Goodbye March, Hello April

Greetings Traveler,

The market is back on its bullshit -- We concluded the recent trading week by hitting another new all-time high. I hope you got yours!

Two major things went down this past week. On Thursday we got the second GDP reading for Q4. The result was a revision higher to 3.4% from 3.2%. This data drop was followed by a PCE announcement. The core inflation reading came in at expectations (2.8%). I would argue these reports, along with various other ones from the month, have made it highly likely we will not get a Fed rate cut in May. In fact, the odds of a rate cut in June are even starting to slightly drop.

The upcoming week should offer more clarity. As detailed below, there is a huge number of scheduled Fed speeches. I’m doubtful their statements will majorly diverge from each other. Once their general hawkish or dovish vibe is publicly understood, we can be highly confident about the May FOMC decision. It will also increase the market's confidence on the prediction of the June decision.

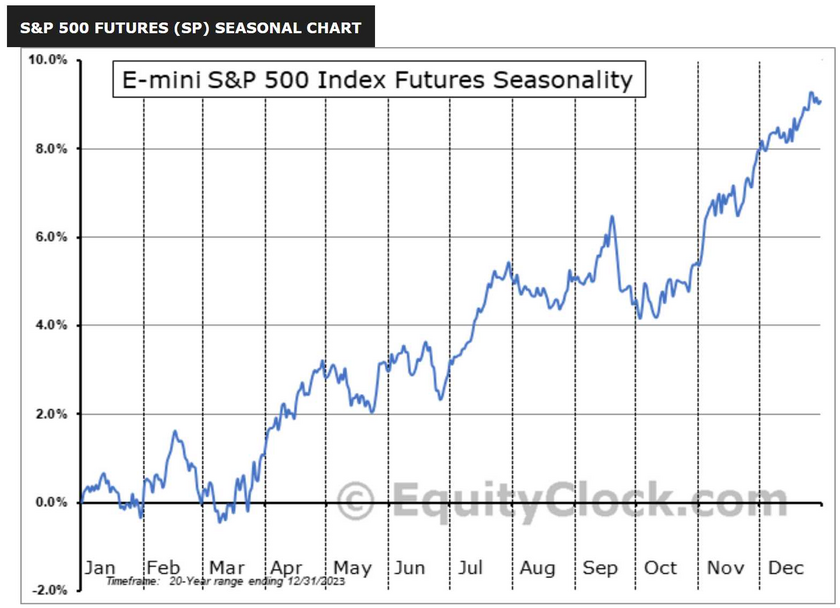

With respect to the higher-level picture, I'm particularly happy the month is over. March is notoriously a choppy, messy trading month. My personal trading account did not get out of the month unscathed. The predicted whipsaw nature was very much apparent in my own trading. April is historically a less volatile month with a bullish bias. Fingers crossed we see history repeats once again!

May the Force Be With You,

Thicc Kohrs

P.S. The official Goonie Discord is live! (FREE Access w/ code GOONIE: https://bit.ly/GoonieGroup)

Market Events

Monday, Apr. 1st

09:45 AM ET S&P Global US Manufacturing PMI (Mar)

10:00 AM ET ISM Manufacturing PMI (Mar)

10:00 AM ET ISM Manufacturing Prices (Mar)

10:00 AM ET Construction Spending

06:50 PM ET Fed Governor Lisa Cook Speaks

Tuesday, Apr. 2nd

10:00 AM ET JOLTs Job Openings (Feb)

10:10 AM ET Fed Governor Michelle Bowman Speaks

12:05 PM ET Cleveland Fed President Loretta Mester Speaks

01:30 PM ET San Francisco Fed President Mary Daly Speaks

Wednesday, Apr. 3rd

05:00 AM ET Eurozone CPI (YoY) (Mar)

08:15 AM ET ADP Nonfarm Employment Change (Mar)

09:45 AM ET Fed Governor Michelle Bowman Speaks

09:45 AM ET S&P Global Services PMI (Mar)

10:00 AM ET ISM Non-Manufacturing PMI (Mar)

10:00 AM ET ISM Non-Manufacturing Prices (Mar)

10:30 AM ET Crude Oil Inventories

12:10 PM ET Fed Chair Powell Speaks

01:10 PM ET Fed Vice Chair For Supervisions Michael Barr Speaks

04:30 PM ET Fed Governor Adriana Kugler Speaks

Thursday, Apr. 4th

08:30 AM ET Initial Jobless Claims

10:00 AM ET Philadelphia Fed President Patrick Harker Speaks

12:15 PM ET Richmond Fed President Tom Barkin Speaks

12:45 PM ET Chicago Fed President Austan Goolsbee Speaks

02:00 PM ET Cleveland Fed President Loretta Mester Speaks

07:30 PM ET Fed Governor Adriana Kugler Speaks

Friday, Apr. 5th

08:30 AM ET Unemployment Rate (Mar)

08:30 AM ET Nonfarm Payrolls (Mar)

08:30 AM ET Avg. Hourly Earnings (MoM) (Mar)

09:15 AM ET Richmond Fed President Tom Barkin Speaks

11:00 AM ET Dallas Fed President Lorie Logan Speaks

12:15 PM ET Fed Governor Michelle Bowman Speaks

03:00 PM ET Consumer Credit

Upcoming Earnings

Monday

None

Tuesday

PM: Dave & Buster's

Wednesday

PM: Blackberry & Levi's

Thursday

None

Friday

None

Seasonality Update

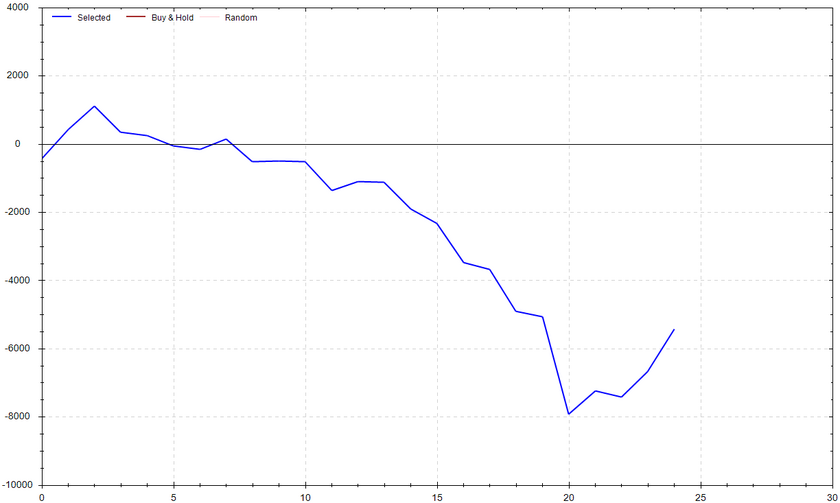

S&P 500 Seasonal Bias (Monday, Apr. 1st)

- Bull Win Percentage: 65%

- Profit Factor: 1.50

- Bias: Bullish

Equity Curve -->

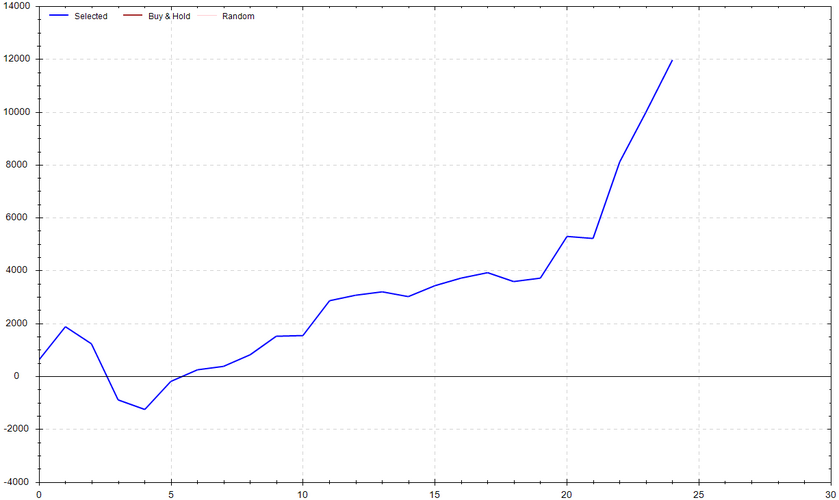

S&P 500 Seasonal Bias (Tuesday, Apr. 2nd)

- Bull Win Percentage: 76%

- Profit Factor: 4.24

- Bias: Very Bullish

Equity Curve -->

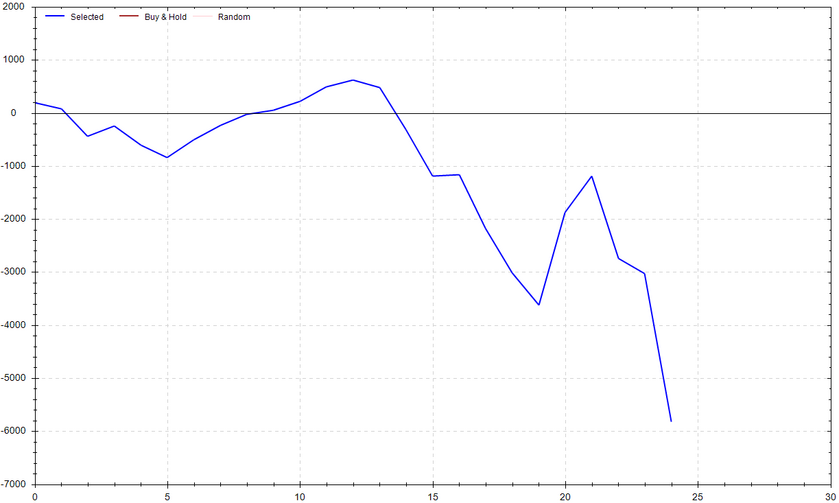

S&P 500 Seasonal Bias (Wednesday, Apr. 3rd)

- Bull Win Percentage: 48%

- Profit Factor: 0.43

- Bias: Bearish

Equity Curve -->

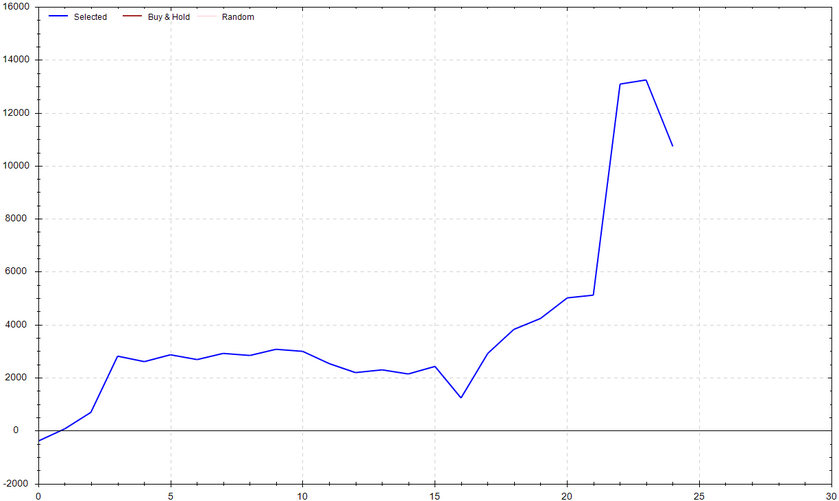

S&P 500 Seasonal Bias (Thursday, Apr. 4th)

- Bull Win Percentage: 60%

- Profit Factor: 2.91

- Bias: Bullish

Equity Curve -->

S&P 500 Seasonal Bias (Friday, Apr. 5th)

- Bull Win Percentage: 32%

- Profit Factor: 0.47

- Bias: Bearish

Equity Curve -->

Notes: These analytics are derived from the performance of the S&P 500 futures contract over the past 25 years. Additionally, results are computed from the futures market open and close.

Options Strategy Update

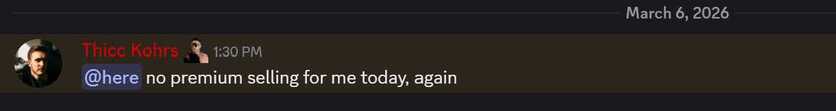

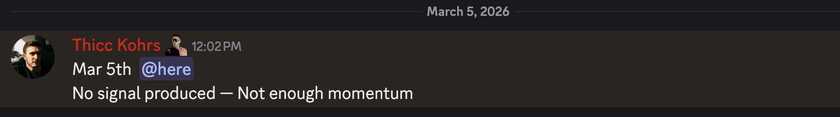

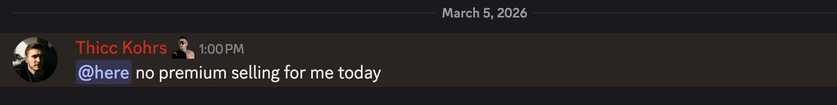

The 0 DTE signal hit 7 for 8 times (10 for 11 total units) this past week.

Signal Accuracy: ~87.5%

I'm not the only one who is happy the month is over. Piper is particularly stoked that the choppy price action that was March has now concluded. The Piper system had its worst performance YTD last week. Fortunately, the bounce back this week was a solid one. Even though it's early, I'm a fan of ranking the SPY and QQQ signals separately. Fingers crossed the quality performance continues into April.

Piper's Current Signal Streak: 3 Trades

March Record: 64/79 Units

Monday Mar. 25th

SPY Put Credit Spread (1x Multiple @ $519 / $518) 🟢

QQQ Put Credit Spread (1x Multiple @ $441 / $440) 🟢

Tuesday Mar. 26th

SPY Call Credit Spread (1x Multiple @ $522 / $523) 🟢

QQQ Call Credit Spread (1x Multiple @ $448 / $449) 🟢

Wednesday Mar. 27th

SPY Call Credit Spread (1x Multiple @ $522 / $523) 🔴

QQQ Call Credit Spread (2x Multiple @ $447 / $448) 🟢

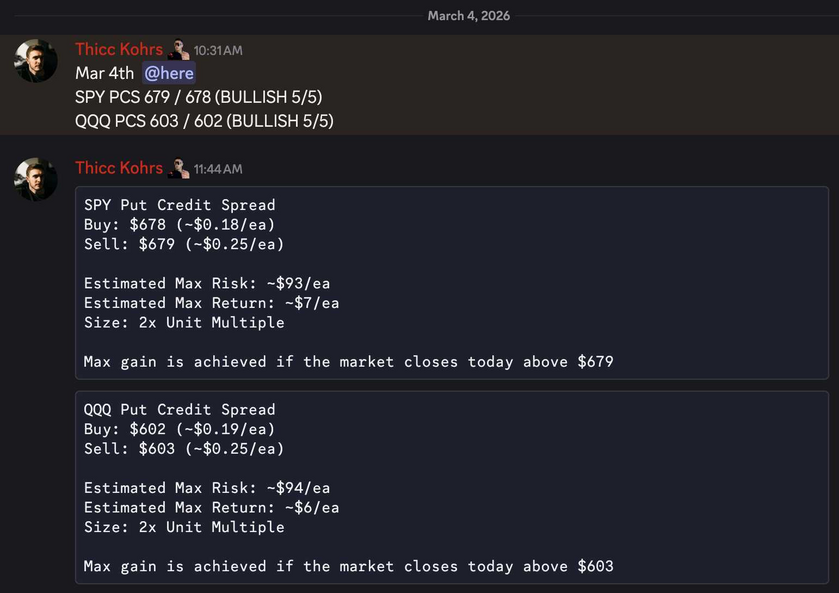

Thursday Mar. 28th

SPY Put Credit Spread (2x Multiple @ $521 / $520) 🟢

QQQ Put Credit Spread (2x Multiple @ $442 / $441) 🟢

Friday Mar. 29th

No Signal (Market Closed)

Top 6 Charts of Interest

Bitcoin

A bullish continuation pattern doesn't get more evident than what is currently being shown by BTC. The classic push, consolidation, followed by another push is favored by countless traders. If the $61k support holds, I'll be watching for a breakout of the $72k - $74k resistance region.

Coinbase

As commonly discussed, COIN will be highly correlated with the price action of BTC. Personally, I'm a big fan of the evident higher highs and higher lows. I believe a break and hold above $283 could easily lead to a test of $300 as long as the overall pattern holds steady.

Nvidia

NVDA -- The gift that keeps on giving. In the short-term, the leading semiconductor play double topped at $960. I'll be paying close attention to a third test, and the following price action, throughout the following week.

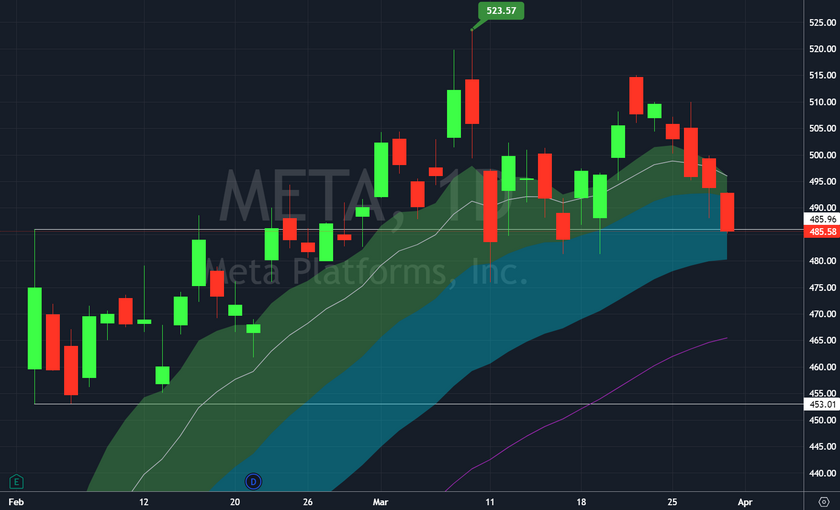

Meta

Similar to NVDA, META is taking a breather after recently putting in a double top. The weekly closing price aligned with a recent breakout level. If this support doesn't hold, the $469 gap fill would be my target. If the bulls step in, I'd be watching for the third test of the $520 region.

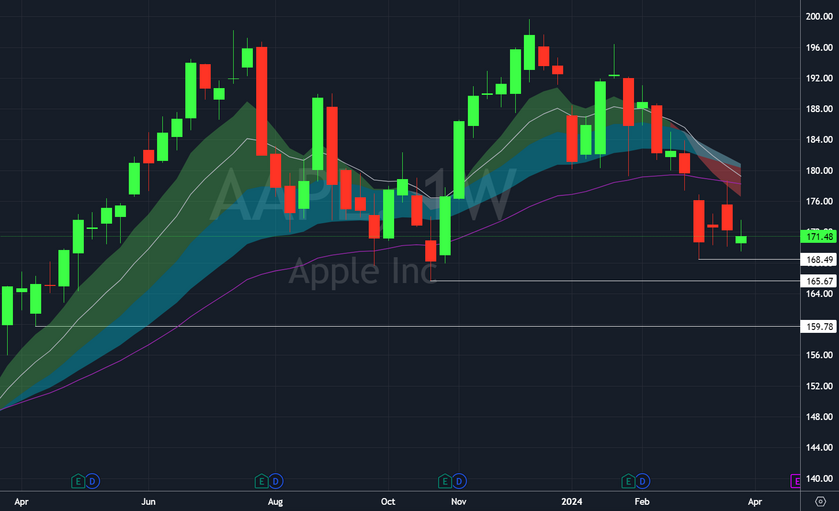

Apple

In my opinion, AAPL is still looking weak af. I'm watching for a test of $168. If that support doesn't hold, I'd then be looking for $165.

Amazon

AMZN is a slow-grinding, bullish monster. Without missing a beat, this ticker is continually clocking in higher highs and higher lows. I wouldn't be surprised if this stock is testing its all-time high ($188) in the medium term.

Occurrences of YouTube & Rumble Chat Blowing Entire Acct.

1 * (haha)

* This data point is from readings over the past week. The reported information should not be taken as an aggregate or cumulative value for any period beyond the most recent week (Sunday through Saturday). Appropriate alterations were made to account for both travel and time zone shifts.

Notes

RISK WARNING: Trading involves HIGH RISK and YOU CAN LOSE a lot of money. Do not risk any money you cannot afford to lose. Trading is not suitable for all investors. We are not registered investment advisors. We do not provide trading or investment advice. We provide research and education through the issuance of statistical information containing no expression of opinion as to the investment merits of a particular security. Information contained herein should not be considered a solicitation to buy or sell any security or engage in a particular investment strategy. Past performance is not necessarily indicative of future results. Links above include affiliate commission or referrals. I'm part of an affiliate network and I receive compensation from partnering websites.

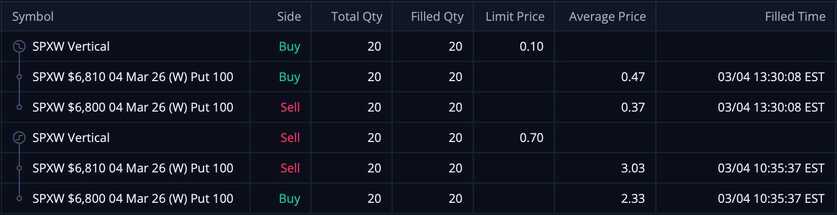

Both of these trades missed. Both of these trades hit if held until close -- 6 total units!

Both of these trades missed. Both of these trades hit if held until close -- 6 total units! These PCS's were sold at $0.70/ea and were bought back at $0.10/ea -- THIS MEANS MY REALIZED GAIN WAS $1,200!

These PCS's were sold at $0.70/ea and were bought back at $0.10/ea -- THIS MEANS MY REALIZED GAIN WAS $1,200!