Deflated

The party has started, and things are feeling a bit... deflated.

The CPI Inflation report dropped early this morning, and it came in cooler than expected (5.0% vs 5.1% YoY Exp). At first, the market popped because it was interpreted as a dovish report -- I fully agreed. The tone of the day clearly changed right when the market opened. There was no rippy skippy, only selly smelly. The market seemed to be focused on the Core CPI numbers (5.6% vs 5.6% Exp). When you take out food and energy, subsectors such as shelter are still not doing the best. We are trending in the right direction, but the magnitude of the numbers is still uncomfortably high.

To be fair, there was a bit of a midday rally. It didn't last long due to the FOMC Minutes & the "r" word:

"Given their assessment of the potential economic effects of the recent banking-sector developments, the staff’s projection at the time of the March meeting included a mild recession starting later this year, with a recovery over the subsequent two years."

As noted yesterday, there is still roughly a 70% chance of a 25bps rate hike at the next FOMC meeting (May 3rd). With the dollar showing serious weakness and oil showing serious strength, it's tough to argue that inflation worries are truly behind us.

The party is not yet over! Tomorrow at 8:30am ET we get another inflation report (PPI). We know consumers are doing slightly better. Now it's time to find out how the producers are doing. I'll be streaming early tomorrow so we can watch all the chaos together. Don't forget that the Retail Sales report is coming out Friday along with various earnings reports from banks (detailed below).

Reminder: We are going to be starting a Streetbeat Algo generation competition. It's free to compete, and yes, there will be cool prizes. Make sure you download Streetbeat to your phone, set up your account and use the referral code "MATT" on the initial page for a free $5-$5,000.

Market Events: Thursday, April 13th

08:30 AM Producer Price Index

08:30 AM Core PPI

08:30 AM PPI (YoY)

08:30 AM Core PPI (YoY)

08:30 AM Initial Jobless Claims

08:30 AM Continuing Jobless Claims

Earnings: April 10th - 14th

Monday: Tilray

Tuesday: Carmax

Wednesday: LVMH

Thursday: Delta & Progressive

Friday: Citi, Blackrock, JPMorgan, PNC, United Health Group & Wells Fargo

Note: This is NOT the full list -- I included the names of companies that are popular within the Goonie Community.

Seasonality Update

S&P 500 Seasonal Bias (April 13th)

- Bull Win Percentage: 56%

- Profit Factor: 0.52

- Bias: Bearish

Equity Curve -->

Current Account Value (April 12th)

$11,639

Daily Realized P&L: +$0

YTD Realized P&L: +$397

Closed Position(s)

None

Current Position(s)

SPY Iron Condor (5) April 14th

- $411/$412 Call Spread --> Credit: $20

- $375/$374 Put Spread --> Credit: $17

- Max Return: $37 & Max Risk: $63

- Current Value: $29

- Profit Target: $15

- Profit Odds: 74%

SPY Iron Condor (5) April 14th

- $413/$414 Call Spread --> Credit: $18

- $380/$379 Put Spread --> Credit: $16

- Max Return: $34 & Max Risk: $66

- Current Value: $14

- Profit Target: $10

- Profit Odds: 86%

SPY Iron Condor (3) April 21st

- $420/$422 Call Spread --> Credit: $48

- $397/$395 Put Spread --> Credit: $30

- Max Return: $78 & Max Risk: $122

- Current Value: $34

- Profit Target: $30

- Profit Odds: 84%

SPY Iron Condor (3) April 28th

- $422/$424 Call Spread --> Credit: $41

- $393/$391 Put Spread --> Credit: $28

- Max Return: $69 & Max Risk: $131

- Current Value: $44

- Profit Target: $30

- Profit Odds: 83%

SPY Iron Condor (3) May 5th

- $424/$426 Call Spread --> Credit: $46

- $397/$395 Put Spread --> Credit: $37

- Max Return: $83 & Max Risk: $117

- Current Value: $71

- Profit Target: $30

- Profit Odds: 72%

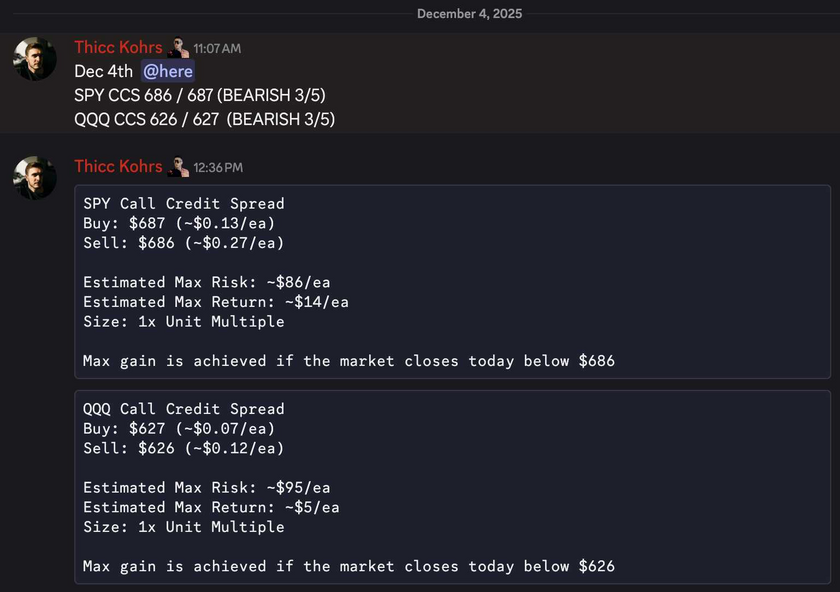

Both of these trades hit if held until close -- 4 total units!

Both of these trades hit if held until close -- 4 total units! These CCS's were sold at an average of $0.62/ea and were bought back at an average $0.15/ea -- THIS MEANS MY REALIZED GAIN WAS $1,400!

These CCS's were sold at an average of $0.62/ea and were bought back at an average $0.15/ea -- THIS MEANS MY REALIZED GAIN WAS $1,400!

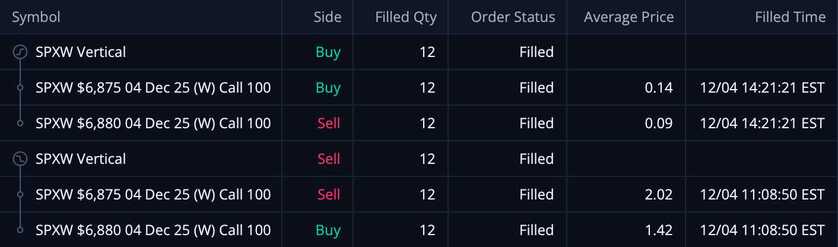

Both of these trades hit if held until close -- 2 total units!

Both of these trades hit if held until close -- 2 total units! These CCS's were sold at $0.60/ea and were bought back at $0.05/ea -- THIS MEANS MY REALIZED GAIN WAS $660!

These CCS's were sold at $0.60/ea and were bought back at $0.05/ea -- THIS MEANS MY REALIZED GAIN WAS $660!

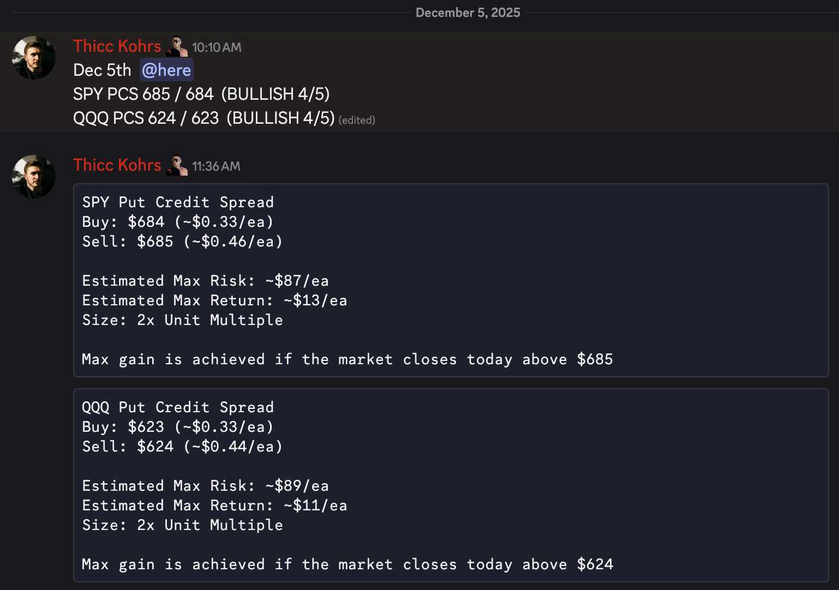

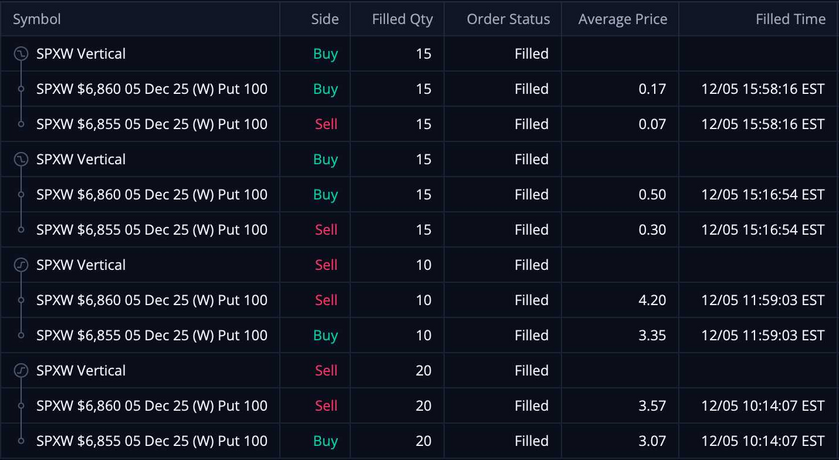

Both of these trades hit if held until close -- 4 total units!

Both of these trades hit if held until close -- 4 total units! These PCS's were sold at $0.65/ea and were bought back at $0.05/ea -- THIS MEANS MY REALIZED GAIN WAS $600!

These PCS's were sold at $0.65/ea and were bought back at $0.05/ea -- THIS MEANS MY REALIZED GAIN WAS $600!