Things Are Getting Spooky

Howdy Partner,

I've had to make numerous revisions to this specific edition of the newsletter because multiple major events are updating rapidly. Please take the time to inform yourself on current developments before making any rash decisions.

Last week was the first week of a new trading month. Historically, the first week of October tends to favor the bears. This prediction seemed to be coming to fruition until Friday afternoon. If you missed it, the week was still technically red, but the Friday rally recovered a considerable amount of the losses. I personally thought the price action was going to be the exact opposite on Friday. At 8:30am ET, the jobs number and unemployment reports dropped. The jobs number was incredibly "good", which made me think things would plummet. Remember that we currently live in the upside down due to inflation and the Fed's monetary policy. By the time the dust settled, the options market won out. Gamma, as it commonly does, remains supreme. Most notional value was on the PUT side -- Meaning the market burned most people.

Looking forward, I'm hesitant to say this bullish pop will hold. Yes, the remainder of the month is very bullish from a seasonal perspective. But don't forget, seasonality isn't the end all be all. The current political situation is a mess. Within the US, we don't have a Speaker of The House since Gaetz orchestrated the ousting of McCarthy. Outside of the US, there is a very serious confliction in and around Israel. It's safe to say you should be keeping a close eye on volatility -- I wouldn't be surprised if it spikes. I'll also be watching the price of oil due to the regional implications. Additionally, various inflation reports will be published this week & it's the start of earnings season (both shown below).

The upcoming week will be a challenging one. Paying attention to your risk is paramount.

Ride Hard,

Matt

Market Events

Monday, Oct. 9th

ALL DAY Thanksgiving Day (Canada)

Tuesday, Oct. 10th

None

Wednesday, Oct. 11th

08:30 AM ET PPI (MoM) (Sep)

02:00 PM ET FOMC Meeting Minutes

Thursday, Oct. 12th

08:30 AM ET Initial Jobless Claims

08:30 AM ET CPI (YoY) (Sep)

08:30 AM ET CPI (MoM) (Sep)

08:30 AM ET Core CPI (MoM) (Sep)

Friday, Oct. 13th (Scary)

None

Upcoming Earnings

Monday

None

Tuesday

AM: Pepsi

Wednesday

None

Thursday

AM: Delta & Walgreens

Friday

AM: Blackrock, Citi, JP Morgan, PNC, United Health & Well Fargo

Note: This is NOT the full list -- I included the names of companies that are popular within the Goonie Community.

Seasonality Update

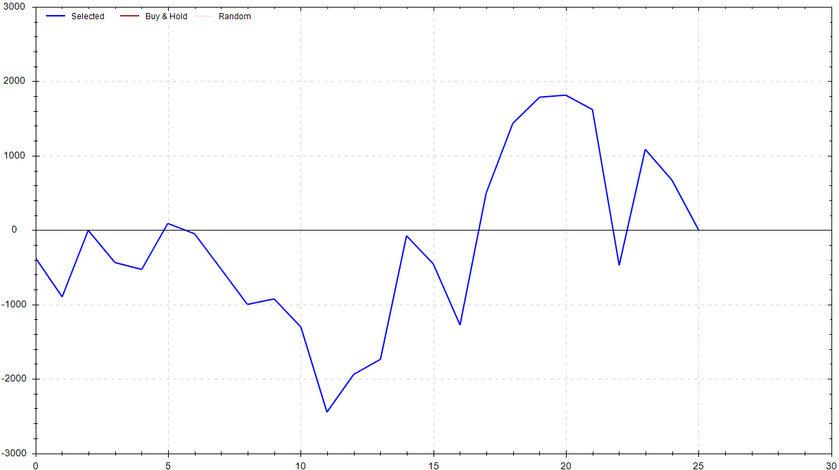

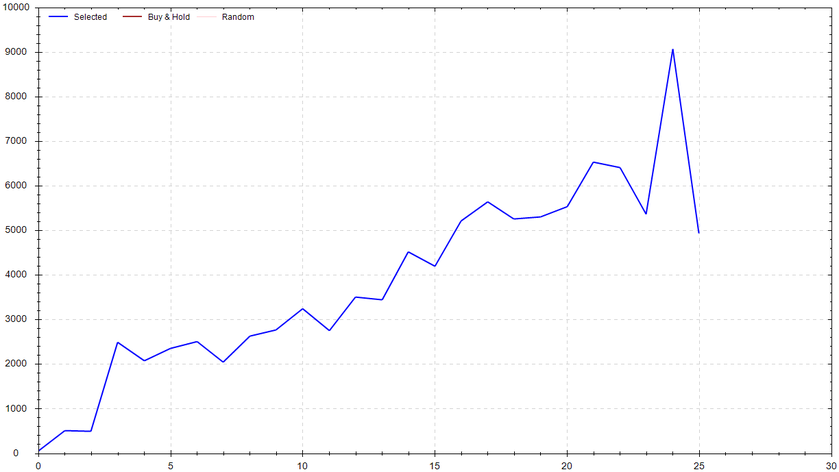

S&P 500 Seasonal Bias (Monday, Oct. 9th)

- Bull Win Percentage: 42.3%

- Profit Factor: 1.00

- Bias: Neutral

Equity Curve -->

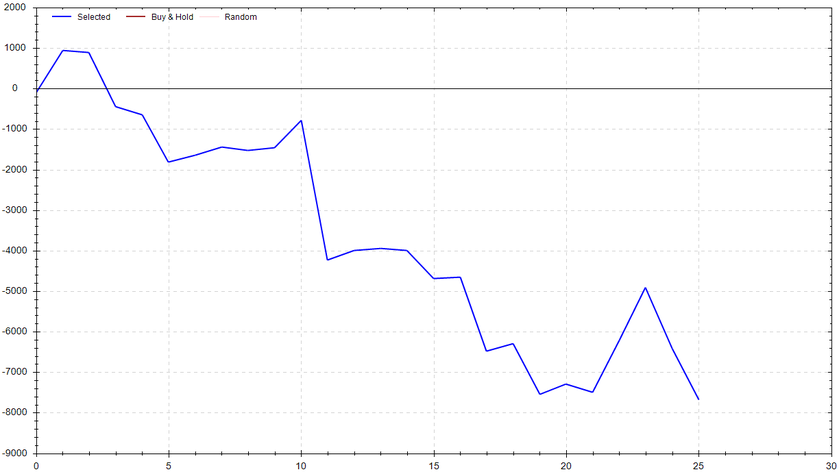

S&P 500 Seasonal Bias (Tuesday, Oct. 10th)

- Bull Win Percentage: 46.2%

- Profit Factor: 0.42

- Bias: Bearish

Equity Curve -->

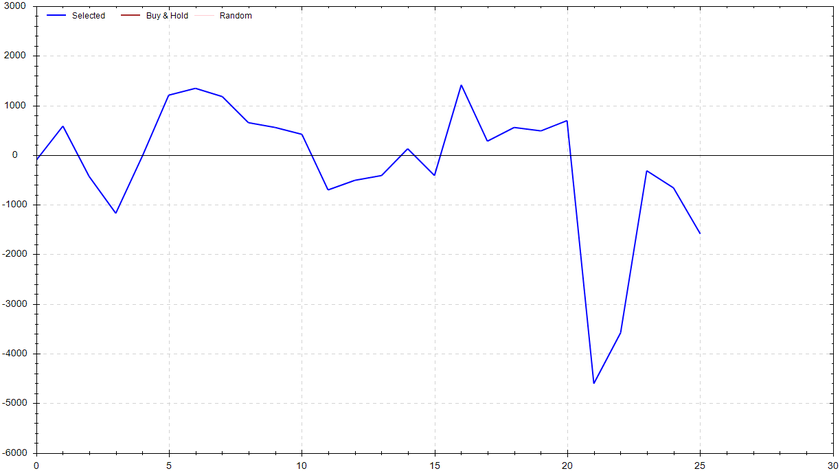

S&P 500 Seasonal Bias (Wednesday, Oct. 11th)

- Bull Win Percentage: 46.2%

- Profit Factor: 0.87

- Bias: Neutral

Equity Curve -->

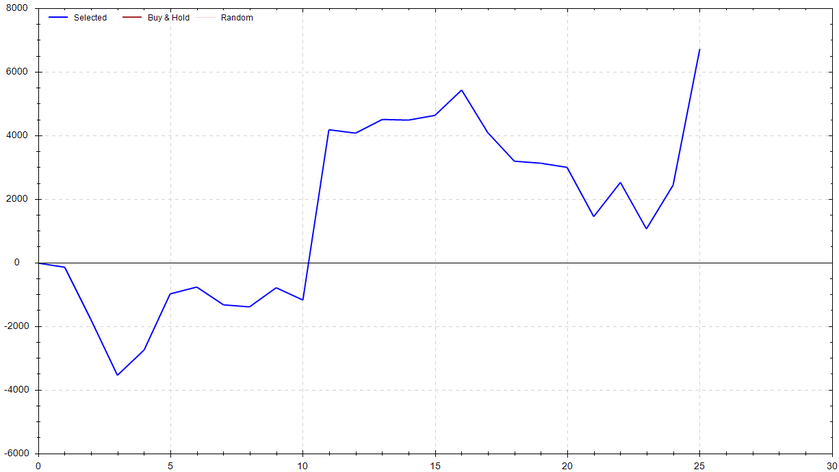

S&P 500 Seasonal Bias (Thursday, Oct. 12th)

- Bull Win Percentage: 42.3%

- Profit Factor: 1.66

- Bias: Bullish

Equity Curve -->

S&P 500 Seasonal Bias (Friday, Oct. 13th)

- Bull Win Percentage: 61.5%

- Profit Factor: 1.66

- Bias: Bullish

Equity Curve -->

Options Strategy Update

The 0 DTE signal went 8 out of 10 (~80% accuracy)*.

Another week has passed, and the strategy has performed as expected (Accuracy Expectation: 80%-85%). I did a bit of data mining throughout the week. The results have made me more confident in the premise of this particular strategy. I strongly believe I'll be able to make improvements as more data is collected. Starting next week, I plan on throwing more money behind this concept. I'll post the results in the upcoming newsletters. Let me know if you have any questions!

Monday Oct. 2nd

SPY PUT Credit Spread ($424 / $425) 🟢

QQQ PUT Credit Spread ($356 / $357) 🟢

QQQ PUT Credit Spread ($356 / $357) 🟢

Tuesday Oct. 3rd

SPY CALL Credit Spread ($428 / $429) 🟢

SPY PUT Credit Spread ($418 / $419) 🟢

QQQ CALL Credit Spread ($362 / $363) 🟢

QQQ PUT Credit Spread ($352 / $353) 🟢

Wednesday Oct. 4th

SPY CALL Credit Spread ($424 / $425) 🔴

SPY CALL Credit Spread ($425 / $426) 🟢

QQQ CALL Credit Spread ($358 / $359) 🔴

Thursday Oct 5th

None

Friday Oct 6th

None

* Moving forward, the 0 DTE's will be skipped on Friday

Charts of Interest

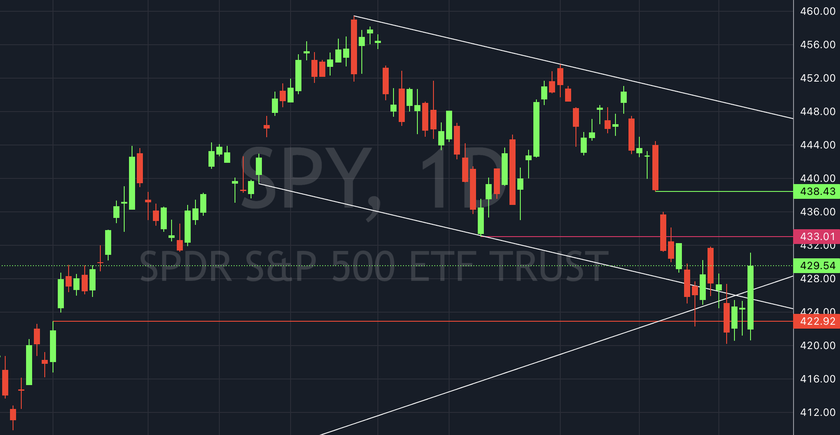

While on the edge of disaster, the market decided to take a step back. Congrats to those of you who had the balls to play balls. My apologies to those of you who got steamrolled with your puts. I'll be watching $433, $436 and then $438 to the upside. To the downside, I'll be watching $425, $423 followed by $420. The move itself will be decided by the CPI report and the first batch of earnings.

While on the edge of disaster, the market decided to take a step back. Congrats to those of you who had the balls to play balls. My apologies to those of you who got steamrolled with your puts. I'll be watching $433, $436 and then $438 to the upside. To the downside, I'll be watching $425, $423 followed by $420. The move itself will be decided by the CPI report and the first batch of earnings.

Similar to the SPY, the QQQs were flirting with disaster and decided to not kiss. The Nasdaq rallied to a trendline resistance point. If it breaks and holds, I'll be watching $369. If things were to reverse, I'd be watching $360 (lots of options interest), $358 followed by $355.

Similar to the SPY, the QQQs were flirting with disaster and decided to not kiss. The Nasdaq rallied to a trendline resistance point. If it breaks and holds, I'll be watching $369. If things were to reverse, I'd be watching $360 (lots of options interest), $358 followed by $355.

As discussed previously, AMD was on breakout watch. It took longer than I expected, but hey, better late than never. Watching for this price action to hold.

As discussed previously, AMD was on breakout watch. It took longer than I expected, but hey, better late than never. Watching for this price action to hold.

Lizard kingdom had a nice consolidation period over the past few weeks, which has now led to a solid bullish breakout. Watching for a continuation.

Lizard kingdom had a nice consolidation period over the past few weeks, which has now led to a solid bullish breakout. Watching for a continuation.

The gift that keeps on giving! Nvidia refuses to quit. As of now, the recent breakdown is looking like a fake out. I'll be looking for $460 to be broken and held. If so, $480 would be on deck. If rejected, I'd be paying attention to $440ish.

The gift that keeps on giving! Nvidia refuses to quit. As of now, the recent breakdown is looking like a fake out. I'll be looking for $460 to be broken and held. If so, $480 would be on deck. If rejected, I'd be paying attention to $440ish.

Times Piper Fell Into Toilet & Sprinted Into A Wall

1*

* This data point is from readings over the past week. The reported information should not be taken as an aggregate or cumulative value for any period beyond the most recent week (Sunday through Saturday). Appropriate alterations were made to account for both travel and time zone shifts.

Notes

RISK WARNING: Trading involves HIGH RISK and YOU CAN LOSE a lot of money. Do not risk any money you cannot afford to lose. Trading is not suitable for all investors. We are not registered investment advisors. We do not provide trading or investment advice. We provide research and education through the issuance of statistical information containing no expression of opinion as to the investment merits of a particular security. Information contained herein should not be considered a solicitation to buy or sell any security or engage in a particular investment strategy. Past performance is not necessarily indicative of future results. Links above include affiliate commission or referrals. I'm part of an affiliate network and I receive compensation from partnering websites.

Both of these trades hit if held until close -- 6 total units!

Both of these trades hit if held until close -- 6 total units! These PCS's were sold at $1.05/ea and were bought back at $0.20/ea -- THIS MEANS MY REALIZED GAIN WAS $!

These PCS's were sold at $1.05/ea and were bought back at $0.20/ea -- THIS MEANS MY REALIZED GAIN WAS $!