What In Tarnation

Oh Brother,

Is it just me or does it feel like the train is going off the tracks. It's almost as if we are witnessing a crash in slow motion. In my humble opinion, the recent bull cycle (Nov. '23 to Apr. '24) is over.

There are three major developments that have prompted a new phase of bearishness in the market. First, markets do not like uncertainty. There are a lot of unknowns surrounding the Israel-Iran conflict. More specifically, the world is uncertain if the tensions will boil over and lead to WW3. I would argue the chance of this is low, but not zero. It must be considered.

The next thorn in our side is inflation. Even though inflation has come down a large percentage relative to its cycle high, the final portion is proving the be sticky. The Fed has made it abundantly clear they will not be cutting rates until inflation drops lower. They would rather overdo it on their restrictive policies than quit too early. In fact, the main messaging from the last two weeks is that there is a possibility of getting no rate cuts this year if inflation doesn't subside. This persistent hawkish stance is putting downward pressure on the market.

Finally, we have earnings. Some of the earliest reporting companies were within the financial sector. To be fair, they were pretty solid. Most major banks beat Wall Street's expectations. Unfortunately, the trend didn't continue. The next batch of pivotal earnings reports related to semiconductors -- Think AI, datacenters, and crypto. The popularity of this industry is a large component of the recent multi-month bull trend. The related earnings we have thus far are suggesting the hype might be waning. If tech falls, look for the entire market to follow suit.

TLDR: Buckle up, buttercup! The easy ride in the market is over. Things are about to get crazy. This isn't a time to panic. This is a time to stay calm and get prepared. Opportunity is just around the corner -- Don't miss out!

Until Next Time,

Thicc Kohrs

P.S. The official Goonie Discord is live! (FREE Access w/ code GOONIE: https://bit.ly/GoonieGroup)

Market Events

Monday, Apr. 22nd

None

Tuesday, Apr. 23rd

09:45 AM ET S&P Global US Manufacturing PMI (Mar)

09:45 AM ET S&P Global Services PMI (Mar)

10:00 AM ET New Home Sales (Mar)

Wednesday, Apr. 24th

08:30 AM ET Durable Goods Orders (MoM) (Mar)

10:30 AM ET Crude Oil Inventories

Thursday, Apr. 25th

08:30 AM ET Initial Jobless Claims

08:30 AM ET GDP (QoQ) (Q1)

10:00 AM ET Pending Home Sales (Mar)

Friday, Apr. 26th

08:30 AM ET PCE Price Index (YoY)

08:30 AM ET PCE Price Index (MoM)

08:30 AM ET Personal Income

08:30 AM ET Personal Spending

10:00 AM ET Consumer Sentiment (Apr)

Upcoming Earnings

Monday

Morning: Verizon

Evening: SAP

Tuesday

Morning: General Electric, General Motors, Halliburton, JetBlue, Lockheed, Pepsi, Spotify & UPS

Evening: Tesla & Visa

Wednesday

Morning: AT&T & Boeing

Evening: Chipotle, Ford & IBM

Thursday

Morning: American Airlines, Caterpillar, Royal Caribbean & Southwest

Evening: Alphabet (Google), Intel, Roku & Snap

Friday

Morning: Abbvie, Chevron & Exxon Mobil

Seasonality Update

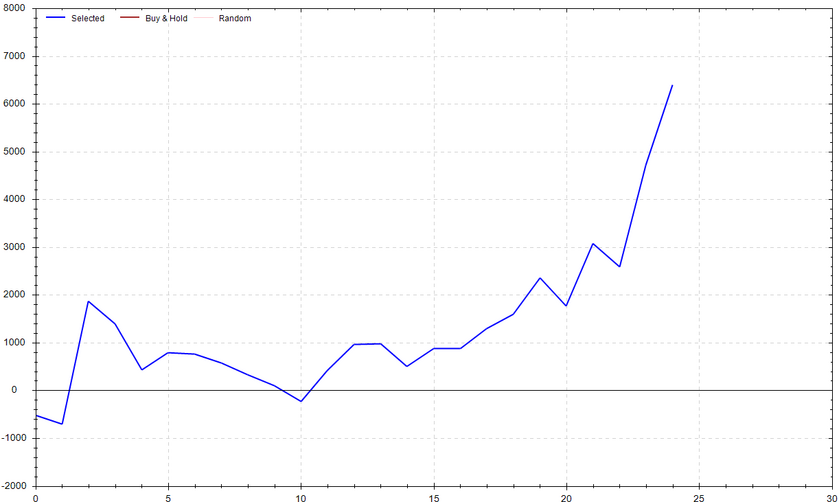

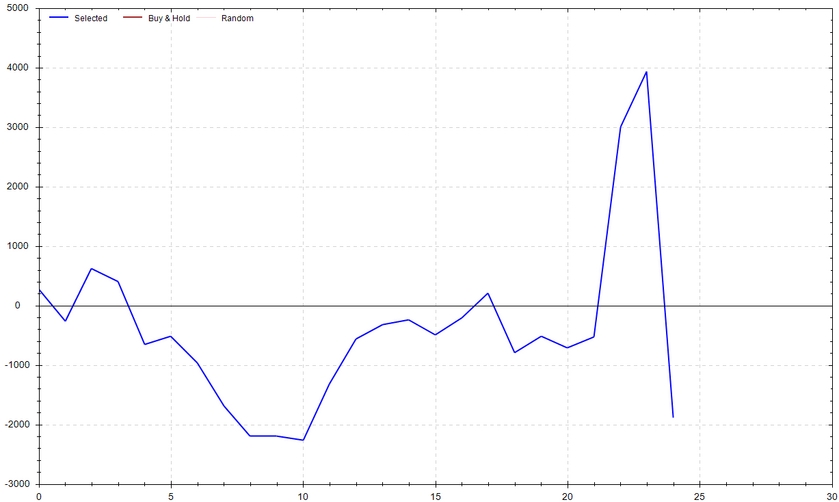

S&P 500 Seasonal Bias (Monday, Apr. 22nd)

- Bull Win Percentage: 48%

- Profit Factor: 2.36

- Bias: Bullish

Equity Curve -->

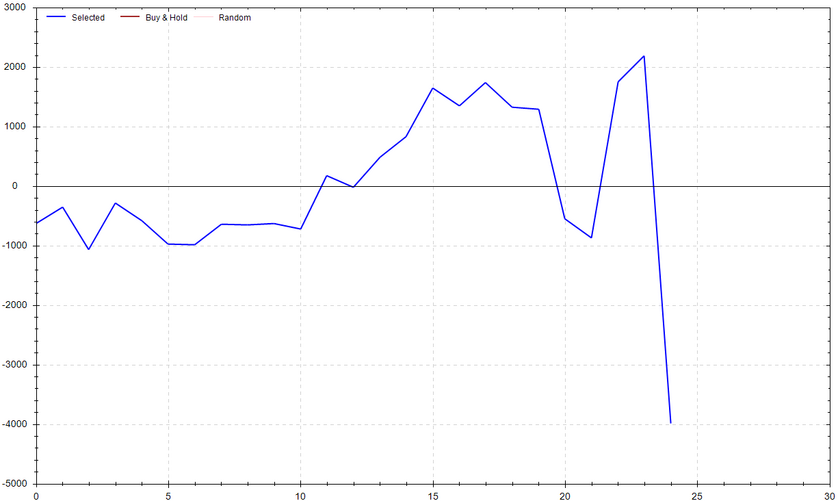

S&P 500 Seasonal Bias (Tuesday, Apr. 23rd)

- Bull Win Percentage: 44%

- Profit Factor: 0.65

- Bias: Neutral

Equity Curve -->

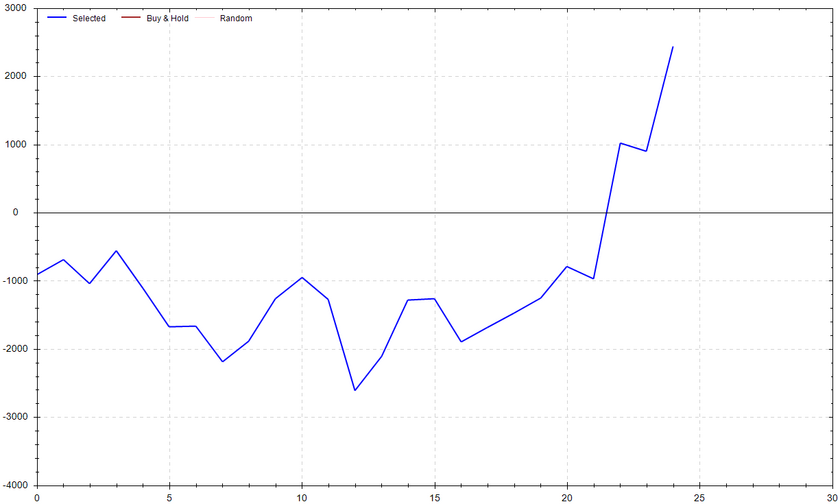

S&P 500 Seasonal Bias (Wednesday, Apr. 24th)

- Bull Win Percentage: 60%

- Profit Factor: 1.44

- Bias: Leaning Bullish

Equity Curve -->

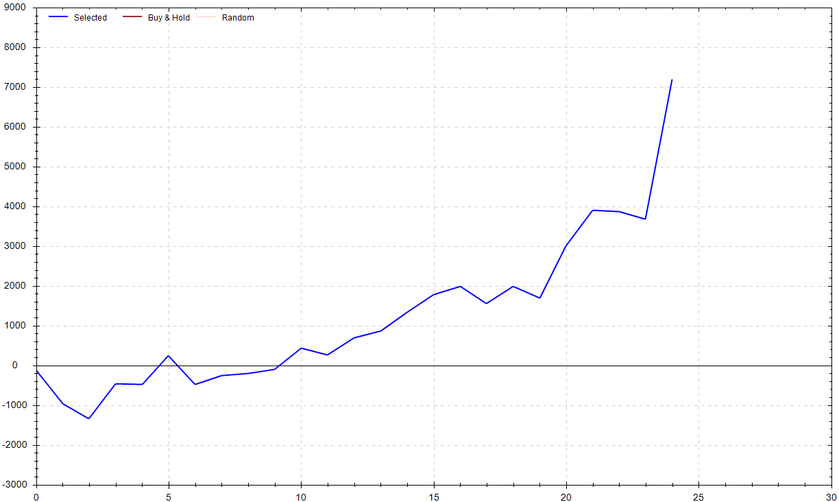

S&P 500 Seasonal Bias (Thursday, Apr. 25th)

- Bull Win Percentage: 60%

- Profit Factor: 3.27

- Bias: Bullish

Equity Curve -->

S&P 500 Seasonal Bias (Friday, Apr. 26th)

- Bull Win Percentage: 52%

- Profit Factor: 0.83

- Bias: Neutral

Equity Curve -->

Notes: These analytics are derived from the performance of the S&P 500 futures contract over the past 25 years. Additionally, results are computed from the futures market open and close.

Options Strategy Update

The 0 DTE signal hit 8 for 8 times (12 for 12 total units) this past week.

Signal Accuracy: ~100%

Back to perfection, baby! Time to see if the good times keep rolling!!!

Piper's Current Signal Streak: 10 Trades

April Record: 35/42 Units

Monday Apr. 15th

SPY Call Credit Spread (1x Multiple @ $517 / $518) 🟢

QQQ Call Credit Spread (1x Multiple @ $444 / $445) 🟢

Tuesday Apr. 16th

SPY Call Credit Spread (2x Multiple @ $506 / $507) 🟢

QQQ Call Credit Spread (2x Multiple @ $434 / $435) 🟢

Wednesday Apr. 17th

SPY Call Credit Spread (2x Multiple @ $507 / $508) 🟢

QQQ Call Credit Spread (2x Multiple @ $434 / $435) 🟢

Thursday Apr. 18th

No Signal Generated

Friday Apr. 19th

SPY Call Credit Spread (1x Multiple @ $501 / $502) 🟢

QQQ Call Credit Spread (1x Multiple @ $423 / $424) 🟢

Piper Assaults on Me While Sleeping At 3am

42.8 *

* This data point is from readings over the past week. The reported information should not be taken as an aggregate or cumulative value for any period beyond the most recent week (Sunday through Saturday). Appropriate alterations were made to account for both travel and time zone shifts.

Notes

RISK WARNING: Trading involves HIGH RISK and YOU CAN LOSE a lot of money. Do not risk any money you cannot afford to lose. Trading is not suitable for all investors. We are not registered investment advisors. We do not provide trading or investment advice. We provide research and education through the issuance of statistical information containing no expression of opinion as to the investment merits of a particular security. Information contained herein should not be considered a solicitation to buy or sell any security or engage in a particular investment strategy. Past performance is not necessarily indicative of future results. Links above include affiliate commission or referrals. I'm part of an affiliate network and I receive compensation from partnering websites.

Both of these trades hit if held until close -- 6 total units!

Both of these trades hit if held until close -- 6 total units! These PCS's were sold at $1.05/ea and were bought back at $0.20/ea -- THIS MEANS MY REALIZED GAIN WAS $!

These PCS's were sold at $1.05/ea and were bought back at $0.20/ea -- THIS MEANS MY REALIZED GAIN WAS $!