The Stonk Market Horror Show

Greetings Degens,

I hope all your bearish dreams came true this past week.

If you happened to be bullish... that's a major bummer. You'll get them next time, brother.

We have lots to chat about. The War in Israel is getting worse. As global tensions continue to intensify, watch for market volatility to increase. Yes, oil prices could be prompted to increase if production or trade routes are impacted, but a more evident play might be defense contractors. The political scene within the US is also proving to be a tense situation. We are still without an elected Speaker of The House. The longer all of this drags out, the more downward pressure on the equities market.

To add to all the fun, Daddy Powell (Mr. Fed Chairman) decided to remind the world how hawkish he is. He reiterated his entire "rates higher for longer" speaking points. In a normal trading week, this would be bearish enough. This week it was particularly impactful because yields and the dollar are ripping. I cannot stress enough: If yields and the dollar continue to rise, I would very much be looking for equities to continue to fall.

Earnings season is in full swing. There were two big report this past week: Netflix & Tesla. The streaming service crushed it. The EV maker got crushed. We have a handful of major tech names reporting this week (MSFT, GOOGL, SNAP, META, AMZN & INTC) -- Stay frosty.

Till Next Time,

Matt

Market Events

Monday, Oct. 23rd

None

Tuesday, Oct. 24th

09:45 AM ET S&P Global Services PMI (Oct)

Wednesday, Oct. 25th

10:00 AM ET New Home Sales (Sep)

10:00 AM ET Canada BoC Interest Rate Decision

Thursday, Oct. 26th

08:15 AM ET Deposit Facility Rate (Oct)

08:15 AM ET ECB Interest Rate Decision (Oct)

08:30 AM ET Core Durable Goods Orders (MoM) (Sep)

08:30 AM ET GDP (QoQ) (Q3)

10:00 AM ET Pending Home Sales (MoM) (Sep)

Friday, Oct. 27th

08:30 AM ET Core PCE Price Index (MoM) (Sep)

08:30 AM ET Core PCE Price Index (YoY) (Sep)

Upcoming Earnings

Monday

AM: Philips

PM: Logitech

Tuesday

AM: 3M, Coca Cola, GE, Spotify & Verizon

PM: Alphabet (Google), Microsoft, Snap & Visa

Wednesday

AM: Boeing, Hilton & T Mobile

PM: IBM & Meta

Thursday

AM: Merck, Northrop Grumman, Royal Caribbean Group, Southwest & UPS

PM: Amazon, Capital One, Chipotle, Enphase, Ford, Intel & Vale

Friday

AM: Abbvie, Chevron, Exxon Mobil, Phillips 66 & T. Rowe Price

Note: This is NOT the full list -- I included the names of companies that are popular within the Goonie Community.

Seasonality Update

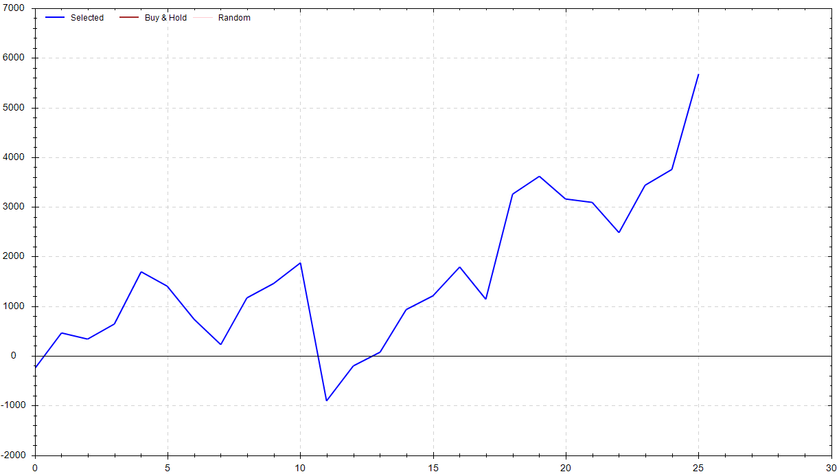

S&P 500 Seasonal Bias (Monday, Oct. 23rd)

- Bull Win Percentage: 61.5%

- Profit Factor: 1.88

- Bias: Bullish

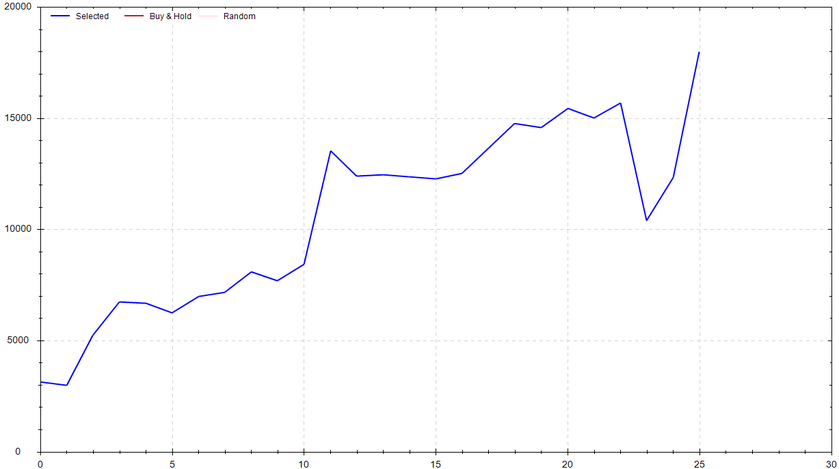

Equity Curve -->

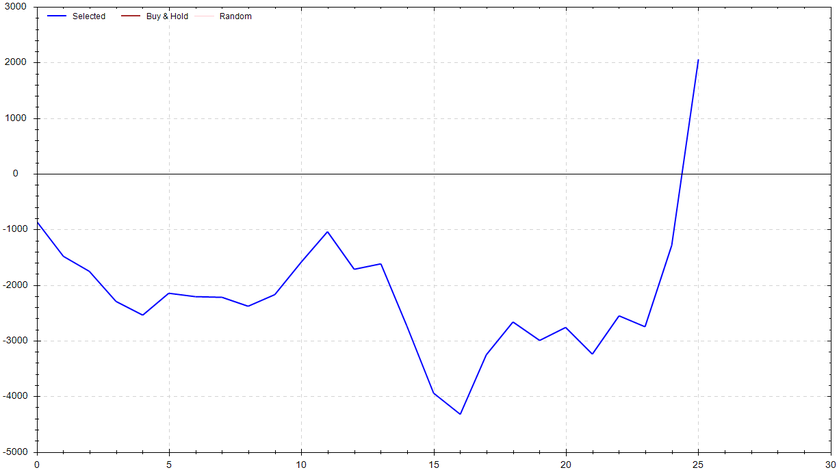

S&P 500 Seasonal Bias (Tuesday, Oct. 24th)

- Bull Win Percentage: 42.3%

- Profit Factor: 1.29

- Bias: Leaning Bullish

Equity Curve -->

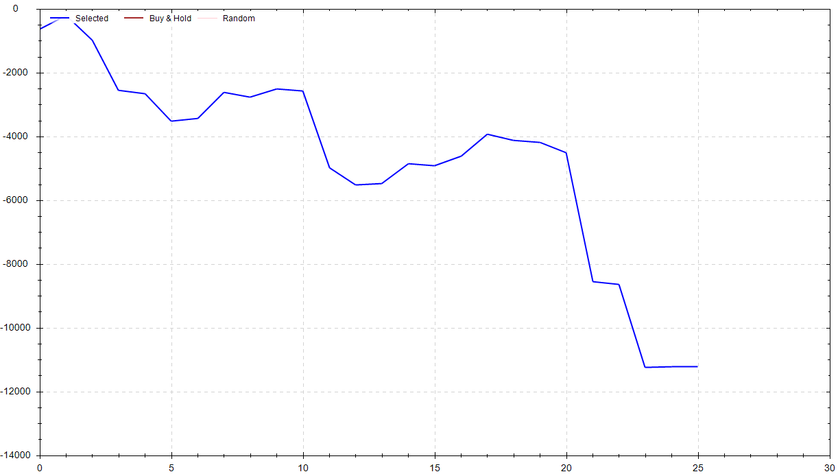

S&P 500 Seasonal Bias (Wednesday, Oct. 25th)

- Bull Win Percentage: 34.6%

- Profit Factor: 0.22

- Bias: Bearish

Equity Curve -->

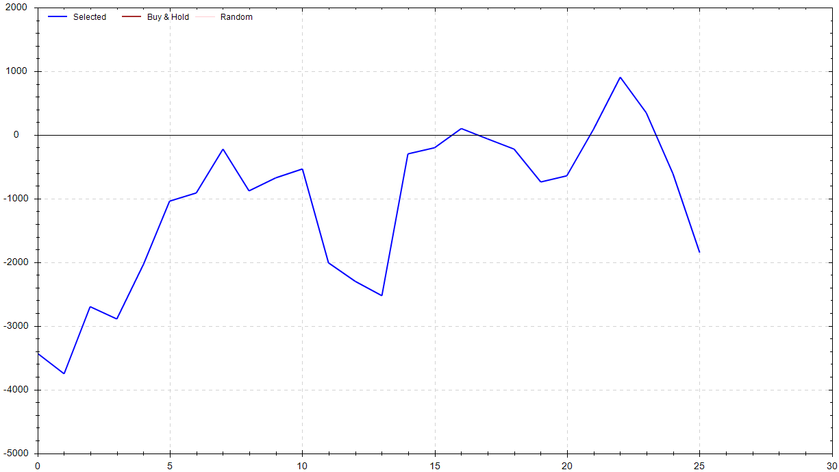

S&P 500 Seasonal Bias (Thursday, Oct. 26th)

- Bull Win Percentage: 50%

- Profit Factor: 0.82

- Bias: Neutral

Equity Curve -->

S&P 500 Seasonal Bias (Friday, Oct. 27th)

- Bull Win Percentage: 61.5%

- Profit Factor: 3.20

- Bias: Bullish

Equity Curve -->

Options Strategy Update

The 0 DTE signal went 10 out of 10 (~100% accuracy)*.

Life (and thus trading) is funny. After the worst weekly performance for this strategy, we now have the best weekly performance. It may be luck. It may be the improvements I've slowly been rolling out. Regardless, more data is needed. I'll continue tracking, monitoring & improving. Fingers crossed for next week!

Monday Oct. 16th

SPY PUT Credit Spread ($433 / $432) 🟢

QQQ PUT Credit Spread ($366 / $365) 🟢

Tuesday Oct. 17th

SPY PUT Credit Spread ($432 / $431) 🟢

QQQ PUT Credit Spread ($363 / $362) 🟢

Wednesday Oct. 18th

SPY CALL Credit Spread ($436 / $437) 🟢

QQQ CALL Credit Spread ($368 / $369) 🟢

Thursday Oct 19th

SPY CALL Credit Spread ($432 / $433) 🟢

QQQ CALL Credit Spread ($366 / $367) 🟢

Friday Oct 20th

SPY CALL Credit Spread ($428 / $427) 🟢

QQQ CALL Credit Spread ($361 / $360) 🟢

Charts of Interest

Lookout below! The S&P 500 broke not one but two major support trendlines this past week. For this upcoming week, I'll be watching $420, $416 and then $410 if the bears are really feeling themselves. If the bull camp decides to fight back, I'd be watching $425, $430 and then $432. I think it's important to note that I believe the bears currently have the upper hand. If yields and the dollar continue to rip, I'd be very confident in equities continue their trip downwards.

Lookout below! The S&P 500 broke not one but two major support trendlines this past week. For this upcoming week, I'll be watching $420, $416 and then $410 if the bears are really feeling themselves. If the bull camp decides to fight back, I'd be watching $425, $430 and then $432. I think it's important to note that I believe the bears currently have the upper hand. If yields and the dollar continue to rip, I'd be very confident in equities continue their trip downwards.

Similar to the overall market, the tech sector had a rough week. The QQQs caught itself at the $354 support. If this support doesn't hold, $351 would be followed by $346. In the event that things get very bad, pay attention to the downside gap fill at $333. Earnings are also key to monitor. Tesla missed and Netflix beat. Next up to bat is META, GOOGL, SNAP, META & AMZN.

Similar to the overall market, the tech sector had a rough week. The QQQs caught itself at the $354 support. If this support doesn't hold, $351 would be followed by $346. In the event that things get very bad, pay attention to the downside gap fill at $333. Earnings are also key to monitor. Tesla missed and Netflix beat. Next up to bat is META, GOOGL, SNAP, META & AMZN.

Bitcoin put in a solid green on the optimism that a Spot BTC ETF will be approved soon. On a larger timeframe, the digital commodity is still rangebound. I'd be willing to bet things will get bullishly fun above $32k.

Bitcoin put in a solid green on the optimism that a Spot BTC ETF will be approved soon. On a larger timeframe, the digital commodity is still rangebound. I'd be willing to bet things will get bullishly fun above $32k.

Tesla got murdered, yo. The earnings report was a big fat miss. The earnings call was an even bigger fatter miss. Elon was a pessimistic on the overall economy as he could have possible been. If $210 doesn't hold, watch the $195 region. If $210 does hold, watch the upside gap fill at $242.

Tesla got murdered, yo. The earnings report was a big fat miss. The earnings call was an even bigger fatter miss. Elon was a pessimistic on the overall economy as he could have possible been. If $210 doesn't hold, watch the $195 region. If $210 does hold, watch the upside gap fill at $242.

Nvidia's breakdown recovery failed when it was announced that the Biden Administration would be increasing its restrictions against selling processing chips to China. This is obviously a direct hit to NVDA's revenue. If the low $400s don't hold, we might be saying "hi" to $366.

Nvidia's breakdown recovery failed when it was announced that the Biden Administration would be increasing its restrictions against selling processing chips to China. This is obviously a direct hit to NVDA's revenue. If the low $400s don't hold, we might be saying "hi" to $366.

The most magical place on Earth isn't seeming too magical. The breakout proved to be a fake out. Watching for a return to $80 in the near term.

The most magical place on Earth isn't seeming too magical. The breakout proved to be a fake out. Watching for a return to $80 in the near term.

Times I Puked While Stair Stepping

2.3 *

* This data point is from readings over the past week. The reported information should not be taken as an aggregate or cumulative value for any period beyond the most recent week (Sunday through Saturday). Appropriate alterations were made to account for both travel and time zone shifts.

Notes

RISK WARNING: Trading involves HIGH RISK and YOU CAN LOSE a lot of money. Do not risk any money you cannot afford to lose. Trading is not suitable for all investors. We are not registered investment advisors. We do not provide trading or investment advice. We provide research and education through the issuance of statistical information containing no expression of opinion as to the investment merits of a particular security. Information contained herein should not be considered a solicitation to buy or sell any security or engage in a particular investment strategy. Past performance is not necessarily indicative of future results. Links above include affiliate commission or referrals. I'm part of an affiliate network and I receive compensation from partnering websites.

Both of these trades hit if held until close -- 6 total units!

Both of these trades hit if held until close -- 6 total units! These PCS's were sold at $1.05/ea and were bought back at $0.20/ea -- THIS MEANS MY REALIZED GAIN WAS $!

These PCS's were sold at $1.05/ea and were bought back at $0.20/ea -- THIS MEANS MY REALIZED GAIN WAS $!