Higher For Longer

Hi,

Well, that was something.

As I'm writing this, I find it odd how much it felt like the market moved this past week vs how much it actually moved. I suppose it could best be summarized as we violently went nowhere.

There were three major things that recently developed to kick off the new quarter. Fed Chair Powell spoke at Stanford and reiterated rates higher for longer and will not budge until inflation comes down even more. This wasn't new news, so the market didn't really react... at first. The following day Minneapolis Fed President Kashkari caused the market to plummet. While being interviewed by CNBC, he stated there might be no rate cuts this year if inflation isn't fixed. This sentiment was quickly echoed by other Fed members. Then, to wrap it all up, the newest Unemployment Report was released on Friday morning. Unemployment came in lower than expected, and more jobs were added than expected. This strength did nothing but increase the Fed's steadfastness in the hawkish regime.

So, where does that leave us? In my opinion, we are at the start of a new period of higher volatility. This upcoming week will contain various inflation reports (CPI & PPI), numerous Fed speeches, and a few Treasury updates. To make things even more spicy, Earnings Season starts this Friday. All the pertinent details are below.

Stick to your plan. Stay disciplined. Godspeed.

Peace,

Thicc Kohrs

P.S. The official Goonie Discord is live! (FREE Access w/ code GOONIE: https://bit.ly/GoonieGroup)

Market Events

Monday, Apr. 8th

01:00 PM ET Chicago Fed President Austan Gollsbee Radio Interview

Tuesday, Apr. 9th

None

Wednesday, Apr. 10th

08:30 AM ET CPI (YoY) (Mar)

08:30 AM ET CPI (MoM) (Mar)

10:00 AM ET Wholesale Inventories

12:00 PM ET Boston Fed President Susan Collins Speaks

01:00 PM ET 10-Year Note Auction

02:00 PM ET FOMC Meeting Minutes

02:00 PM ET Monthly US Federal Budget

Thursday, Apr. 11th

08:15 AM ET ECB Interest Rate Decision

08:30 AM ET PPI (YoY) (Mar)

08:30 AM ET PPI (MoM) (Mar)

08:30 AM ET Initial Jobless Claims

08:45 AM ET ECB Press Conference

12:45 PM ET Chicago Fed President Austan Gollsbee Speaks

01:30 PM ET Atlanta Fed President Raphael Bostic Speaks

Friday, Apr. 12th

02:30 PM ET Atlanta Fed President Raphael Bostic Speaks

03:30 PM ET San Francisco Fed President Mary Daly Speaks

Upcoming Earnings

Monday

None

Tuesday

Morning: Tilray

Wednesday

Morning: Delta

Thursday

Morning: CarMax

Friday

Morning: BlackRock, Citi, JPMorgan & Wells Fargo

Seasonality Update

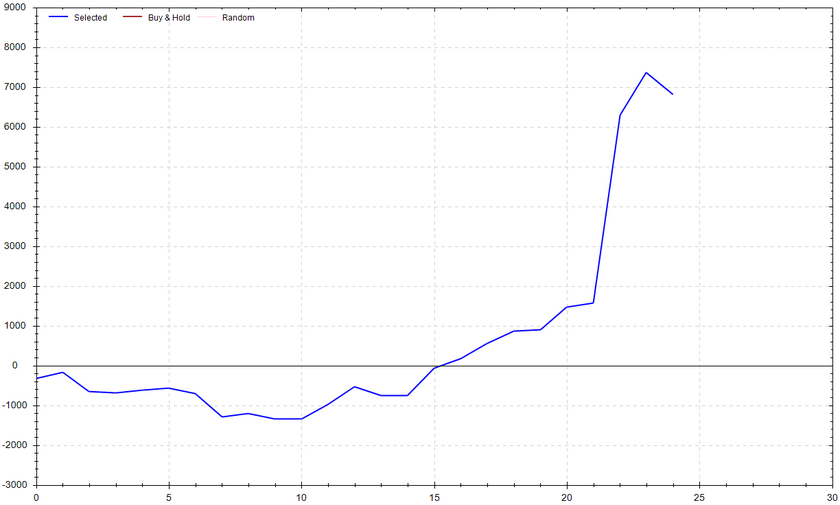

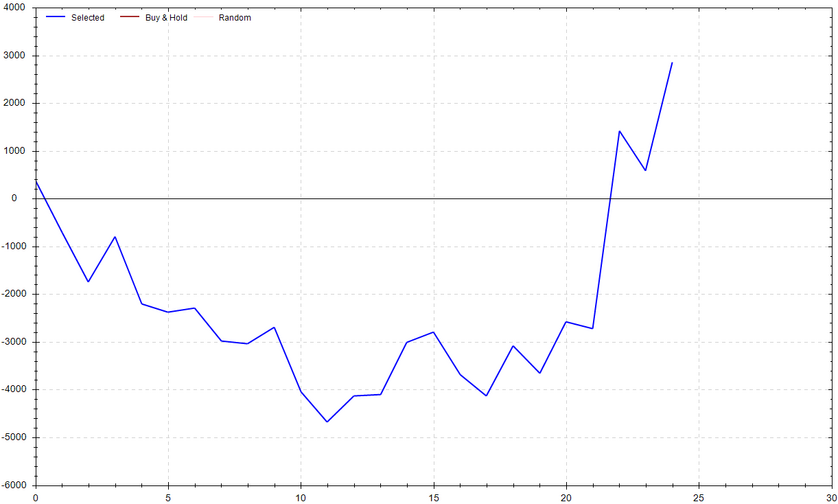

S&P 500 Seasonal Bias (Monday, Apr. 8th)

- Bull Win Percentage: 60%

- Profit Factor: 3.71

- Bias: Bullish

Equity Curve -->

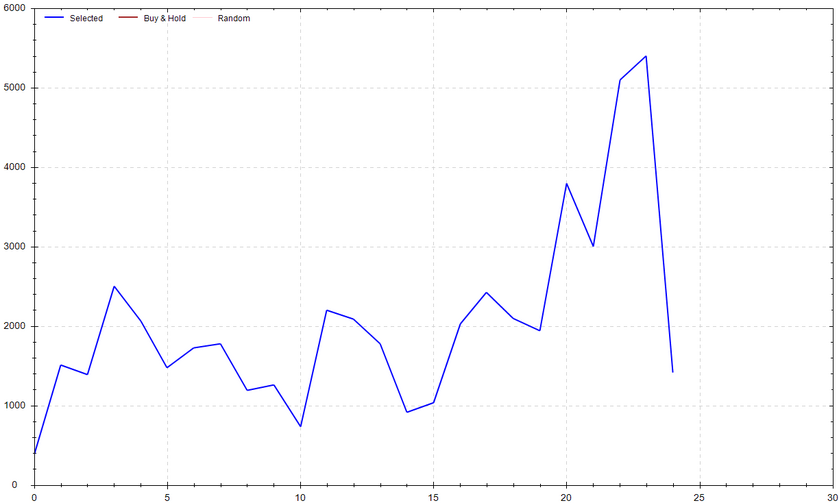

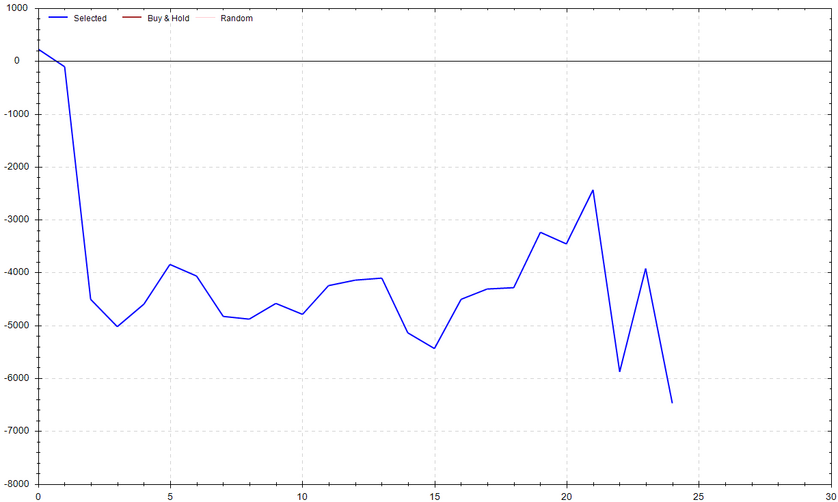

S&P 500 Seasonal Bias (Tuesday, Apr. 9th)

- Bull Win Percentage: 52%

- Profit Factor: 1.16

- Bias: Neutral

Equity Curve -->

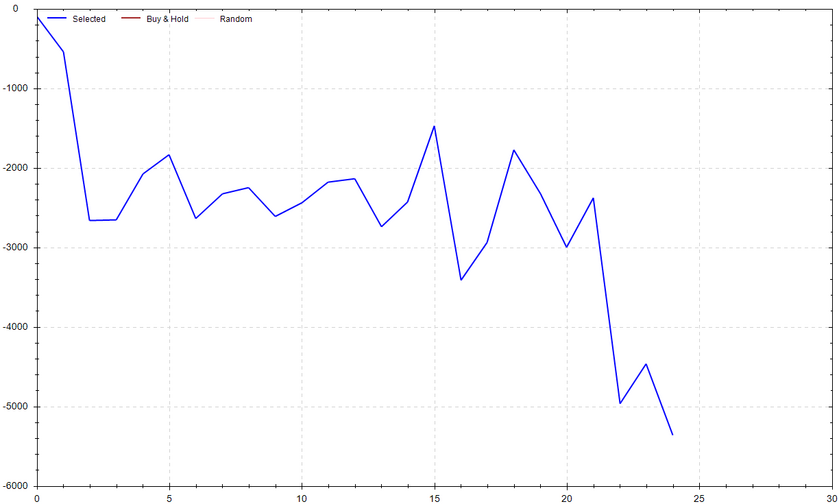

S&P 500 Seasonal Bias (Wednesday, Apr. 10th)

- Bull Win Percentage: 56%

- Profit Factor: 0.52

- Bias:

Equity Curve -->

S&P 500 Seasonal Bias (Thursday, Apr. 11th)

- Bull Win Percentage: 48%

- Profit Factor: 1.31

- Bias: Leaning Bullish

Equity Curve -->

S&P 500 Seasonal Bias (Friday, Apr. 12th)

- Bull Win Percentage: 52%

- Profit Factor: 0.54

- Bias: Leaning Bearish

Equity Curve -->

Notes: These analytics are derived from the performance of the S&P 500 futures contract over the past 25 years. Additionally, results are computed from the futures market open and close.

Options Strategy Update

The 0 DTE signal hit 6 for 8 times (11 for 15 total units) this past week.

Signal Accuracy: ~75%

We are back on track! Piper is slowly but surely recovering to trading at expectations. Onward and upward, brother!

Piper's Current Signal Streak: 2 Trades

April Record: 11/15 Units

Monday Apr. 1st

SPY Put Credit Spread (2x Multiple @ $525 / $526) 🟢

QQQ Put Credit Spread (1x Multiple @ $448 / $449) 🟢

Tuesday Apr. 2nd

SPY Call Credit Spread (2x Multiple @ $519 / $520) 🟢

QQQ Call Credit Spread (2x Multiple @ $441 / $442) 🟢

Wednesday Apr. 3rd

No Signal Produced

Thursday Apr. 4th

SPY Put Credit Spread (2x Multiple @ $521 / $520) 🔴

QQQ Put Credit Spread (2x Multiple @ $444 / $443) 🔴

Friday Apr. 5th

SPY Put Credit Spread (2x Multiple @ $513 / $512) 🟢

QQQ Put Credit Spread (2x Multiple @ $435 / $434) 🟢

Boxes of Mac & Cheese Consumed

14.2 *

* This data point is from readings over the past week. The reported information should not be taken as an aggregate or cumulative value for any period beyond the most recent week (Sunday through Saturday). Appropriate alterations were made to account for both travel and time zone shifts.

Notes

RISK WARNING: Trading involves HIGH RISK and YOU CAN LOSE a lot of money. Do not risk any money you cannot afford to lose. Trading is not suitable for all investors. We are not registered investment advisors. We do not provide trading or investment advice. We provide research and education through the issuance of statistical information containing no expression of opinion as to the investment merits of a particular security. Information contained herein should not be considered a solicitation to buy or sell any security or engage in a particular investment strategy. Past performance is not necessarily indicative of future results. Links above include affiliate commission or referrals. I'm part of an affiliate network and I receive compensation from partnering websites.

Both of these trades hit if held until close -- 6 total units!

Both of these trades hit if held until close -- 6 total units! These PCS's were sold at $1.05/ea and were bought back at $0.20/ea -- THIS MEANS MY REALIZED GAIN WAS $!

These PCS's were sold at $1.05/ea and were bought back at $0.20/ea -- THIS MEANS MY REALIZED GAIN WAS $!