Cookin'

A classic continuation -- A continuation of a bunch of nothingness that is, ha!

Even though some serious earnings reports dropped, we didn't see much happening today. Initially, there was a gap down because a couple mega-cap companies reported some sus stuff and the UK's inflation came in higher than expected. People were all in a tizzy before the market opened, but then seasonality eventually prevailed. We rallied to the upside gap fill and then some (ending at b/e).

With respect to earnings, NFLX posted mixed numbers. MS (Morgan Stanley) beat on their top and bottom numbers, but they signaled serious concern about the corporate real estate sector and their exposure to it. It's not too much of a surprise as to why the market was weak this morning. However, by the time you're reading this, it's old news. We have other major market events and earnings coming up (detailed below), so stay frosty!

Market Events: Thursday, April 20th

08:30 AM Initial Jobless Claims

08:30 AM Continuing Jobless Claims

08:30 AM Philadelphia Fed Manufacturing Survey

10:00 AM Existing Home Sales

10:00 AM U.S. Leading Economic Indicators

12:00 PM Fed Gov. Christopher Waller Speaks

12:20 PM Cleveland Fed President Loretta Mester Speaks

03:00 PM Dallas Fed listens w/ Dallas Fed President Logan & Fed Gov. Bowman

05:00 PM Atlanta Fed President Raphael Bostic Speaks

Earnings: April 17th - 21st

Monday: Charles Schwab & State Street

Tuesday: Bank of America, Bank of NY Mellon, Goldman Sachs, Interactive Brokers, J&J, Lockheed Martin, Netflix, Silvergate Cap & United Airlines

Wednesday: Heineken, IBM, Las Vegas Sands, L’Oreal, Morgan Stanley, Nasdaq & Tesla

Thursday: Alaska Air, American Airlines, American Express, AT&T, Blackstone, Philip Morris, Taiwan Semiconductor, Union Pacific & Virtu Financial

Friday: P&G & Schlumberger

Note: This is NOT the full list -- I included the names of companies that are popular within the Goonie Community.

Seasonality Update

S&P 500 Seasonal Bias (April 20th)

- Bull Win Percentage: 56%

- Profit Factor: 0.56

- Bias: Bearish

Equity Curve -->

Current Account Value (April 19th)

Daily Realized P&L: +$0

YTD Realized P&L: +$505

Closed Position(s)

None

Current Position(s)

SPY Iron Condor (3) April 28th

- $419/$421 Call Spread --> Credit: $38

- $399/$397 Put Spread --> Credit: $34

- Max Return: $72 & Max Risk: $128

- Current Value: $61

- Profit Target: $30

- Profit Odds: 72%

SPY Iron Condor (3) May 5th

- $418/$419 Call Spread --> Credit: $37

- $403/$402 Put Spread --> Credit: $20

- Max Return: $57 & Max Risk: $43

- Current Value: $60

- Profit Target: $20

- Profit Odds: 61%

SPY Iron Condor (3) May 5th

- $422/$423 Call Spread --> Credit: $23

- $400/$399 Put Spread --> Credit: $18

- Max Return: $41 & Max Risk: $59

- Current Value: $42

- Profit Target: $15

- Profit Odds: 74%

SPY Iron Condor (3) May 5th

- $424/$426 Call Spread --> Credit: $46

- $397/$395 Put Spread --> Credit: $37

- Max Return: $83 & Max Risk: $117

- Current Value: $59

- Profit Target: $30

- Profit Odds: 79%

New Position(s)

SPY Call Credit Spread (3) May 12th

- Sold: $426 & Bought: $428 --> Credit: $40

- Max Return: $40 & Max Risk: $160

- Current Value: $41

- Profit Target: $10

- Profit Odds: 80%

SPY Put Credit Spread (3) May 12th

- Sold: $399 & Bought: $397 --> Credit: $25

- Max Return: $25 & Max Risk: $175

- Current Value: $25

- Profit Target: $10

- Profit Odds: 80%

Reasoning: A continuaion of the Iron Condor strategy.

My Thoughts

Even though we had a strong push all day, we still essentially went nowhere. When you take a gander at the daily chart, you'll see we basically ended today where we ended yesterday. We are still in the chop. The next beautiful trend move will start eventually, we just need to have the patience and discipline to wait for it.

If you've been listening to me ranting about the new 0 DTE strategy, it would have worked today. Unfortunately, I had no more day trades (stupid fucking PDT). I couldn’t execute to trade, but I did continue with the iron condor methodology. Here's to a green tomorrow!

Thanks for reading -- Much Love!

Notes

Max Return (Credit Spreads): The credit received when creating the position. This is achieved when you get to the expiration date and the price is below the sold contract for a Call Credit Spread and above the sold contract for a Put Credit Spread.

Max Risk (Credit Spreads): The difference between the spread's two strikes minus the credit received when the position was created.

Breakeven (Credit Spreads): The sold strike plus the credit for CCS and the strike minus the credit for PCS.

RISK WARNING: Trading involves HIGH RISK and YOU CAN LOSE a lot of money. Do not risk any money you cannot afford to lose. Trading is not suitable for all investors. We are not registered investment advisors. We do not provide trading or investment advice. We provide research and education through the issuance of statistical information containing no expression of opinion as to the investment merits of a particular security. Information contained herein should not be considered a solicitation to buy or sell any security or engage in a particular investment strategy. Past performance is not necessarily indicative of future results. Links above include affiliate commission or referrals. I'm part of an affiliate network and I receive compensation from partnering websites.

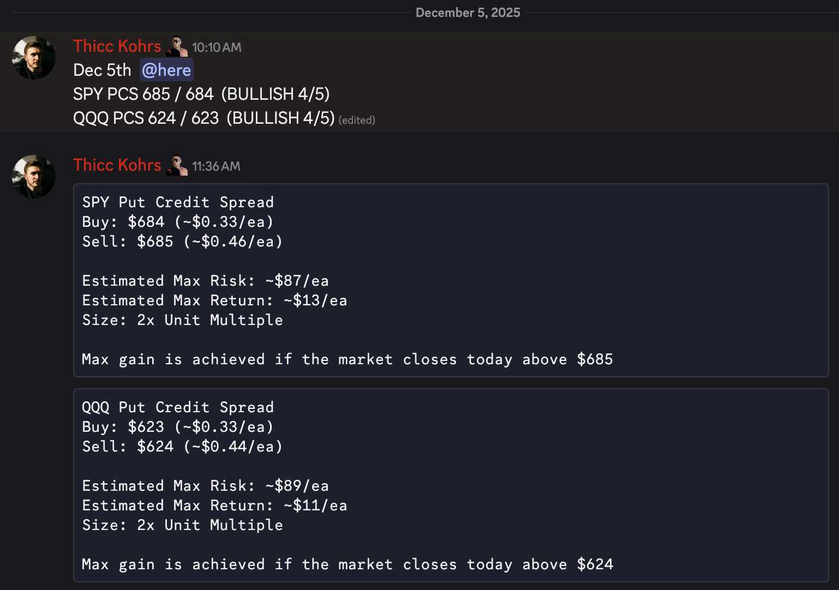

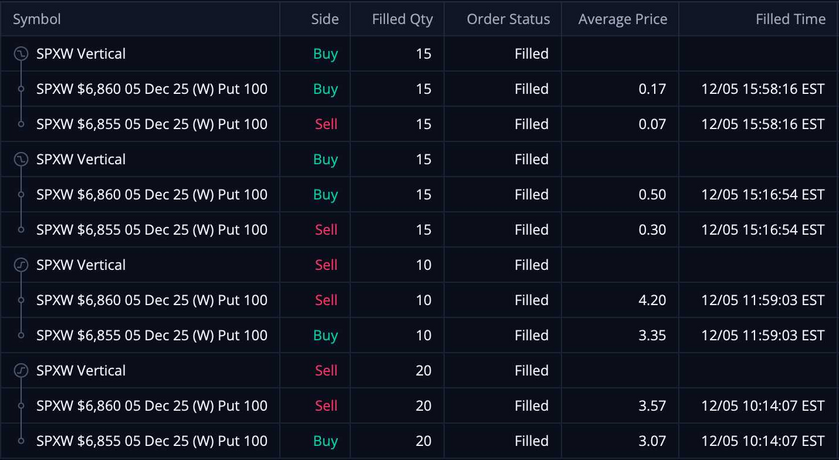

Both of these trades hit if held until close -- 4 total units!

Both of these trades hit if held until close -- 4 total units! These CCS's were sold at an average of $0.62/ea and were bought back at an average $0.15/ea -- THIS MEANS MY REALIZED GAIN WAS $1,400!

These CCS's were sold at an average of $0.62/ea and were bought back at an average $0.15/ea -- THIS MEANS MY REALIZED GAIN WAS $1,400!

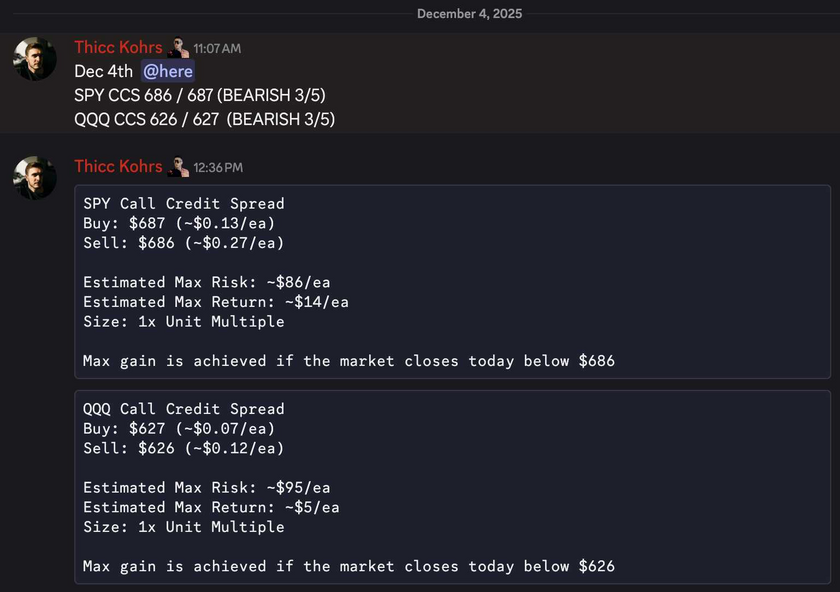

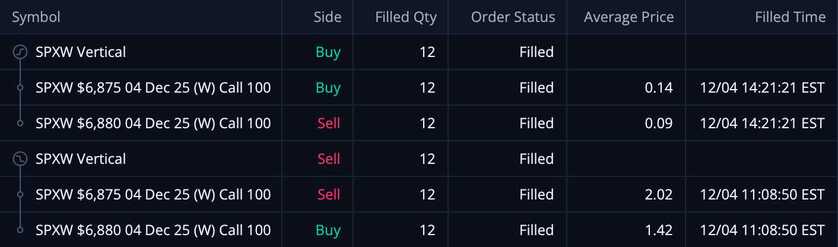

Both of these trades hit if held until close -- 2 total units!

Both of these trades hit if held until close -- 2 total units! These CCS's were sold at $0.60/ea and were bought back at $0.05/ea -- THIS MEANS MY REALIZED GAIN WAS $660!

These CCS's were sold at $0.60/ea and were bought back at $0.05/ea -- THIS MEANS MY REALIZED GAIN WAS $660!

Both of these trades hit if held until close -- 4 total units!

Both of these trades hit if held until close -- 4 total units! These PCS's were sold at $0.65/ea and were bought back at $0.05/ea -- THIS MEANS MY REALIZED GAIN WAS $600!

These PCS's were sold at $0.65/ea and were bought back at $0.05/ea -- THIS MEANS MY REALIZED GAIN WAS $600!