Back To The Chop

Good and bad news -->

The good news: Seasonality called for a bullish day, and that's exactly what we got.

The bad news: My current positions benefit from bearish movement, so my unrealized PnL is hurting.

The major market event of the day was the jobless claims report (228k vs 200k Exp). Early this morning, the market was looking sluggish. I'm not sure if they got up late or just needed a coffee, but the bulls really started to show up around 10:45am ET. If you caught this trade, massive congrats.

Even though this is that last trading day of the week (the market is closed on Friday, April 7th in observation of Murder Friday), the Unemployment Report is coming out tomorrow at 8:30am ET. You'll be able to see if the market is happy or not by watching the reaction in the crypto market -- specifically Bitcoin.

Moving forward, seasonality tells us that Monday has a greater statistical likelihood of being bearish rather than bullish. My positions, all detailed below, very much hope this prediction becomes a reality.

Enjoy the long weekend!

Market Events: Friday, April 7th & Monday, April 10th

Friday

08:30AM U.S. Employment Report

08:30AM U.S. Unemployment Rate

08:30AM Average Hourly Wages

08:30AM Average hourly wages (YoY)

03:00PM Consumer Credit

Monday

10:00AM Wholesale Inventories

Seasonality Update

S&P 500 Seasonal Bias (April 10th)

- Bull Win Percentage: 32%

- Profit Factor: 0.47

- Bias: Bearish

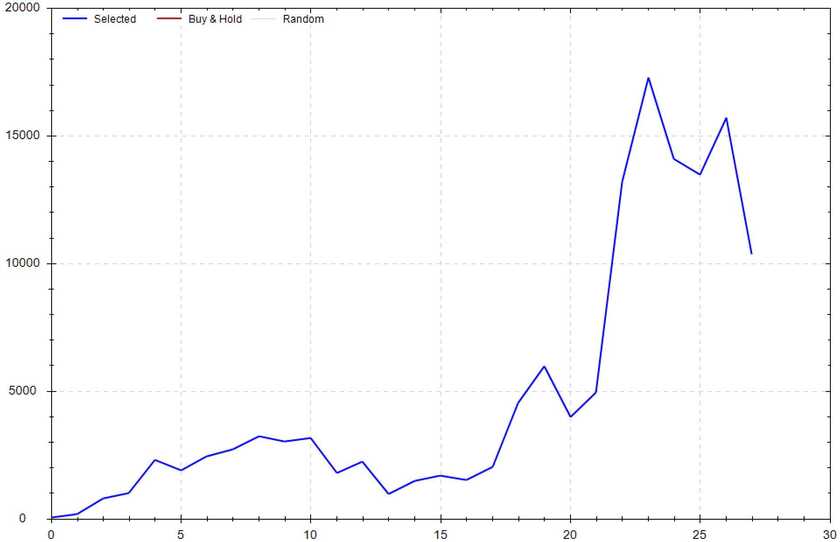

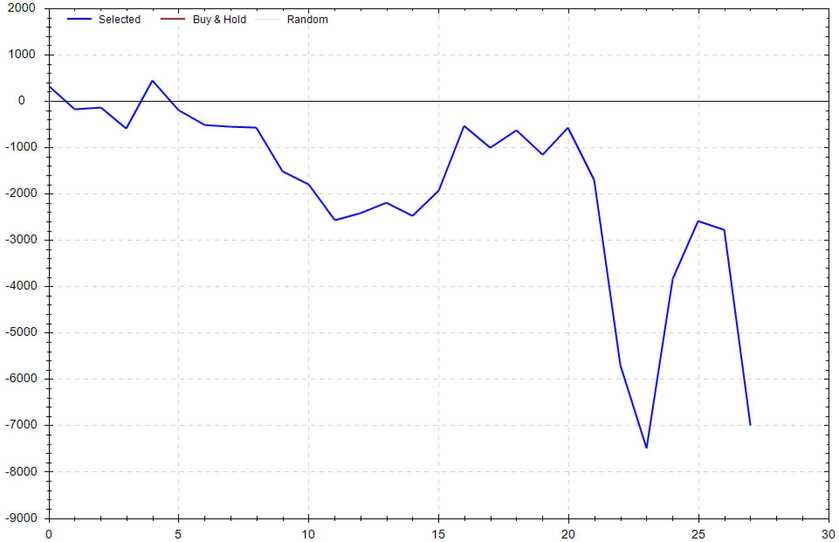

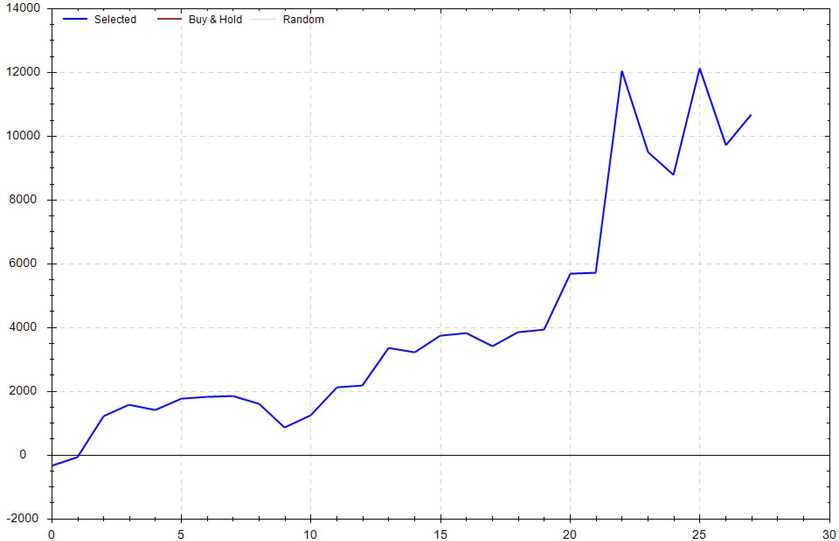

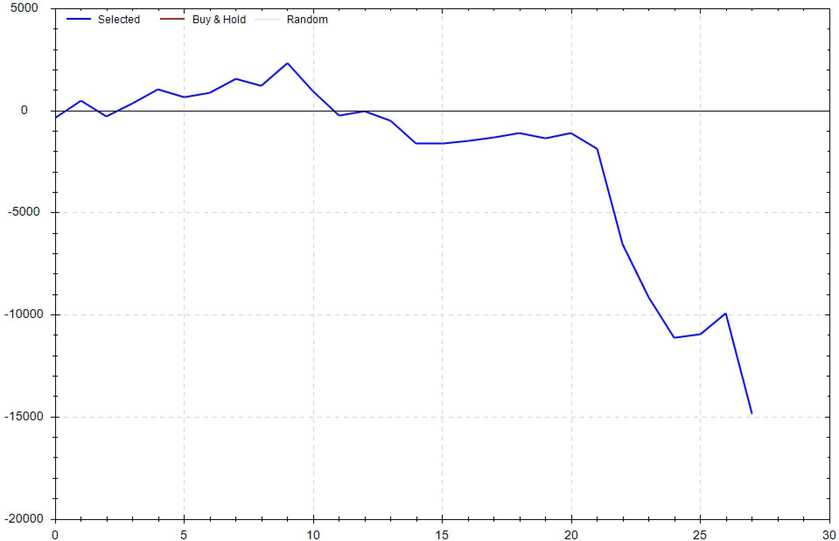

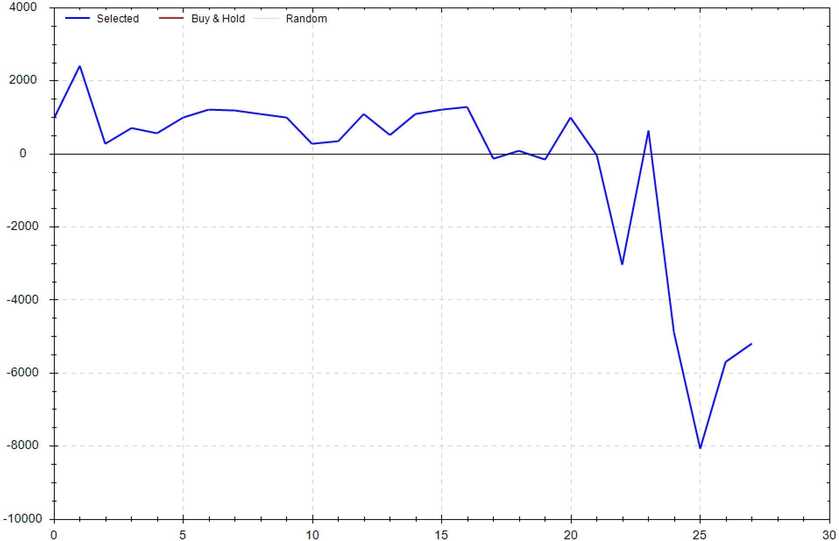

Equity Curve -->

Current Account Value (April 6th)

$11,144

Daily Realized P&L: -$205

YTD Realized P&L: +$520

Closed Position(s) -$205

SPY $406/$407 Call Credit Spread (5) April 6th

- Original Credit: $23

- Closed Debit: $100

- P&L: -$385 (-77%)

SPY Iron Condor $411/$386 (5) April 6th

- Original Credit: $37

- Closed Debit: $1

- P&L: +$180 (+97%)

Current Position(s)

SPY Iron Condor (3) April 10th

- $407/$408 Call Spread --> Credit: $23

- $387/$386 Put Spread --> Credit: $16

- Max Return: $39 & Max Risk: $61

- Current Value: $65

- Profit Target: $15

- Profit Odds: 32%

SPY Iron Condor (3) April 10th

- $405/$406 Call Spread --> Credit: $22

- $384/$383 Put Spread --> Credit: $16

- Max Return: $38 & Max Risk: $62

- Current Value: $77

- Profit Target: $15

- Profit Odds: 19%

SPY Put Credit Spread (15) April 10th

- Sold: $402 & Bought: $403 --> Credit: $18

- Max Return: $18 & Max Risk: $82

- Current Value: $8

- Profit Target: $0

- Profit Odds: 89%

SPY Iron Condor (5) April 14th

- $411/$412 Call Spread --> Credit: $20

- $375/$374 Put Spread --> Credit: $17

- Max Return: $37 & Max Risk: $63

- Current Value: $45

- Profit Target: $15

- Profit Odds: 57%

SPY Iron Condor (5) April 14th

- $413/$414 Call Spread --> Credit: $18

- $380/$379 Put Spread --> Credit: $16

- Max Return: $34 & Max Risk: $66

- Current Value: $36

- Profit Target: $15

- Profit Odds: 66%

SPY Iron Condor (3) April 21st

- $420/$422 Call Spread --> Credit: $48

- $397/$395 Put Spread --> Credit: $30

- Max Return: $78 & Max Risk: $122

- Current Value: $60

- Profit Target: $30

- Profit Odds: 81%

SPY Iron Condor (3) April 28th

- $422/$424 Call Spread --> Credit: $41

- $393/$391 Put Spread --> Credit: $28

- Max Return: $69 & Max Risk: $131

- Current Value: $63

- Profit Target: $30

- Profit Odds: 87%

New Position(s)

None

My Thoughts

Well, that was a waste of a week.

We essentially ended where we started. I hope you didn't make too many silly moves due to boredom. This aint no Silly Goose University.

I'm still holding my SPY & TSLA puts. My risk hasn't been hit on either, but I'm not feeling as confident as I was yesterday. I'm still hopeful seasonality will favor me come Monday. I'm hoping that this upcoming week is more exciting. I've said this a million times, and I'm sure I'll say it a million more: Markets expand & they contract. One phase naturally leads to the other. You can make money in either environment, but big money is typically waiting for the expansion to start and then riding the wave.

I would strongly argue this entire week has proven to be a contraction. It could be because we've already moved too much. It could be because of the holiday. It could be both. Who knows, who cares? The point is to wait for the deck to be stacked in your favor and that's when you throw your money on the table.

Thanks for reading -- Much Love!

Notes

Max Return (Credit Spreads): The credit received when creating the position. This is achieved when you get to the expiration date and the price is below the sold contract for a Call Credit Spread and above the sold contract for a Put Credit Spread.

Max Risk (Credit Spreads): The difference between the spread's two strikes minus the credit received when the position was created.

Breakeven (Credit Spreads): The sold strike plus the credit for CCS and the strike minus the credit for PCS.

RISK WARNING: Trading involves HIGH RISK and YOU CAN LOSE a lot of money. Do not risk any money you cannot afford to lose. Trading is not suitable for all investors. We are not registered investment advisors. We do not provide trading or investment advice. We provide research and education through the issuance of statistical information containing no expression of opinion as to the investment merits of a particular security. Information contained herein should not be considered a solicitation to buy or sell any security or engage in a particular investment strategy. Past performance is not necessarily indicative of future results. Links above include affiliate commission or referrals. I'm part of an affiliate network and I receive compensation from partnering websites.

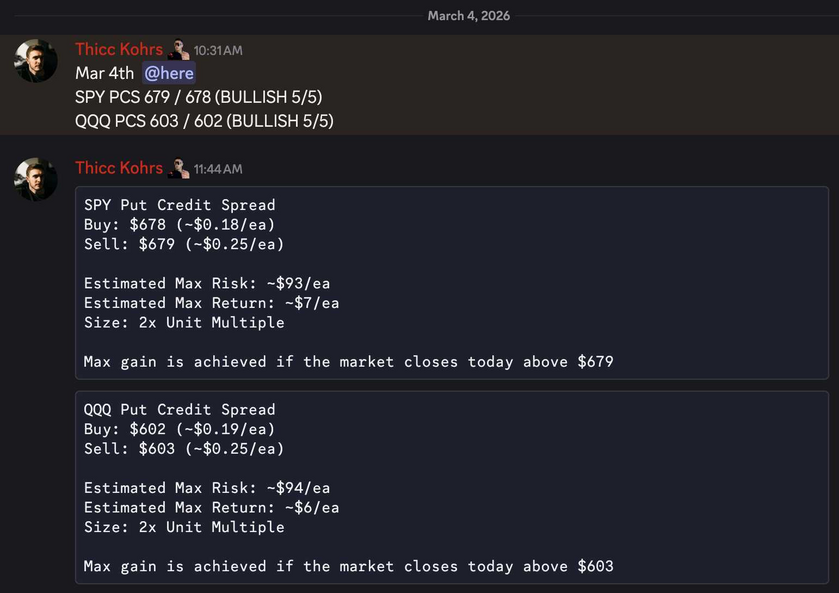

Both of these trades missed. Both of these trades hit if held until close -- 4 total units!

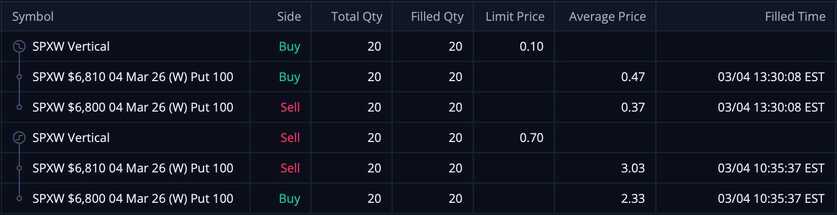

Both of these trades missed. Both of these trades hit if held until close -- 4 total units! These PCS's were sold at $0.70/ea and were bought back at $0.10/ea -- THIS MEANS MY REALIZED GAIN WAS $1,200!

These PCS's were sold at $0.70/ea and were bought back at $0.10/ea -- THIS MEANS MY REALIZED GAIN WAS $1,200!