New Highs, FTW!

Talk about deja vu. Inflation is ripping higher, the government is adding debt at a record rate, and the economy is starting to show serious cracks. Don't worry though! The stock market just hit another new all-time high. This seemingly illogical situation has been the story of the market since 2020 -- We've totally been here before.

I fully appreciate that this combination seems contradictory, but it's actually not. When the economy gets rough, the Fed loves to print money to battle the situation. This increase in money supply causes inflation to pump higher, which can be directly felt through the devaluation of the dollar. Here's a fun fact for you! In the past 3 years, the cumulative inflation rate is roughly 20%. This means in only 3 years, your dollar lost 1/5 of its purchasing power. Congrats!

Anyway, the stock market isn't much different. When the entire system has more money, it gets poured into assets such as stocks, real estate, etc. This drives nominal prices higher, but the increase doesn't necessarily outpace inflation. In more direct terms, a company with a $1B market cap a decade ago was more valuable than a company with the same market cap now. Stocks are rarely, if ever, discussed in an inflation adjusted manner. If they were, it would become apparent that we aren't at a new high when you consider the dollar's devaluation.

What does this mean for you trading? To be honest, not much. Your trading will be better if you understand what's happening and what's prompting the moves, but your goal is the same. As an active trader, you want to accept minimal risk while attempting to capture the "meat of the move." We live in the world of smaller timeframes. The world of investing would be much more concerned with how the macroeconomic backdrop will look decades out in the future. There is a time and place for both, but please don't fall into the trap of conflating the two. Trading is a game of reaction while investing is a game of prediction.

Everything you need to know about the upcoming week is posted below. Godspeed!

Later, Skater!

Thicc Kohrs

P.S. The official Goonie Discord is live! (FREE Access w/ code GOONIE: https://bit.ly/GoonieGroup)

Market Events

Monday, May 27th

ALL DAY Market Closed for Memorial Day

Tuesday, May 28th

09:55 AM ET Minneapolis Fed President Neel Kashkari Speaks

10:00 AM ET CB Consumer Confidence (May)

01:00 PM ET Fed Gov. Cook & Fed President Daly Speak

Wednesday, May 29th

01:45 PM ET New York Fed President John Williams Speaks

02:00 PM ET Fed Beige Book

07:00 PM ET Atlanta Fed President Raphael Bostic Speaks

Thursday, May 30th

08:30 AM ET GDP (QoQ) (Q1)

08:30 AM ET Initial Jobless Claims

10:00 AM ET Pending Home Sales

12:05 PM ET New York Fed President John Williams Speaks

05:00 PM ET Dallas Fed President Lorie Logan Speaks

Friday, May 31st

05:00 AM ET Eurozone CPI (YoY) (May)

08:30 AM ET PCE Price Index (MoM) (Apr)

08:30 AM ET PCE Price Index (YoY) (Apr)

08:30 AM ET Personal Income (Apr)

08:30 AM ET Personal Spending (Apr)

09:45 AM ET Chicago PMI (May)

Upcoming Earnings

Monday

None

Tuesday

Evening: Cava

Wednesday

Morning: Advanced Auto Parts, Chewy & Dick's

Evening: C3.AI & Salesforce

Thursday

Morning: Best Buy, Canopy Growth, Foot Locker & Kohl's

Evening: Costco, Dell & Ulta

Friday

None

Seasonality Update

S&P 500 Seasonal Bias (Monday, May 27th)

- MARKET CLOSED

S&P 500 Seasonal Bias (Tuesday, May 28th)

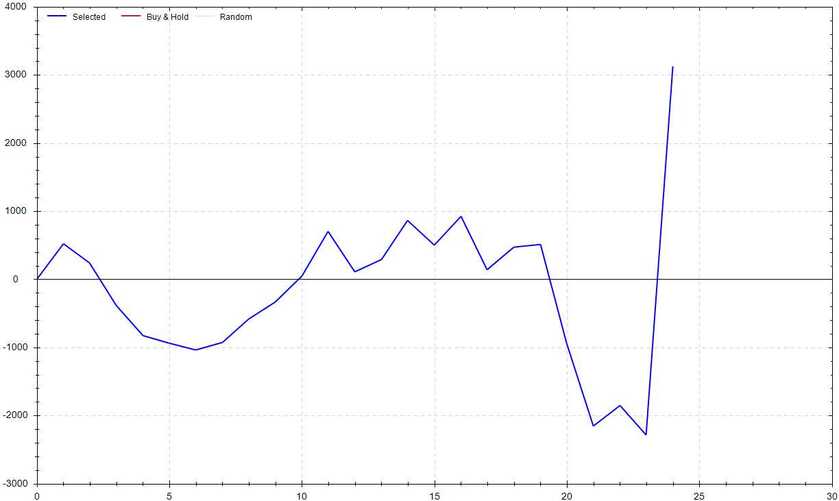

- Bull Win Percentage: 68%

- Profit Factor: 2.17

- Bias: Bullish

Equity Curve -->

S&P 500 Seasonal Bias (Wednesday, May 29th)

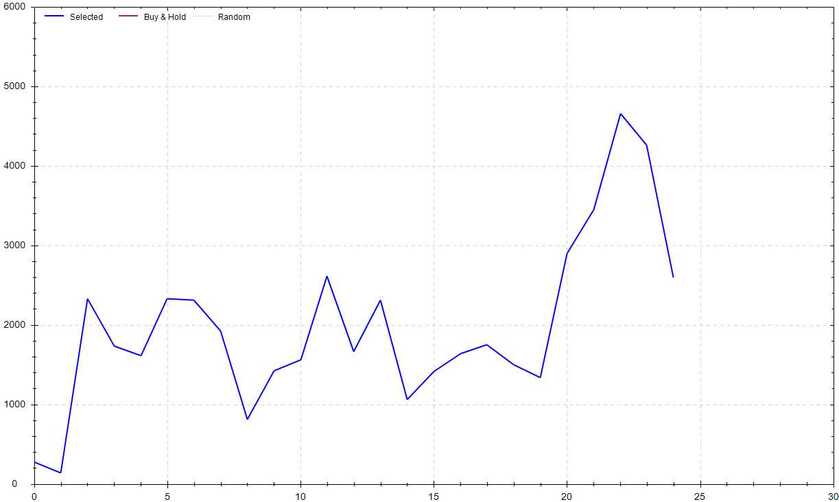

- Bull Win Percentage: 52%

- Profit Factor: 1.49

- Bias: Neutral

Equity Curve -->

S&P 500 Seasonal Bias (Thursday, May 30th)

- Bull Win Percentage: 52%

- Profit Factor: 1.37

- Bias: Leaning Bullish

Equity Curve -->

S&P 500 Seasonal Bias (Friday, May 31st)

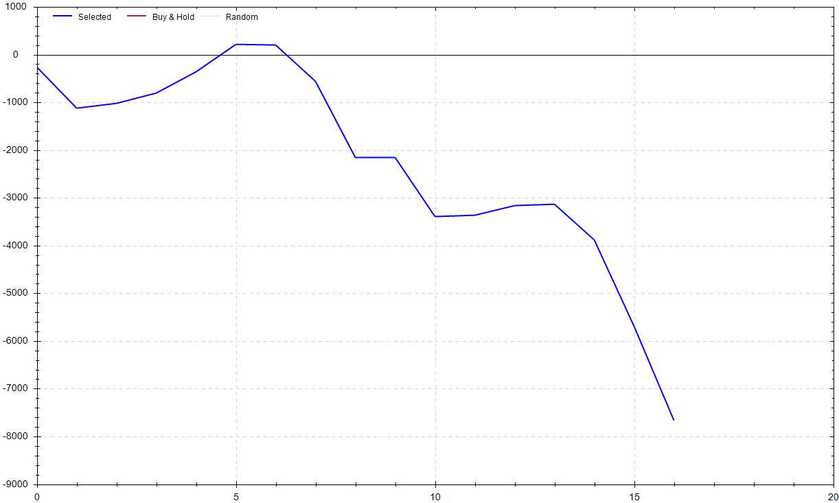

- Bull Win Percentage: 47%

- Profit Factor: 0.17

- Bias: Bearish

Equity Curve -->

Notes: These analytics are derived from the performance of the S&P 500 futures contract over the past 25 years. Additionally, results are computed from the futures market open and close.

Options Strategy Update

The 0 DTE signal hit 6 for 8 times (11 for 13 total units) this past week.

Signal Accuracy: ~75%

It goes without saying I prefer when Piper bats one thousand, but I'm still happy with the recent performance. The accuracy was slightly low, but the losing day was the minimum unit sizing. Things are slowly chugging along as we wait for the return of volatility -- That's when the market will become more interesting and (hopefully) even more profitable.

Piper's Current Signal Streak: 2 Trades

May Record: 36/40 Units

Monday May 20th

SPY Put Credit Spread (2x Multiple @ $529 / $528) 🟢

QQQ Put Credit Spread (3x Multiple @ $451 / $450) 🟢

Tuesday May 21st

No Signal Generated

Wednesday May 22nd

SPY Put Credit Spread (2x Multiple @ $530 / $529) 🟢

QQQ Put Credit Spread (2x Multiple @ $455 / $454) 🟢

Thursday May 23rd

SPY Put Credit Spread (1x Multiple @ $528 / $527) 🔴

QQQ Put Credit Spread (1x Multiple @ $456 / $455) 🔴

Friday May 24th

SPY Put Credit Spread (1x Multiple @ $526 / $525) 🟢

QQQ Put Credit Spread (1x Multiple @ $454 / $453) 🟢

Times I Got Severely Burned on The Beach

1 (Singular occurrence but it's still enough to make me look like a lobster) *

* This data point is from readings over the past week. The reported information should not be taken as an aggregate or cumulative value for any period beyond the most recent week (Sunday through Saturday). Appropriate alterations were made to account for both travel and time zone shifts.

Notes

RISK WARNING: Trading involves HIGH RISK and YOU CAN LOSE a lot of money. Do not risk any money you cannot afford to lose. Trading is not suitable for all investors. We are not registered investment advisors. We do not provide trading or investment advice. We provide research and education through the issuance of statistical information containing no expression of opinion as to the investment merits of a particular security. Information contained herein should not be considered a solicitation to buy or sell any security or engage in a particular investment strategy. Past performance is not necessarily indicative of future results. Links above include affiliate commission or referrals. I'm part of an affiliate network and I receive compensation from partnering websites.

Both of these trades hit if held until close -- 6 total units!

Both of these trades hit if held until close -- 6 total units! These PCS's were sold at $1.05/ea and were bought back at $0.20/ea -- THIS MEANS MY REALIZED GAIN WAS $!

These PCS's were sold at $1.05/ea and were bought back at $0.20/ea -- THIS MEANS MY REALIZED GAIN WAS $!