Oh Duck

Welcome back to the action!

I hope you had a great weekend. I particularly hope you were able to enjoy a meal at Texas Roadhouse -- There's nothing that can't be fixed by their magical rolls.

Let's talk about the markets! In terms of Market Events, this week is a little quiet. There are some economic reports that are worthwhile paying attention to, but nothing that is Matt-Do-An-Extra-Stream worthy. I'll make sure to cover the things you most likely care about during the typical show (promise).

With that being said, we are in Earnings Season. Last week was the official start, but this week is when things get fun. I detailed the dates of the major earnings reports below. If you want me to do a specialty stream from Tesla's announcement, please let me know.

Beyond Tesla, I'll be paying close attention to BAC, NFLX, AAL, UAL & PG. I think this specific group will give us useful insights into the current state of the economy & markets. Buckle up for the ride!

Market Events: Tuesday, April 18th

08:30 AM Housing Starts

08:30 AM Building Permits

01:00 PM Fed Gov. Michelle Bowman Speaks

Earnings: April 17th - 21st

Monday: Charles Schwab & State Street

Tuesday: Bank of America, Bank of NY Mellon, Goldman Sachs, Interactive Brokers, J&J, Lockheed Martin, Netflix, Silvergate Cap & United Airlines

Wednesday: Heineken, IBM, Las Vegas Sands, L’Oreal, Morgan Stanley, Nasdaq & Tesla

Thursday: Alaska Air, American Airlines, American Express, AT&T, Blackstone, Philip Morris, Taiwan Semiconductor, Union Pacific & Virtu Financial

Friday: P&G & Schlumberger

Note: This is NOT the full list -- I included the names of companies that are popular within the Goonie Community.

Seasonality Update

S&P 500 Seasonal Bias (April 18th)

- Bull Win Percentage: 56%

- Profit Factor: 1.89

- Bias: Bullish

Equity Curve -->

Current Account Value (April 17th) +$117

Daily Realized P&L: $117

YTD Realized P&L: +$505

Closed Position(s) +$117

SPY $422/$393 Iron Condor (3) April 28th

- Original Credit: $69

- Closed Debit: $30

- P&L: +$117 (+56.5%)

Current Position(s)

SPY Iron Condor (3) April 28th

- $419/$421 Call Spread --> Credit: $38

- $399/$397 Put Spread --> Credit: $34

- Max Return: $72 & Max Risk: $128

- Current Value: $68

- Profit Target: $30

- Profit Odds: 69%

SPY Iron Condor (3) May 5th

- $422/$423 Call Spread --> Credit: $23

- $400/$399 Put Spread --> Credit: $18

- Max Return: $41 & Max Risk: $59

- Current Value: $44

- Profit Target: $15

- Profit Odds: 71%

SPY Iron Condor (3) May 5th

- $424/$426 Call Spread --> Credit: $46

- $397/$395 Put Spread --> Credit: $37

- Max Return: $83 & Max Risk: $117

- Current Value: $65

- Profit Target: $30

- Profit Odds: 77%

New Position(s)

SPY Call Credit Spread (3) May 5th

- Sold: $418 & Bought: $419 --> Credit: $37

- Max Return: $37 & Max Risk: $63

- Current Value: $45

- Profit Target: $15

- Profit Odds: 60%

SPY Put Credit Spread (3) May 5th

- Sold: $403 & Bought: $402 --> Credit: $

- Max Return: $20 & Max Risk: $80

- Current Value: $17

- Profit Target: $8

- Profit Odds: 77%

Reasoning: A continuation of the Iron Condor strategy.

My Thoughts

I was really enjoying the idea of degenerately selling 0 DTE premium until I got boned by it on the very first day. At one point I was up $750, and then like a true dipshit, I let the play blowout in my face. I'm continuing forward with the tried-and-true iron condor strategy, but I want to add something more exciting to the mix. If you have any ideas for what a solid 0 DTE strategy could be, shoot your shot -- I'm ready to be hurt again.

Thanks for reading -- Much Love!

Notes

Max Return (Credit Spreads): The credit received when creating the position. This is achieved when you get to the expiration date and the price is below the sold contract for a Call Credit Spread and above the sold contract for a Put Credit Spread.

Max Risk (Credit Spreads): The difference between the spread's two strikes minus the credit received when the position was created.

Breakeven (Credit Spreads): The sold strike plus the credit for CCS and the strike minus the credit for PCS.

RISK WARNING: Trading involves HIGH RISK and YOU CAN LOSE a lot of money. Do not risk any money you cannot afford to lose. Trading is not suitable for all investors. We are not registered investment advisors. We do not provide trading or investment advice. We provide research and education through the issuance of statistical information containing no expression of opinion as to the investment merits of a particular security. Information contained herein should not be considered a solicitation to buy or sell any security or engage in a particular investment strategy. Past performance is not necessarily indicative of future results. Links above include affiliate commission or referrals. I'm part of an affiliate network and I receive compensation from partnering websites.

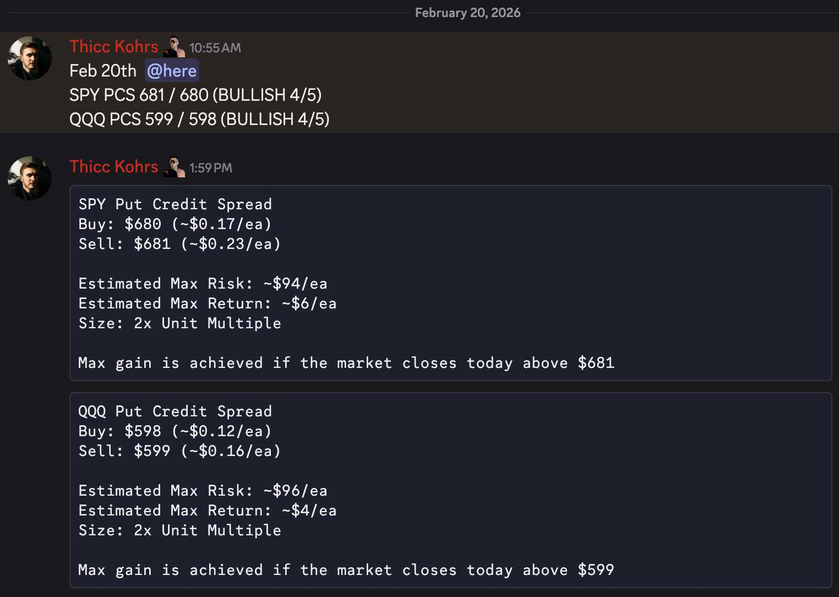

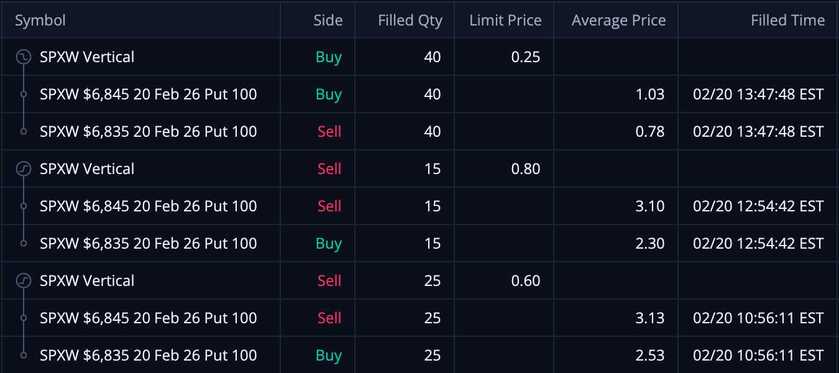

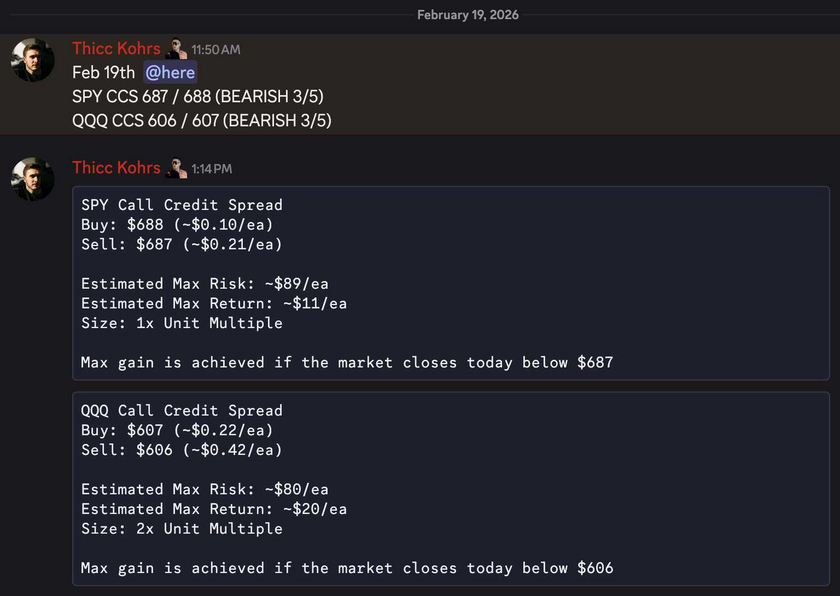

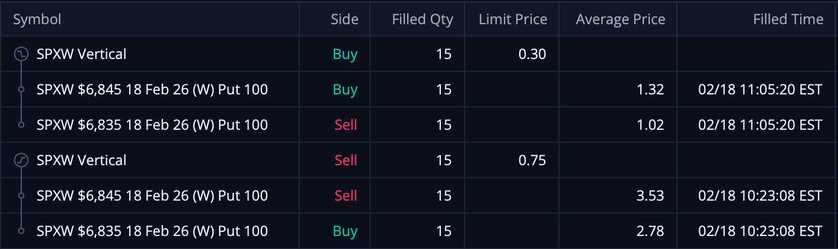

Both of these trades missed. Both of these trades hit if held until close -- 4 total units!

Both of these trades missed. Both of these trades hit if held until close -- 4 total units! These PCS's were sold at $0.70/ea (average) and were bought back at $0.675/ea -- THIS MEANS MY REALIZED GAIN WAS $1,700!

These PCS's were sold at $0.70/ea (average) and were bought back at $0.675/ea -- THIS MEANS MY REALIZED GAIN WAS $1,700!

Both of these trades missed. Both of these trades hit if held until close -- 2 total units!

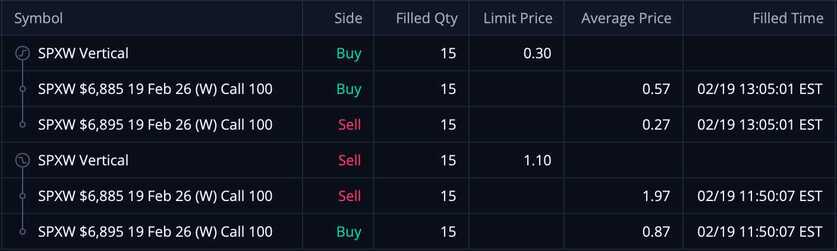

Both of these trades missed. Both of these trades hit if held until close -- 2 total units! These CCS's were sold at $1.10/ea (average) and were bought back at $0.30/ea (average) -- THIS MEANS MY REALIZED GAIN WAS $1,200!

These CCS's were sold at $1.10/ea (average) and were bought back at $0.30/ea (average) -- THIS MEANS MY REALIZED GAIN WAS $1,200!

Both of these trades missed. Both of these trades hit if held until close -- 4 total units!

Both of these trades missed. Both of these trades hit if held until close -- 4 total units! These PCS's were sold at $0.75/ea (average) and were bought back at $0.30/ea (average) -- THIS MEANS MY REALIZED GAIN WAS $675!

These PCS's were sold at $0.75/ea (average) and were bought back at $0.30/ea (average) -- THIS MEANS MY REALIZED GAIN WAS $675!