It's Christmas Time!

Happy Holidays,

It might be a little early to say, but it looks like the Santa Claus rally is coming to town!

The market is continuing to be one hot tamale. As of market close on Friday, the S&P 500 put in its fifth positive week in a row. Most recently, the bullish price action was supported by an impressive GDP & inflation report -- not to mention all the good vibes.

As shown below, this upcoming week has even more macroeconomic reports. Various interest rate decisions will be announced, and the unemployment report will drop on Friday. With respect to individual companies, earnings seasons is effectively over, but there are still a few you might care about. The remaining reports are detailed below.

Yes, the market is clearly overextended in the short term. That doesn't mean you should randomly bet against the market. I explained last week that I thought mean reversion was reasonable, but it didn't much matter in terms of my personal trades. I trade what the market gives me. I trade the current trend. I'm not lucky enough to pick the tops and bottoms. This means if the price action is to the upside (ie breakouts followed by breakout), I'll continue to make bullish bets. However, if the trend starts to revert (ie lower lows), I'd make bearish bets.

I strongly believe my "gut" isn't good enough to be a profitable trader. I find success by simply following the trend and monitoring my risk. It's so simple even a degen can do it!

Best,

MK

P.S. The official Goonie Discord is live!

If you want to trade with me on a daily basis, you should join --> https://bit.ly/GoonieGroup

Market Events

Monday, Dec. 4th

10:30 PM ET RBA Interest Rate Decision (Dec)

Tuesday, Dec. 5th

09:45 AM ET S&P Global Services PMI (Nov)

10:00 AM ET ISM Non-Manufacturing PMI (Nov)

10:00 AM ET ISM Non-Manufacturing Prices (Nov)

10:00 AM ET JOLTs Job Openings (Oct)

Wednesday, Dec. 6th

08:15 AM ET ADP Nonfarm Employment Change (Nov)

10:00 AM ET Canada BoC Interest Rate Decision

10:30 AM ET Crude Oil Inventories

Thursday, Dec. 7th

08:30 AM ET Initial Jobless Claims

Friday, Dec. 8th

08:30 AM ET Unemployment Rate (Nov)

08:30 AM ET Nonfarm Payrolls (Nov)

08:30 AM ET Avg. Hourly Earnings (MoM) (Nov)

Upcoming Earnings

Monday

PM: GitLab

Tuesday

AM: Auto Zone & NIO

PM: Dave + Buster's & mongoDB

Wednesday

AM: Campbell's

PM: C3, Chewy, & GameStop

Thursday

AM: Dollar General

PM: Broadcom, DocuSign, Lululemon& Vail

Friday

None

Note: This is NOT the full list -- I included the names of companies that are popular within the Goonie Community.

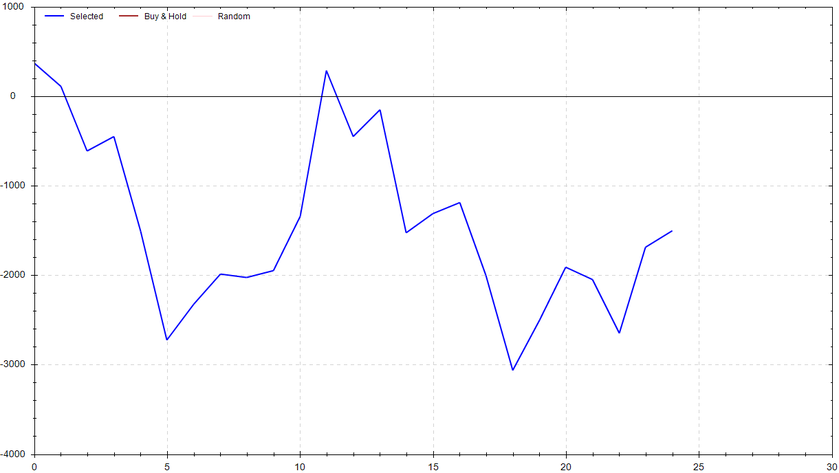

Seasonality Update

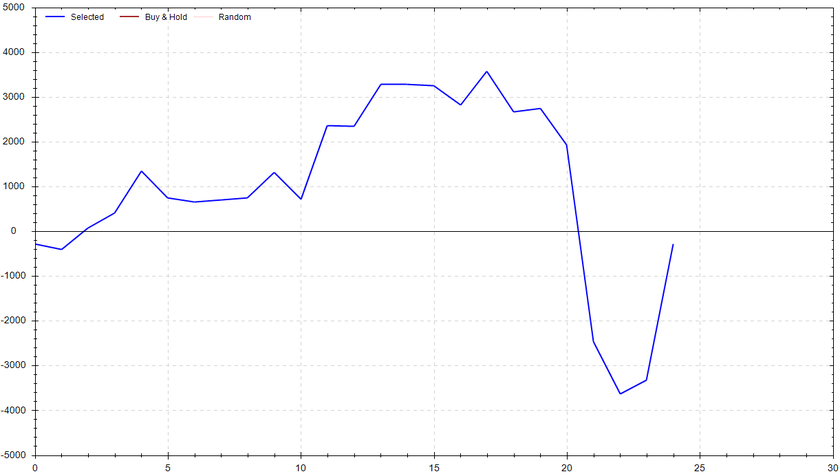

S&P 500 Seasonal Bias (Monday, Dec. 4th)

- Bull Win Percentage: 48%

- Profit Factor: 0.97

- Bias: Neutral

Equity Curve -->

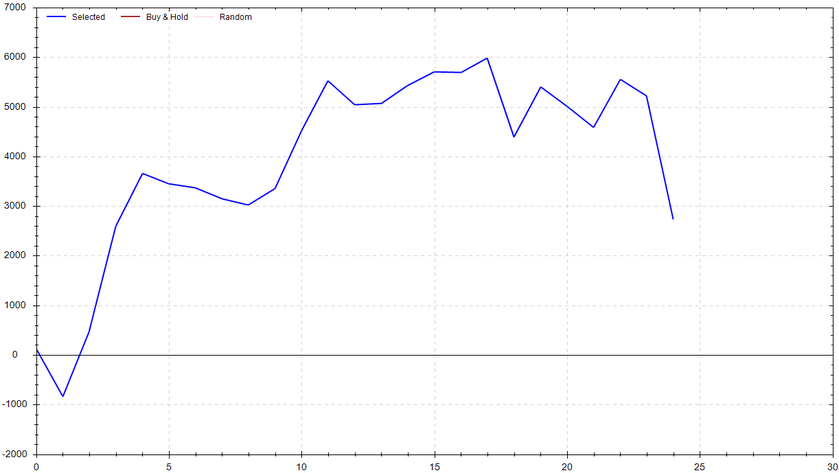

S&P 500 Seasonal Bias (Tuesday, Dec. 5th)

- Bull Win Percentage: 52%

- Profit Factor: 1.37

- Bias: Leaning Bullish

Equity Curve -->

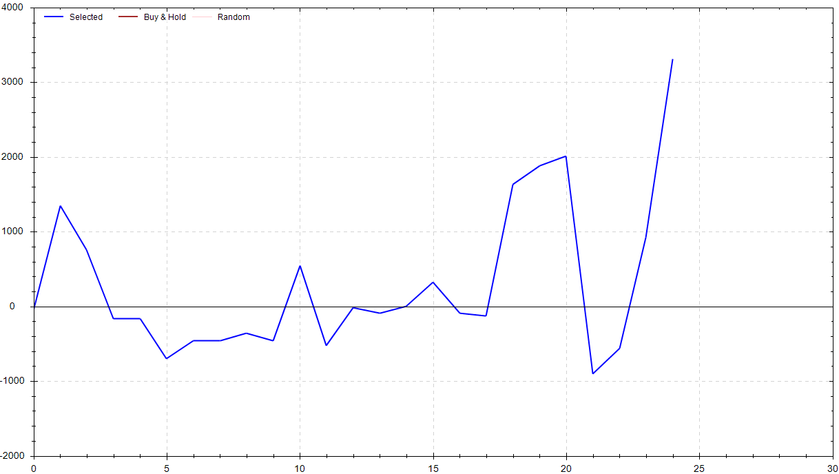

S&P 500 Seasonal Bias (Wednesday, Dec. 6th)

- Bull Win Percentage: 52%

- Profit Factor: 1.49

- Bias: Leaning Bullish

Equity Curve -->

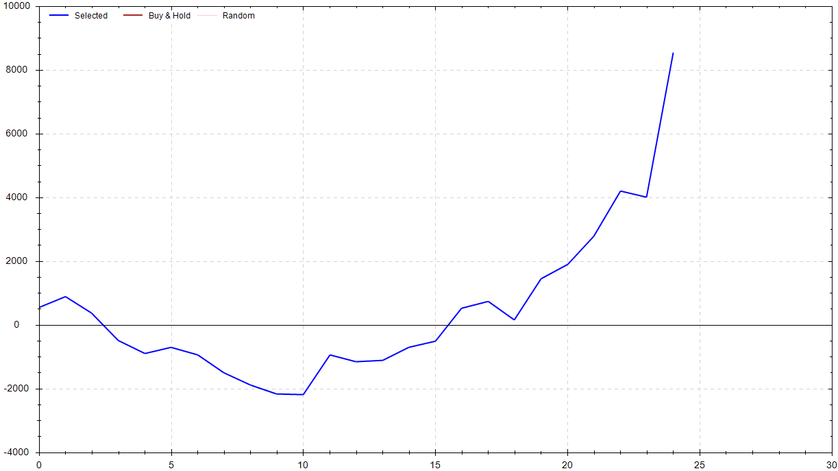

S&P 500 Seasonal Bias (Thursday, Dec. 7th)

- Bull Win Percentage: 56%

- Profit Factor: 3.01

- Bias: Bullish

Equity Curve -->

S&P 500 Seasonal Bias (Friday, Dec. 8th)

- Bull Win Percentage: 56%

- Profit Factor: 0.81

- Bias: Leaning Bearish

Equity Curve -->

Options Strategy Update

The 0 DTE signal went out 7 of 8 (~87.5% accuracy).

Another week, another solid performance. I'm really enjoying the newer version that's a bit less aggressive. The emotional capital required for these trades seems to have dropped dramatically. I'm going to let the current iteration cook a bit more so I can collect data. The next step will be to introduce variable bet sizing based on signal confidence -- exciting times ahead!

Current Streak: 3

November Record: 33/38

Monday Nov. 27th

SPY PUT Credit Spread ($454 / $453) 🟢

QQQ PUT Credit Spread ($389 / $388) 🟢

Tuesday Nov. 28th

SPY PUT Credit Spread ($453 / $452) 🟢

QQQ PUT Credit Spread ($388 / $387) 🟢

Wednesday Nov. 29th

None

Thursday Nov. 30th

SPY CALL Credit Spread ($456 / $457) 🔴

QQQ CALL Credit Spread ($391 / $392) 🟢

Friday Dec. 1st

SPY PUT Credit Spread ($455 / $454) 🟢

QQQ PUT Credit Spread ($386 / $385) 🟢

Charts of Interest

SPY

The market has been, and continues to be, bullllllish. I know many people are calling for price reversion, but we are seeing a great example of how the "reasonable" play isn't what always happens. The trend is your friend! There is no reason to bail if the bears aren't doing squat. If the SPY can push and hold $459.50, my next target would be $462. If the bulls decided to lock in some year-ear profits, I'd be monitoring $451 to serve as support.

The market has been, and continues to be, bullllllish. I know many people are calling for price reversion, but we are seeing a great example of how the "reasonable" play isn't what always happens. The trend is your friend! There is no reason to bail if the bears aren't doing squat. If the SPY can push and hold $459.50, my next target would be $462. If the bulls decided to lock in some year-ear profits, I'd be monitoring $451 to serve as support.

QQQ

The Nasdaq has been moving in a similar manner to the SPY. There were massive upside moves over the past month that led to a bit of consolidation. QQQ bounced perfectly out of the EMA cloud at the end of the last week. My first two upside targets would be $392 & $395. If this bounce gets smacked, I'd be watching for $385 to be support.

The Nasdaq has been moving in a similar manner to the SPY. There were massive upside moves over the past month that led to a bit of consolidation. QQQ bounced perfectly out of the EMA cloud at the end of the last week. My first two upside targets would be $392 & $395. If this bounce gets smacked, I'd be watching for $385 to be support.

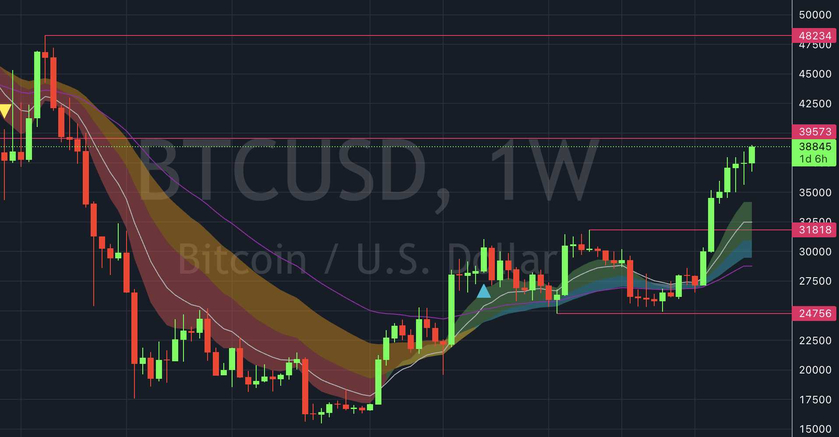

BTC

What can I say about Bitcoin besides "Bullish"? Digital gold is continuing to the upside as it seems to want to test $40k. I would assume the initial test leads to a rejection, but if I'm wrong, I'll be watching for $42.5k.

What can I say about Bitcoin besides "Bullish"? Digital gold is continuing to the upside as it seems to want to test $40k. I would assume the initial test leads to a rejection, but if I'm wrong, I'll be watching for $42.5k.

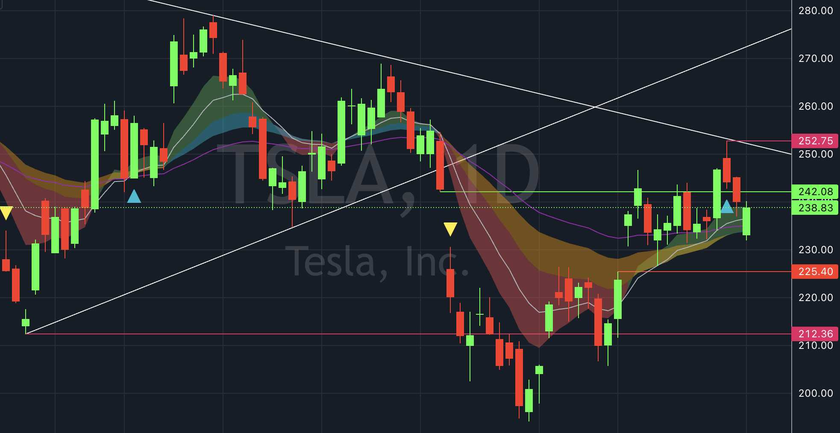

TSLA

Tesla is still consolidation in its EMA cloud. This ticker is still on my watch list for an upside breakout. This thesis would be invalidated if TSLA cannot hold $225. A strong (and obvious) bullish signal would be if Tesla closes above $250.

Tesla is still consolidation in its EMA cloud. This ticker is still on my watch list for an upside breakout. This thesis would be invalidated if TSLA cannot hold $225. A strong (and obvious) bullish signal would be if Tesla closes above $250.

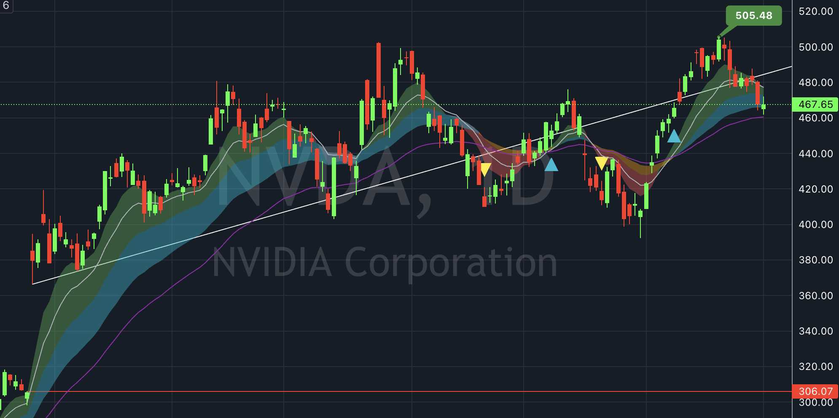

NVDA

The world's leading processing chip company, Nvidia, is finally show a tiny bit of weakness. Throughout my streaming sessions this past week, I spoke about how NVDA falling to the low $460s seemed like a quality play. The callout was fortunately spot on, which leads us to a pivotal level. I'll be looking for Nvidia to either bounce off on $460, and push the white trendline, or breakdown and fall to $440.

The world's leading processing chip company, Nvidia, is finally show a tiny bit of weakness. Throughout my streaming sessions this past week, I spoke about how NVDA falling to the low $460s seemed like a quality play. The callout was fortunately spot on, which leads us to a pivotal level. I'll be looking for Nvidia to either bounce off on $460, and push the white trendline, or breakdown and fall to $440.

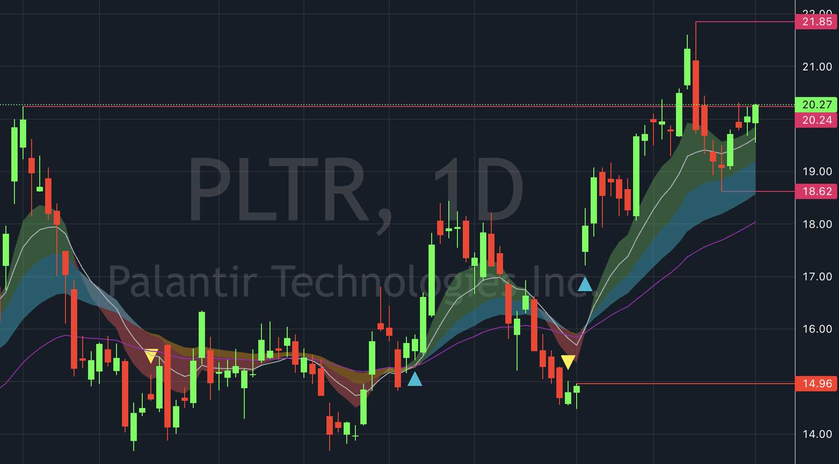

PLTR

Palantir ripped to the upside, which was recently followed by some consolidation in the EMA cloud. The bullish bounce out of the cloud was exactly what I was on the lookout for in last week's newsletter. I'll be looking for the price action to continue in early December.

Palantir ripped to the upside, which was recently followed by some consolidation in the EMA cloud. The bullish bounce out of the cloud was exactly what I was on the lookout for in last week's newsletter. I'll be looking for the price action to continue in early December.

AAPL

Apple performed very well in the month of November. The bullish burst led to some recent consolidation. The price action dropped back into the EMA cloud and is now turning back to the upside. Tim Apple's company is on my watchlist for a continuation to the upside.

Apple performed very well in the month of November. The bullish burst led to some recent consolidation. The price action dropped back into the EMA cloud and is now turning back to the upside. Tim Apple's company is on my watchlist for a continuation to the upside.

Times Piper Bit My Ankle Then Immediately Vomited

* 1

* This data point is from readings over the past week. The reported information should not be taken as an aggregate or cumulative value for any period beyond the most recent week (Sunday through Saturday). Appropriate alterations were made to account for both travel and time zone shifts.

Notes

RISK WARNING: Trading involves HIGH RISK and YOU CAN LOSE a lot of money. Do not risk any money you cannot afford to lose. Trading is not suitable for all investors. We are not registered investment advisors. We do not provide trading or investment advice. We provide research and education through the issuance of statistical information containing no expression of opinion as to the investment merits of a particular security. Information contained herein should not be considered a solicitation to buy or sell any security or engage in a particular investment strategy. Past performance is not necessarily indicative of future results. Links above include affiliate commission or referrals. I'm part of an affiliate network and I receive compensation from partnering websites.

Both of these trades hit if held until close -- 6 total units!

Both of these trades hit if held until close -- 6 total units! These PCS's were sold at $1.05/ea and were bought back at $0.20/ea -- THIS MEANS MY REALIZED GAIN WAS $!

These PCS's were sold at $1.05/ea and were bought back at $0.20/ea -- THIS MEANS MY REALIZED GAIN WAS $!