The Battle Ahead

Goonies,

Say hello to return of volatility!

For the first time in a while, the VIX (the volatility of the S&P 500) is starting to show signs of life. I want to be clear: This isn't a reason to panic. Higher volatility simply means things will playout faster. If you're on the right side, you'll see your gains more rapidly. If you're on the wrong side, I hope you're comfortable with pulling the ripcord in a timely manner. Personally, I handle the increased priced velocity and swings by sizing down. Remember that not all markets are made equally -- Don't be afraid to adjust as you see fit!

So why is volatility returning to the market? In my humble opinion, there is multiple valid answers. The number of Fed rates cuts is becoming more uncertain. This past week we received conflicting inflation reports -- one hot & one cold. When this is considered with the general "sticky" nature of our inflation, the Fed will most likely keep rates higher for longer. The market went from thinking we would have 6 cuts at the beginning of this year to now begging for a measly 2. Volatility is also increasing due to the start of a new earnings season. The market is very eager to learn how some of the world's largest companies handled the first quarter. And finally, the market closed right after learning global tensions are boiling over due to Iran and Israel. I think it's safe to say the threat of global conflict is a volatility-inducing event.

The battle ahead will not be an easy one. From a price action standpoint, the market is on the edge of a pivotal structural change (bullish to bearish). The days of an easy slow grind to the upside might be behind us. The new regime will most likely include larger swings and more red days. I hope you're prepared because there will be a considerable increase in tradable opportunities. Godspeed!

Keep on Rockin,

Thicc Kohrs

P.S. The official Goonie Discord is live! (FREE Access w/ code GOONIE: https://bit.ly/GoonieGroup)

Market Events

Monday, Apr. 15th

08:30 AM ET Retail Sales (MoM) (Mar)

08:00 PM ET San Francisco Fed President Mary Daly Speaks

Tuesday, Apr. 16th

08:30 AM ET Housing Starts

08:30 AM ET Building Permits

01:15 PM ET Fed Chair Powell Speaks

Wednesday, Apr. 17th

08:30 AM ET Eurozone CPI (YoY) (Mar)

02:00 PM ET Fed Beige Book

05:30 PM ET Cleveland Fed President Loretta Mester Speaks

Thursday, Apr. 18th

08:30 AM ET Initial Jobless Claims

08:30 AM ET Philadelphia Fed Manufacturing Index (Apr)

09:15 AM ET New York Fed President John Williams Speaks

10:00 AM ET Existing Home Sales (Mar)

10:00 AM ET US Leading Economic Indicators (Mar)

11:00 AM ET Atlanta Fed President Raphael Bostic Speaks

05:45 PM ET Atlanta Fed President Raphael Bostic Speaks

Friday, Apr. 19th

10:30 AM ET Chicago Fed President Austan Goolsbee Speaks

Upcoming Earnings

Monday

Morning: Charles Schwab & Goldman Sachs

Evening: First Bank

Tuesday

Morning: Bank of America, BNY Mellon, Johnson & Johnson, PNC & United Health Group

Evening: Interactive Brokers & United

Wednesday

Morning: ASML

Evening: Discover & Las Vegas Sands

Thursday

Morning: Alaska Airlines, Ally, Nokia & TSMC

Evening: Netflix

Friday

Morning: American Express & P&G

Seasonality Update

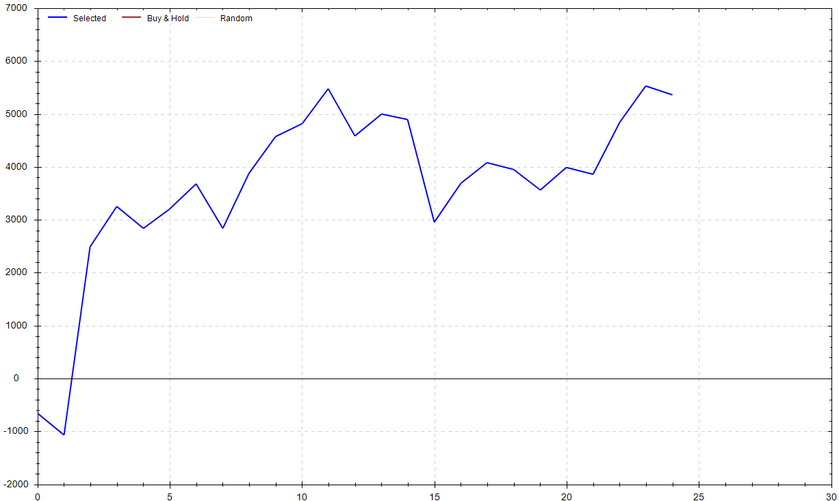

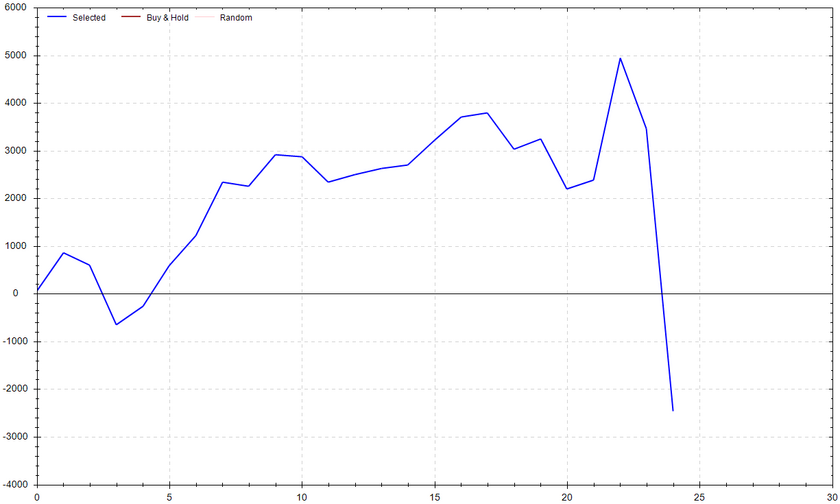

S&P 500 Seasonal Bias (Monday, Apr. 15th)

- Bull Win Percentage: 56%

- Profit Factor: 1.89

- Bias: Bullish

Equity Curve -->

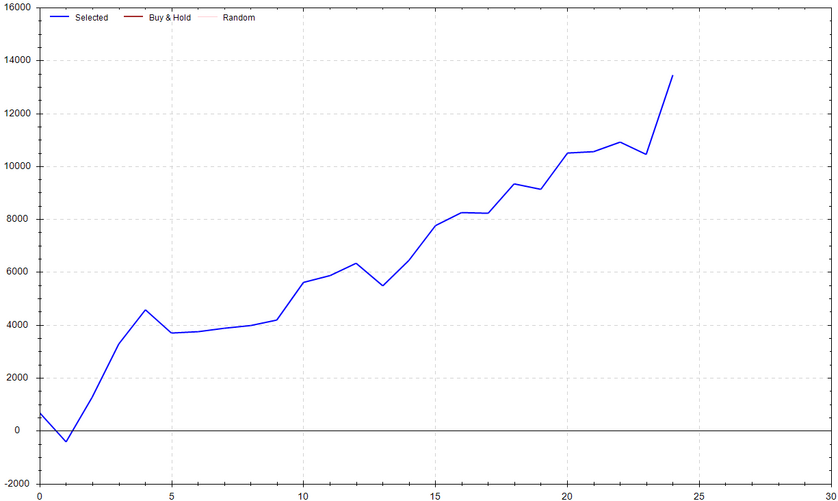

S&P 500 Seasonal Bias (Tuesday, Apr. 16th)

- Bull Win Percentage: 76%

- Profit Factor: 4.78

- Bias: Bullish

Equity Curve -->

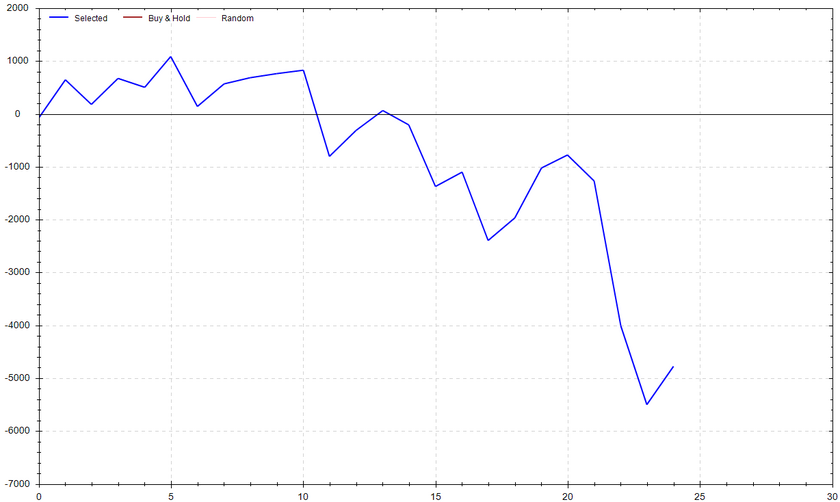

S&P 500 Seasonal Bias (Wednesday, Apr. 17th)

- Bull Win Percentage: 56%

- Profit Factor: 0.56

- Bias: Bearish

Equity Curve -->

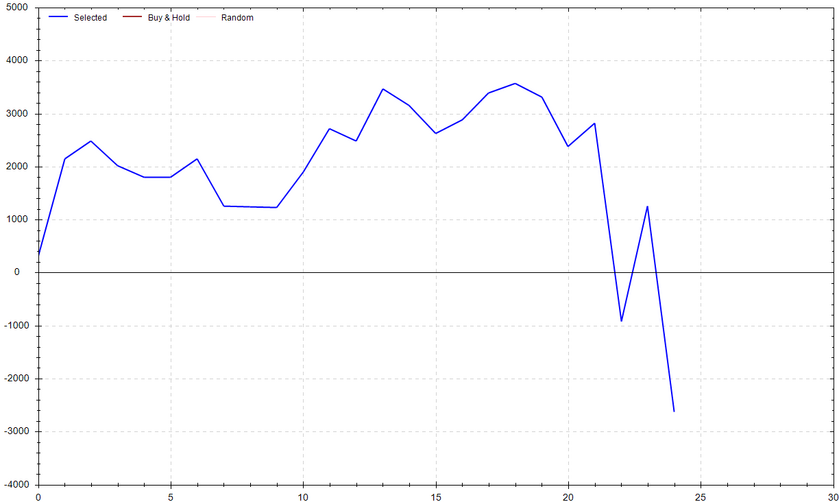

S&P 500 Seasonal Bias (Thursday, Apr. 18th)

- Bull Win Percentage: 48%

- Profit Factor: 0.77

- Bias: Leaning Bearish

Equity Curve -->

S&P 500 Seasonal Bias (Friday, Apr. 19th)

- Bull Win Percentage: 64%

- Profit Factor: 0.78

- Bias: Neutral

Equity Curve -->

Notes: These analytics are derived from the performance of the S&P 500 futures contract over the past 25 years. Additionally, results are computed from the futures market open and close.

Options Strategy Update

The 0 DTE signal hit 8 for 10 times (12 for 15 total units) this past week.

Signal Accuracy: ~80%

Another week, another solid performance. Of course I would like Piper to trader perfectly, but that's not really a thing that's possible for a long period of time. February was a gift while March felt like a giant bad beat. Piper is currently trading at expectations -- Let's hope the success continues!

Piper's Current Signal Streak: 2 Trades

April Record: 23/30 Units

Monday Apr. 8th

SPY Put Credit Spread (2x Multiple @ $517 / $516) 🟢

QQQ Put Credit Spread (2x Multiple @ $438 / $437) 🟢

Tuesday Apr. 9th

SPY Call Credit Spread (1x Multiple @ $522 / $523) 🟢

QQQ Call Credit Spread (1x Multiple @ $444 / $445) 🟢

Wednesday Apr. 10th

SPY Put Credit Spread (1x Multiple @ $511 / $510) 🟢

QQQ Put Credit Spread (1x Multiple @ $435 / $434) 🟢

Thursday Apr. 11th

SPY Call Credit Spread (2x Multiple @ $517 / $518) 🔴

QQQ Call Credit Spread (1x Multiple @ $441 / $442) 🔴

Friday Apr. 12th

SPY Call Credit Spread (2x Multiple @ $517 / $518) 🟢

QQQ Call Credit Spread (2x Multiple @ $444 / $445) 🟢

Times I Spilled Coffee on My Lap During A Flight

1.6 * (Low count but very painful)

* This data point is from readings over the past week. The reported information should not be taken as an aggregate or cumulative value for any period beyond the most recent week (Sunday through Saturday). Appropriate alterations were made to account for both travel and time zone shifts.

Notes

RISK WARNING: Trading involves HIGH RISK and YOU CAN LOSE a lot of money. Do not risk any money you cannot afford to lose. Trading is not suitable for all investors. We are not registered investment advisors. We do not provide trading or investment advice. We provide research and education through the issuance of statistical information containing no expression of opinion as to the investment merits of a particular security. Information contained herein should not be considered a solicitation to buy or sell any security or engage in a particular investment strategy. Past performance is not necessarily indicative of future results. Links above include affiliate commission or referrals. I'm part of an affiliate network and I receive compensation from partnering websites.

Both of these trades hit if held until close -- 6 total units!

Both of these trades hit if held until close -- 6 total units! These PCS's were sold at $1.05/ea and were bought back at $0.20/ea -- THIS MEANS MY REALIZED GAIN WAS $!

These PCS's were sold at $1.05/ea and were bought back at $0.20/ea -- THIS MEANS MY REALIZED GAIN WAS $!