Stonkman

Hey,

What a time to be a degenerate trader! The market is ripping to new highs, crypto is pushing, and the meme stonk saga is unrelenting. The market is offering incredible opportunity. I truly hope you're crushing it!

This upcoming week is going to be a wild one. I'm extremely confident there will be numerous chances to take advantage of heightened volatility. All the related details are highlighted below, but there are seemingly endless macroeconomic reports. There are multiple inflation updates, impactful bond auctions, and there is a FOMC meeting. It would be remiss of me to not mention the party is much larger than the general market. Both crypto and meme stonks deserve extra attention on your watchlist.

With all the current craziness, don't forget to breathe. Do your best to approach the market in a calm, cool, and collected manner on a daily basis. Don't force trades. Don't oversize your plays. And for the love of God, don't fomo into a situation without a plan. Godspeed!

Smell Ya Later,

Thicc Kohrs

P.S. The official Goonie Discord is live! (FREE Access w/ code GOONIE: https://bit.ly/GoonieGroup)

Market Events

Monday, June 10th

None

Tuesday, June 11th

01:00 PM ET 10-Year Note Auction

Wednesday, June 12th

08:30 AM ET CPI (MoM) (May)

08:30 AM ET CPI (YoY) (May)

08:30 AM ET Initial Jobless Claims

10:30 AM ET Crude Oil Inventories

02:00 PM ET Fed Interest Rate Decision

02:30 PM ET Fed Chair Powell Press Conference

Thursday, June 13th

08:30 AM ET PPI (YoY) (May)

08:30 AM ET PPI (MoM) (May)

08:30 AM ET Initial Jobless Claims

01:00 PM ET 30-Year Note Auction

Friday, June 14th

10:00 AM ET Consumer Sentiment (June)

11:00 AM ET Fed Monetary Policy Report (June)

Upcoming Earnings

Monday

None

Tuesday

Evening: Oracle

Wednesday

Evening: Broadcom

Thursday

Evening: Adobe

Friday

None

Seasonality Update

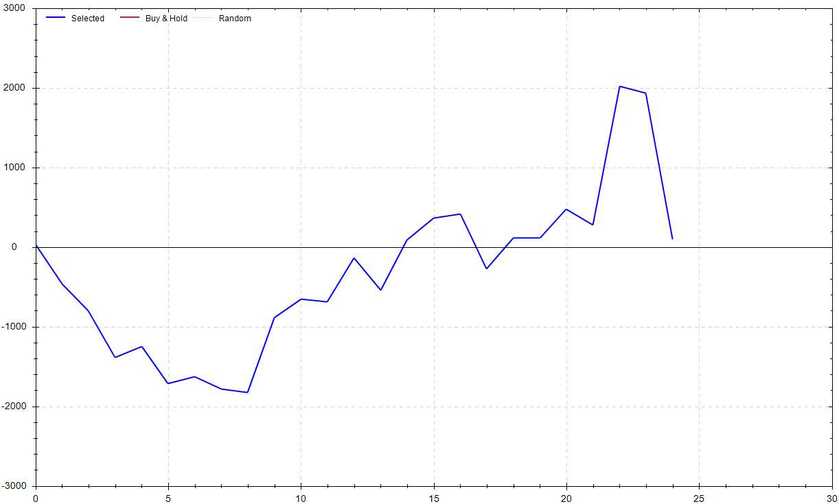

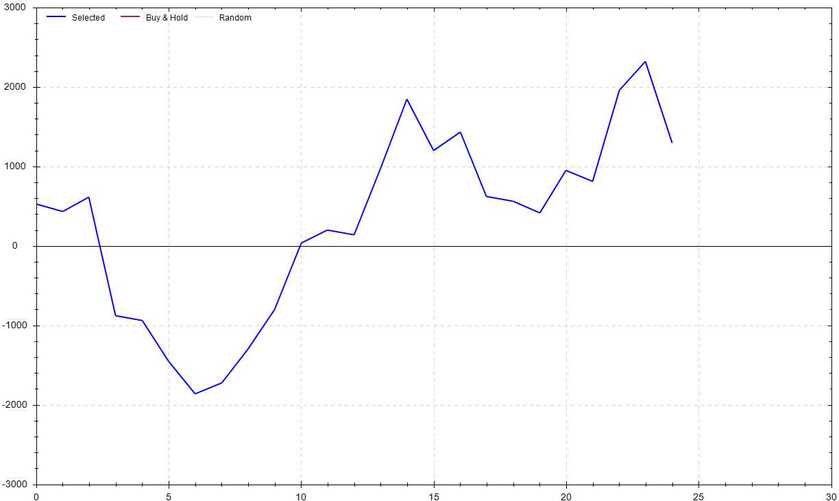

S&P 500 Seasonal Bias (Monday, June 10th)

- Bull Win Percentage: 48%

- Profit Factor: 1.02

- Bias: Neutral

Equity Curve -->

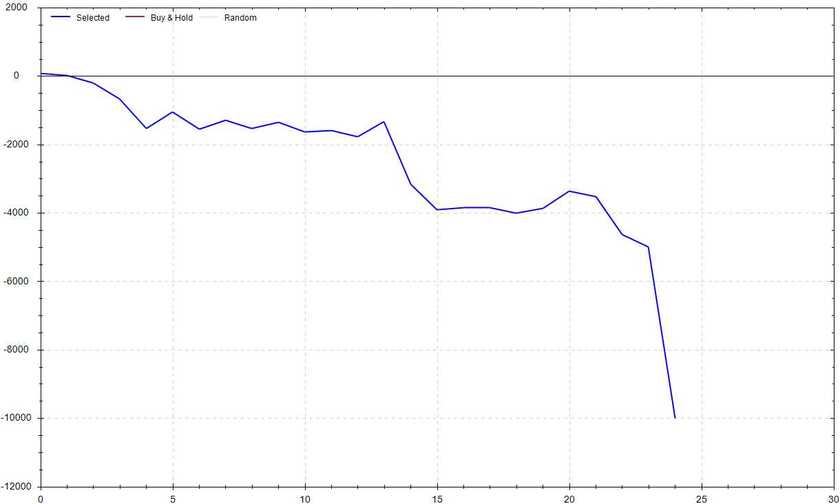

S&P 500 Seasonal Bias (Tuesday, June 11th)

- Bull Win Percentage: 36%

- Profit Factor: 0.18

- Bias: Bearish

Equity Curve -->

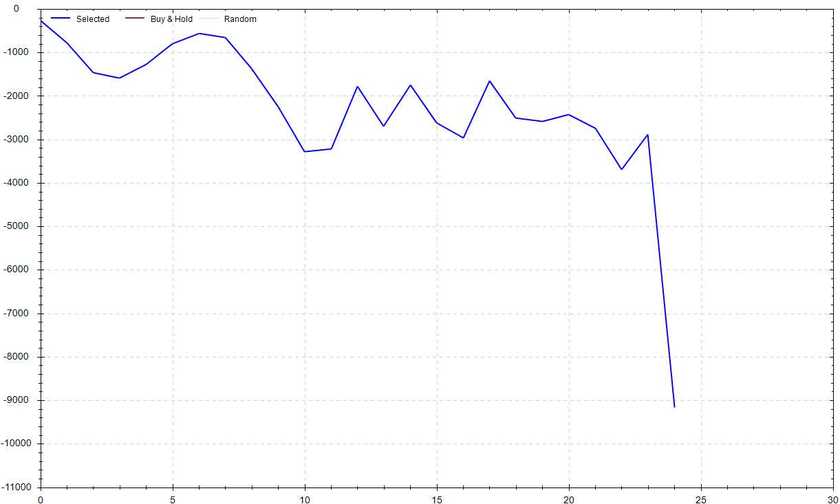

S&P 500 Seasonal Bias (Wednesday, June 12th)

- Bull Win Percentage: 36%

- Profit Factor: 0.39

- Bias: Bearish

Equity Curve -->

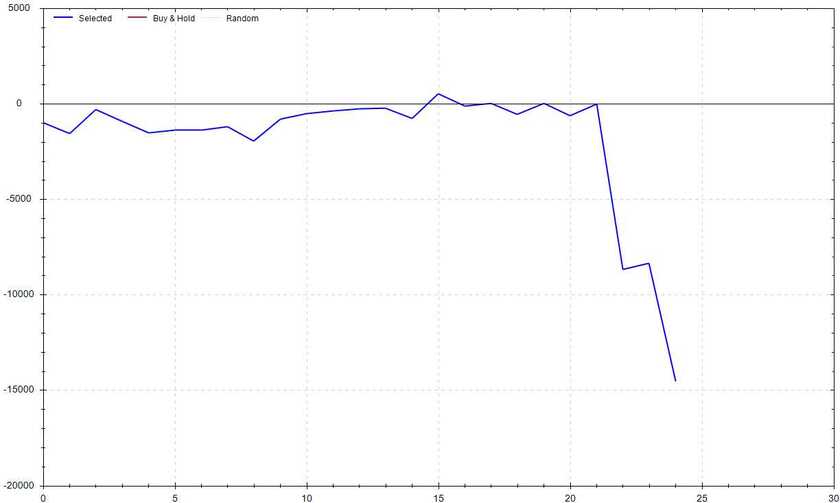

S&P 500 Seasonal Bias (Thursday, June 13th)

- Bull Win Percentage: 52%

- Profit Factor: 0.30

- Bias: Bearish

Equity Curve -->

S&P 500 Seasonal Bias (Friday, June 14th)

- Bull Win Percentage: 52%

- Profit Factor: 1.24

- Bias: Leaning Bullish

Equity Curve -->

Notes: These analytics are derived from the performance of the S&P 500 futures contract over the past 25 years. Additionally, results are computed from the futures market open and close.

Options Strategy Update

The 0 DTE signal hit 8 for 8 times (16 for 16 total units) this past week.

Signal Accuracy: ~100%

Absolute perfection -- I hope you got yours!!!

Piper's Current Signal Streak: 9 Trades

June Record: 16/16 Units

Monday June 3rd

SPY Put Credit Spread (2x Multiple @ $526 / $525) 🟢

QQQ Put Credit Spread (2x Multiple @ $452 / $451) 🟢

Tuesday June 4th

No Signal Generated

Wednesday June 5th

SPY Put Credit Spread (2x Multiple @ $528 / $527) 🟢

QQQ Put Credit Spread (2x Multiple @ $456 / $455) 🟢

Thursday June 6th

SPY Put Credit Spread (2x Multiple @ $533 / $532) 🟢

QQQ Put Credit Spread (2x Multiple @ $461 / $460) 🟢

Friday June 7th

SPY Put Credit Spread (2x Multiple @ $532 / $531) 🟢

QQQ Put Credit Spread (2x Multiple @ $461 / $460) 🟢

Times I Ate At Texas Roadhouse In Texas

1 * (Not high volume, but it was life-changing)

* This data point is from readings over the past week. The reported information should not be taken as an aggregate or cumulative value for any period beyond the most recent week (Sunday through Saturday). Appropriate alterations were made to account for both travel and time zone shifts.

Notes

RISK WARNING: Trading involves HIGH RISK and YOU CAN LOSE a lot of money. Do not risk any money you cannot afford to lose. Trading is not suitable for all investors. We are not registered investment advisors. We do not provide trading or investment advice. We provide research and education through the issuance of statistical information containing no expression of opinion as to the investment merits of a particular security. Information contained herein should not be considered a solicitation to buy or sell any security or engage in a particular investment strategy. Past performance is not necessarily indicative of future results. Links above include affiliate commission or referrals. I'm part of an affiliate network and I receive compensation from partnering websites.

Both of these trades hit if held until close -- 6 total units!

Both of these trades hit if held until close -- 6 total units! These PCS's were sold at $1.05/ea and were bought back at $0.20/ea -- THIS MEANS MY REALIZED GAIN WAS $!

These PCS's were sold at $1.05/ea and were bought back at $0.20/ea -- THIS MEANS MY REALIZED GAIN WAS $!