SANTA IS JACKED TO TITS!!!

Howdy Brother,

I'm not sure what workout plan Santa was on this past year, but jolly ole' Saint Nick is looking jacked. After exploding to the upside in November, the market took a couple of weeks to consolidate slightly off the recent highs. It might be too early to say but it looks like the current phase of price compression is coming to an end. The market is starting to show signs of incoming expansion. Call me a romantic, but I'd that the argument one step farther and say that bullish momentum will win out. I'm looking for the next leg to be to the upside -- I'm looking for Santa to come to town!

The duration of the consolidation hasn't surprised me. The recent upswing was significant and rapid. It's no surprise the engines needed to cool off. On top of that, there was no list of major catalysts that would prompt excitement. Earnings season is effectively over, and there was only one key macroeconomic report: The Unemployment Report. The report itself was a bit dovish, which would normally favor the bears in the current state of monetary policy. As you can see from the charts posted below, the bull camp didn't get that memo because they have continued their party that started six weeks ago.

This upcoming trading week will most likely be full of volatility and large market moves. The specific details are posted below, but there are a considerable number of inflation-related reports being announced. Every single day of the upcoming week has some sort of event that can cause craziness. I highly recommend you secure your socks -- wouldn't want them to be knocked off.

If you don't mind, I'd like to interject an extra note.

The recent market movement is a perfect example of why being predictive, rather than reactive, in the market is detrimental. I have previously noted that the market is "high" and would most likely experience a pullback. Guess what? It hasn't happened yet. However, if you simply trade with the current price action, you would have made money in the bullish direction with relative ease. I'm trying to say it's great to have thoughts, opinions, and predictions about the market, but don't let those get in the way of you making money.

Keep On Keepin' On,

Brother Matt

P.S. The official Goonie Discord is live!

If you want to trade with me on a daily basis, you should join --> https://bit.ly/GoonieGroup

Market Events

Monday, Dec. 11th

01:00 PM ET 10-Year Note Auction

Tuesday, Dec. 12th

08:30 PM ET CPI (YoY) (Nov)

08:30 PM ET Core CPI (YoY) (Nov)

08:30 PM ET CPI (MoM) (Nov)

08:30 PM ET Core CPI (MoM) (Nov)

01:00 PM ET 30-Year Note Auction

Wednesday, Dec. 13th

08:30 PM ET PPI (YoY) (Nov)

08:30 PM ET PPI (MoM) (Nov)

10:30 PM ET Crude Oil Inventories

02:00 PM ET Fed Interest Rate Decision (FOMC)

02:30 PM ET FOMC Press Conference

Thursday, Dec. 14th

08:15 PM ET ECB Interest Rate Decision

08:30 PM ET Retail Sales (MoM) (Nov)

08:30 AM ET Initial Jobless Claims

08:45 AM ET ECB Press Conference

10:30 AM ET Crude Oil Inventories

Friday, Dec. 15th

09:45 AM ET S&P Global Services PMI (Dec)

Upcoming Earnings

Monday

PM: Oracle

Tuesday

None

Wednesday

PM: Adobe

Thursday

PM: Costco

Friday

AM: Darden Restaurants

Note: This is NOT the full list -- I included the names of companies that are popular within the Goonie Community.

Seasonality Update

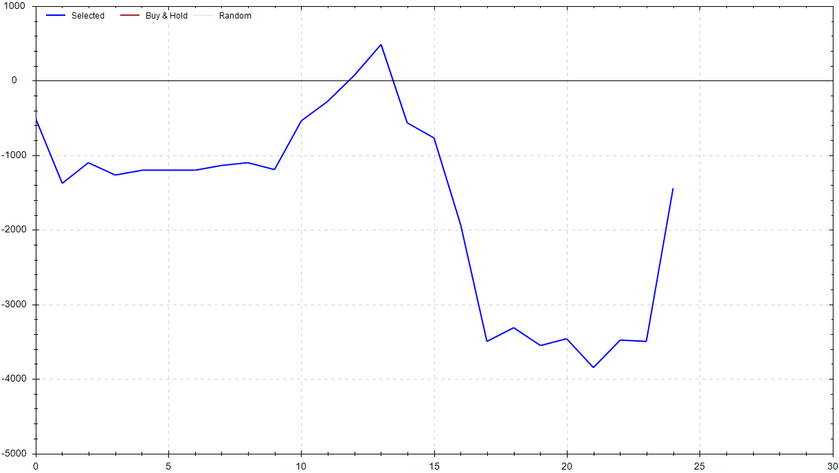

S&P 500 Seasonal Bias (Monday, Dec. 11th)

- Bull Win Percentage: 60%

- Profit Factor: 0.88

- Bias: Neutral

Equity Curve -->

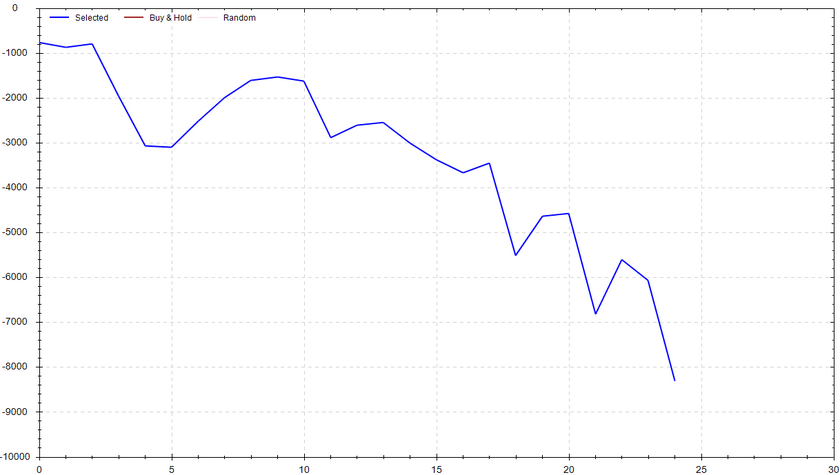

S&P 500 Seasonal Bias (Tuesday, Dec. 12th)

- Bull Win Percentage: 48%

- Profit Factor: 0.77

- Bias: Neutral

Equity Curve -->

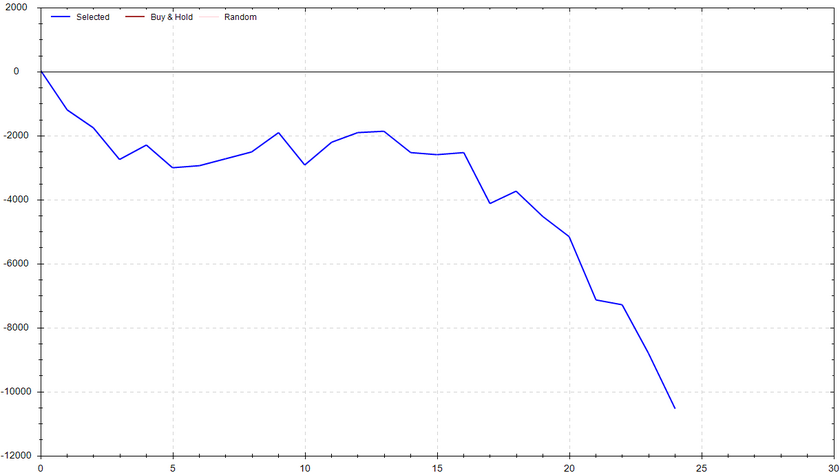

S&P 500 Seasonal Bias (Wednesday, Dec. 13th)

- Bull Win Percentage: 44%

- Profit Factor: 0.34

- Bias: Bearish

Equity Curve -->

S&P 500 Seasonal Bias (Thursday, Dec. 14th)

- Bull Win Percentage: 44%

- Profit Factor: 0.23

- Bias: Bearish

Equity Curve -->

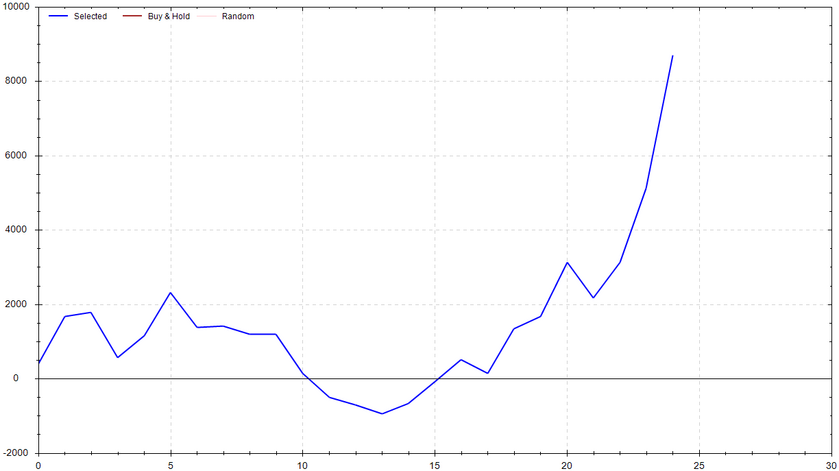

S&P 500 Seasonal Bias (Friday, Dec. 15th)

- Bull Win Percentage: %

- Profit Factor: 2.48

- Bias: Bullish

Equity Curve -->

Options Strategy Update

The 0 DTE signal went out 9 of 10 (~% accuracy).

FULL STEAM AHEAD! After many iterations, the 0 DTE strategy is now functioning like a well-oiled machine. The expectations are being consistently hit. The losing trades are being hedged well. And, most importantly, the profits are juicy. I'll continue to monitor everything, but it looks like it might be time to start working on a new degen strategy.

Current Streak: 9

December Record: 11/12

Monday Dec. 4th

SPY CALL Credit Spread ($457 / $458) 🟢

QQQ CALL Credit Spread ($386 / $387) 🔴

Tuesday Dec. 5th

SPY PUT Credit Spread ($454 / $453) 🟢

QQQ PUT Credit Spread ($384 / $383) 🟢

Wednesday Dec. 6th

SPY CALL Credit Spread ($459 / $460) 🟢

QQQ CALL Credit Spread ($391 / $392) 🟢

Thursday Dec. 7th

SPY PUT Credit Spread ($456 / $455) 🟢

QQQ PUT Credit Spread ($386 / $385) 🟢

Friday Dec. 8th

SPY CALL Credit Spread ($457 / $456) 🟢

QQQ CALL Credit Spread ($388 / $387) 🟢

Charts of Interest

SPY

She's about to (potentially) blow! The overall market is looking strong. Technically it's still consolidating, but the momentum is in favor of the bull camp. Things could easily revert if the upcoming announcements are negative, but they could just as likely prompt an official breakout. I'll be watching $453 & $448 as support. To the upside, I'll be looking at $462 & $466 to serve as resistance.

She's about to (potentially) blow! The overall market is looking strong. Technically it's still consolidating, but the momentum is in favor of the bull camp. Things could easily revert if the upcoming announcements are negative, but they could just as likely prompt an official breakout. I'll be watching $453 & $448 as support. To the upside, I'll be looking at $462 & $466 to serve as resistance.

QQQ

In my humble opinion, the tech sector is setting up for a nice bullish follow through. The QQQ's pushed to the upside, consolidated in the EMA cloud, and is now regaining momentum. Both $383 and $378 are major supports. A breakout of $394 could easily lead to $400.

In my humble opinion, the tech sector is setting up for a nice bullish follow through. The QQQ's pushed to the upside, consolidated in the EMA cloud, and is now regaining momentum. Both $383 and $378 are major supports. A breakout of $394 could easily lead to $400.

BTC

Bitcoin is a freaking tank -- A monster! There is a lot of excitement/fomo surrounding the Spot Bitcoin ETF approval, which is expected to come in early 2024. After going up for the past eight weeks in row, digital gold shows no signs of slowing down. My next upside levels of interest are $46k & $48k. I truly believe these could be hit with ease, but I still wouldn't be chasing in the current environment. I'm not sure when, but I'd bet there will be some sort of short-term pullback that will offer a better risk to reward setup.

Bitcoin is a freaking tank -- A monster! There is a lot of excitement/fomo surrounding the Spot Bitcoin ETF approval, which is expected to come in early 2024. After going up for the past eight weeks in row, digital gold shows no signs of slowing down. My next upside levels of interest are $46k & $48k. I truly believe these could be hit with ease, but I still wouldn't be chasing in the current environment. I'm not sure when, but I'd bet there will be some sort of short-term pullback that will offer a better risk to reward setup.

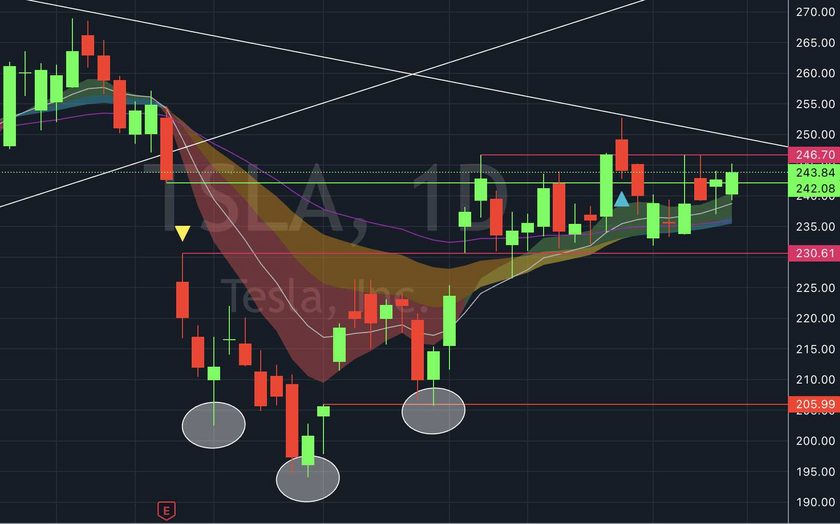

TSLA

Teslerrr still has broken out, but I'm not giving up. The chart is still showing various signs of consolidation that favors the bulls. As long as $230 holds, I think we could be talking about TSLA at $270 in the near future. Stay tuned.

Teslerrr still has broken out, but I'm not giving up. The chart is still showing various signs of consolidation that favors the bulls. As long as $230 holds, I think we could be talking about TSLA at $270 in the near future. Stay tuned.

NVDA

Nvidia once again proved why you shouldn't bet against it. NVDA flirted with an official breakdown just enough to entice the bears. Once the trap was set, the titan of a stock reverted course. I believe $450 will now serve as key support. In terms of upside targets, I'll be watching $490 followed by $505.

Nvidia once again proved why you shouldn't bet against it. NVDA flirted with an official breakdown just enough to entice the bears. Once the trap was set, the titan of a stock reverted course. I believe $450 will now serve as key support. In terms of upside targets, I'll be watching $490 followed by $505.

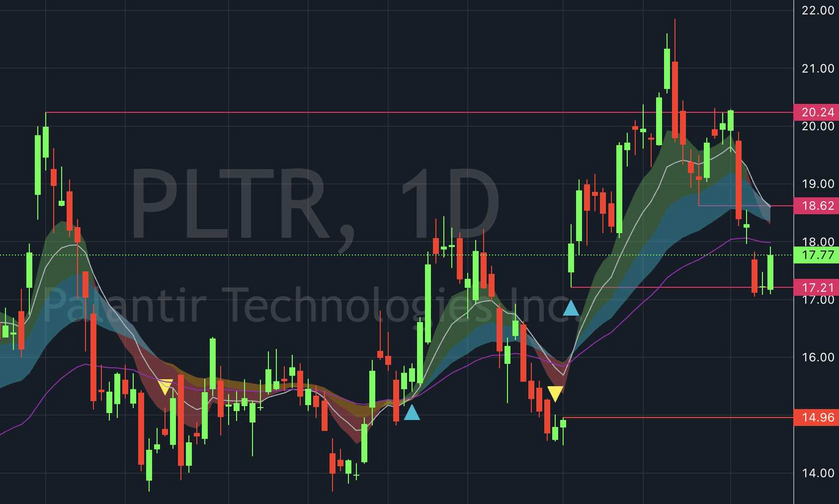

PLTR

Palantir's breakout never came and is now showing signs of a breakdown -- I'll be looking for a potential investment (not active trade) at the downside gap fill of $15.

Palantir's breakout never came and is now showing signs of a breakdown -- I'll be looking for a potential investment (not active trade) at the downside gap fill of $15.

Times Piper Ruined My Show & Broke My Coffee Cup

1*

* This data point is from readings over the past week. The reported information should not be taken as an aggregate or cumulative value for any period beyond the most recent week (Sunday through Saturday). Appropriate alterations were made to account for both travel and time zone shifts.

Notes

RISK WARNING: Trading involves HIGH RISK and YOU CAN LOSE a lot of money. Do not risk any money you cannot afford to lose. Trading is not suitable for all investors. We are not registered investment advisors. We do not provide trading or investment advice. We provide research and education through the issuance of statistical information containing no expression of opinion as to the investment merits of a particular security. Information contained herein should not be considered a solicitation to buy or sell any security or engage in a particular investment strategy. Past performance is not necessarily indicative of future results. Links above include affiliate commission or referrals. I'm part of an affiliate network and I receive compensation from partnering websites.

Both of these trades hit if held until close -- 6 total units!

Both of these trades hit if held until close -- 6 total units! These PCS's were sold at $1.05/ea and were bought back at $0.20/ea -- THIS MEANS MY REALIZED GAIN WAS $!

These PCS's were sold at $1.05/ea and were bought back at $0.20/ea -- THIS MEANS MY REALIZED GAIN WAS $!