Hello November!

Brothers & Sisters,

What a week it has been! The bulls managed to execute an impressive rally by murdering all bears within sight. I hope you were able to crush it on some degen (or reasonable) calls.

So, what in the world happened? In the first two days of the week, we saw decent earnings reports, which could partially explain the slight bullish sentiment. Stonks and bonds had been under considerable pressure, but the downward trend finally began to lose momentum. Sellers seemingly became exhausted. This theory might right. It might be wrong. In all reality, it doesn't much matter because the party officially started on Wednesday.

The FOMC decision (no change to the Fed rate) was announced on Wednesday. The decision was fully expected -- Not a surprise whatsoever. Later in the afternoon, Chair Powell made a public statement. The market was a little rocky at first as everyone was trying to figure out Powell's true feelings. Eventually, it became pretty evident he is pumping the brakes on his hardcore hawkish stance. The Fed rate has most likely peaked. In fact, the market is even anticipating rate cuts in mid 2024. The excitement of the new dovish tone within the Fed was enough to even overshadow Apple's lackluster (not horrible) earnings report.

Moving forward, I'm personally not chasing this explosion to the upside. I'm a believer that the market moves in two phases: expansions & contractions. The recent expansion was a considerable one, which makes me think the next phase will be sideways chop. I would like to see some consolidation before I make any sizeable bullish, or even bearish, decisions. As always, having predictions is nifty, but reacting to price action is how you actually make money. I'll let the market tell me what to do.

Posted below are the market events, earnings & seasonality for the upcoming week. Enjoy!

Yours Truly,

Matt

P.S. BIG Announcement

The official Goonie Discord is live! If you want access to private lessons, trading competitions & the best trading community in the world, join here -->

Discord Link: https://discord.gg/3dxBRVrgGG

Market Events

Monday, Nov. 6th

11:30 PM ET RBA Interest Rate Decision (Nov)

Tuesday, Nov. 7th

9:30 AM ET USA Trade Balance (Sep)

Wednesday, Nov. 8th

10:15 AM ET Fed Chair Powell Speaks

11:30 AM ET Crude Oil Inventories

9:30 PM ET China CPI (MoM) (Oct)

9:30 PM ET China CPI (YoY) (Oct)

Thursday, Nov. 9th

9:30 AM ET Initial Jobless Claims

2:00 PM ET Fed Chair Powell Speaks

Friday, Nov. 10th

11:00 AM ET Michigan 1-Year Inflation Expectations (Nov)

11:00 AM ET Michigan 5-Year Inflation Expectations (Nov)

11:00 AM ET Michigan Consumer Expectations (Nov)

11:00 AM ET Michigan Consumer Sentiment (Nov)

Upcoming Earnings

Monday

AM: Berkshire Hathaway & Dish

PM: Tripadvisor

Tuesday

AM: Celsius & Uber

PM: Devon, Rivian, OXY & Upstart

Wednesday

AM: Roblox & Under Armour

PM: Affirm, AMC & Disney

Thursday

AM: Fiverr & Yeti

PM: Plug, Unity & Wynn

Friday

None

Note: This is NOT the full list -- I included the names of companies that are popular within the Goonie Community.

Seasonality Update

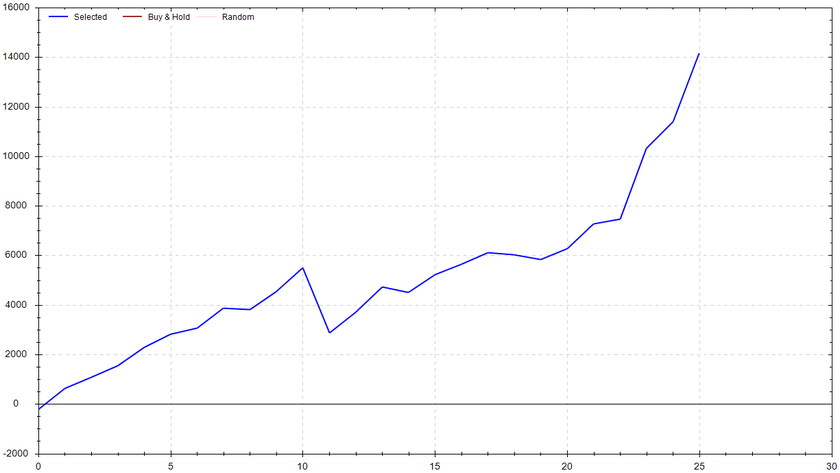

S&P 500 Seasonal Bias (Monday, Nov. 6th)

- Bull Win Percentage: 76.9%

- Profit Factor: 5.09

- Bias: Very Bullish

Equity Curve -->

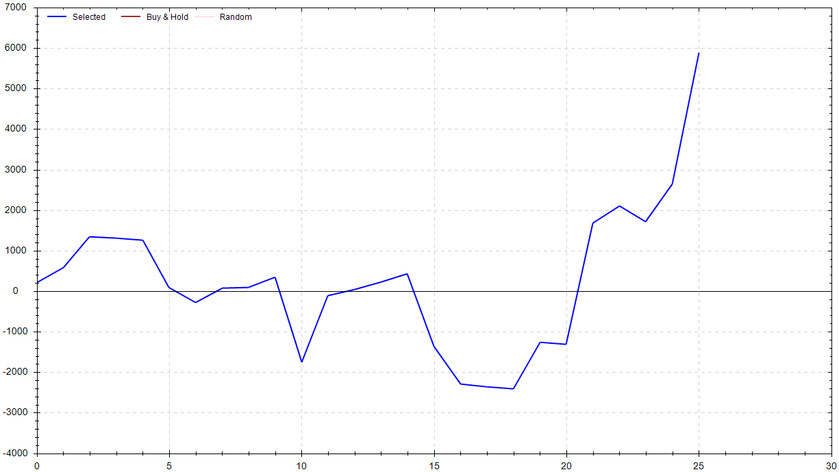

S&P 500 Seasonal Bias (Tuesday, Nov. 7th)

- Bull Win Percentage: 57.7%

- Profit Factor: 1.84

- Bias: Leaning Bullish

Equity Curve -->

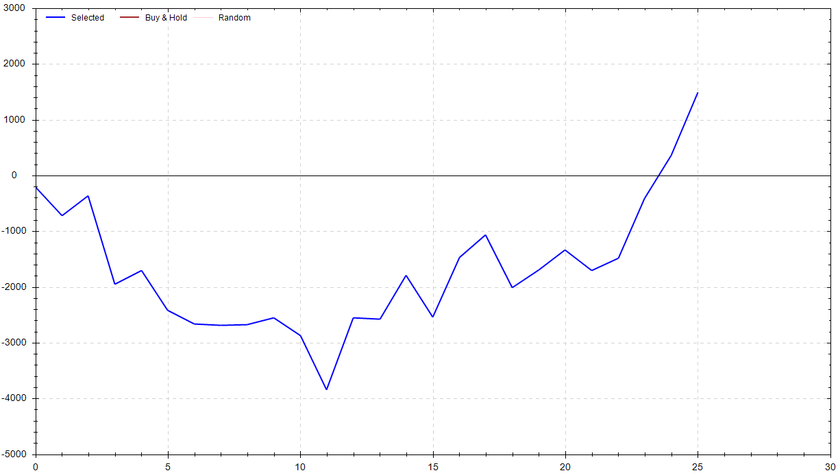

S&P 500 Seasonal Bias (Wednesday, Nov. 8th)

- Bull Win Percentage: 53.8%

- Profit Factor: 1.22

- Bias: Leaning Bullish

Equity Curve -->

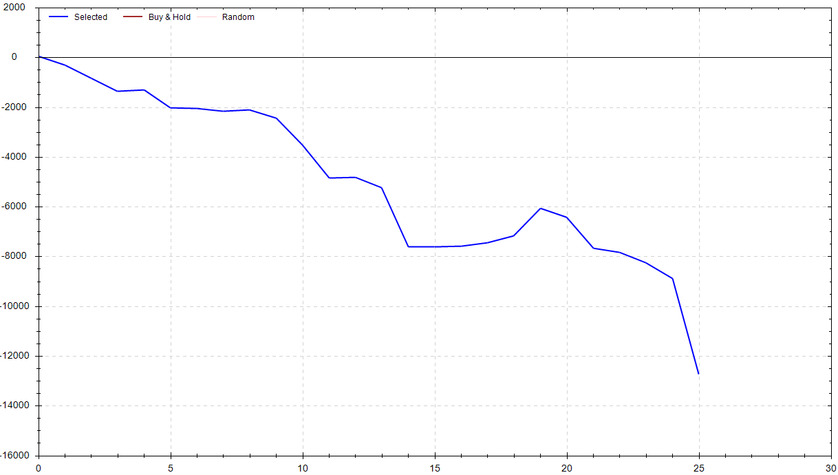

S&P 500 Seasonal Bias (Thursday, Nov. 9th)

- Bull Win Percentage: 30.8%

- Profit Factor: 0.12

- Bias: Bearish

Equity Curve -->

S&P 500 Seasonal Bias (Friday, Nov. 10th)

- Bull Win Percentage: 53.8%

- Profit Factor: 1.42

- Bias: Neutral

Equity Curve -->

Options Strategy Update

The 0 DTE signal went 9 out of 10 (~90% accuracy).

It's with a heavy heart that I must report the trading streak is over. After 27 straight winners, I could not clear the crevasse to 28. I suppose you can't win them all. Obviously, I'm happy with the winnings, but I'm more happy with the performance of the strategy. I have a couple more ideas I want to test to see if I can bring the methodology to the next level. Even if I can't, I'm confident in the system enough to throw more money behind it.

Current Streak: 2

November Record: 5/6

Monday Oct. 30th

SPY CALL Credit Spread ($416 / $417) 🟢

QQQ CALL Credit Spread ($350 / $351) 🟢

Tuesday Oct. 31st

SPY PUT Credit Spread ($414 / $413) 🟢

QQQ PUT Credit Spread ($346 / $345) 🟢

Wednesday Nov. 1st

SPY PUT Credit Spread ($418 / $417) 🟢

QQQ PUT Credit Spread ($351 / $350) 🟢

Thursday Nov. 2nd

SPY CALL Credit Spread ($431 / $432) 🟢

QQQ CALL Credit Spread ($363 / $364) 🔴

Friday Nov. 3rd

SPY PUT Credit Spread ($432 / $431) 🟢

QQQ PUT Credit Spread ($364 / $363) 🟢

Charts of Interest

BULLISH! The S&P 500 ripped the face off the bears this past week. For five days in a row, Monday to Friday, the bear camp got demolished. I don't want to come off as a negative Nancy or anything. Yes, the market could easily continue to the upside. But personally, I think the highest odds situation is chop. The market naturally tends to expand and contract. Over the past two weeks, there was a large expansion to the downside followed by a large expansion to the upside. Nice trends are commonly followed by chop price action. If the SPY can hold $435, I'll be watching $438. If it doesn't hold, there are three downside gap fills: $431, $423 & $418.

On a relative basis, the tech sector was even more bullish. Not only did the QQQs put in a perfect green week, but it recovered above various key technical levels. The entire EMA cloud was leapfrogged, both trendlines were broken, and things are setting up nicely for $370. As of now, I like $374 as an upside target. If the bulls don't hold the line, there are three downside gap fills: $363, $357 & $351. My current base case is choppy, sideways price action.

Bitcoin continued to hold its key breakout level of $32K. If BTC can successfully get above and gold $35K, I'll then be watching $39-$40k. The overall momentum in crypto is clearly bullish and I'm looking for it to continue in the short term. If $32K doesn't hold, the next support would be around ~25K.

Tesla's recent breakdown appear to be a fake out -- A bear trap. If the momentum continues, I'll paying looking for $230. From there, I would argue the odds of an upside gap fill to $242 are high (not guaranteed). If the grey line (the 13 EMA) doesn't hold, I'd then argue the odds of a downside gap fill to $206 are enticing.

Nvidia is the gift that keeps on giving. Even when it looks like it's about to get rocked, it pulls off an impressive recovery. I suppose to lesson to be learned is to never bet against NVDA. In the short term, $460 and $470 become interesting if $450 holds. If not, my major levels are $433 followed by the downside gap fill at $424.

A few weeks ago, I discussed a potential continuation after Microsoft broke out. It was ugly for a bit, but the bullish momentum is finally playing out smoothly. Congrats to all of you who caught it. If MSFT holds $350, I'd be paying attention to $360 followed by $366. I should also warn you that there is also a downside gap fill to $339.

Times Piper Hurt My Feelings

4 *

* This data point is from readings over the past week. The reported information should not be taken as an aggregate or cumulative value for any period beyond the most recent week (Sunday through Saturday). Appropriate alterations were made to account for both travel and time zone shifts.

Notes

RISK WARNING: Trading involves HIGH RISK and YOU CAN LOSE a lot of money. Do not risk any money you cannot afford to lose. Trading is not suitable for all investors. We are not registered investment advisors. We do not provide trading or investment advice. We provide research and education through the issuance of statistical information containing no expression of opinion as to the investment merits of a particular security. Information contained herein should not be considered a solicitation to buy or sell any security or engage in a particular investment strategy. Past performance is not necessarily indicative of future results. Links above include affiliate commission or referrals. I'm part of an affiliate network and I receive compensation from partnering websites.

Both of these trades hit if held until close -- 6 total units!

Both of these trades hit if held until close -- 6 total units! These PCS's were sold at $1.05/ea and were bought back at $0.20/ea -- THIS MEANS MY REALIZED GAIN WAS $!

These PCS's were sold at $1.05/ea and were bought back at $0.20/ea -- THIS MEANS MY REALIZED GAIN WAS $!