TOUCHDOWN!!!

Team Team Team,

What a week it has been! I know I'm starting to sound like a broken record, but the market hit a new high again. Both the S&P 500 and Nasdaq 100 notched a new record to conclude the week leading us into the Super Bowl. I hope you got yours because the bull camp has been printing tendies like they got the password to Powell's login.

The party has been raging on into the night for a few reasons. The AI/semiconductor sector continues to be a hot tamale. The fervor is helping push the entire tech sector higher and higher. To less of a degree, but still definitely bullish, both the energy and financial sector are posting some decent gains. When you have three of the most dominant sectors continually posting gains, it's no surprise the overall market is crushing the bears.

I should also note that most macroeconomic reports are trending in a favorable direction. Inflation is still bad, but its velocity is continually slowing down. All the major treasury bond auctions went well this past week, which was a huge sigh of relief.

Overall, the stonk market is clearly bullish. I know everyone and their grandma is shouting about overvaluation, but where has it gotten them. Personally, I make the most money when I tune all the noise and out and simply trade with the trend. I see no valid reason to fight the trend. Why would I want to fight my friend.

Below you’ll find the upcoming macroeconomic reports and earning announcements. As always, I also included Piper's recent performance. Enjoy!

Fortune Favors The Bold,

Coach Kohrs

P.S. The official Goonie Discord is live! (FREE Access w/ code GOONIE: https://bit.ly/GoonieGroup)

Market Events

Monday, Feb. 12th

None

Tuesday, Feb. 13th

08:30 AM ET CPI (YoY) (Jan)

08:30 AM ET CPI (MoM) (Jan)

Wednesday, Feb. 14th

None

Thursday, Feb. 15th

08:30 AM ET Retail Sales (MoM) (Jan)

08:30 AM ET Initial Jobless Claims

08:30 AM ET Philadelphia Fed Manufacturing Index

Friday, Feb. 16th

08:30 AM ET PPI (MoM) (Jan)

Upcoming Earnings

Monday

PM: Waste Management

Tuesday

AM: Coca Cola, Hasbro, Marriott & Shopify

PM: Airbnb, Lyft, MGM, Robinhood & Upstart

Wednesday

AM: Sony

PM: Cisco, Occidental Petroleum & Twilio

Thursday

AM: Crocs, John Deere, Wendy's & Yeti

PM: Coinbase, Door Dash, Draft Kings & Roku

Friday

None

Seasonality Update

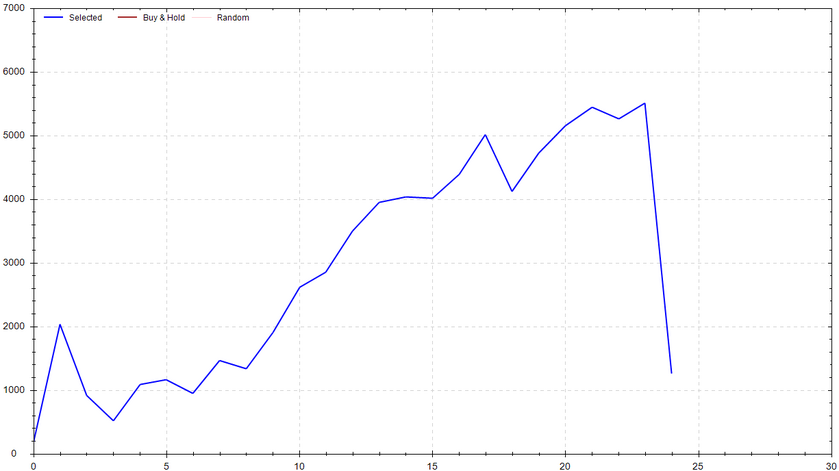

S&P 500 Seasonal Bias (Monday, Feb. 12th)

- Bull Win Percentage: 60%

- Profit Factor: 1.23

- Bias: Leaning Bullish

Equity Curve -->

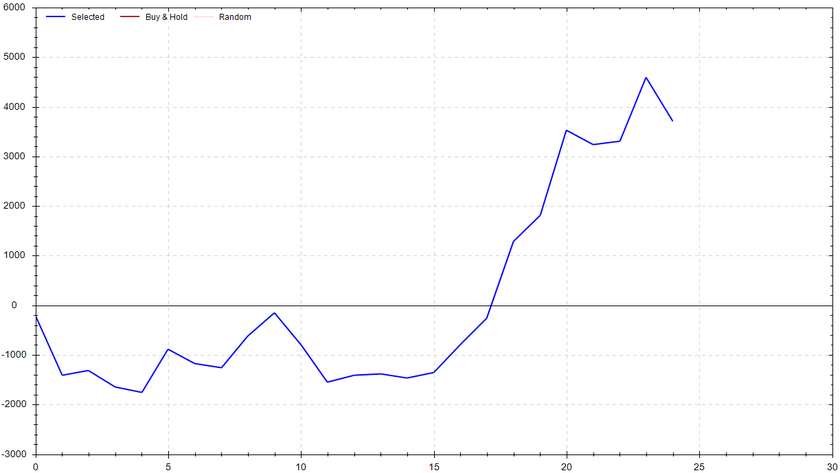

S&P 500 Seasonal Bias (Tuesday, Feb. 13th)

- Bull Win Percentage: 68%

- Profit Factor: 1.18

- Bias: Leaning Bullish

Equity Curve -->

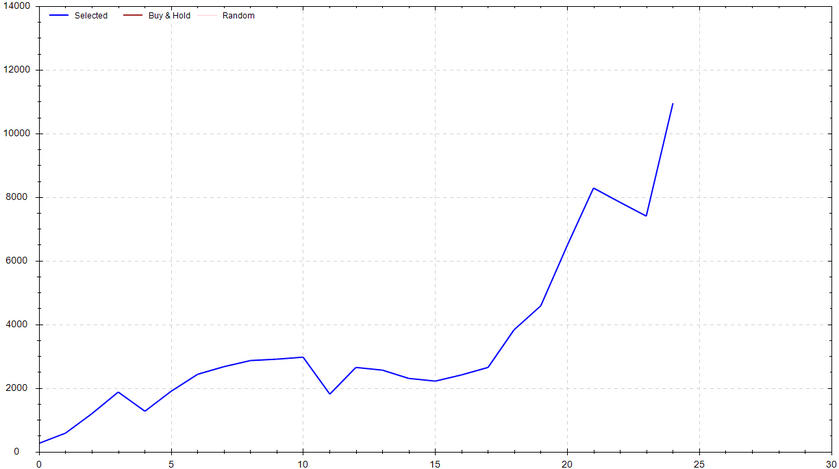

S&P 500 Seasonal Bias (Wednesday, Feb. 14th)

- Bull Win Percentage: 56%

- Profit Factor: 1.76

- Bias: Leaning Bearish

Equity Curve -->

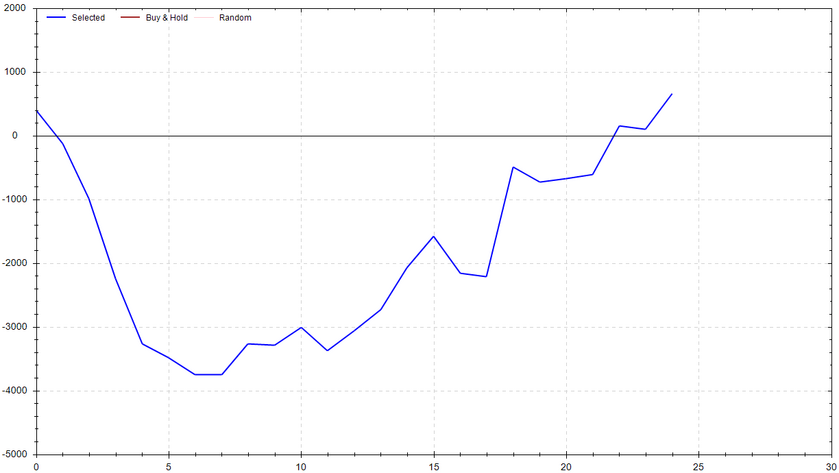

S&P 500 Seasonal Bias (Thursday, Feb. 15th)

- Bull Win Percentage: 72%

- Profit Factor: 4.58

- Bias: Bullish

Equity Curve -->

S&P 500 Seasonal Bias (Friday, Feb. 16th)

- Bull Win Percentage: 48%

- Profit Factor: 1.12

- Bias: Leaning Bullish

Equity Curve -->

Notes: These analytics are derived from the performance of the S&P 500 futures contract over the past 25 years. Additionally, results are computed from the futures market open and close.

Options Strategy Update

The 0 DTE signal hit 10 for 10 times (18 for 18 total units) this past week.

Signal Accuracy: ~100%

Piper continues to snap necks and cash checks. I don't have anything special to say because nothing has changed -- Piper in dominating. With a bit of luck, the second 0 DTE strategy will also a money printing machine. Roo is still under construction but is progressing daily.

Piper's Current Signal Streak: 48

February Unit Record: 26/26

Monday Feb. 5th

SPY CALL Credit Spread (1x Multiple @ $494 / $495) 🟢

QQQ CALL Credit Spread (1x Multiple @ $430 / $431) 🟢

Tuesday Feb. 6th

SPY CALL Credit Spread (1x Multiple @ $495 / $496) 🟢

QQQ CALL Credit Spread (1x Multiple @ $431 / $432) 🟢

Wednesday Feb. 7st

SPY PUT Credit Spread (3x Multiple @ $495 / $494) 🟢

QQQ PUT Credit Spread (3x Multiple @ $428 / $427) 🟢

Thursday Feb. 8th

SPY PUT Credit Spread (2x Multiple @ $497 / $496) 🟢

QQQ PUT Credit Spread (2x Multiple @ $431 / $430) 🟢

Friday Feb. 9th

SPY PUT Credit Spread (2x Multiple @ $498 / $497) 🟢

QQQ PUT Credit Spread (2x Multiple @ $432 / $431) 🟢

Total Margaritas Consumed

83.7 *

* This data point is from readings over the past week. The reported information should not be taken as an aggregate or cumulative value for any period beyond the most recent week (Sunday through Saturday). Appropriate alterations were made to account for both travel and time zone shifts.

Notes

RISK WARNING: Trading involves HIGH RISK and YOU CAN LOSE a lot of money. Do not risk any money you cannot afford to lose. Trading is not suitable for all investors. We are not registered investment advisors. We do not provide trading or investment advice. We provide research and education through the issuance of statistical information containing no expression of opinion as to the investment merits of a particular security. Information contained herein should not be considered a solicitation to buy or sell any security or engage in a particular investment strategy. Past performance is not necessarily indicative of future results. Links above include affiliate commission or referrals. I'm part of an affiliate network and I receive compensation from partnering websites.

Both of these trades hit if held until close -- 6 total units!

Both of these trades hit if held until close -- 6 total units! These PCS's were sold at $1.05/ea and were bought back at $0.20/ea -- THIS MEANS MY REALIZED GAIN WAS $!

These PCS's were sold at $1.05/ea and were bought back at $0.20/ea -- THIS MEANS MY REALIZED GAIN WAS $!