Brutal Monday

TODAY'S GAIN: +$275

My posted, REAL-TIME TRADES WERE TRASH! Today's trades would have paid for MORE THAN FIVE MONTHS OF GOONIE DISCORD ACCESS! With the being said, my execution today was garbage. The details are showcased below, but it was horrendous. I got lucky -- Hopefully, I can improve tomorrow.

You can join the Goonie Discord for FREE w/ code GOONIE (Click Here!)

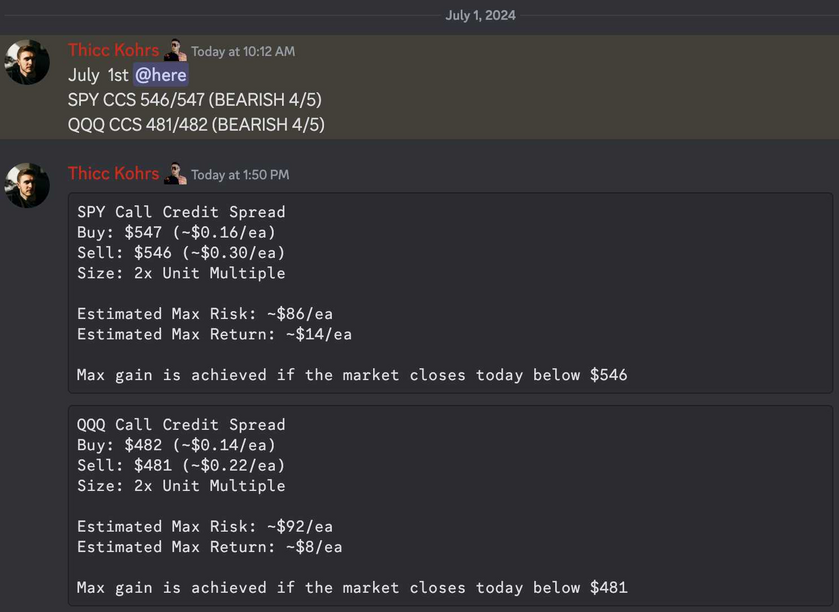

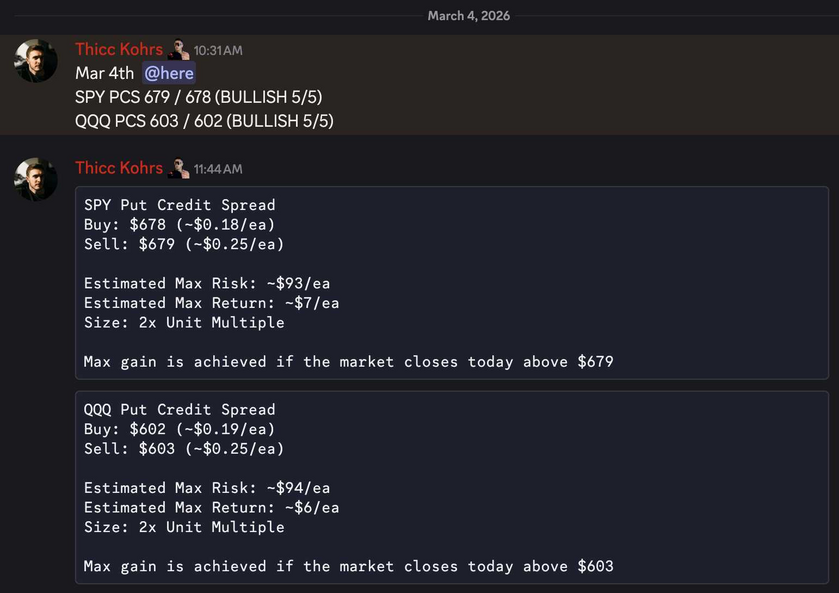

Piper's Picks

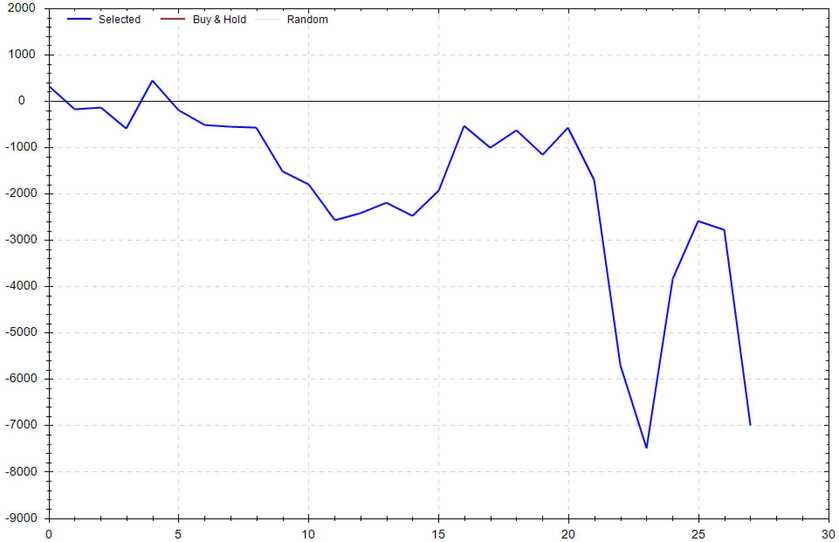

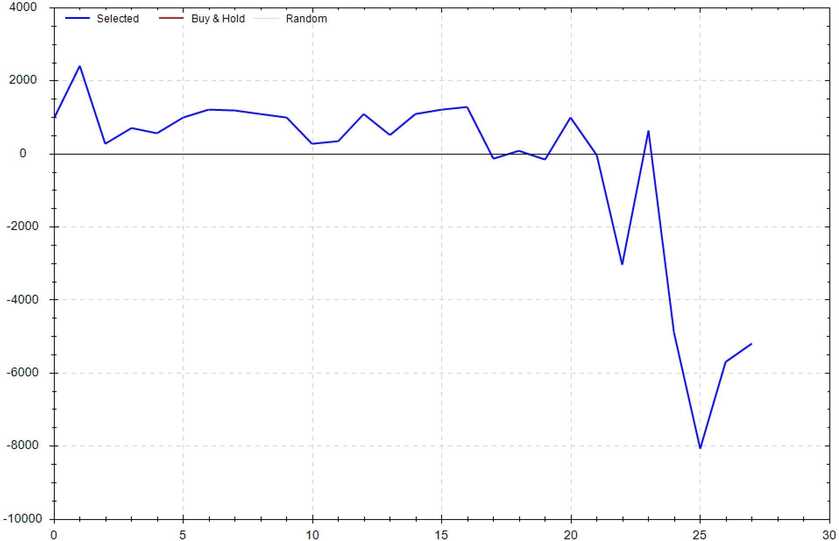

A BEARISH signal, 4/5 strength, was generated at 10:12am ET by Piper. The signal was used with various advanced options strategies to score (don't worry, I'll teach you every aspect of the strategy).

One trade hit and the other did not -- One for two.

SPY Return: +$28 (+100%) per $172 signal cost

QQQ Return: -$168 per $184 signal cost

Total Return: -$140

Thicc Matt's Personal Trades

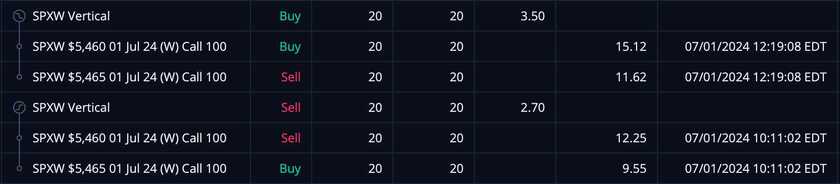

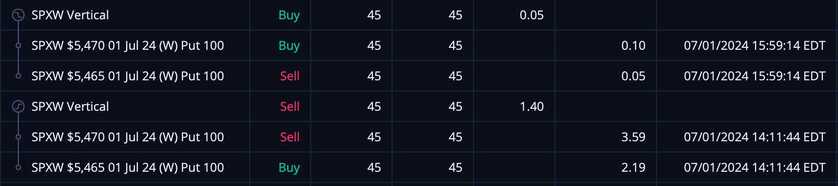

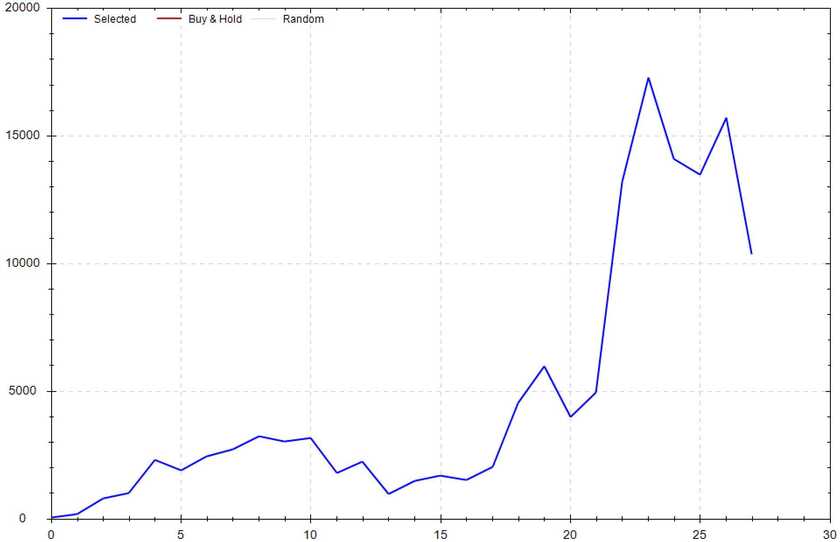

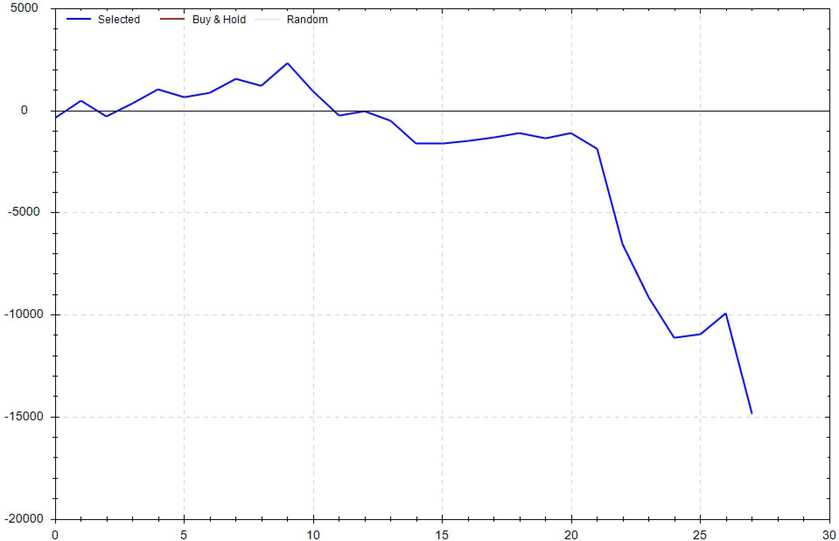

Trade One: 20 x SPX 5460/5465 Call Credit Spread (Scalp Strategy Trade)

I really liked the setup of this trade, which is why I erroneously traded double the size I should have. For a solid hour, I was sitting on a nice unrealized profit. I got too greedy and overstayed my welcome. When it turned against me, I quickly cut the position and started to mentally spiral. The exit was at $3.50 from a $2.70/ea entry -- The realized loss was $1,600.

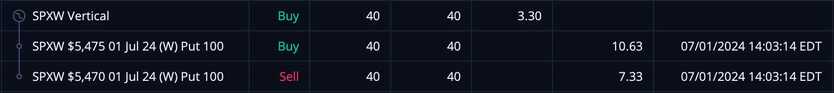

Trade Two: 40 x SPX 5475/5470 Put Credit Spread (Revenge Trade)

Instead of being calm, cool and collected, I decided I should go on tilt by revenge trading. Due to my first trade being too much size, I made the stupid, undisciplined move to double down and fire from the hit. It ended horribly as you might have guessed. The exit was at $3.30 from a $2.25/ea entry -- The realized loss was $4,200.

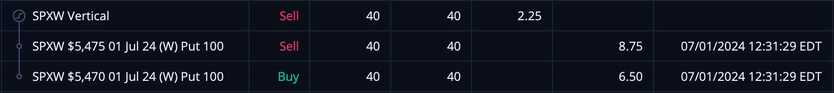

Trade Three: 45 x SPX 5470/5465 Put Credit Spread (FULL TILT Trade)

I'm not really sure what to say. I got lucky. I want to be clear -- THIS WAS NOT A GOOD TRADE. THIS WAS NOT A GOOD TRADING DAY. I was on tilt. I was revenge trading. I took on too much risk. Fortunately for my account, I got lucky with the price movement at the end of the day. The exit was at $0.05 from a $1.40/ea entry -- The realized gain was $6,075.

I'm not really sure what to say. I got lucky. I want to be clear -- THIS WAS NOT A GOOD TRADE. THIS WAS NOT A GOOD TRADING DAY. I was on tilt. I was revenge trading. I took on too much risk. Fortunately for my account, I got lucky with the price movement at the end of the day. The exit was at $0.05 from a $1.40/ea entry -- The realized gain was $6,075.

Trade One Return: -$1,600

Trade Two Return: -$4,200

Trade Three Return: +$6,075

Total Return: +$275 (before fees)

These trades would have paid for MORE THAN FIVE MONTHS OF GOONIE MEMBERSHIP!!!

How To Join The Goonie Discord (For FREE)

Join the Goonie Discord if you want access to any of the following:

- My Live Trades & Thoughts

- Weekly Teaching Sessions

- Weekly Newsletter

- Trading Competitions

- Texas Roadhouse Talk

Remember you can join the Discord for FREE with the code GOONIE (Click Here!). This code will allow to become a Locals "supporter". Supporters get full access to the entire Locals Community & Goonie Discord server.

Discord Link: https://discord.gg/3dxBRVrgGG

(Allow up to 24hrs to process after you've become a "supporter". If you have any issues, don't hesitate to reach out -- Feel free to DM on Discord or Twitter.)

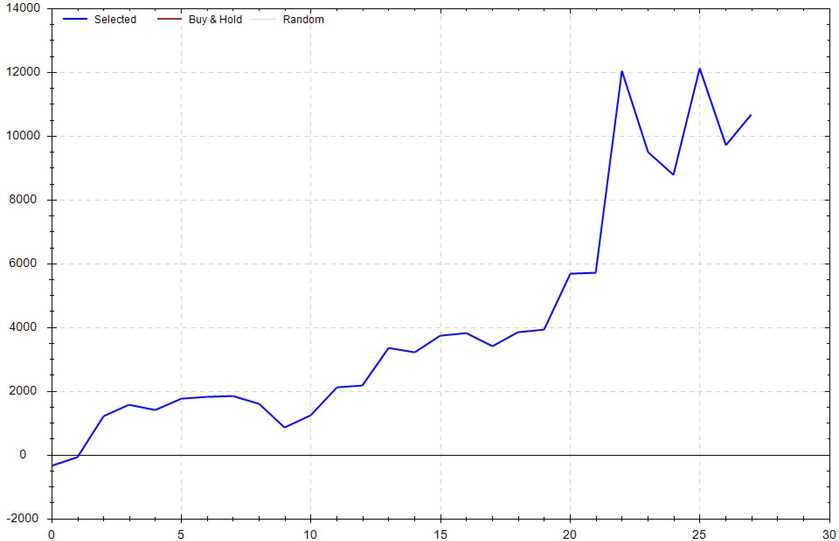

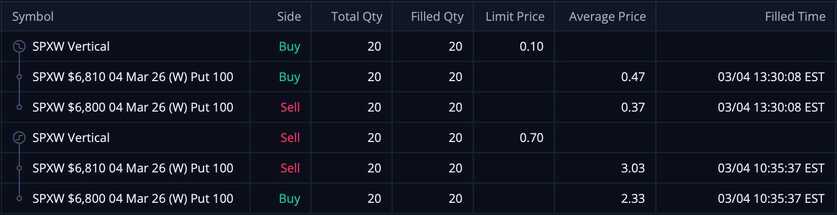

Both of these trades missed. Both of these trades hit if held until close -- 4 total units!

Both of these trades missed. Both of these trades hit if held until close -- 4 total units! These PCS's were sold at $0.70/ea and were bought back at $0.10/ea -- THIS MEANS MY REALIZED GAIN WAS $1,200!

These PCS's were sold at $0.70/ea and were bought back at $0.10/ea -- THIS MEANS MY REALIZED GAIN WAS $1,200!