Higher, Higher & More Higher

Hey Y'all,

Another week, another all-time high in the market. I hope the same thing happened in your trading account!

For those of you who missed it, a few key things went down recently. The US's GDP was announced to be better than expected. We also found out inflation was lower than anticipated. This bullish combo undoubtably helped push both the S&P and Nasdaq to new heights.

With respect to earnings, it was a mixed bag. Netflix crushed all metrics -- Tesla & Intel got crushed by all metrics. The upcoming week will have more impactful earnings. Make sure you stay on your toes. Personally, I'll be paying close attention to Apple, Amazon, Meta & Microsoft. Together, these four represent a considerable portion of the entire market.

I know you might be thinking that's a lot of excitement, but the fun doesn't stop there?! This upcoming week we will be receiving impactful updates related to monetary policy. The results of the FOMC meeting will be announced Wednesday afternoon. There is a very low chance of any change to the Fed Fund Rate. However, there is a high chance we will be getting more of an idea about when rate cuts will start. This will have considerable implications on bonds, their yields, gold, and the dollar. Buckle up!

Later,

Matt

P.S. The official Goonie Discord is live! (FREE Access w/ code GOONIE: https://bit.ly/GoonieGroup)

Market Events

Monday, Jan. 29th

None

Tuesday, Jan. 30th

10:00 AM ET JOLTs Job Openings (Dec)

10:00 AM ET CB Consumer Confidence (Jan)

Wednesday, Jan. 31st

08:15 AM ET ADP Nonfarm Employment Change (Jan)

09:45 AM ET Chicago PMI (Jan)

10:30 AM ET Crude Oil Inventories

02:00 PM ET Fed Interest Decision -- I'll Be Streaming This!!!

02:30 PM ET FOMC Press Conference -- I'll Be Streaming This!!!

Thursday, Feb. 1st

05:00 AM ET Eurozone CPI (YoY) (Jan)

08:30 AM ET Initial Jobless Claims

09:45 AM ET S&P Global Us Manufacturing PMI (Jan)

10:00 AM ET ISM Manufacturing PMI (Jan)

10:00 AM ET ISM Manufacturing Prices (Jan)

Friday, Feb. 2nd

08:30 AM ET Unemployment Report (Jan)

08:30 AM ET Average Hourly Earnings (MoM) (Jan)

Upcoming Earnings

Monday

AM: Philips & SoFi

Tuesday

AM: GM, JetBlue, Marathon, Pfizer & UPS

PM: Alphabet (Google), AMD, Microsoft & Starbucks

Wednesday

AM: Boeing & Mastercard

PM: Qualcomm

Thursday

AM: Peloton

PM: Apple, Amazon & Meta

Friday

AM: Abbvie, Chevron & ExxonMobil

Seasonality Update

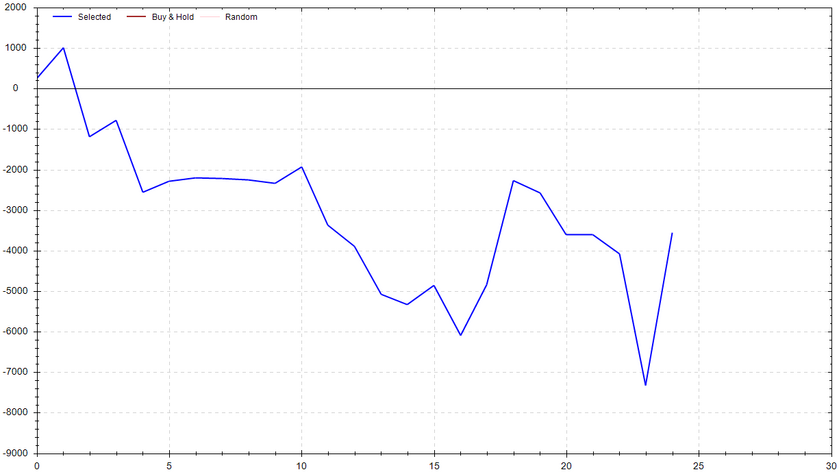

S&P 500 Seasonal Bias (Monday, Jan. 29th)

- Bull Win Percentage: 40%

- Profit Factor: 0.74

- Bias: Bearish

Equity Curve -->

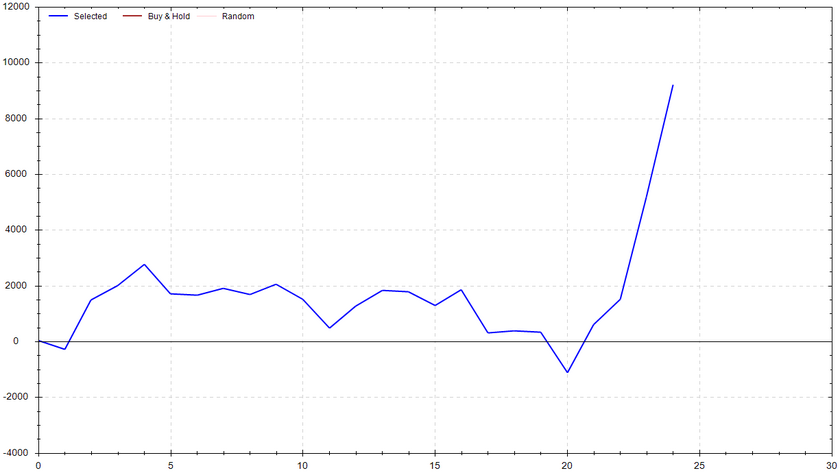

S&P 500 Seasonal Bias (Tuesday, Jan. 30th)

- Bull Win Percentage: 56%

- Profit Factor: 2.35

- Bias: Leaning Bullish

Equity Curve -->

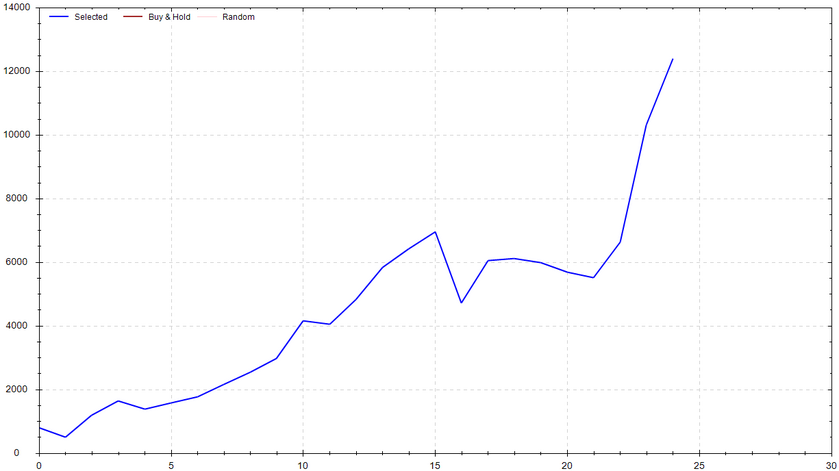

S&P 500 Seasonal Bias (Wednesday, Jan. 31st)

- Bull Win Percentage: 76%

- Profit Factor: 2.99

- Bias: Bullish

Equity Curve -->

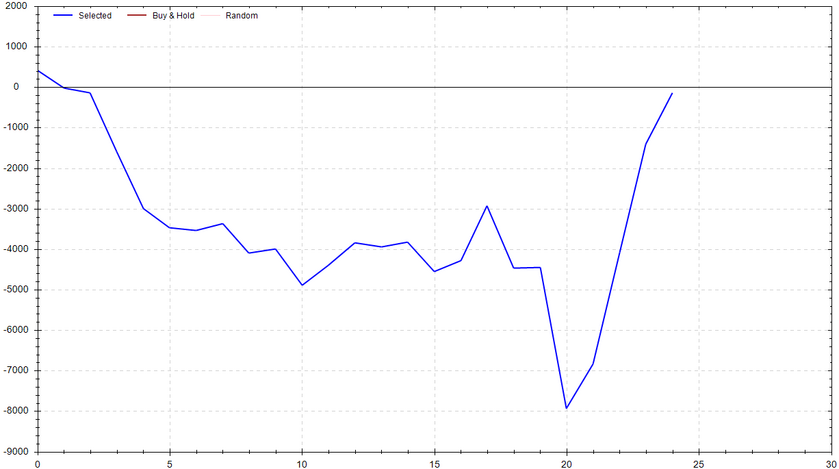

S&P 500 Seasonal Bias (Thursday, Feb. 1st)

- Bull Win Percentage: 72%

- Profit Factor: 4.49

- Bias: Bullish

Equity Curve -->

S&P 500 Seasonal Bias (Friday, Feb. 2nd)

- Bull Win Percentage: 52%

- Profit Factor: 0.99

- Bias: Neutral

Equity Curve -->

Options Strategy Update

The 0 DTE signal hit 5 for 5 times (20 for 20 total units) this past week.

Signal Accuracy: ~100%

I don't have much to say. Piper is legit af. Roo is becoming legit af. More testing is needed to perfect things, but the posted theoretical results speak for themself. I hope you got a piece.

Current Streak: 28

January Record: 64/66

Monday Jan. 22nd

SPY PUT Credit Spread (2x Multiple @ $482 / $481) 🟢

QQQ PUT Credit Spread (2x Multiple @ $420 / $419) 🟢

Tuesday Jan. 23rd

SPY PUT Credit Spread (2x Multiple @ $482 / $481) 🟢

QQQ PUT Credit Spread (2x Multiple @ $420 / $419) 🟢

Wednesday Jan. 24th

SPY PUT Credit Spread (2x Multiple @ $485 / $484) 🟢

QQQ PUT Credit Spread (2x Multiple @ $425 / $424) 🟢

Thursday Jan. 25th

SPY PUT Credit Spread (2x Multiple @ $486 / $488) 🟢

QQQ PUT Credit Spread (2x Multiple @ $426 / $425) 🟢

Friday Jan. 26th

SPY PUT Credit Spread (2x Multiple @ $487 / $486) 🟢

QQQ PUT Credit Spread (2x Multiple @ $423 / $422) 🟢

Top 3 Charts of Interest

BTC

Bitcoin is showing the classic signs of a fake out breakdown. After the craziness of the Spot BTC ETF approval, we experienced a "sell the news" event. Price momentum has not been bullish since then. Fortunately, the bull camp recently recaptured the price trendline and is pushing the upper side of the EMA cloud. Looking for a solid continuation from here.

TSLA

After a clearly disastrous earnings report and call, Tesla's stock got kicked in the balls. I'm looking for "earnings drift" to playout from here. I'm looking for the bearish trend to continue to $178 and then potentially $164. From there, I would be highly interested in a reversionary bounce.

RUM

Potential squeeze alert. There is obviously no such thing as a guarantee, but I wanted to throw this ticker on the watchlist. Rumble's stock has a high SI, medium size free float & is starting to get more discussion on social media. A break and close above $7 could get very exciting imo.

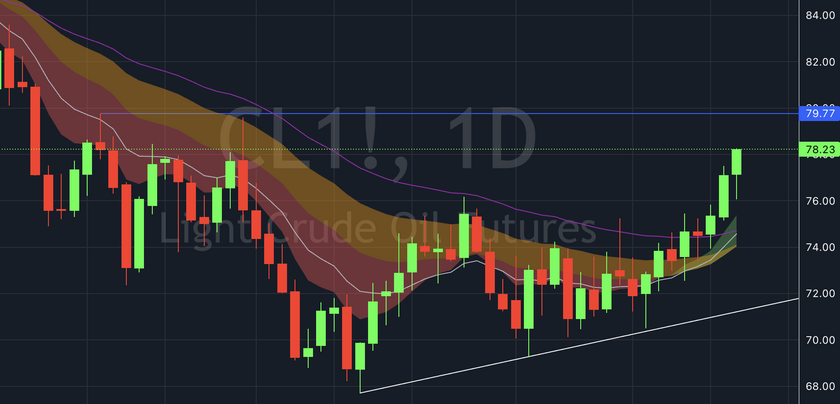

Bonus Chart: CL

Due to various global political issues, the supply of oil is coming into question. If supply drops and demand stays constant, price must increase. As show in the chart above, oil is clearly breaking out to the upside. I'll be looking for the retest of the EMA cloud followed by a bounce continuation.

Total Count of Claws Marks on Forearm

84 *

* This data point is from readings over the past week. The reported information should not be taken as an aggregate or cumulative value for any period beyond the most recent week (Sunday through Saturday). Appropriate alterations were made to account for both travel and time zone shifts.

Notes

RISK WARNING: Trading involves HIGH RISK and YOU CAN LOSE a lot of money. Do not risk any money you cannot afford to lose. Trading is not suitable for all investors. We are not registered investment advisors. We do not provide trading or investment advice. We provide research and education through the issuance of statistical information containing no expression of opinion as to the investment merits of a particular security. Information contained herein should not be considered a solicitation to buy or sell any security or engage in a particular investment strategy. Past performance is not necessarily indicative of future results. Links above include affiliate commission or referrals. I'm part of an affiliate network and I receive compensation from partnering websites.

Both of these trades hit if held until close -- 6 total units!

Both of these trades hit if held until close -- 6 total units! These PCS's were sold at $1.05/ea and were bought back at $0.20/ea -- THIS MEANS MY REALIZED GAIN WAS $!

These PCS's were sold at $1.05/ea and were bought back at $0.20/ea -- THIS MEANS MY REALIZED GAIN WAS $!