Round & Round We Go!!!

Howdy,

In darkness, we found light!

The shortened trading week was notably bearish. Well, that was true until the final hour. The entire trading week was defined by lower highs and lower lows -- A classic downward trend. The bears dominated until Friday's power hour. We may never know exactly why, but prcies finally got low enough for the market to buy the dip and with massive size. I hope you caught both sides of the trade, or at minimum, avoided the whipsaw.

Looking ahead, I'm very excited. After months of quietness, volatility is finally returning to the system. This means there should be an abundance of opportunity. Volatility is on the rise, political turmoil is at a new level, and we have myriad on macroeconomic reports on deck. If you're on the correct side, large windfalls could easily be in your near future.

It should go without saying, but you don't need to be oversized to make good money. Your number one priority as a trader is to manage your risk. As ranges increase, you must be even more mindful of your risk. You may not believe me, but I promise you your profits will take care of themselves. The people who serve the gauntlet that is trading are the people who never let a singular trade put them in risk of ending their career. You should be in this game for the law of large numbers. You need to survive long enough to see your edge crystalize -- Never forget that!

All the pertinent information for the upcoming week is detailed below. Godspeed.

Stay Liquid,

Thicc Kohrs

P.S. The official Goonie Discord is live! (FREE Access w/ code GOONIE: https://bit.ly/GoonieGroup)

Market Events

Monday, June 3rd

09:45 AM ET S&P Global US Manufacturing PMI (May)

10:00 AM ET ISM Manufacturing PMI (May)

10:00 AM ET ISM Manufacturing Prices (May)

Tuesday, June 4th

10:00 AM ET JOLTs Job Openings (Apr)

Wednesday, June 5th

08:15 AM ET ADP Nonfarm Employment Change (May)

09:45 AM ET S&P Global US Services PMI (May)

10:00 AM ET ISM Non-Manufacturing PMI (May)

10:00 AM ET ISM Non-Manufacturing Prices (May)

Thursday, June 6th

08:30 AM ET ECB Interest Rate Decision (June)

08:30 AM ET Initial Jobless Claims

08:30 AM ET ECB Press Conference

Friday, June 7th

08:30 AM ET Unemployment Report (May)

08:30 AM ET Nonfarm Payrolls (May)

08:30 AM ET Avg. Hour Earnings (MoM) (May)

03:00 PM ET Consumer Credit (May)

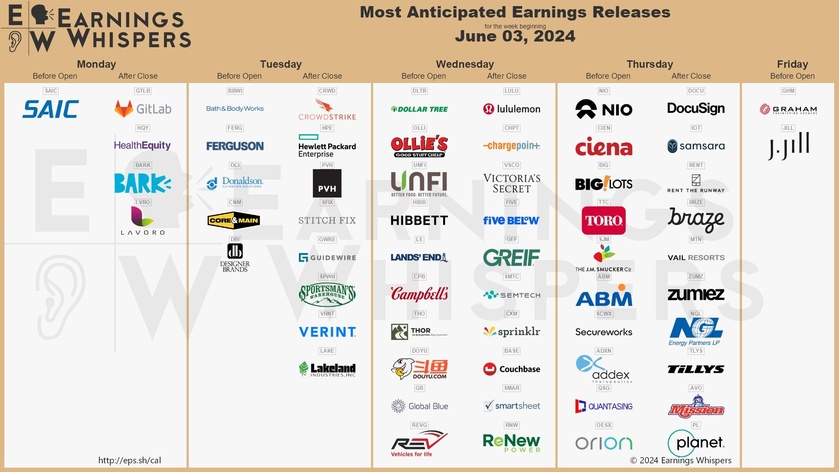

Upcoming Earnings

Monday

Evening: GitLab

Tuesday

Morning: Bath & Body Works

Evening: CrowdStrike

Wednesday

Morning: Dollar Tre

Evening: ChargePoint, Five Below & Lululemon

Thursday

Morning: Nio

Evening: DocuSign

Friday

None

Seasonality Update

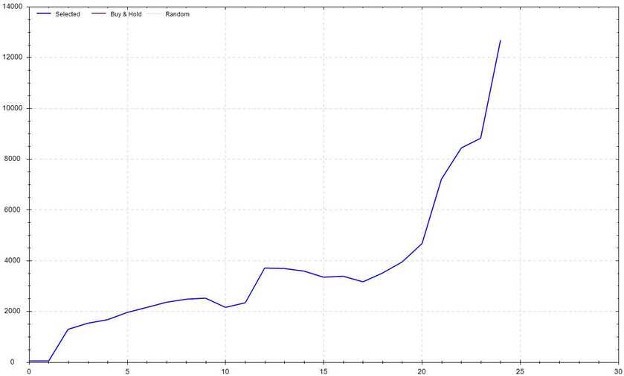

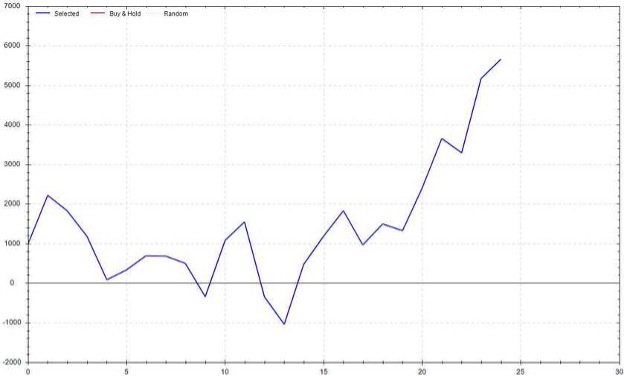

S&P 500 Seasonal Bias (Monday, June 3rd)

- Bull Win Percentage: 76%

- Profit Factor: 1.27

- Bias: Leaning Bullish

Equity Curve -->

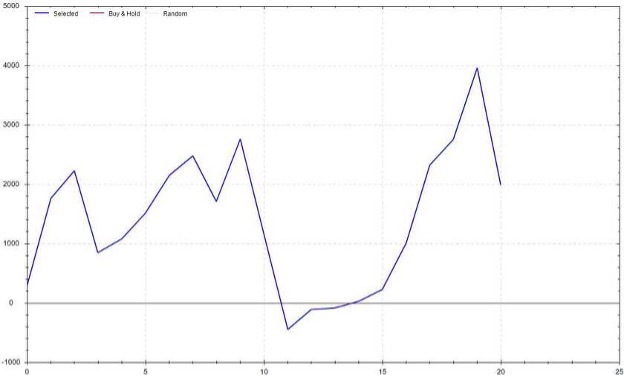

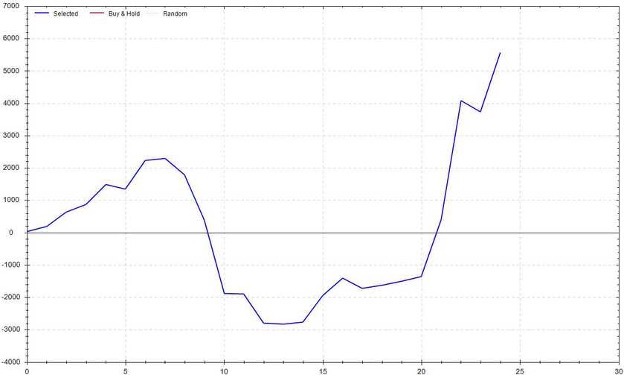

S&P 500 Seasonal Bias (Tuesday, June 4th)

- Bull Win Percentage: 80%

- Profit Factor: 14.53

- Bias: VERY BULLISH

Equity Curve -->

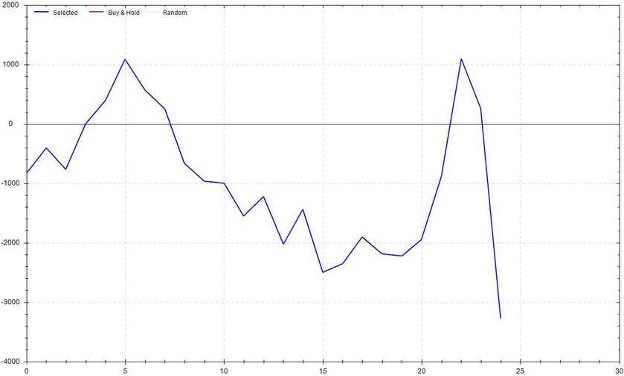

S&P 500 Seasonal Bias (Wednesday, June 5th)

- Bull Win Percentage: 44%

- Profit Factor: 0.69

- Bias: Leaning Bearish

Equity Curve -->

S&P 500 Seasonal Bias (Thursday, June 6th)

- Bull Win Percentage: 56%

- Profit Factor: 1.79

- Bias: Leaning Bullish

Equity Curve -->

S&P 500 Seasonal Bias (Friday, June 7th)

- Bull Win Percentage: 64%

- Profit Factor: 1.94

- Bias: Bullish

Equity Curve -->

Notes: These analytics are derived from the performance of the S&P 500 futures contract over the past 25 years. Additionally, results are computed from the futures market open and close.

Options Strategy Update

The 0 DTE signal hit 7 for 8 times (12 for 13 total units) this past week.

Signal Accuracy: ~87.5%

Close, but no cigar! Piper was 1 hour away from having a perfect week. The power hour push tilted Piper's SPY prediction. Beyond that, Piper was dominant. It's a bit of a slow burn, but the new premium scalping strategy is coming along nicely. The last two weeks have come along swimmingly. I'm happy with the current trajectory. When it's finalized, I'll start reporting the results within the newsletter.

Piper's Current Signal Streak: 1 Trades

May Record: 48/53 Units

Monday May 27th

Market Closed

Tuesday May 28th

SPY Put Credit Spread (1x Multiple @ $528 / $527) 🟢

QQQ Put Credit Spread (1x Multiple @ $456 / $455) 🟢

Wednesday May 29th

SPY Call Credit Spread (2x Multiple @ $528 / $529) 🟢

QQQ Call Credit Spread (2x Multiple @ $459 / $460) 🟢

Thursday May 30th

SPY Call Credit Spread (2x Multiple @ $526 / $527) 🟢

QQQ Call Credit Spread (2x Multiple @ $456 / $457) 🟢

Friday May 31st

SPY Call Credit Spread (1x Multiple @ $526 / $527) 🔴

QQQ Call Credit Spread (2x Multiple @ $453 / $454) 🟢

Bouts of Crying on The Stair Stepper

36 *

* This data point is from readings over the past week. The reported information should not be taken as an aggregate or cumulative value for any period beyond the most recent week (Sunday through Saturday). Appropriate alterations were made to account for both travel and time zone shifts.

Notes

RISK WARNING: Trading involves HIGH RISK and YOU CAN LOSE a lot of money. Do not risk any money you cannot afford to lose. Trading is not suitable for all investors. We are not registered investment advisors. We do not provide trading or investment advice. We provide research and education through the issuance of statistical information containing no expression of opinion as to the investment merits of a particular security. Information contained herein should not be considered a solicitation to buy or sell any security or engage in a particular investment strategy. Past performance is not necessarily indicative of future results. Links above include affiliate commission or referrals. I'm part of an affiliate network and I receive compensation from partnering websites.

Both of these trades hit if held until close -- 6 total units!

Both of these trades hit if held until close -- 6 total units! These PCS's were sold at $1.05/ea and were bought back at $0.20/ea -- THIS MEANS MY REALIZED GAIN WAS $!

These PCS's were sold at $1.05/ea and were bought back at $0.20/ea -- THIS MEANS MY REALIZED GAIN WAS $!