A Bullish Feast

Hola,

I hope all is well my favorite nerdy degens!

Another week, another victory for the bulls. The market has sustained a very impressive rally since the end of October. Momentum carried to the upside this past week because of the dovish (aka bullish) inflation reports. Both the CPI & PPI reports came in below expectations. The market interpreted this to mean the Fed has (most likely) hit its terminal rate. For obvious reasons, the stock market was pretty happy that our central bank is no longer fighting demand so aggressively.

I should note that cost of living is still more expensive. Prices are continuing to increase, but the rate of increase is less. It's like you were driving your car in the wrong direction at 90 mph and now you're going the same way at 45 mph. It both situations you're going the wrong way (prices are increasing), but now you're simply going slower.

This upcoming trading week is a shortened week. The market will be closed on Thursday and Friday will be a half day. If you're engaging in options, there is a good chance that you'll have less time and volatility than you're expecting. Personally, I'm not planning on doing anything too crazy this upcoming week. My base expectation is that not too much will be happening since most people be focused on unplugging, relaxing, and really doing anything else that isn't realted to the markets.

With all the being said, there are a few key things I'll still be paying attention. The announcements, earnings, and price levels I care about are all noted below.

Adios,

Mateo

P.S. The official Goonie Discord is live -- You join right now!

Join here --> https://bit.ly/GoonieGroup

Market Events

Monday, Nov. 20th

None

Tuesday, Nov. 21st

10:00 AM ET Existing Home Sales (Oct)

02:00 PM ET FOMC Meeting Minutes

Wednesday, Nov. 22nd

08:30 AM ET Initial Jobless Claims

08:30 AM ET Core Durable Goods Orders (MoM) (Oct)

10:30 AM ET Crude Oil Inventories

Thursday, Nov. 23rd

All Day Market Closed (Thanksgiving Day)

Friday, Nov. 24th

09:45 AM ET S&P Global Services PMI (Nov)

Market Closes @ 1:00pm ET

Upcoming Earnings

Monday

PM: Trip.com, Zoom

Tuesday

AM: Abercrombie, Best Buy, Burlington, Dick's, Kohl's & Lowe's

PM: Guess, HP, Jack In The Box, Nordstrom, Nvidia & Urban Outfitters

Wednesday

AM: John Deere

Thursday

AM: Futu

Friday

None

Note: This is NOT the full list -- I included the names of companies that are popular within the Goonie Community.

Seasonality Update

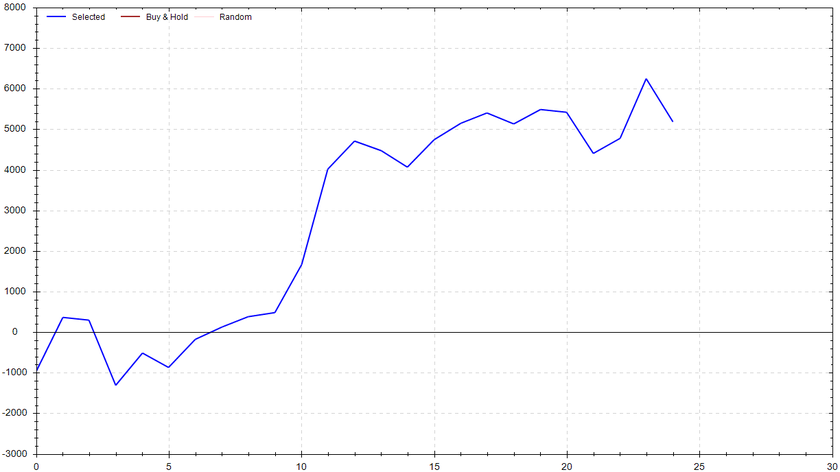

S&P 500 Seasonal Bias (Monday, Nov. 20th)

- Bull Win Percentage: 61.5%

- Profit Factor: 0.81

- Bias: Leaning Bearish

Equity Curve -->

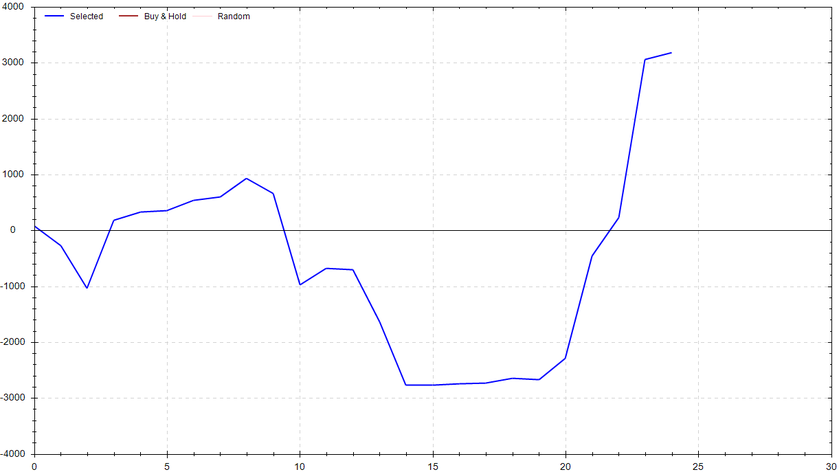

S&P 500 Seasonal Bias (Tuesday, Nov. 21st)

- Bull Win Percentage: 64%

- Profit Factor: 1.72

- Bias: Bullish

Equity Curve -->

S&P 500 Seasonal Bias (Wednesday, Nov. 22nd)

- Bull Win Percentage: 60%

- Profit Factor: 1.86

- Bias: Bullish

Equity Curve -->

S&P 500 Seasonal Bias (Thursday, Nov. 23rd)

- Market Closed All Day

S&P 500 Seasonal Bias (Friday, Nov. 24th)

- Market Closes @ 1:00 pm ET

- Bull Win Percentage: 64%

- Profit Factor: 1.62

- Bias: Leaning Bullish

Equity Curve -->

Options Strategy Update

The 0 DTE signal went 9 out of 10 (~90% accuracy).

Massive overhauls are coming to this strategy shortly. As key differences have been identified between theory and reality, alterations are required for success. In the coming weeks, this strategy will be trading slightly less, and the tradeoff will be higher accuracy (hopefully). I also believe I had come up with a better risk management system. As these things play out in the future, they will be documented and posted here & in the Discord.

Current Streak: 0

November Record: 22/26

Monday Nov. 13th

SPY PUT Credit Spread ($438 / $437) 🟢

QQQ PUT Credit Spread ($375 / $374) 🟢

Tuesday Nov. 14th

SPY PUT Credit Spread ($446 / $445) 🟢

QQQ PUT Credit Spread ($383 / $382) 🟢

Wednesday Nov. 15th

SPY PUT Credit Spread ($449 / $448) 🟢

QQQ PUT Credit Spread ($385 / $384) 🟢

Thursday Nov. 16th

SPY PUT Credit Spread ($449 / $448) 🟢

QQQ PUT Credit Spread ($384 / $383) 🟢

Friday Nov. 17th

SPY CALL Credit Spread ($451 / $452) 🟢

QQQ CALL Credit Spread ($386 / $387) 🔴

Charts of Interest

The S&P 500 is continuing to represent serious strength. I have no clue when, but eventually there will be some form of mean reversion. Until the bulls decide to take profits, or the bears finally fight back, I'll be watching the key upside levels: $452, $455.50 & $459. If this week is the week that price reverts, I’ll be paying close attention to $448, $446 & $441.

The S&P 500 is continuing to represent serious strength. I have no clue when, but eventually there will be some form of mean reversion. Until the bulls decide to take profits, or the bears finally fight back, I'll be watching the key upside levels: $452, $455.50 & $459. If this week is the week that price reverts, I’ll be paying close attention to $448, $446 & $441.

The tech-heavy Nasdaq is taking no prisoners. The QQQs are knocking on the door of a major breakout at $388. If the breakout is rejected, I'll be watching $384, $382 followed by $378. The bulls are clearly dominating, but please be mindful of a potential mean reversion setup (similar to the SPY).

The tech-heavy Nasdaq is taking no prisoners. The QQQs are knocking on the door of a major breakout at $388. If the breakout is rejected, I'll be watching $384, $382 followed by $378. The bulls are clearly dominating, but please be mindful of a potential mean reversion setup (similar to the SPY).

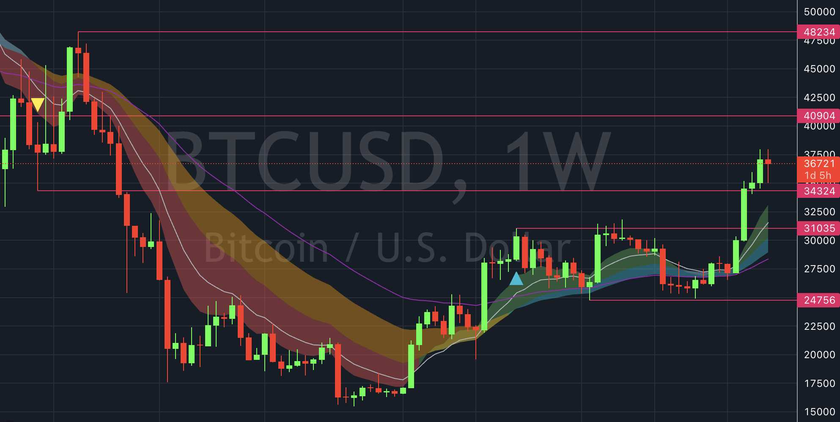

Bitcoin is continuing to consolidate after its recent breakout. If it can hold $34K, I strongly believe $40K is in play.

Bitcoin is continuing to consolidate after its recent breakout. If it can hold $34K, I strongly believe $40K is in play.

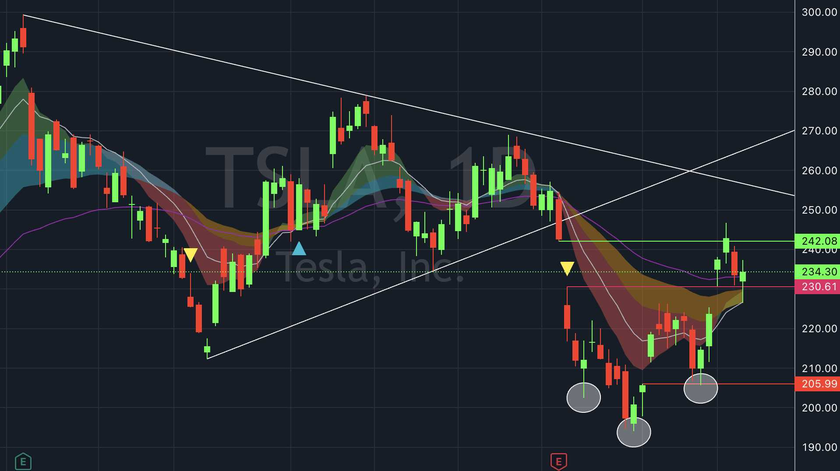

As previously discussed, the major setup involving Tesla was an inverse head & shoulders. This pattern played out beautifully last week and even managed to hit the upside gap fill at $242. I'll be watching to see if the momentum is enough to get the EMA cloud to flip bullish.

As previously discussed, the major setup involving Tesla was an inverse head & shoulders. This pattern played out beautifully last week and even managed to hit the upside gap fill at $242. I'll be watching to see if the momentum is enough to get the EMA cloud to flip bullish.

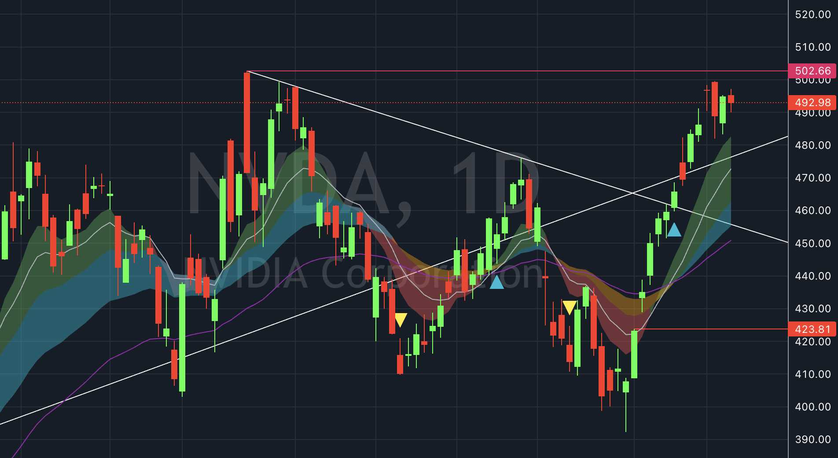

Nvidia is nearing its all-time high as we approach its earnings report. Stay frosty -- Big moves could be on the horizon.

Nvidia is nearing its all-time high as we approach its earnings report. Stay frosty -- Big moves could be on the horizon.

Palantir is refusing to quit. PLTR had a very nice breakout and solid weekly close. I'll be watching to see if the current level will hold. If so, we might be looking at an additional leg to the upside.

Palantir is refusing to quit. PLTR had a very nice breakout and solid weekly close. I'll be watching to see if the current level will hold. If so, we might be looking at an additional leg to the upside.

Microsoft hit a new all-time high. I'm unsure if this momentum will hold given all the drama going on with MSFT and OpenAI. Surely a worthwhile ticker to watch.

Microsoft hit a new all-time high. I'm unsure if this momentum will hold given all the drama going on with MSFT and OpenAI. Surely a worthwhile ticker to watch.

Amazon has managed to pull off a very impressive recovery. If AMZN can get above and hold above the (white) trendline, I'd be looking for a nice bullish follow through.

Amazon has managed to pull off a very impressive recovery. If AMZN can get above and hold above the (white) trendline, I'd be looking for a nice bullish follow through.

Times My Fiancée Didn't Want Extra Fries & Then Ate Mine Anyway

4.8 *

* This data point is from readings over the past week. The reported information should not be taken as an aggregate or cumulative value for any period beyond the most recent week (Sunday through Saturday). Appropriate alterations were made to account for both travel and time zone shifts.

Notes

RISK WARNING: Trading involves HIGH RISK and YOU CAN LOSE a lot of money. Do not risk any money you cannot afford to lose. Trading is not suitable for all investors. We are not registered investment advisors. We do not provide trading or investment advice. We provide research and education through the issuance of statistical information containing no expression of opinion as to the investment merits of a particular security. Information contained herein should not be considered a solicitation to buy or sell any security or engage in a particular investment strategy. Past performance is not necessarily indicative of future results. Links above include affiliate commission or referrals. I'm part of an affiliate network and I receive compensation from partnering websites.

Both of these trades hit if held until close -- 6 total units!

Both of these trades hit if held until close -- 6 total units! These PCS's were sold at $1.05/ea and were bought back at $0.20/ea -- THIS MEANS MY REALIZED GAIN WAS $!

These PCS's were sold at $1.05/ea and were bought back at $0.20/ea -- THIS MEANS MY REALIZED GAIN WAS $!