Buckle Up! This Could Get Wild

Howdy Space Travelers,

The upcoming week should be an exciting one -- I hope you're ready. From an economic standpoint, the next Fed Interest Rate decision will be announced on Wednesday. I'm anticipating no rate change, but I'm fully expecting that markets to a have volatile reaction to Powell's press conference. If he comes off hawkish, look for the market to drop. If he comes off dovish, look for the market to pop. The timing of this is interesting because the second half of week favors the bears from a seasonal perspective. Only time will tell who is "right" this time around.

Later in this newsletter you can find the results of the 0 DTE trades from last week. I also decided to include various stock charts that I think deserve a place on your watchlist. Enjoy!

Much Love,

Thicc Kohrs

Market Events

Tuesday, Sept. 19th

05:00 AM ET EUR CPI (YoY) (Aug)

08:30 AM ET Building Permits (Aug)

Wednesday, Sept. 20th

10:30 AM ET Crude Oil Inventories

02:00 PM ET FOMC Economic Projections

02:00 PM ET Fed Interest Rate Decision

02:30 PM ET FOMC Press Conference -- Fed Chair Jerome Powell

Thursday, Sept. 21st

08:30 AM ET Initial Jobless Claims

08:30 AM ET Philadelphia Fed Manufacturing Index (Sep)

10:30 AM ET Existing Home Sales (Aug)

Friday, Sept. 22nd

09:45 AM ET S&P Global Services PMI (Sep)

Earnings

Monday

Evening: Stitch Fix

Tuesday

Morning: AutoZone

Wednesday

Morning: General Mills

Evening: FedEx

Thursday

Morning: Darden Restaurants

Friday

None

Note: This is NOT the full list -- I included the names of companies that are popular within the Goonie Community.

Seasonality Update

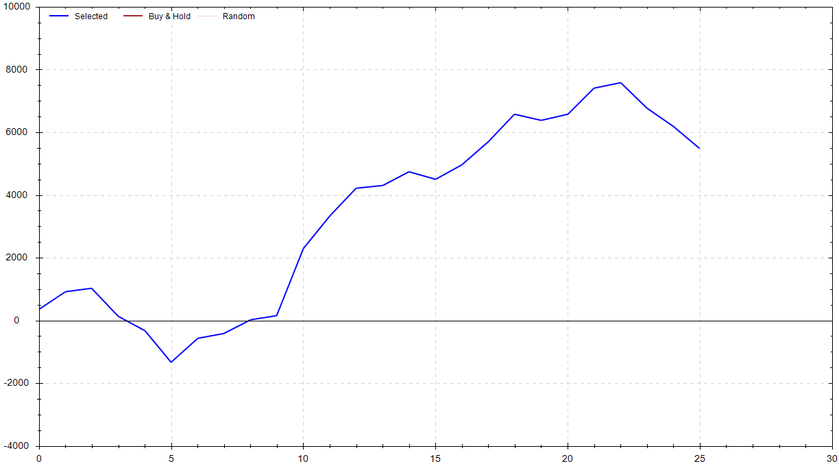

S&P 500 Seasonal Bias (Monday, Sept. 18th)

- Bull Win Percentage: 69%

- Profit Factor: 2.12

- Bias: Bullish

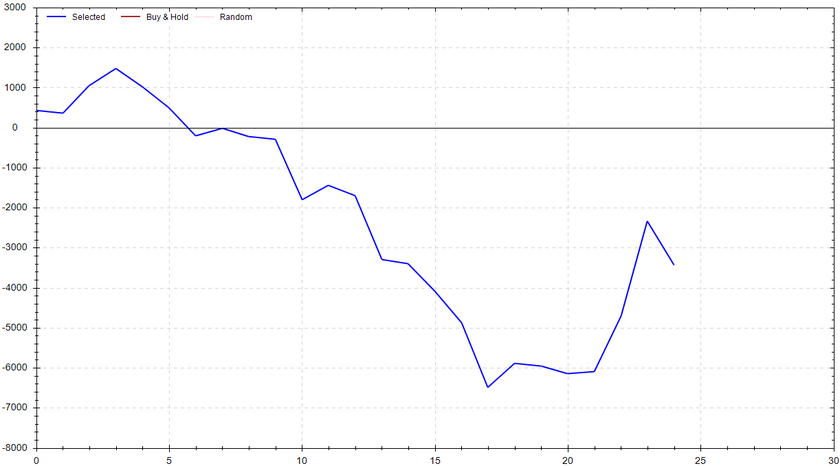

Equity Curve -->

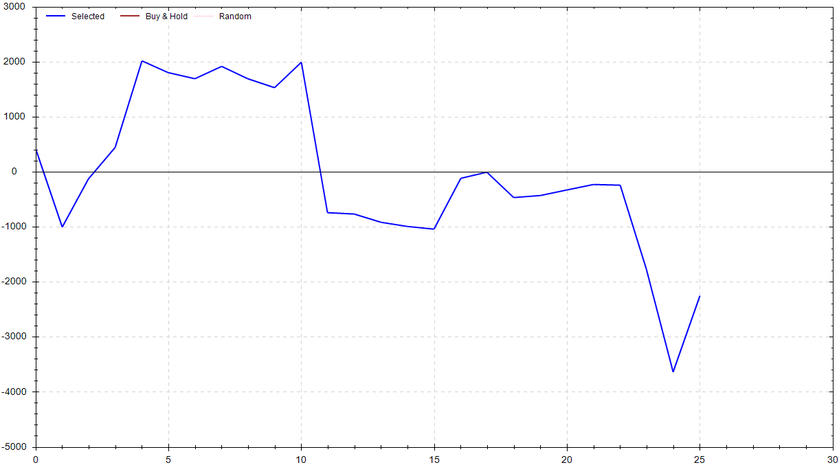

S&P 500 Seasonal Bias (Tuesday, Sept. 19th)

- Bull Win Percentage: 46%

- Profit Factor: 0.75

- Bias: Leaning Bearish

Equity Curve -->

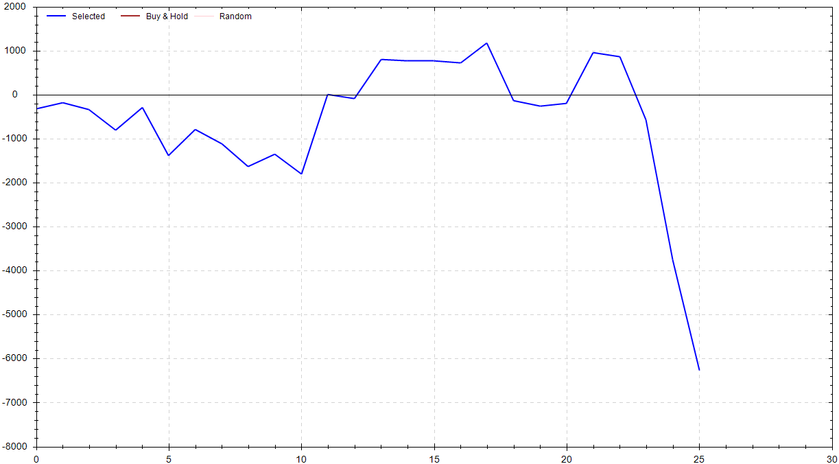

S&P 500 Seasonal Bias (Wednesday, Sept. 20th)

- Bull Win Percentage: 34%

- Profit Factor: 0.49

- Bias: Leaning Bearish

Equity Curve -->

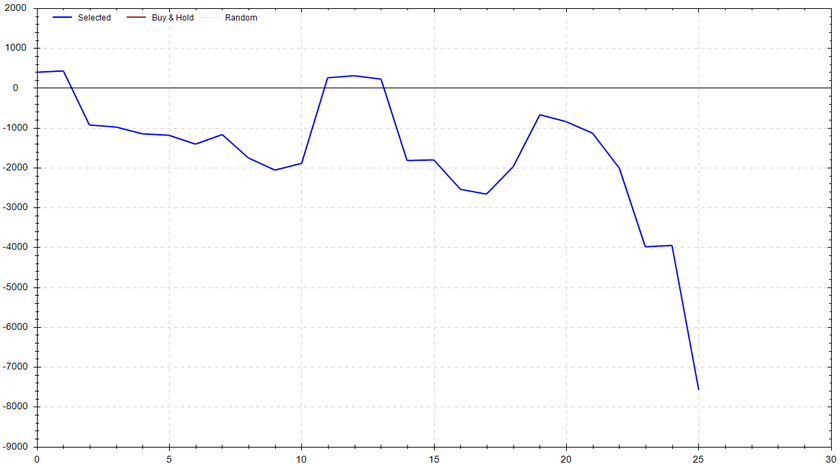

S&P 500 Seasonal Bias (Thursday, Sept. 21st)

- Bull Win Percentage: 38%

- Profit Factor: 0.40

- Bias: Bearish

Equity Curve -->

S&P 500 Seasonal Bias (Friday, Sept. 22nd)

- Bull Win Percentage: 36%

- Profit Factor: 0.66

- Bias: Bearish

Equity Curve -->

Options Strategy Update

The 0 DTE signal went 6 out of 8 (~75% accuracy). The expectation for this method is ~80%, so the results are essentially what was predicted. Overall, the numbers should continue to converge to expectation as the data set (the total number of signals) grows.

Monday Sept. 11th

SPY CALL Credit Spread ($449 / $450) 🟢

QQQ CALL Credit Spread ($377 / $378) 🟢

Tuesday Sept. 12th

SPY CALL Credit Spread ($448 / $449) 🟢

QQQ CALL Credit Spread ($377 / $378) 🟢

Wednesday Sept. 13th

SPY CALL Credit Spread ($448 / $449) 🟢

QQQ CALL Credit Spread ($375 / $376) 🟢

Thursday Sept. 14th

SPY CALL Credit Spread ($450 / $451) 🔴

QQQ CALL Credit Spread ($377 / $378) 🔴

Friday Sept. 15th

None

Charts of Interest

The overall market, aka the SPY, is currently filling out a wedge. Watching this to breakout or breakdown following the FOMC results and press conference.

The tech sector is currently representing a failed breakout. The price action is now approaching downside support. Watching for a bounce or break.

Microsoft has clearly broken its bullish trend -- looking for a continuation to the downside.

Nvidia is seemingly about to test its trendline from the post-earnings gap up. Watching for the bounce or break.

Trust me, I'm more surprised I'm writing this than you are, but Carvana is looking froggy. I'm seeing a classic cup & handle plus an inverse head & shoulders. I’d argue it’s worth watching CVNA for a continuation to the upside.

Notes

RISK WARNING: Trading involves HIGH RISK and YOU CAN LOSE a lot of money. Do not risk any money you cannot afford to lose. Trading is not suitable for all investors. We are not registered investment advisors. We do not provide trading or investment advice. We provide research and education through the issuance of statistical information containing no expression of opinion as to the investment merits of a particular security. Information contained herein should not be considered a solicitation to buy or sell any security or engage in a particular investment strategy. Past performance is not necessarily indicative of future results. Links above include affiliate commission or referrals. I'm part of an affiliate network and I receive compensation from partnering websites.

Both of these trades hit if held until close -- 6 total units!

Both of these trades hit if held until close -- 6 total units! These PCS's were sold at $1.05/ea and were bought back at $0.20/ea -- THIS MEANS MY REALIZED GAIN WAS $!

These PCS's were sold at $1.05/ea and were bought back at $0.20/ea -- THIS MEANS MY REALIZED GAIN WAS $!