Taking A Pit Stop

Amigo!

The market is finally taking a breather. For weeks we've been wondering what will stop the market from pushing to new heights. We now have the answer: Not one, but two "hot" inflation reports.

To be clear, I don't want to sound like a Debby Downer. In my humble opinion, the bulls are still in control. The overall price action structure is still higher highs and higher lows. I wouldn't be betting on an official trend change until I see lower lows. Even then, we could easily be witnessing a classic bear trap. There is a very good reason the saying "The trend is your friend" exists -- It pays to go with the flow.

What will happen this upcoming week? I have absolutely no clue, but it is bound to be an exciting one. We will be receiving the results of the FOMC meeting, and Chair Powell will be making a public speech. Historically, both events are associated with high volatility. Don’t get caught on your back foot!

Be prepared for extreme moves in all major markets -- The key details are shared below. Cheers!

Best,

Thicc Kohrs

P.S. The official Goonie Discord is live! (FREE Access w/ code GOONIE: https://bit.ly/GoonieGroup)

Market Events

Monday, Mar. 18th

06:00 AM ET Eurozone CPI (YoY) (Feb)

10:00 AM ET Home Builder Confidence Index

11:30 PM ET Australia (RBA) Interest Rate Decision

Tuesday, Mar. 19th

08:30 AM ET Housing Starts

08:30 AM ET Building Permits

01:00 PM ET 20-Year Bond Auction Results

Wednesday, Mar. 20th

10:30 AM ET Crude Oil Inventories

02:00 PM ET Fed Interest Rate Decision

02:30 PM ET Fed Chair Powell Press Conference

Thursday, Mar. 21st

08:30 AM ET Initial Jobless Claims

08:30 AM ET Philadelphia Fed Manufacturing Index (Mar)

09:45 AM ET S&P Global US Manufacturing PMI (Mar)

09:45 AM ET S&P Global Services PMI (Mar)

10:00 AM ET Existing Home Sales (Feb)

10:00 AM ET US Leading Economic Indicators

Friday, Mar. 22nd

09:00 AM ET Fed Chair Powell Speaks

Upcoming Earnings

Monday

None

Tuesday

None

Wednesday

AM: General Mills

PM: Chewy & Micron

Thursday

AM: Accenture & Darden Restaurants

PM: FedEx, Lululemon & Nike

Friday

None

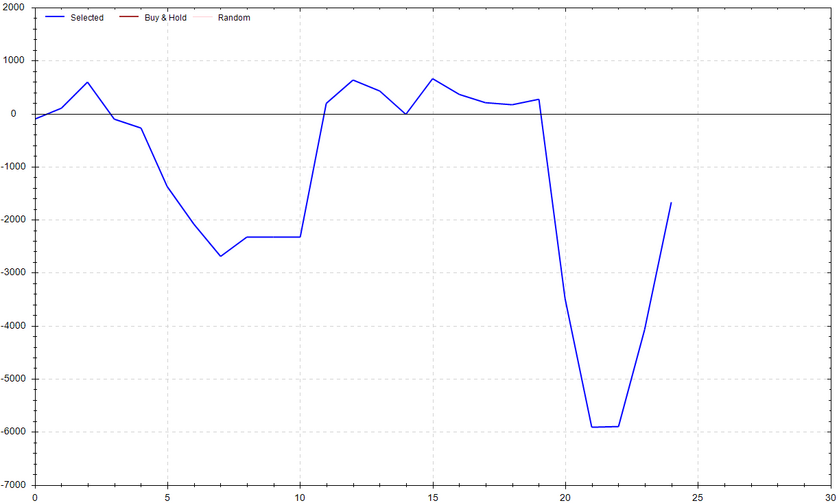

Seasonality Update

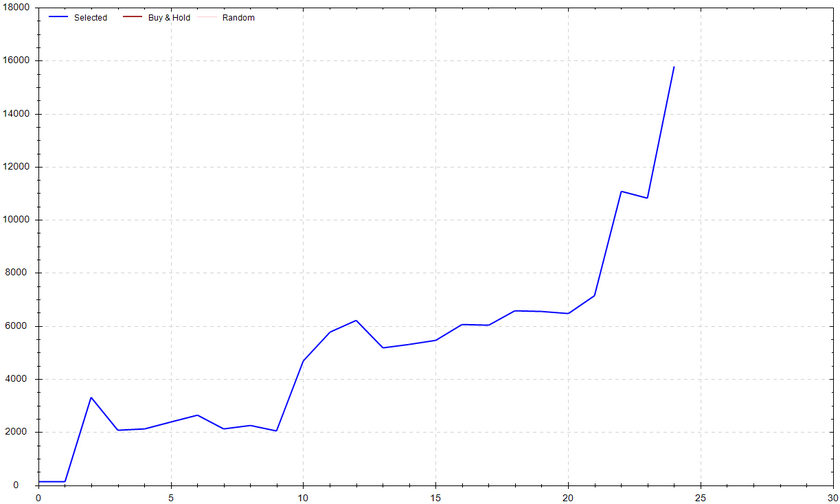

S&P 500 Seasonal Bias (Monday, Mar. 18th)

- Bull Win Percentage: 64%

- Profit Factor: 5.68

- Bias: Bullish

Equity Curve -->

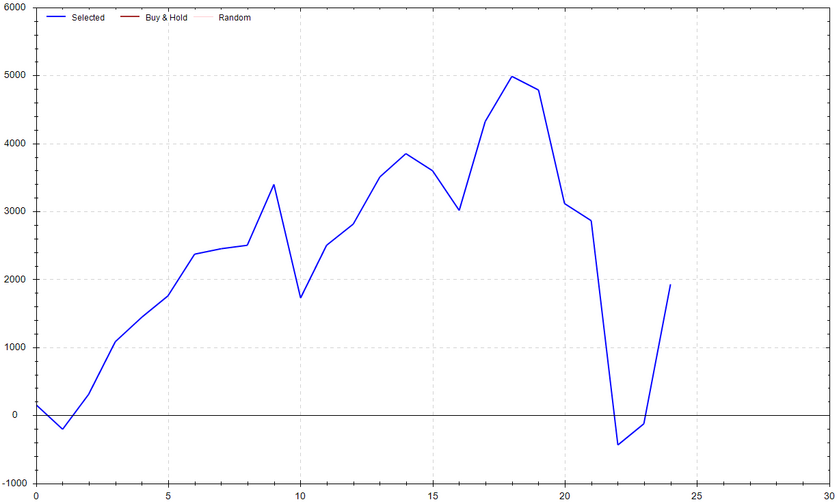

S&P 500 Seasonal Bias (Tuesday, Mar. 19th)

- Bull Win Percentage: 68%

- Profit Factor: 1.23

- Bias: Leaning Bullish

Equity Curve -->

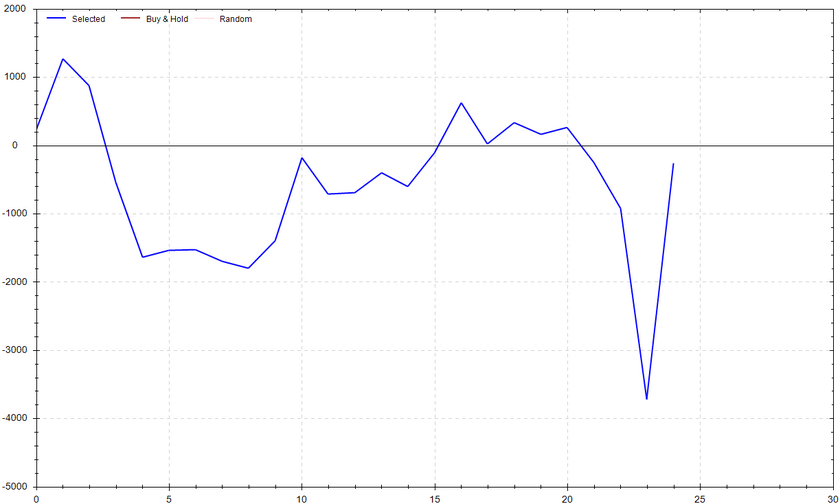

S&P 500 Seasonal Bias (Wednesday, Mar. 20th)

- Bull Win Percentage: 52%

- Profit Factor: 0.97

- Bias: Neutral

Equity Curve -->

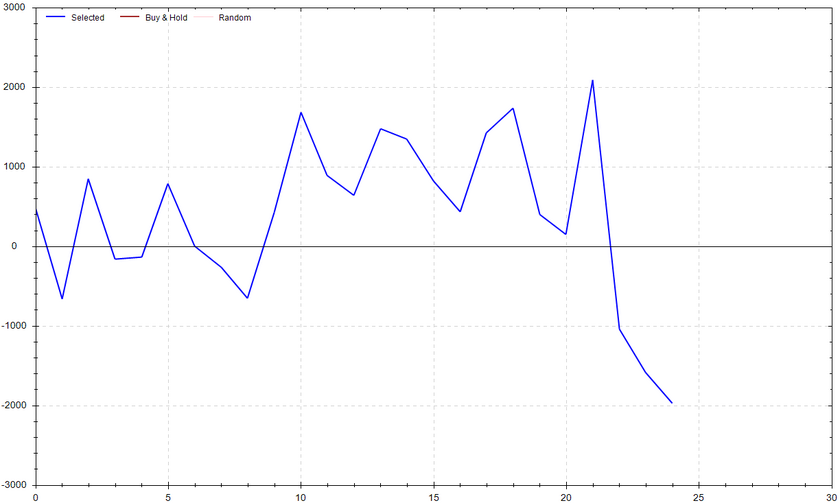

S&P 500 Seasonal Bias (Thursday, Mar. 21st)

- Bull Win Percentage: 40%

- Profit Factor: 0.83

- Bias: Neutral

Equity Curve -->

S&P 500 Seasonal Bias (Friday, Mar. 22nd)

- Bull Win Percentage: 40%

- Profit Factor: 0.84

- Bias: Neutral

Equity Curve -->

Notes: These analytics are derived from the performance of the S&P 500 futures contract over the past 25 years. Additionally, results are computed from the futures market open and close.

Options Strategy Update

The 0 DTE signal hit 10 for 10 times (22 for 22 total units) this past week.

Signal Accuracy: ~100%

Yes, Piper took a hit last Friday. The best systems in the world take a hit. There is no such thing as a perfect trading system. The real question is twofold. How bad is the hit and how long does it take to recover. On the latter point, Piper traded with perfect over the past week and made a glorious recovery. Let's see how far this new streak can run!

Piper's Current Signal Streak: 10 Trades

March Record: 42/48 Units

Monday Mar. 11th

SPY CALL Credit Spread (3x Multiple @ $512 / $513) 🟢

QQQ CALL Credit Spread (3x Multiple @ $439 / $440) 🟢

Tuesday Mar. 12th

SPY PUT Credit Spread (2x Multiple @ $510 / $509) 🟢

QQQ PUT Credit Spread (2x Multiple @ $436 / $435) 🟢

Wednesday Mar. 13th

SPY CALL Credit Spread (2x Multiple @ $518 / $519) 🟢

QQQ CALL Credit Spread (2x Multiple @ $443 / $444) 🟢

Thursday Mar. 14th

SPY CALL Credit Spread (2x Multiple @ $518 / $519) 🟢

QQQ CALL Credit Spread (2x Multiple @ $442 / $443) 🟢

Friday Mar. 15th

SPY Credit Spread (2x Multiple @ $513 / $514) 🟢

QQQ Credit Spread (2x Multiple @ $438 / $439) 🟢

Top 5 Charts of Interest

S&P 500

The SPY is finally taking a small breather after pumping for most of the calendar year. I'm honestly surprised it didn't selloff even more. We received two hot inflation reports, which essentially forces the Fed to stay on the hawkish side of monetary policy. To be clear, I believe the bull camp is still in control unless $503 is given up. If that were to happen, I'd be looking for the $497 gap to be filled.

Nasdaq 100

On a relative base, the tech sector took a harder hit than the SPY. If the key support of $434 doesn't hold, I'd be paying close attention to the $426 gap fill. Don't forget that a lot of this will be determined by the market's reaction to the upcoming FOMC decision.

Bitcoin

Digital gold took a small hit after hitting another new all-time higher. In my opinion, this is a healthy pullback. I have no reason to think the bulls have somehow lost control. The pattern of higher highs and higher lows is showing no signs of slowing down. Personally, I wouldn't be concerned unless $58k is given up.

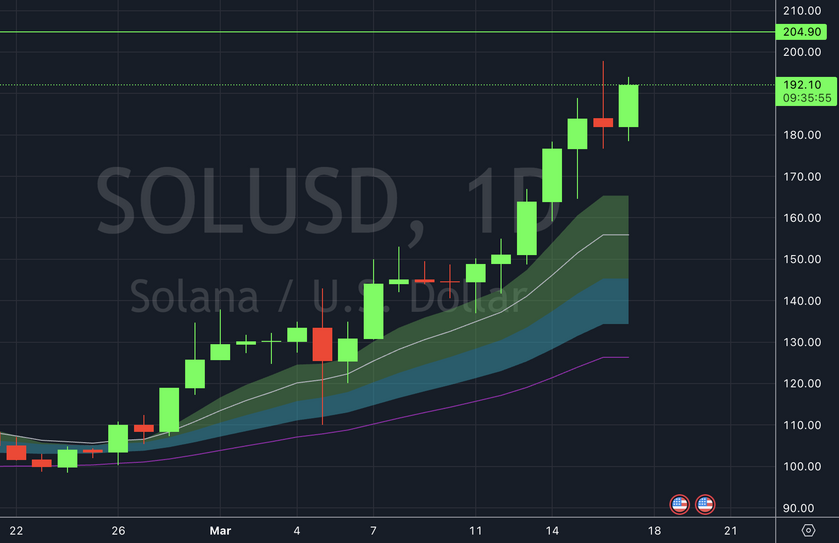

Solana

Even though crypto in general is taking a breather, SOL is ripping higher and higher. It makes no sense at all, but the Mememania in the Solana community is alive at well. My short-term target is $205ish.

Tesla

As discussed multiple time over the past few weeks, TSLA is under a lot of sell side pressure. My downside target of $164 was hit -- Congrats to all of you who played it! If the selling were to continue, my next target would be $152ish.

Weekly Count of Market Being "Stupid"

48,933 *

* This data point is from readings over the past week. The reported information should not be taken as an aggregate or cumulative value for any period beyond the most recent week (Sunday through Saturday). Appropriate alterations were made to account for both travel and time zone shifts.

Notes

RISK WARNING: Trading involves HIGH RISK and YOU CAN LOSE a lot of money. Do not risk any money you cannot afford to lose. Trading is not suitable for all investors. We are not registered investment advisors. We do not provide trading or investment advice. We provide research and education through the issuance of statistical information containing no expression of opinion as to the investment merits of a particular security. Information contained herein should not be considered a solicitation to buy or sell any security or engage in a particular investment strategy. Past performance is not necessarily indicative of future results. Links above include affiliate commission or referrals. I'm part of an affiliate network and I receive compensation from partnering websites.

Both of these trades hit if held until close -- 6 total units!

Both of these trades hit if held until close -- 6 total units! These PCS's were sold at $1.05/ea and were bought back at $0.20/ea -- THIS MEANS MY REALIZED GAIN WAS $!

These PCS's were sold at $1.05/ea and were bought back at $0.20/ea -- THIS MEANS MY REALIZED GAIN WAS $!