Happy Thanksgiving, Goonies!

Hi Y'all,

If you decided to be a real human being and spend time with your friends & family instead of watching every single minute bar last night, you didn't miss much. You should also be applauded for having your priorities set straight, but that's beside the point.

With respect to economic announcements, not much went down last week. Nvidia had its earnings, which were pretty good, but the market didn't respond in too positive of a manner. The market's overall momentum carried up the upside. However, the volatility was nonexistent due to Thanksgiving.

There are still some upcoming earnings scheduled to be released. None of the listed companies seem to be too popular in the world of Retail trading. It will remain that way for a few weeks because Earnings Season is now effectively over. The excitement isn't completely gone though. There is both an inflation report and Powell speech going down this week.

The market has been on a very impressive rip to the upside over the past month. The extent of the move makes me think a pullback is more likely than a continuation. The rocket engines are simply running too hot and need chance to cool off. My prediction might be right. It might be wrong. In reality, it doesn't matter. I'm going to trade what the market gives me. I'll react to whatever the price action is -- I don't need to flirt with Lady Luck and attempt to guess what's going to happen.

Warm Regards,

Extra Thicc Kohrs

P.S. The official Goonie Discord is live -- You should join right now!

Join here --> https://bit.ly/GoonieGroup

Market Events

Monday, Nov. 27th

10:00 AM ET New Homes Sales (Oct)

Tuesday, Nov. 28th

10:00 AM ET CB Consumer Confidence (Nov)

Wednesday, Nov. 29th

08:30 AM ET GDP (QoQ) (Q3)

10:30 AM ET Crude Oil Inventories

Thursday, Nov. 30th

05:00 AM ET Eurozone CPI (YoY) (Nov)

08:30 AM ET PCE Price Index (YoY) (Oct)

08:30 AM ET PCE Price Index (MoM) (Oct)

08:30 AM ET Initial Jobless Claims

10:00 AM ET Pending Home Sales (MoM) (Oct)

Friday, Dec. 1st

10:00 AM ET ISM Manufacturing PMI (Nov)

10:00 AM ET ISM Manufacturing Prices (Nov)

11:00 AM ET Fed Chair Powell Speaks

Upcoming Earnings

Monday

None

Tuesday

PM: Crowdstrike, Intuit & Workday

Wednesday

AM: Footlocker & Petco

PM: Salesforce & Snowflake

Thursday

AM: Cracker Barrel, Kroger & TD Bank

PM: Dell

Friday

None

Note: This is NOT the full list -- I included the names of companies that are popular within the Goonie Community.

Seasonality Update

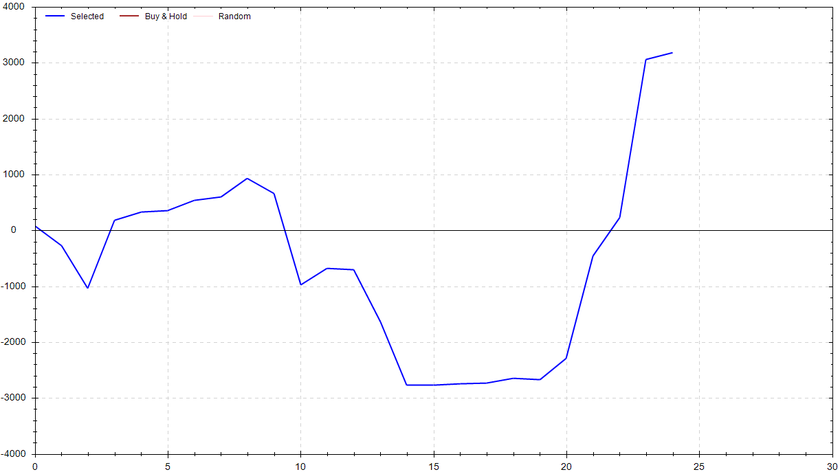

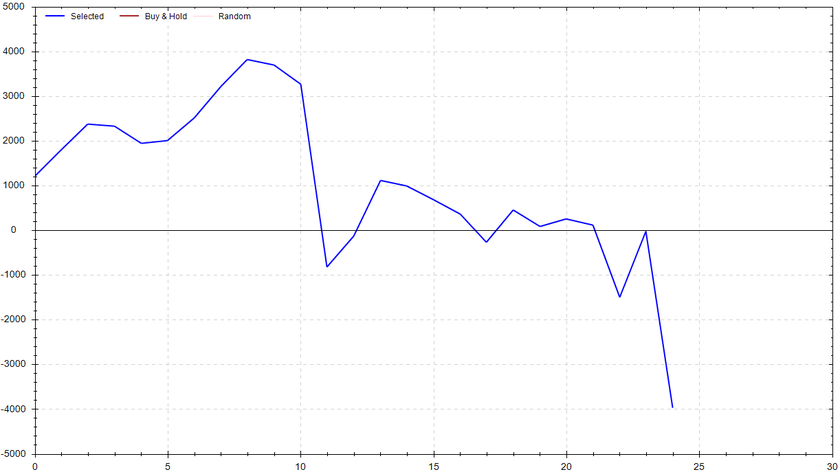

S&P 500 Seasonal Bias (Monday, Nov. 27th)

- Bull Win Percentage: 64%

- Profit Factor: 1.62

- Bias: Leaning Bullish

Equity Curve -->

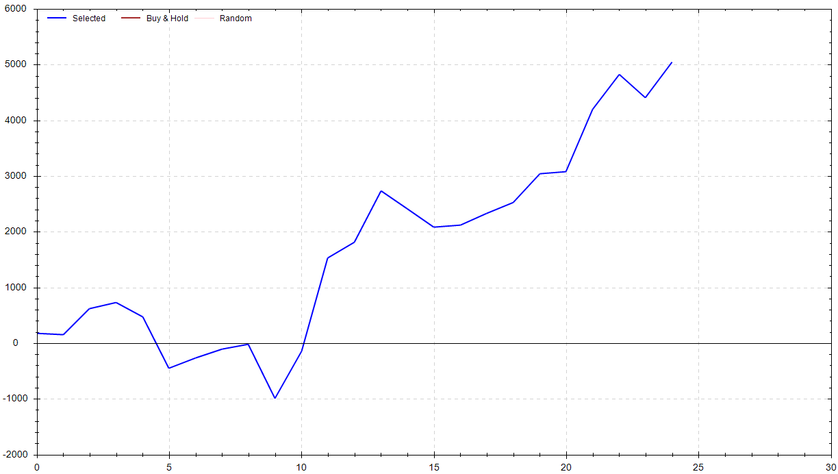

S&P 500 Seasonal Bias (Tuesday, Nov. 28th)

- Bull Win Percentage: 72%

- Profit Factor: 2.57

- Bias: Bullish

Equity Curve -->

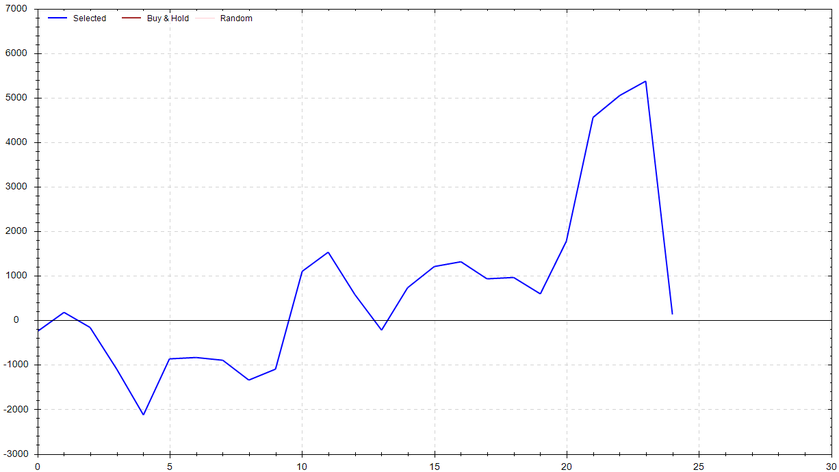

S&P 500 Seasonal Bias (Wednesday, Nov. 29th)

- Bull Win Percentage: 56%

- Profit Factor: 1.01

- Bias: Neutral

Equity Curve -->

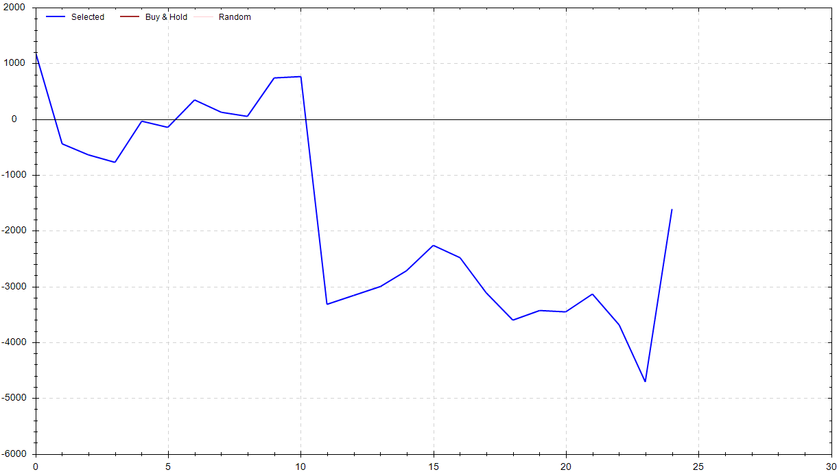

S&P 500 Seasonal Bias (Thursday, Nov. 30th)

- Bull Win Percentage: 48%

- Profit Factor: 0.83

- Bias: Leaning Bearish

Equity Curve -->

S&P 500 Seasonal Bias (Friday, Dec. 1st)

- Bull Win Percentage: 48%

- Profit Factor: 0.68

- Bias: Leaning Bearish

Equity Curve -->

Options Strategy Update

The 0 DTE signal went 4 out of 4 (~100% accuracy).

This week was the first week I ran the "more conservative" 0 DTE strategy. Not only was it a shortened trading week, but there were no signals fired on Wednesday. It's a little bit of a bummer it didn't trade more, but at least it was perfect the times it did trade. I don't have much to breakdown or analyze because the current dataset is small -- I'll have much more to say next newsletter.

Current Streak: 4

November Record: 26/30

Monday Nov. 20th

SPY PUT Credit Spread ($450 / $449) 🟢

QQQ PUT Credit Spread ($386 / $385) 🟢

Tuesday Nov. 21st

SPY CALL Credit Spread ($454 / $455) 🟢

QQQ CALL Credit Spread ($390 / $391) 🟢

Wednesday Nov. 22nd

None (No Signal Generated)

Thursday Nov. 23rd

None (Market Closed)

Friday Nov. 24th

None (Market Half Day)

Charts of Interest

The overall market has continued its ascent to the moon. Most recently, the upside gap fill of $455 was successfully hit. If the momentum continues, my next target is the summer high of $459. If mean reversion decides to come into effect, I'll be watching $451, $448 followed by the closest downside gap fill at $441. Personally, I'd favor the pullback situation because the market has gone up a lot in a short period of time. I'm not overly confident though because the current seasonality strongly favors the bulls. I'll take what the market gives -- I'll be reactive, not predictive.

The overall market has continued its ascent to the moon. Most recently, the upside gap fill of $455 was successfully hit. If the momentum continues, my next target is the summer high of $459. If mean reversion decides to come into effect, I'll be watching $451, $448 followed by the closest downside gap fill at $441. Personally, I'd favor the pullback situation because the market has gone up a lot in a short period of time. I'm not overly confident though because the current seasonality strongly favors the bulls. I'll take what the market gives -- I'll be reactive, not predictive.

The tech-heavy Nasdaq hit a new 52-week high. Similar to the S&P 500 analysis, I think a pull back is more likely than a continuation. I have the various downside targets marked ($388, $384 & $378). If the bulls prove to be unrelenting, I'll be looking to see how the market reacts to the recent high of $393.

The tech-heavy Nasdaq hit a new 52-week high. Similar to the S&P 500 analysis, I think a pull back is more likely than a continuation. I have the various downside targets marked ($388, $384 & $378). If the bulls prove to be unrelenting, I'll be looking to see how the market reacts to the recent high of $393.

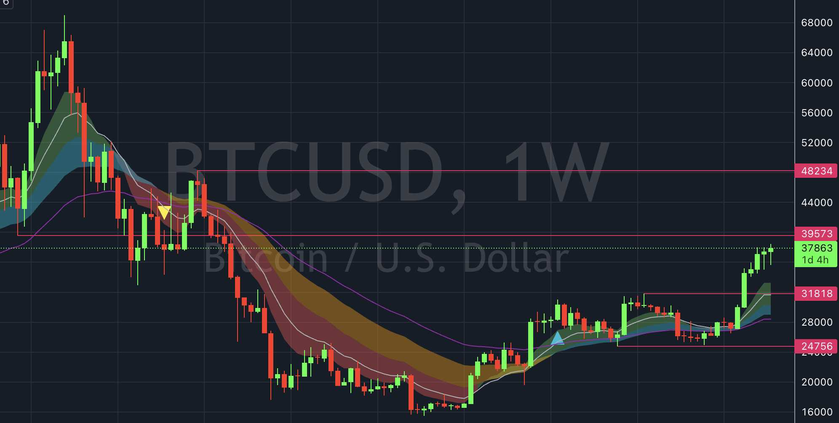

Digital gold is still strong af. I think there will be a serious battle at $40k in the near future. Until then, I'd argue the bulls are in control as long as Bitcoin holds above $34k.

Digital gold is still strong af. I think there will be a serious battle at $40k in the near future. Until then, I'd argue the bulls are in control as long as Bitcoin holds above $34k.

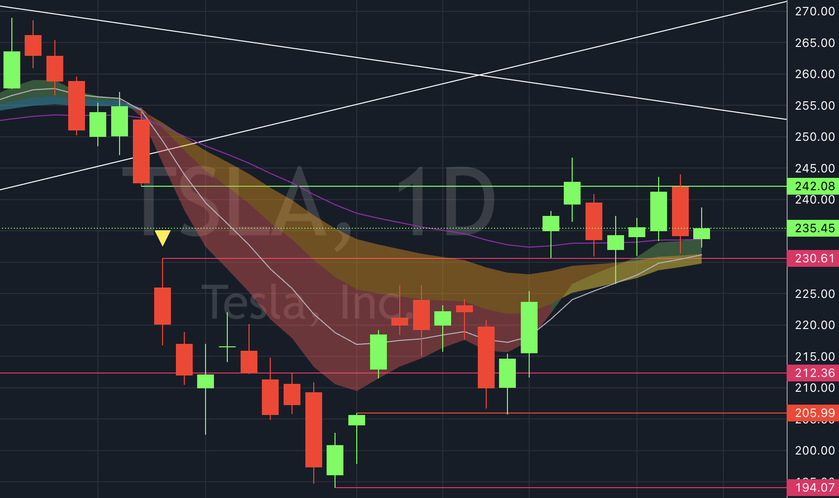

Tesla hasn't been doing much beyond consolidating. I know it might look boring but pay close attention to the EMA cloud. We are witnessing a flip from bearishness to bullishness. These are my favor swing trade setups. Ole' Teslerrr is worth a spot on your watchlist for a potential breakout.

Tesla hasn't been doing much beyond consolidating. I know it might look boring but pay close attention to the EMA cloud. We are witnessing a flip from bearishness to bullishness. These are my favor swing trade setups. Ole' Teslerrr is worth a spot on your watchlist for a potential breakout.

Nvidia hit a new all-time high before its earnings were reported. The earnings were solid, but the market clearly had higher expectations. The EMA cloud is still bullish, but the major trendline was broken. There could be a considerable reversal in NVDA if the price is pushed down and closed below the 50 EMA (the purple line).

Nvidia hit a new all-time high before its earnings were reported. The earnings were solid, but the market clearly had higher expectations. The EMA cloud is still bullish, but the major trendline was broken. There could be a considerable reversal in NVDA if the price is pushed down and closed below the 50 EMA (the purple line).

Rumble's stock hasn't been doing much lately, but I wanted to specifically put it on your radar. We very well might be in the early stages of its EMA cloud flipping from bearish to bullish. I'll personally be paying closer attention to this ticker over the next couple weeks to see if I can snag a solid risk/reward opportunity.

Rumble's stock hasn't been doing much lately, but I wanted to specifically put it on your radar. We very well might be in the early stages of its EMA cloud flipping from bearish to bullish. I'll personally be paying closer attention to this ticker over the next couple weeks to see if I can snag a solid risk/reward opportunity.

Turkeys I Personally Consumed

3.7 *

* This data point is from readings over the past week. The reported information should not be taken as an aggregate or cumulative value for any period beyond the most recent week (Sunday through Saturday). Appropriate alterations were made to account for both travel and time zone shifts.

Notes

RISK WARNING: Trading involves HIGH RISK and YOU CAN LOSE a lot of money. Do not risk any money you cannot afford to lose. Trading is not suitable for all investors. We are not registered investment advisors. We do not provide trading or investment advice. We provide research and education through the issuance of statistical information containing no expression of opinion as to the investment merits of a particular security. Information contained herein should not be considered a solicitation to buy or sell any security or engage in a particular investment strategy. Past performance is not necessarily indicative of future results. Links above include affiliate commission or referrals. I'm part of an affiliate network and I receive compensation from partnering websites.

Both of these trades hit if held until close -- 6 total units!

Both of these trades hit if held until close -- 6 total units! These PCS's were sold at $1.05/ea and were bought back at $0.20/ea -- THIS MEANS MY REALIZED GAIN WAS $!

These PCS's were sold at $1.05/ea and were bought back at $0.20/ea -- THIS MEANS MY REALIZED GAIN WAS $!