NEW HIGHS!!!

Hey Hey Hey,

It pays to be a bull! Both the SPY and the QQQ’s hit a new all-time high to conclude the trading week. If you’ve been in the bull camp, you’ve been printing! Congrats!

You might be wondering what in the world is going on? That’s a fair question. Unfortunately, there isn’t a quality answer. Throughout the week, there was no bombshell bullish report. There were some data points that suggested inflation is continuing to slow down. However, some Fed members sounded a bit more hawkish than expected in their public speeches. My main point is there was no salient announcement that pushed prices to new heights.

I know the lack of clear cause and effect can be frustrating, but I do have good news. I strongly believe this upcoming week will be even more exciting. As detailed below, we have some major macroeconomic reports, and earnings season is really heating up with some major tech companies being on deck.

I highly recommend paying attention to the news flow. It’s never a bad idea to have your finger on the pulse of major, ongoing developments. With that in mind, it doesn’t change my personal gameplan. I always (attempt) to go with the flow. It’s a bonus if the price action “makes sense” to me, but my trading methodology remains consistent. I will remain bullish until there is a clear reason not to be -- It does not matter to me how much Fintwit says everything is overvalued.

Later,

Matt

P.S. The official Goonie Discord is live! (FREE Access w/ code GOONIE: https://bit.ly/GoonieGroup)

Market Events

Monday, Jan. 22nd

None

Tuesday, Jan. 23rd

None

Wednesday, Jan. 24th

09:45 AM ET S&P Global Services PMI (Jan)

09:45 AM ET S&P Global Manufacturing PMI (Jan)

10:00 AM ET BoC Interest Rate Decision

10:30 AM ET Crude Oil Inventories

Thursday, Jan. 25th

08:15 AM ET ECB Interest Rate Decision (Jan)

08:30 AM ET Durable Goods Orders (MoM) (Dec)

08:30 AM ET GDP (QoQ) (Q4)

08:30 AM ET Initial Jobless Claims

08:45 AM ET ECB Press Conference

10:00 AM ET New Home Sales

Friday, Jan. 26th

08:30 AM ET PCE Price Index (MoM)

08:30 AM ET PCE Price Index (YoY)

Upcoming Earnings

Monday

PM: Logitech & United

Tuesday

AM: GE, Halliburton, J&J, Lockheed Martin, P&G & Verizon

PM: Netflix

Wednesday

AM: ASML & AT&T

PM: IBM & Tesla

Thursday

AM: Alaska Airlines, American Airlines & Southwest

PM: Capital One, Intel & Visa

Friday

AM: American Express

Seasonality Update

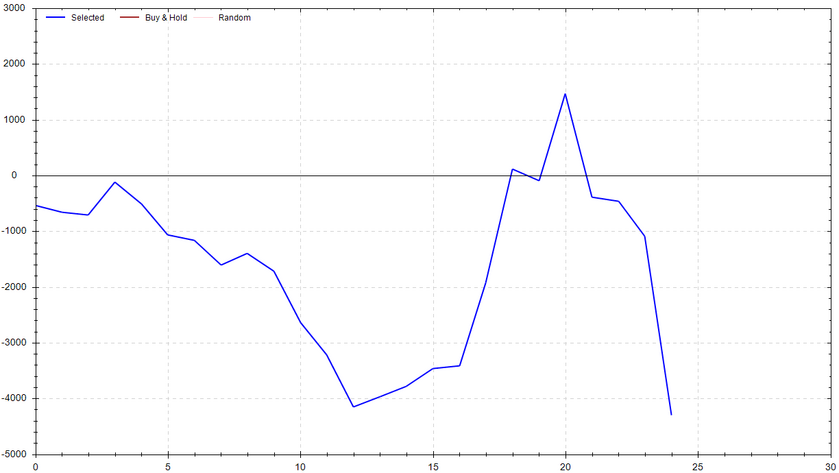

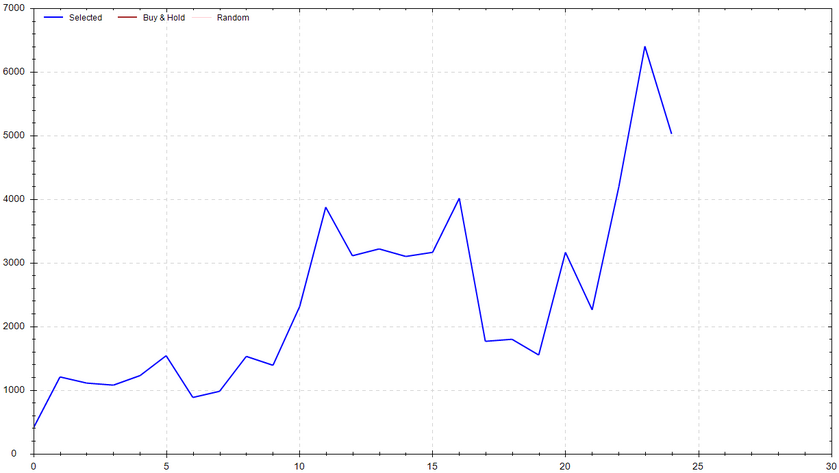

S&P 500 Seasonal Bias (Monday, Jan. 22nd)

- Bull Win Percentage: 36%

- Profit Factor: 0.61

- Bias: Leaning Bearish

Equity Curve -->

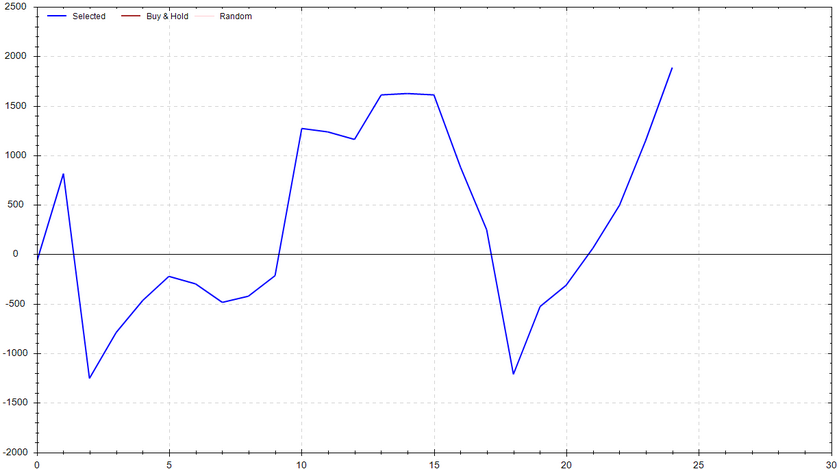

S&P 500 Seasonal Bias (Tuesday, Jan. 23rd)

- Bull Win Percentage: 60%

- Profit Factor: 1.35

- Bias: Leaning Bullish

Equity Curve -->

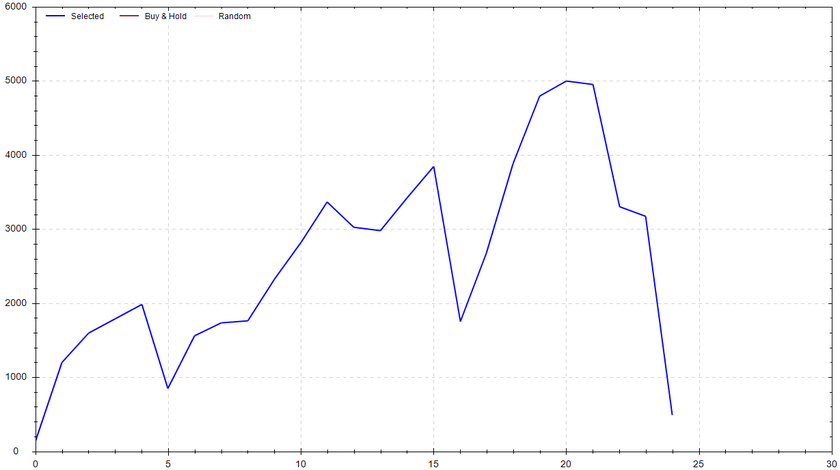

S&P 500 Seasonal Bias (Wednesday, Jan. 24th)

- Bull Win Percentage: 68%

- Profit Factor: 1.06

- Bias: Neutral

Equity Curve -->

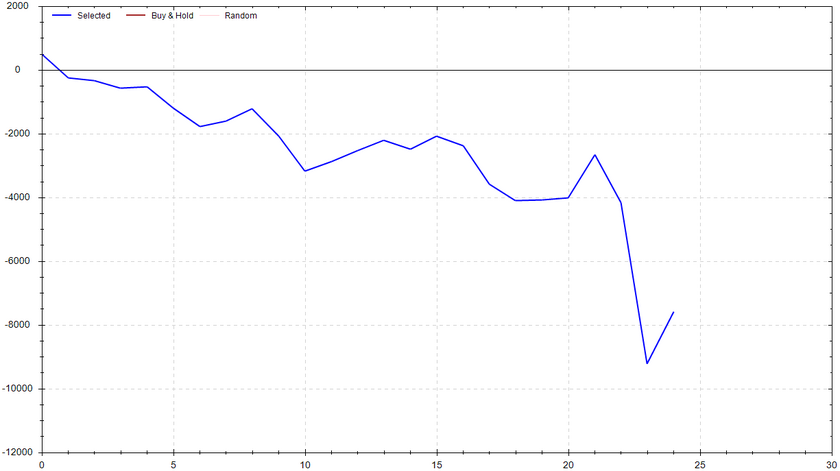

S&P 500 Seasonal Bias (Thursday, Jan. 25th)

- Bull Win Percentage: 48%

- Profit Factor: 0.42

- Bias: Bearish

Equity Curve -->

S&P 500 Seasonal Bias (Friday, Jan. 26th)

- Bull Win Percentage: 60%

- Profit Factor: 1.77

- Bias: Bullish

Equity Curve -->

Options Strategy Update

The 0 DTE signal hit 3 for 3 times (14 for 14 total units) this past week.

Signal Accuracy: ~100%

The good times keep rolling! The Piper System has now been perfect for two weeks in a row. I hope Piper and the strength signals have helped you better navigate the markets on a daily basis. Personally, I very happy with the recent performance, and I'm even more excited about the soon-to-come Roo System (another 0 DTE strategy).

Current Streak: 18

January Record: 44/46

Monday Jan. 15th

Market Closed

Tuesday Jan. 16th

No Signal Produced

Wednesday Jan. 17th

SPY CALL Credit Spread (2x Multiple @ $474 / $475) 🟢

QQQ CALL Credit Spread (2x Multiple @ $408 / $409) 🟢

Thursday Jan. 18th

SPY PUT Credit Spread (2x Multiple @ $473 / $472) 🟢

QQQ PUT Credit Spread (2x Multiple @ $410 / $409) 🟢

Friday Jan. 19th

SPY PUT Credit Spread (3x Multiple @ $476 / $475) 🟢

QQQ PUT Credit Spread (3x Multiple @ $414 / $413) 🟢

Top 5 Charts of Interest

AAPL

Apple was having a rough run the past two weeks, but it looks as if its luck is finally changing. The price action is starting to represent an obvious double bottom. The stock price has now recaptured its EMA cloud. Looking for $185 to hold and for a retest of $195.

NFLX

Netflix has been consolidating in bullish (slightly) higher high and (slightly) higher low pattern. If the earnings report this upcoming week are well received by the market, I'll be looking for a recapture and push about $500.

GC

We've been here before! Gold is seemingly playing out the same pattern it's been in for months. Support appears to have been found at the EMA cloud once again. I remain bullish on the follow through unless 2,000 is broken.

BTC

After a failed breakout attempt, Bitcoin is now in danger of breaking down. Multiple closes below the EMA cloud & 48 EMA tells me the bears are gaining some strength. Looking for the trendline to hold. If it doesn't, the next support it at $38k. If the bulls step in, I'd be looking for a retest of $44k.

COIN

As alerted last week, Coinbase is showing some serious weakness. I mentioned COIN's potential reversion at $175 -- It's now down more than $50/share. The reversion has turned into a full-fledged selloff. Personally, I wouldn't be doing anything at this stage. It's chasing to short & it's catching a knife to go long. Patience would be my play.

Times Piper Attacked Me During Business Calls

1* (Low count, but it really hurt)

* This data point is from readings over the past week. The reported information should not be taken as an aggregate or cumulative value for any period beyond the most recent week (Sunday through Saturday). Appropriate alterations were made to account for both travel and time zone shifts.

Notes

RISK WARNING: Trading involves HIGH RISK and YOU CAN LOSE a lot of money. Do not risk any money you cannot afford to lose. Trading is not suitable for all investors. We are not registered investment advisors. We do not provide trading or investment advice. We provide research and education through the issuance of statistical information containing no expression of opinion as to the investment merits of a particular security. Information contained herein should not be considered a solicitation to buy or sell any security or engage in a particular investment strategy. Past performance is not necessarily indicative of future results. Links above include affiliate commission or referrals. I'm part of an affiliate network and I receive compensation from partnering websites.

Both of these trades hit if held until close -- 6 total units!

Both of these trades hit if held until close -- 6 total units! These PCS's were sold at $1.05/ea and were bought back at $0.20/ea -- THIS MEANS MY REALIZED GAIN WAS $!

These PCS's were sold at $1.05/ea and were bought back at $0.20/ea -- THIS MEANS MY REALIZED GAIN WAS $!