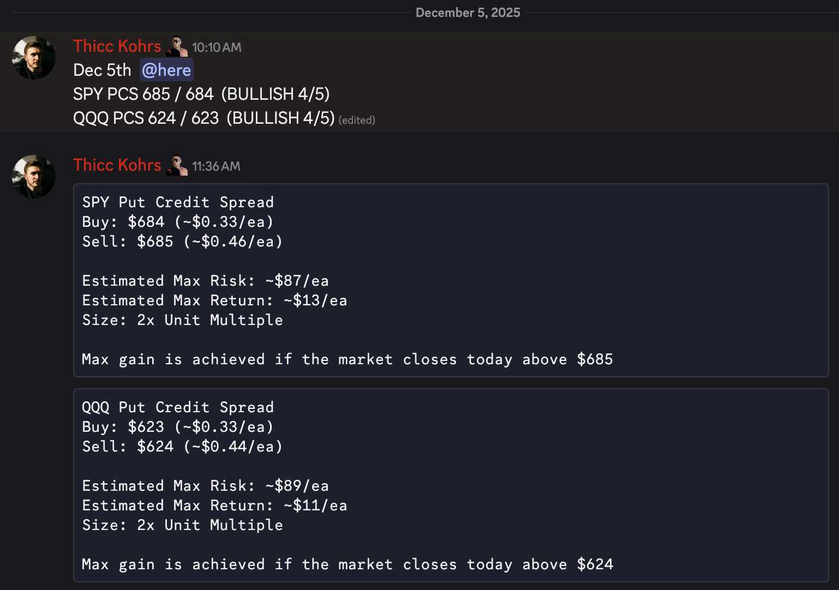

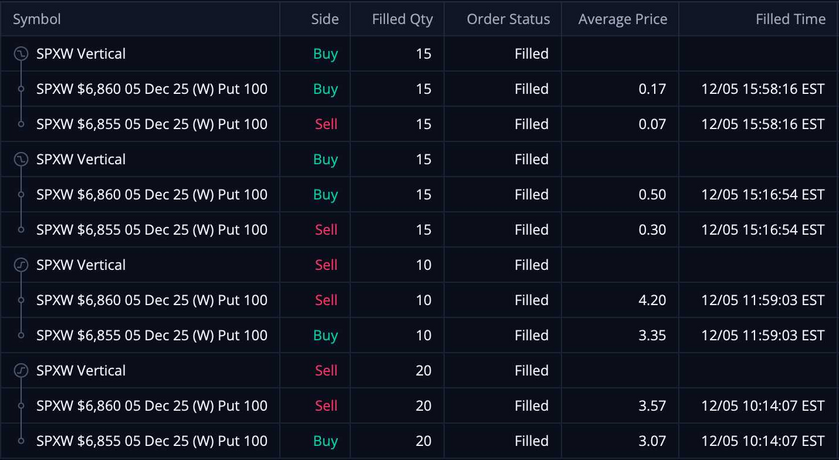

Both of these trades hit if held until close -- 4 total units!

Both of these trades hit if held until close -- 4 total units! These PCS's were sold at $0.65/ea and were bought back at $0.05/ea -- THIS MEANS MY REALIZED GAIN WAS $600!

These PCS's were sold at $0.65/ea and were bought back at $0.05/ea -- THIS MEANS MY REALIZED GAIN WAS $600!