Happy New Year, Brother!

Howdy,

That's a wrap on 2023! Here's to an even better time in 2024!!!

If you're like me, you may have hit some of your trading and investing goals in 2023, but there is always more you want to accomplish. I personally like to set the bar high because I want to see how far the competition can push me. This typically leaves me in a state of hunger at the end of the year. There is always room to "do better", which keeps me engaged. With that in mind, I'm sure many of you reading this would resonate with the sentiment. The next logical question is: How?

The truth is you already most likely possess the knowledge to not only be a profitable trader, but an extremely profitable trader. I don't know all your individual situations, but I wouldn't be surprised if it's similar to mine. My major Achilles heel when it comes to trading is a lack of discipline. I'm more of a gunslinging cowboy rather than a calm, cool & consistent trader. I’m not systematically exploiting an edge. I'm aware of multiple edges, but I don't have the psychology to consistently take advantage of my knowledge.

My 2024 goal is to be as robotic, systematic & unemotional as possible. I wholeheartedly believe this will make me more money than I know what to do with. The chances of success will greatly increase if we do this as a team -- I hope you join me on this journey!

Let's Get It,

Matt

P.S. The official Goonie Discord is live! (FREE Access w/ code GOONIE: https://bit.ly/GoonieGroup)

Market Events

Monday, Jan. 1st

ALL DAY MARKET CLOSED (Happy New Year!)

10:30 PM ET RBA Interest Rate Decision (Jan)

Tuesday, Jan. 2nd

09:45 AM ET S&P Global US Manufacturing PMI (Dec)

Wednesday, Jan. 3rd

10:00 AM ET ISM Manufacturing PMI (Dec)

10:00 AM ET ISM Manufacturing Prices (Dec)

10:00 AM ET JOLTs Job Openings (Nov)

02:00 PM ET FOMC Meeting Minutes

Thursday, Jan. 4th

08:15 AM ET ADP Nonfarm Employment Change (Dec)

08:30 AM ET Initial Jobless Claims

Friday, Jan. 5th

05:00 AM ET Eurozone CPI (YoY) (Dec)

08:30 AM ET Average Hourly Earnings (MoM) (Dec)

08:30 AM ET Nonfarm Payrolls (Dec)

08:30 AM ET Unemployment Report (Dec)

10:00 AM ET Initial Jobless Claims

10:00 AM ET Initial Jobless Claims

Upcoming Earnings

Monday

None

Tuesday

None

Wednesday

AM: Walgreens

Thursday

None

Friday

None

Seasonality Update

S&P 500 Seasonal Bias (Monday, Jan. 1st)

- MARKET CLOSED

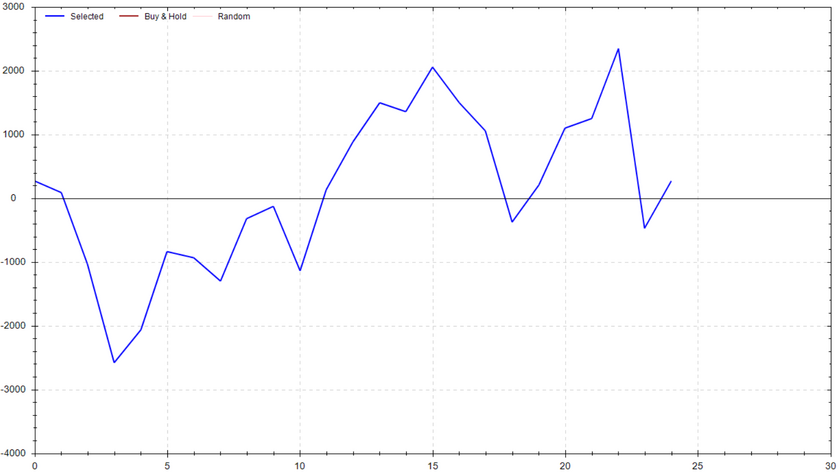

S&P 500 Seasonal Bias (Tuesday, Jan. 2nd)

- Bull Win Percentage: 56%

- Profit Factor: 1.03

- Bias: Neutral

Equity Curve -->

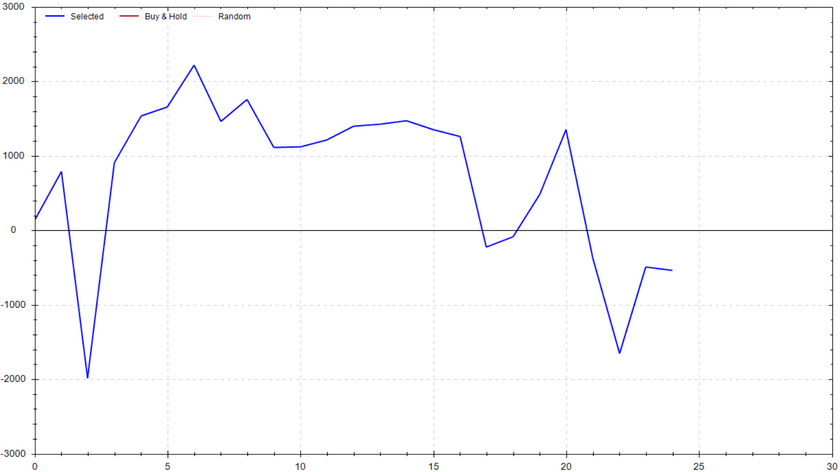

S&P 500 Seasonal Bias (Wednesday, Jan. 3rd)

- Bull Win Percentage: 64%

- Profit Factor: 0.94

- Bias: Neutral

Equity Curve -->

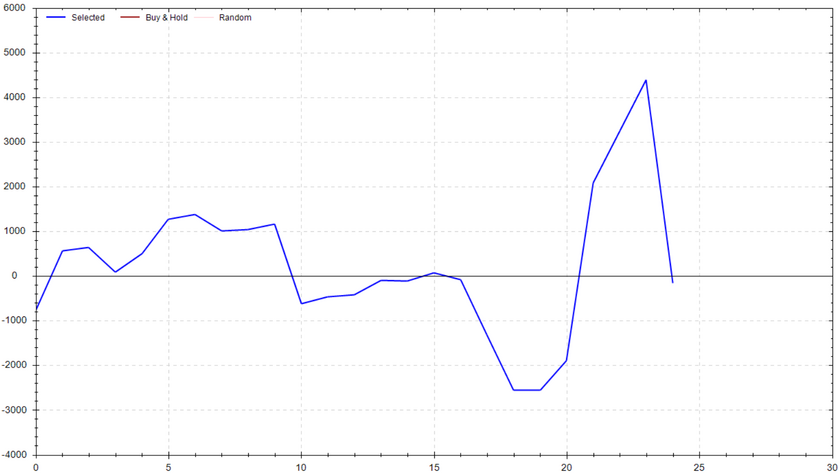

S&P 500 Seasonal Bias (Thursday, Jan. 4th)

- Bull Win Percentage: 60%

- Profit Factor: 0.99

- Bias: Neutral

Equity Curve -->

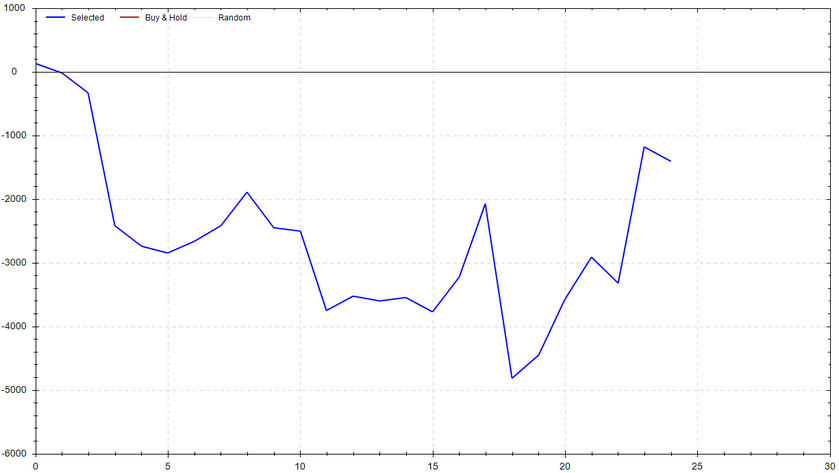

S&P 500 Seasonal Bias (Friday, Jan. 5th)

- Bull Win Percentage: 48%

- Profit Factor: 0.84

- Bias: Neutral

Equity Curve -->

Options Strategy Update

The 0 DTE signal hit 4 for 4 times (6 total unites) this past week (Signal Accuracy: ~100%).

A solid way to close out the year! The degen strategy continues to make new PnL highs. I'm excited to see how it performs in 2024. I'm also very interested in rolling out some new strategies I have been working on in the background. The upcoming year will certainly bring some exciting times -- Stay tuned!

Current Streak: 8

December Record: 34/37

Monday Dec. 25th

None

Tuesday Dec. 26th

SPY PUT Credit Spread (2 units @ $473 / $472) 🟢

QQQ PUT Credit Spread (2 unit @ $409 / $408) 🟢

Wednesday Dec. 27th

None

Thursday Dec. 28th

SPY PUT Credit Spread (1 unit @ $476 / $475) 🟢

QQQ PUT Credit Spread (1 unit @ $411 / $410) 🟢

Friday Dec. 29th

None

Charts of Interest

SPY

The overall market came extremely close to hitting a new all-time high ($477.50 vs $480). Unfortunately, the bull camp didn't have enough in the tank to push us to a record level before the year was out. This pullback in healthy in my book. Honestly, I would argue the bulls are in control unless $455 is given up. Until then, I'll be looking for the classic pattern of expansion, contraction, followed by expansion.

QQQ

Unlike the S&P 500, the NASDAQ hit a new all-time high this past week. Similar to the S&P 500, the week concluded with a bit of weakness. In the larger picture, this is still a healthy, reasonable pullback. Based on the posted chart, the tech sector is still very bullish as long as $403 holds and doesn't really turn bearish until $390ish.

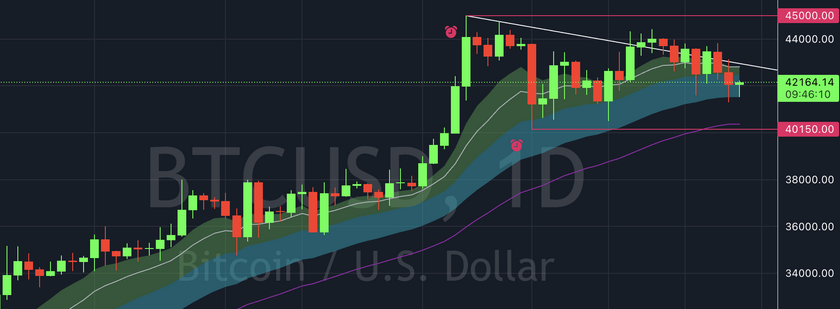

BTC

In the short term, Bitcoin's breakout attempt appears to have failed. The support of $40k-ish is still intact, so it's now a patience game. Will we see $45k or $40k first?

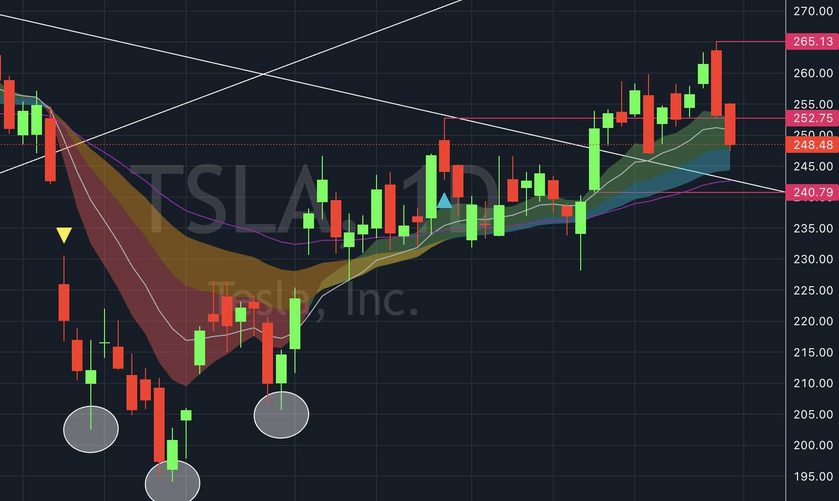

TSLA

The ole Teslerrr breakout appears to be taking a breather. It's up to you and your personal risk tolerance if you lock in the gains since it fell back into the EMA cloud. On a positive note, this could be start of a new bullish consolidation, which could lead to something even better. TSLA is definitely "on watch" to see how this recovery plays out.

MSFT

Microsoft still remains my top breakout watch. The consolidation has not lasted an uncharacteristically long amount of time. Alas, the major trigger I'm personally looking for is a close about $376-$377. The bullish thesis will remain as long as $364 holds. My target is currently a test/break of $384.

COIN

Coinbase is showing a clear toping sign on the daily chart. I'll be looking for more of a breather before a continuation.

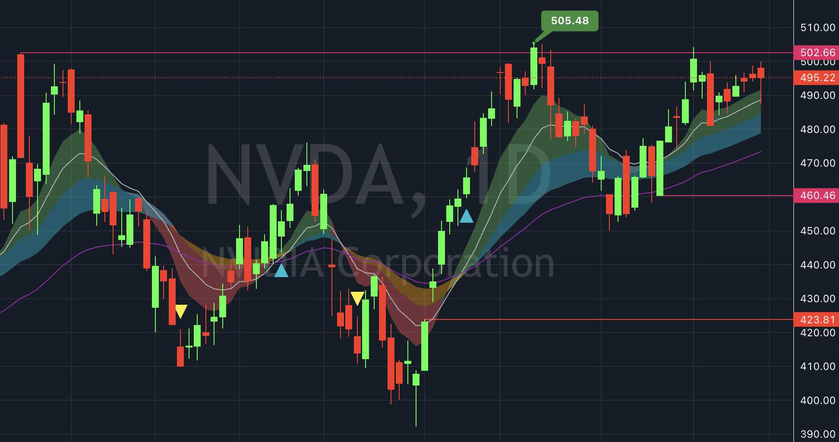

NVDA

Potential triple top, but all the lows are higher. It will be very interesting to see which way this ticker breaks. I'm not leaning bullish or bearish, but I'm expecting a large move.

Total Times Piper And/Or I Vomited In The Car

1.2 *

* This data point is from readings over the past week. The reported information should not be taken as an aggregate or cumulative value for any period beyond the most recent week (Sunday through Saturday). Appropriate alterations were made to account for both travel and time zone shifts.

Notes

RISK WARNING: Trading involves HIGH RISK and YOU CAN LOSE a lot of money. Do not risk any money you cannot afford to lose. Trading is not suitable for all investors. We are not registered investment advisors. We do not provide trading or investment advice. We provide research and education through the issuance of statistical information containing no expression of opinion as to the investment merits of a particular security. Information contained herein should not be considered a solicitation to buy or sell any security or engage in a particular investment strategy. Past performance is not necessarily indicative of future results. Links above include affiliate commission or referrals. I'm part of an affiliate network and I receive compensation from partnering websites.

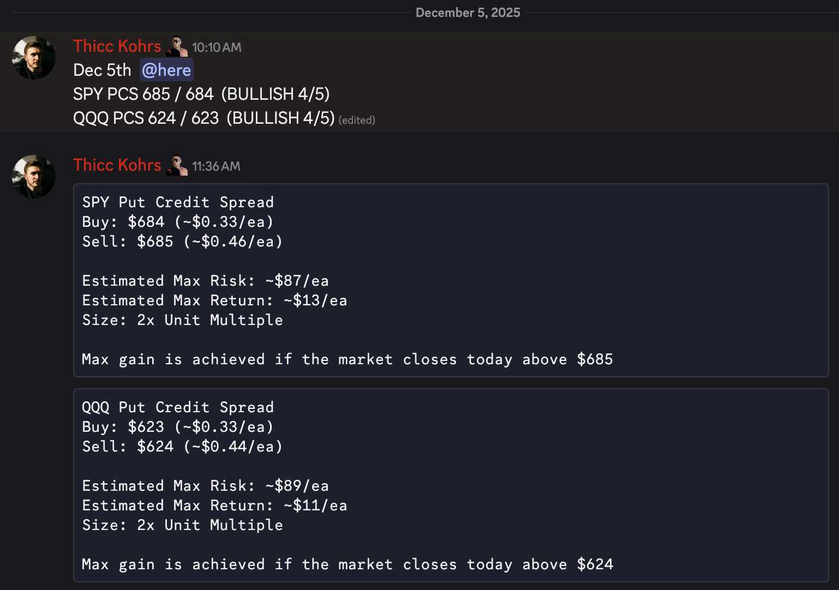

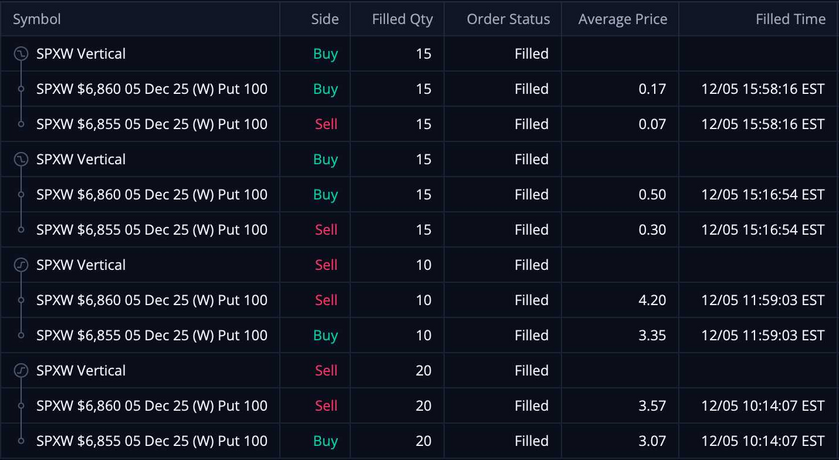

Both of these trades hit if held until close -- 4 total units!

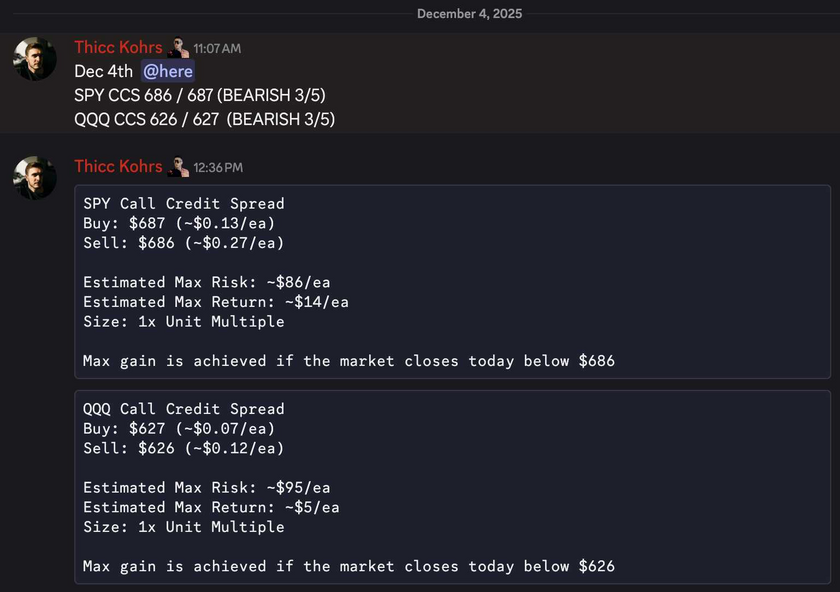

Both of these trades hit if held until close -- 4 total units! These CCS's were sold at an average of $0.62/ea and were bought back at an average $0.15/ea -- THIS MEANS MY REALIZED GAIN WAS $1,400!

These CCS's were sold at an average of $0.62/ea and were bought back at an average $0.15/ea -- THIS MEANS MY REALIZED GAIN WAS $1,400!

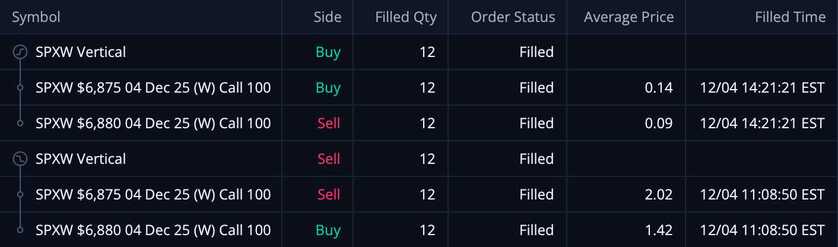

Both of these trades hit if held until close -- 2 total units!

Both of these trades hit if held until close -- 2 total units! These CCS's were sold at $0.60/ea and were bought back at $0.05/ea -- THIS MEANS MY REALIZED GAIN WAS $660!

These CCS's were sold at $0.60/ea and were bought back at $0.05/ea -- THIS MEANS MY REALIZED GAIN WAS $660!

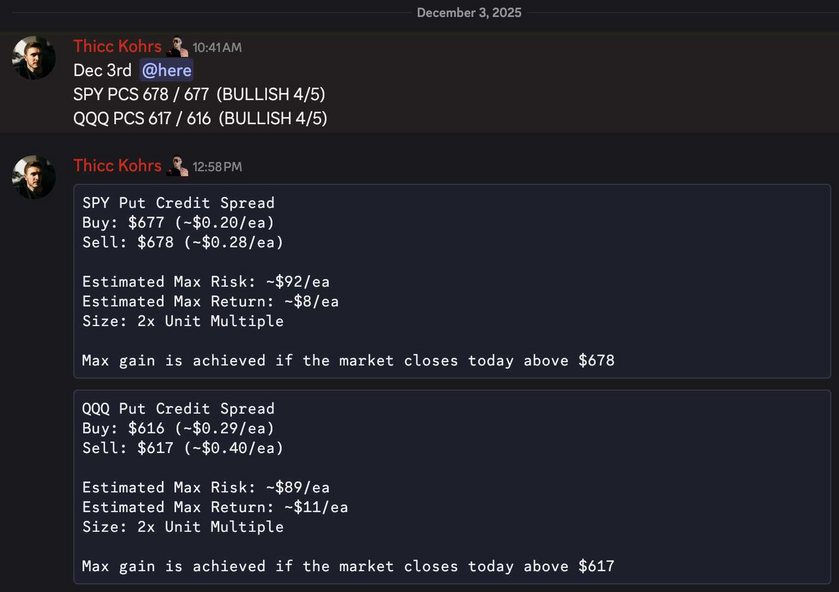

Both of these trades hit if held until close -- 4 total units!

Both of these trades hit if held until close -- 4 total units! These PCS's were sold at $0.65/ea and were bought back at $0.05/ea -- THIS MEANS MY REALIZED GAIN WAS $600!

These PCS's were sold at $0.65/ea and were bought back at $0.05/ea -- THIS MEANS MY REALIZED GAIN WAS $600!