Welcome To The Stratosphere

Howdy Space Traveler,

Another trading week, another new all-time high in the stock market. The good times are rolling -- I hope you’re crushing it!

Why? Why? Why? That's the golden question. With respect to macroeconomic developments, this past week was a bit more calm than normal. There were only two things of noteworthy value in my opinion, and both relate to monetary policy. The first was a bond auction (the 20-year) the performed below expectations. Second, various Fed members made their willingness to remain hawkish very apparent. These two developments are arguably bearish, so why did the S&P 500 and the Nasdaq 100 pump to new highs? The shorts answer is Nvidia.

All eyes were on Nvidia. Anyone who has a brokerage account and a pulse was watching the world's leading semiconductor play. There was an immense amount of pressure on the company, and they more than delivered. Nvidia reported its earnings and functionally stabbed the bears in the heart. I implore you to review the details of NVDA's earnings announcement for yourself, but they were impressive. Once the numbers went public, there was an audible sigh of relief from the tech bulls. The AI bubble is still growing, so the market is continuing to rip for now.

Looking ahead to the final trading week of February, I think things will get even more spicy. Even though there aren't any mega earnings reports, there is still a handful of companies in which I think you'll be interested. There are also various inflation reports and a GDP update. All the details are posted below!

Live Long & Prosper,

Thiccness

P.S. The official Goonie Discord is live! (FREE Access w/ code GOONIE: https://bit.ly/GoonieGroup)

Market Events

Monday, Feb. 26th

10:00 AM ET New Home Sales (Jan)

Tuesday, Feb. 27th

08:30 AM ET Core Durable Goods Orders (MoM) (Jan)

10:00 AM ET CB Consumer Confidence (Feb)

Wednesday, Feb. 28th

08:30 AM ET GDP (QoQ) (Q4)

10:30 AM ET Crude Oil Inventories

Thursday, Feb. 29th

08:30 AM ET PCE Price Index (YoY)

08:30 AM ET PCE Price Index (MoM)

08:30 AM ET Initial Jobless Claims

09:45 AM ET Chicago PMI (Feb)

Friday, Mar. 1st

05:00 AM ET Eurozone CPI (YoY) (Feb)

09:45 AM ET S&P Global US Manufacturing PMI (Feb)

10:00 AM ET ISM Manufacturing PMI (Feb)

10:00 AM ET ISM Manufacturing Prices (Feb)

Upcoming Earnings

Monday

AM: Berkshire Hathaway & Domino's Pizza

PM: Unity & Zoom

Tuesday

AM: AutoZone, Cracker Barrel, Lowe's, Macy's & Norwegian Cruise Line

PM: Cava & Devon

Wednesday

AM: Advanced Auto Parts & TJX

PM: C3.AI, Paramount, Salesforce & Snowflake

Thursday

AM: Best Buy & Celsius

PM: Dell & Fisker

Friday

AM: Fubo TV & Plug

Seasonality Update

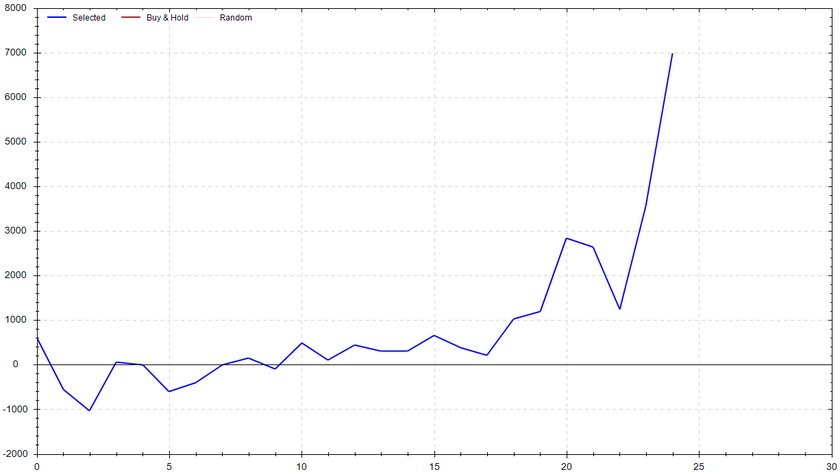

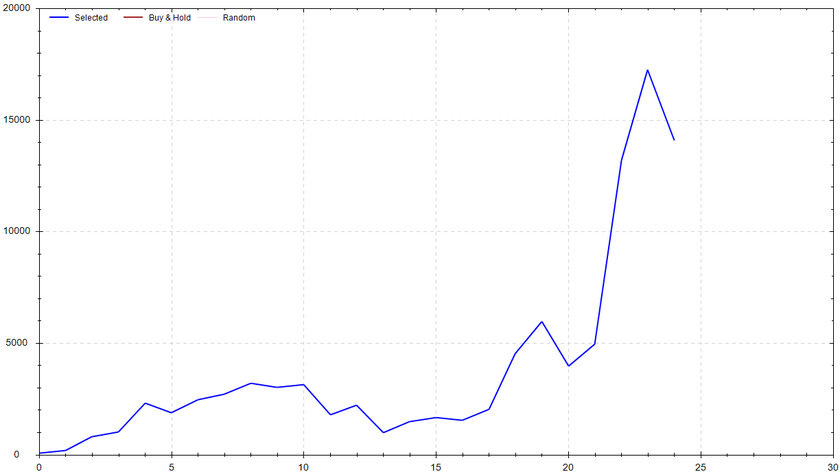

S&P 500 Seasonal Bias (Monday, Feb. 26th)

- Bull Win Percentage: 56%

- Profit Factor: 2.36

- Bias: Bullish

Equity Curve -->

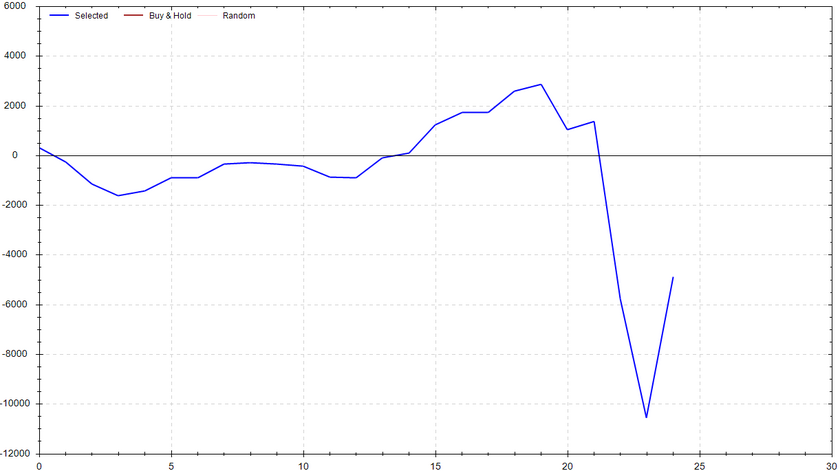

S&P 500 Seasonal Bias (Tuesday, Feb. 27th)

- Bull Win Percentage: 52%

- Profit Factor: 0.70

- Bias: Leaning Bearish

Equity Curve -->

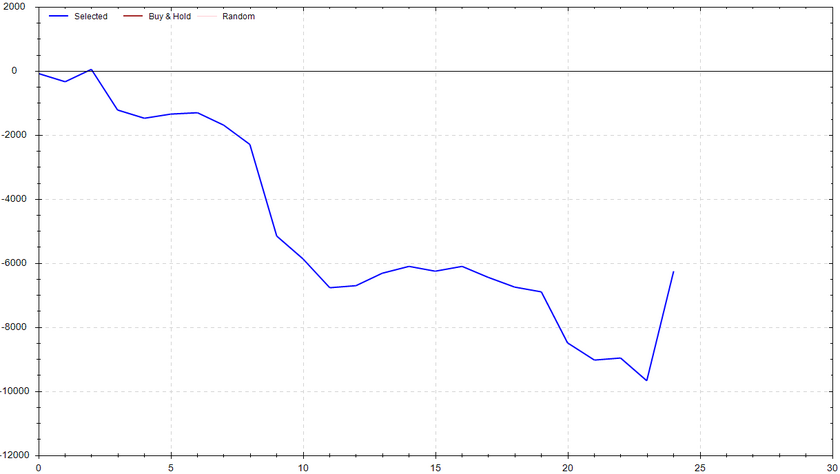

S&P 500 Seasonal Bias (Wednesday, Feb. 28th)

- Bull Win Percentage: 36%

- Profit Factor: 0.44

- Bias: Bearish

Equity Curve -->

S&P 500 Seasonal Bias (Thursday, Feb. 29th)

- Bull Win Percentage: 64%

- Profit Factor: 1.86

- Bias: Leaning Bullish

Equity Curve -->

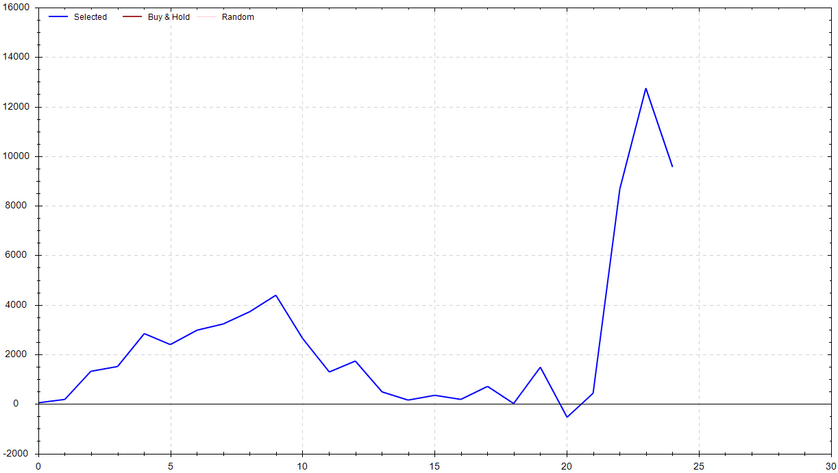

S&P 500 Seasonal Bias (Friday, Mar. 1st)

- Bull Win Percentage: 72%

- Profit Factor: 2.64

- Bias: Bullish

Equity Curve -->

Notes: These analytics are derived from the performance of the S&P 500 futures contract over the past 25 years. Additionally, results are computed from the futures market open and close.

Options Strategy Update

The 0 DTE signal hit 6 for 6 times (10 for 10 total units) this past week.

Signal Accuracy: ~100%

I don't have much to say in this section. Piper is crushing the market. She is a monster. Piper is the GOAT. I'm legitimately scared that she is getting even better.

Piper's Current Signal Streak: 15

February Unit Record: 52/54

Monday Feb. 19th

Market Closed

Tuesday Feb. 20th

SPY CALL Credit Spread (2x Multiple @ $502 / $503) 🟢

QQQ CALL Credit Spread (2x Multiple @ $435 / $436) 🟢

Wednesday Feb. 21st

SPY PUT Credit Spread (1x Multiple @ $494 / $493) 🟢

QQQ PUT Credit Spread (1x Multiple @ $423 / $422) 🟢

Thursday Feb. 22nd

SPY PUT Credit Spread (2x Multiple @ $503 / $502) 🟢

QQQ PUT Credit Spread (2x Multiple @ $433 / $432) 🟢

Friday Feb. 23rd

No Signal Generated

Top 5 Charts of Interest

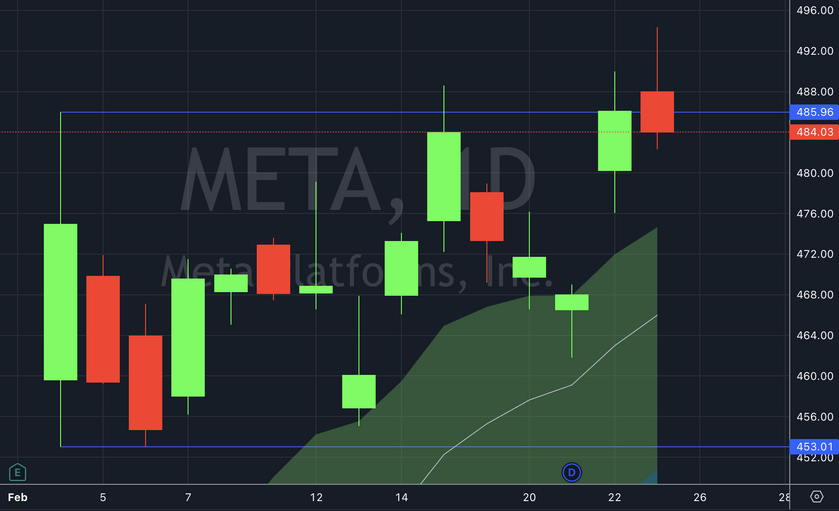

Meta

After a pretty solid earnings report, META gapped up and the proceeded to consolidate in an evident range. I'll be looking for a close above $488 to trigger a continuation to the upside.

Netflix

NFLX had an impressive rally after its most recently quarterly report. Unfortunately, this quickly led to a multi-week period of congestion. There was eventually a glimmer of hope to turned out to be a fake out breakout. The current price action is suggesting another attempt will be coming soon. Watching closely.

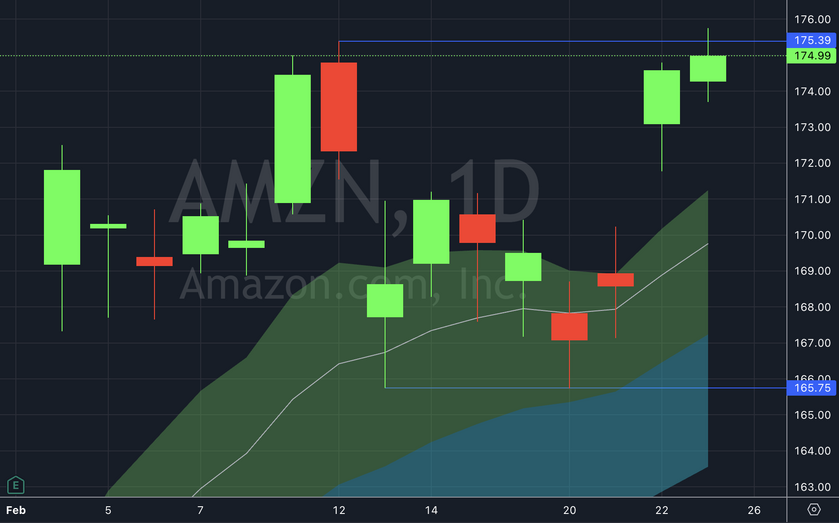

Amazon

AMZN got caught in a $10 range after its earnings announcement. Currently, the ceiling of the range is being tested. A push above and close about $176 could prompt another leg to the upside.

Tesla

After clearly establishing an inverse head and shoulders, I'm looking for TSLA to gain a bit of bullish traction. The upside gap fill of $207 is highly interesting to me.

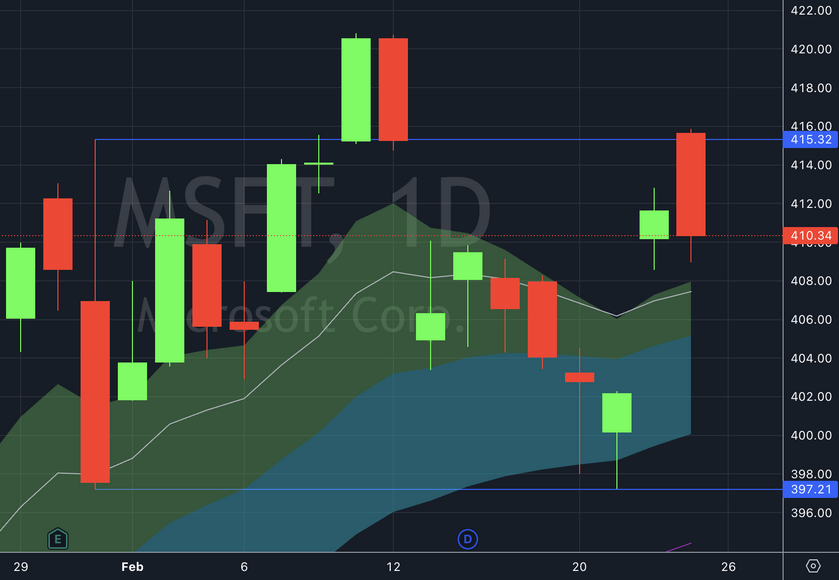

Microsoft

The world's number one company hasn't been doing too much since the market reacted to its earnings. There was a breakout attempt, but it was aggressively denied. If the overall market continues to express bullish enthusiasm, I'll be looking for MSFT to close above $416. In my opinion, this would be a favorable setup for an additional move to the upside.

Count of Shower Cries

19.4* (small magnitude, but still life altering)

* This data point is from readings over the past week. The reported information should not be taken as an aggregate or cumulative value for any period beyond the most recent week (Sunday through Saturday). Appropriate alterations were made to account for both travel and time zone shifts.

Notes

RISK WARNING: Trading involves HIGH RISK and YOU CAN LOSE a lot of money. Do not risk any money you cannot afford to lose. Trading is not suitable for all investors. We are not registered investment advisors. We do not provide trading or investment advice. We provide research and education through the issuance of statistical information containing no expression of opinion as to the investment merits of a particular security. Information contained herein should not be considered a solicitation to buy or sell any security or engage in a particular investment strategy. Past performance is not necessarily indicative of future results. Links above include affiliate commission or referrals. I'm part of an affiliate network and I receive compensation from partnering websites.

Both of these trades hit if held until close -- 6 total units!

Both of these trades hit if held until close -- 6 total units! These PCS's were sold at $1.05/ea and were bought back at $0.20/ea -- THIS MEANS MY REALIZED GAIN WAS $!

These PCS's were sold at $1.05/ea and were bought back at $0.20/ea -- THIS MEANS MY REALIZED GAIN WAS $!