Santa Loves Degens

Greetings Earthling,

I hope you packed appropriately because we are going to the moon!

It once again paid to be a bull. I'm aware every talking head on mainstream media and twitter is saying the market "has to pull back." I'm also aware most people have no clue what they are talking about. Predictions are right 100% of the time 50% of the time. I've discussed it more thoroughly in the past few newsletters, but I truly believe most money is made from going with the flow. Don't let yourself, or your predictions, get in your own. Follow the current trend and respect your risk. Don't over complicate it -- Life is already hard enough.

So, why? Why did the market push higher to the point it's within spitting distance of all-time high?

The short answer is that Wall Street believes the Fed is winning the war on inflation. Various inflation reports came out last week. The results were a mixed bag slightly favoring the doves. The real excitement came from the FOMC meeting. The Fed decided to leave rates at the previous level, 5.25. This was fully expected by legitimately anyone who was paying attention at all. In the following press conference, Chairman Powell, for the first time, acknowledged that the Fed will consider cutting rates in 2024 -- The bullish pivot that prompted everyone to yolo into 0 DTE OTM calls. I hope you got yours.

Will it continue?

Honestly, I have no fucking clue. Highlighted below are all the macroeconomic and earnings announcements that dropping this upcoming week. For obvious reasons, they could swing the market is one direction or the other. From a seasonal perspective, the bulls are heavily favored from now until mid-January. All this stuff is great to know and pay attention to, but price action is what rules the day. Follow the trend, stick to your plan, and always respect your risk.

Message Over,

Astronaut Matt

P.S. The official Goonie Discord is live! (FREE Access w/ code GOONIE: https://bit.ly/GoonieGroup)

Market Events

Monday, Dec. 18th

None

Tuesday, Dec. 19th

05:00 AM ET Eurozone CPI (YoY) (Nov)

08:30 AM ET Building Permits

Wednesday, Dec. 20th

10:00 AM ET CB Consumer Confidence (Dec)

10:00 AM ET Existing Home Sales (Nov)

10:30 AM ET Crude Oil Inventories

Thursday, Dec. 21st

08:30 AM ET GDP (QoQ) (Q3)

08:30 AM ET Philadelphia Fed Manufacturing Index (Dec)

08:30 AM ET Initial Jobless Claims

Friday, Dec. 22nd

08:30 AM ET Building Permits

08:30 AM ET Core Durable Goods Orders (MoM) (Nov)

08:30 AM ET PCE Price Index (YoY) (Nov)

08:30 AM ET PCE Price Index (MoM) (Nov)

10:00 AM ET New Home Sales (Nov)

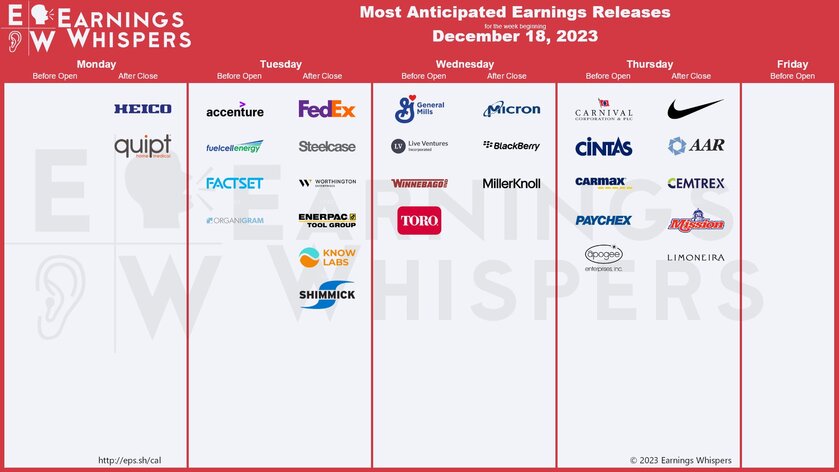

Upcoming Earnings

Monday

None

Tuesday

AM: Accenture

PM: FedEx

Wednesday

AM: General Mills

PM: Blackberry & Micron

Thursday

AM: Carmax & Carnival

PM: Nike

Friday

None

Note: This is NOT the full list -- I included the names of companies that are popular within the Goonie Community.

Seasonality Update

S&P 500 Seasonal Bias (Monday, Dec. 18th)

- Bull Win Percentage: 56%

- Profit Factor: 1.36

- Bias: Leaning Bullish

Equity Curve -->

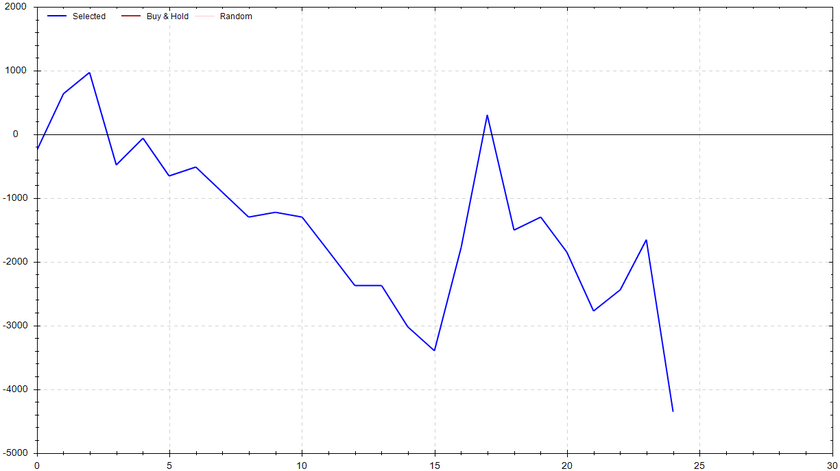

S&P 500 Seasonal Bias (Tuesday, Dec. 19th)

- Bull Win Percentage: 40%

- Profit Factor: 0.61

- Bias: Leaning Bearish

Equity Curve -->

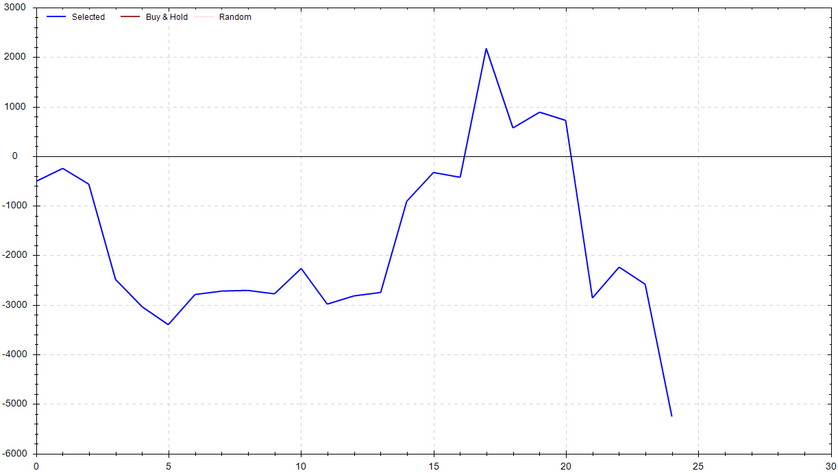

S&P 500 Seasonal Bias (Wednesday, Dec. 20th)

- Bull Win Percentage: 48%

- Profit Factor: 0.59

- Bias: Leaning Bearish

Equity Curve -->

S&P 500 Seasonal Bias (Thursday, Dec. 21st)

- Bull Win Percentage: 68%

- Profit Factor: 1.73

- Bias: Bullish

Equity Curve -->

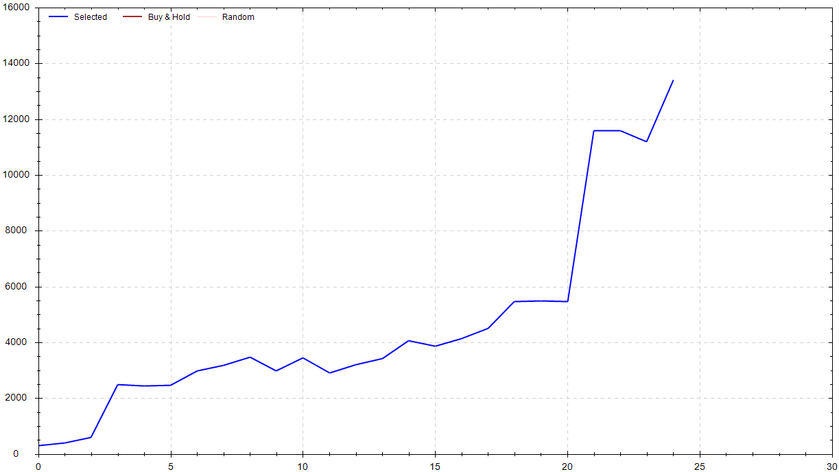

S&P 500 Seasonal Bias (Friday, Dec. 22nd)

- Bull Win Percentage: 76%

- Profit Factor: 8.83

- Bias: VERY Bullish

Equity Curve -->

Options Strategy Update

The 0 DTE signal hit 8 for 8 times this past week (Signal Accuracy: ~100%).

All aboard! The 0 DTE strategy is a money train that is snapping necks & cashing checks. The final improvements for this particular system are almost done. Once the dynamic betting (more or less units based on the current environment) is fully incorporated, I don't anticipate much more work will need to be completed. It will soon be time to start building out an entirely new system -- stay tuned!

Current Streak: 17

December Record: 19/20

Monday Dec. 11th

SPY PUT Credit Spread ($459 / $458) 🟢

QQQ PUT Credit Spread ($391 / $390) 🟢

Tuesday Dec. 12th

SPY PUT Credit Spread ($460 / $459) 🟢

QQQ PUT Credit Spread ($394 / $393) 🟢

Wednesday Dec. 13th

None

Thursday Dec. 14th

SPY CALL Credit Spread ($474 / $475) 🟢

QQQ CALL Credit Spread ($407 / $408) 🟢

Friday Dec. 15th

SPY PUT Credit Spread ($469 / $468) 🟢

QQQ PUT Credit Spread ($404 / $403) 🟢

Charts of Interest

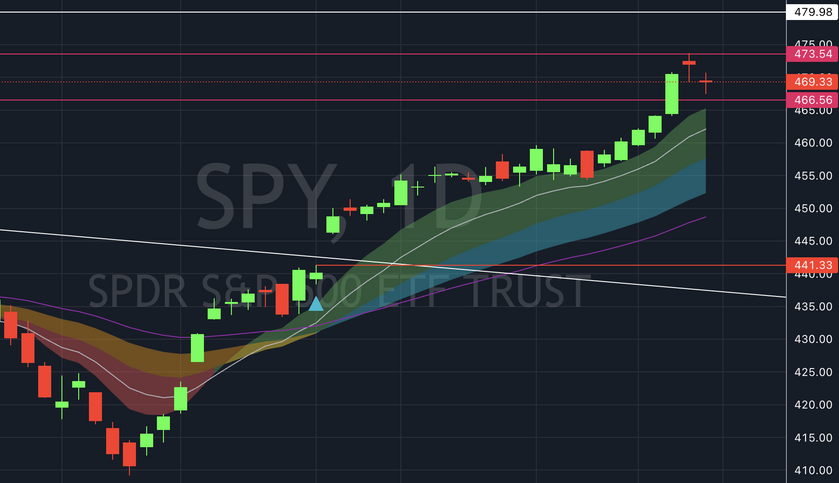

SPY

The S&P 500 is showing signs of topping. The previous resistance of $473.50 served as a price wall once again. The key question is: Will it hold on the next attempt? Your guess is as good as mine. It could easily be argued the market is overextended and needs to mean revert. That's true, but it's also been true for a few weeks, which is stopping the bulls from partying. If there is breakout, I'll be watching for the all-time high at $480. If a pullback occurs, I'll be looking for support to be found between $455 & $460.

QQQ

The tech sector is begging to touch its all-time high of $409. As I'm writing this, the Nasdaq is less than 1% away from hitting a new record price level. If that were to happen, it would be an open range breakout (ie new previous price levels to anchor too). In this situation, certain tools like Fibonacci extension levels could be used, but I find it more fund to find the rollercoaster. If the breakout gets denied, I'd watch for $400 & $394 to act as potential support.

BTC

Bitcoin has now entered a period of consolidation after its monstrous rally. After 8 green weeks in a row, it finally had a down week. To be fair, it was a baby red week. All the previous weekly lows in the current run are higher relative to the one before. This tells me that the bulls continue to be in control -- Patience is just needed during this consolidation. The next key level for me is $48k - $50k. To the downside, I'd be focusing on $36k - $38k.

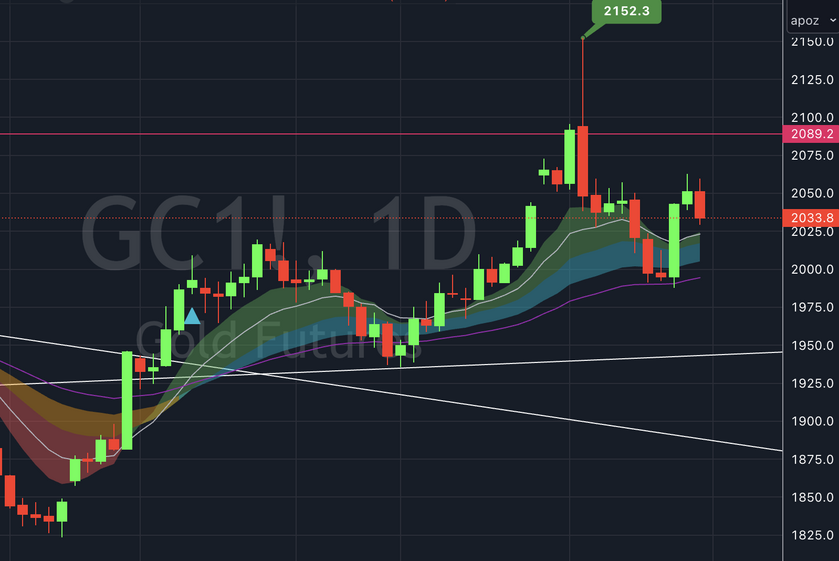

GC (Gold)

After hitting a new high, gold got smacked and consolidated. The EMAs proved to be support, and now we are seeing a slight bounce. Personally, I think there could be a nice follow through here -- Watching closely.

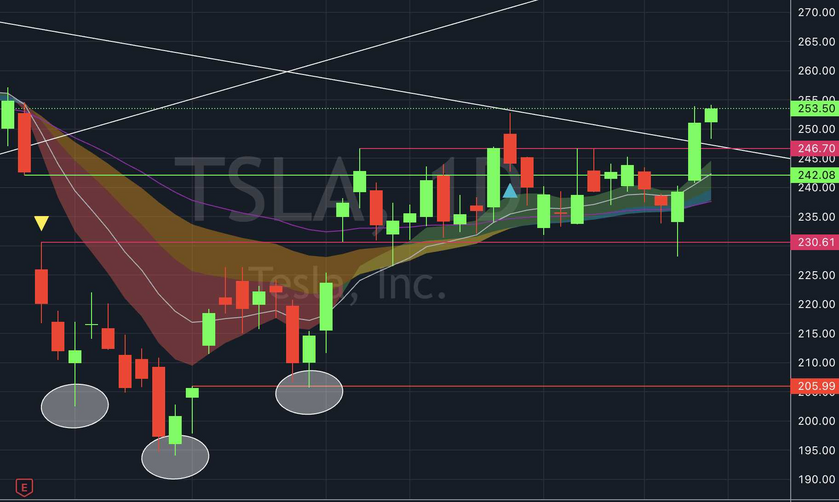

TSLA

Tesla is finally starting to breakout. This ticker was a top watch for me over the past few weeks because of its evident bullish setup. Patience has finally started to pay. My next upside targets are $260 followed by $270. The rally could be denied at any moment, so stay frosty (I like trailing stop losses). Congrats to all who hoped onto this train.

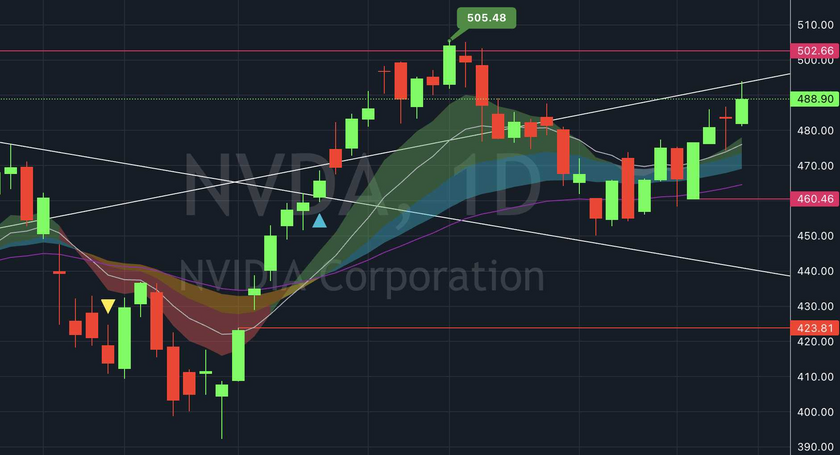

NVDA

Nvidia had a textbook breakout, consolidation & continuation. Things were a bit suspect when price was below $460, but the bull camp made the bears pay dearly for the fake out breakdown. This has now moved too far for me to chase, but if I had a position, I would be watching $495 followed by $505 (the current all-time high).

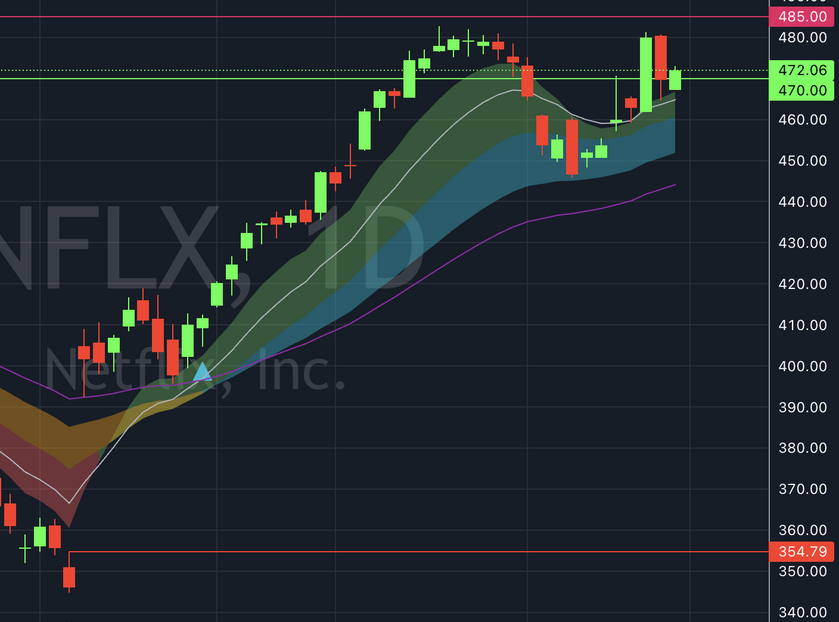

NFLX

Another textbook push, consolidation & continuation. If this structure holds, Netflix could easily have another strong bullish push upward.

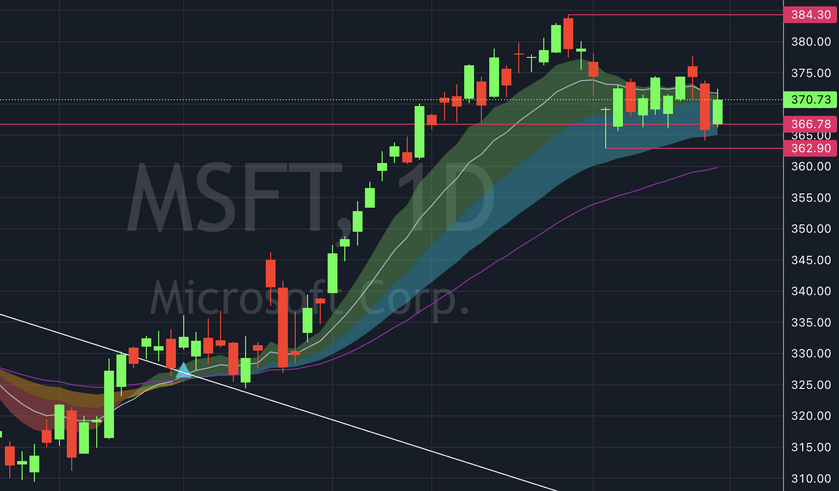

MSFT

Microsoft is setting up for a consolidation breakout. Watch for a close above $375 (bullish) or a close below $365 (bearish).

Number of Times Piper Suplexed Me While I Slept

14 *

* This data point is from readings over the past week. The reported information should not be taken as an aggregate or cumulative value for any period beyond the most recent week (Sunday through Saturday). Appropriate alterations were made to account for both travel and time zone shifts.

Notes

RISK WARNING: Trading involves HIGH RISK and YOU CAN LOSE a lot of money. Do not risk any money you cannot afford to lose. Trading is not suitable for all investors. We are not registered investment advisors. We do not provide trading or investment advice. We provide research and education through the issuance of statistical information containing no expression of opinion as to the investment merits of a particular security. Information contained herein should not be considered a solicitation to buy or sell any security or engage in a particular investment strategy. Past performance is not necessarily indicative of future results. Links above include affiliate commission or referrals. I'm part of an affiliate network and I receive compensation from partnering websites.

Both of these trades hit if held until close -- 6 total units!

Both of these trades hit if held until close -- 6 total units! These PCS's were sold at $1.05/ea and were bought back at $0.20/ea -- THIS MEANS MY REALIZED GAIN WAS $!

These PCS's were sold at $1.05/ea and were bought back at $0.20/ea -- THIS MEANS MY REALIZED GAIN WAS $!