Don't @ Me, Bro

Fellow Degens,

In case you missed it, I was fortunate to have my best trade of the entire year this past week. I wrote a specialty newsletter to breakdown how I made a $50,000 trade -->

https://mattkohrs.locals.com/post/5880006/lfg-50-000-join-the-goonie-trading-discord-for-free

Key Weekly Performance Stats:

- S&P 500: -1.96% (New High)

- Nasdaq 100: -3.96%

- Russel 2000: +1.74%

- Bitcoin: +15.19%

I know it's strange to say this because the S&P 500 hit another new all-time high, but the market is finally taking a breather. All three of the major indexes, the SPY, QQQ & IWM, sold off into the conclusion of the week. In my honest opinion, this will eventually represent an amazing bullish swing opportunity. It's a tough prediction to callout when the bottom will occur, so extreme patience is a must. Have the discipline to wait for the selling aggression to stop and for buying aggression to start. This might not be your preferred methodology, but I'm a fan of waiting for the first close above the previous high to suggest a changing of the tides.

The market dynamic is clearly changing -- I'm more confident of that since we started discussing the concept two weeks ago. The Fed has made enough progress on inflation that a rate cut is all but imminent in September. This makes me highly interested in joining the bull camp on IWM & KRE. Small caps, especially smaller banks, should theoretically benefit from cheaper capital. As the remainder of July playouts out, I will be watching these potential plays like a hawk.

In a different corner of the market, crypto is starting to pump. My best estimation is that this is happening because the Mt. Gox situation is priced in, Germany has concluded its Bitcoin sale, and the likely next US President is clearly a crypto supporter. Bitcoin, and other correlated plays such as Coinbase, posted a phenomenal week. The sector is worth a place on your watchlist.

Your expectation should be nothing but fireworks over the new few weeks. There are fun times on the horizon. Be disciplined, stick to your plan, and trade what the market gives you. Godspeed.

Later Skater,

Thicc Kohrs

P.S. The official Goonie Discord is live! (FREE Access w/ code GOONIE: https://bit.ly/GoonieGroup)

Market Events

Monday, July 22nd

None

Tuesday, July 23rd

10:00 AM ET Existing Home Sales (Jun)

01:00 PM ET 2-Year Bond Auction

Wednesday, July 24th

09:45 AM ET S&P Global US Manufacturing PMI (Jul)

09:45 AM ET S&P Global Services PMI (Jul)

10:00 AM ET New Home Sales (Jun)

10:30 AM ET Crude Oil Inventories

01:00 PM ET 5-Year Bond Auction

Thursday, July 25th

08:30 AM ET GDP (QoQ) (Q2)

08:30 AM ET Initial Jobless Claims

08:30 AM ET Durable Goods Orders (MoM) (June)

01:00 PM ET 7-Year Bond Auction

Friday, July 26th

08:30 AM ET PCE Price Index

08:30 AM ET Personal Spending (Jun)

08:30 AM ET Personal Income (Jun)

10:00 AM ET Consumer Sentiment

Upcoming Earnings Monday, July 22nd

Monday, July 22nd

Morning: Verizon

Evening: SAP

Tuesday, July 23rd

Morning: Coca Cola, Comcast, GE, GM, Spotify & UPS

Evening: Alphabet, Capital One, Tesla & Visa

Wednesday, July 24th

Morning: AT&T

Evening: Chipotle, IBM & Ford

Thursday, July 25th

Morning: American Airlines & Southwest

Evening: Texas Roadhouse

Friday, July 26th

Morning: 3M

Seasonality Update

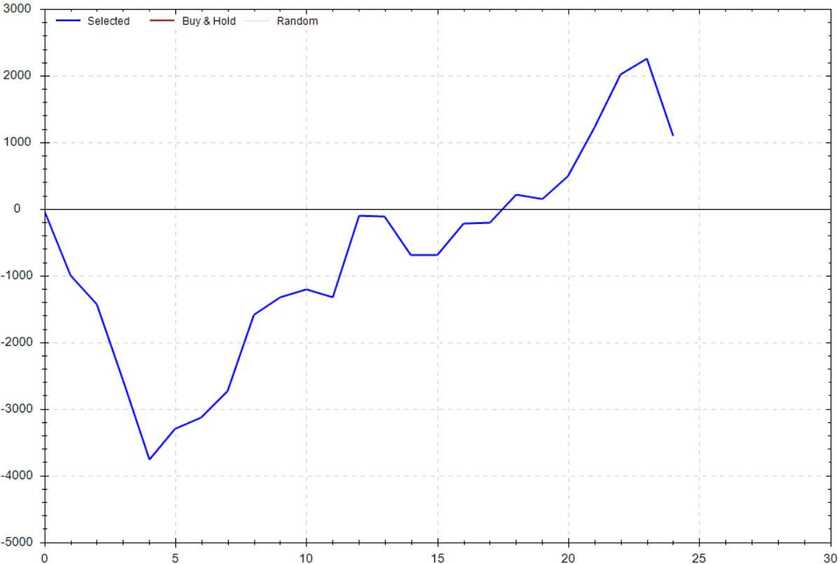

S&P 500 Seasonal Bias (Monday, July 22nd)

- Bull Win Percentage: 60%

- Profit Factor: 1.19

- Bias: Bullish

Equity Curve -->

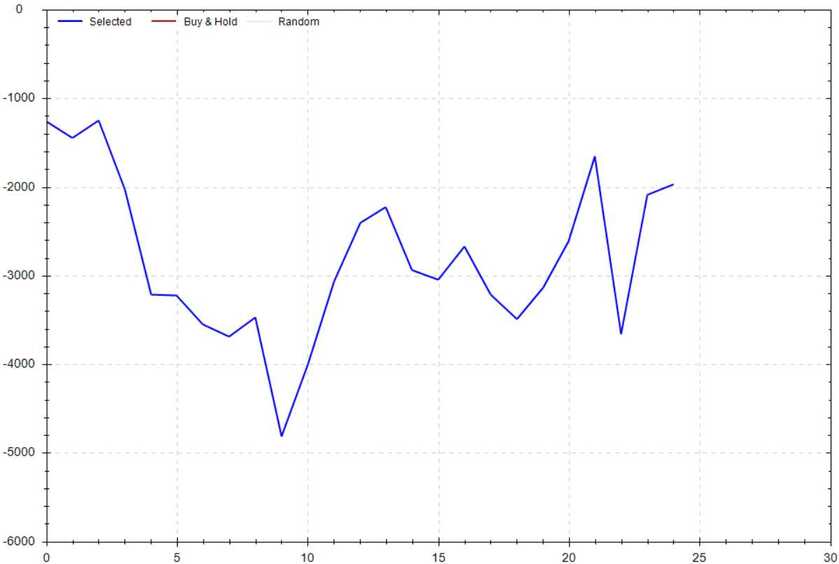

S&P 500 Seasonal Bias (Tuesday, July 23rd)

- Bull Win Percentage: 48%

- Profit Factor: 0.78

- Bias: Neutral

Equity Curve -->

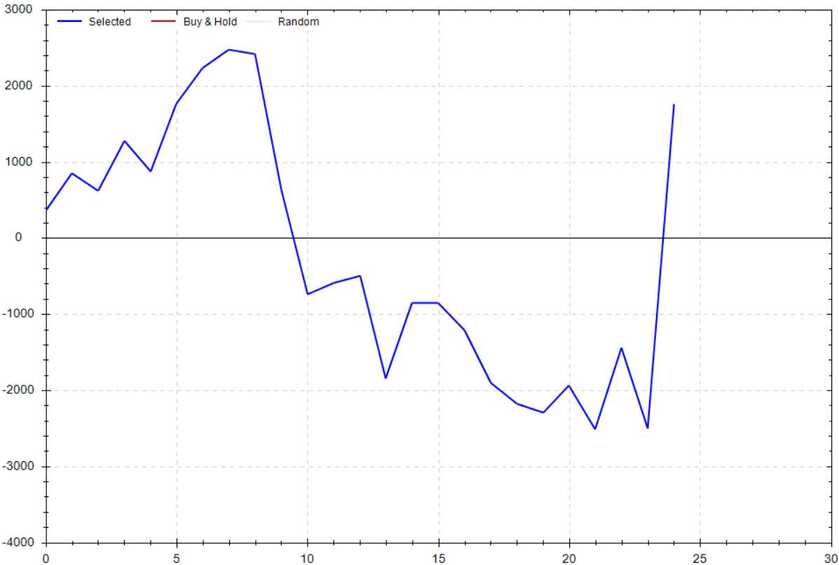

S&P 500 Seasonal Bias (Wednesday, July 24th)

- Bull Win Percentage: 52%

- Profit Factor: 1.14

- Bias: Leaning Bullish

Equity Curve -->

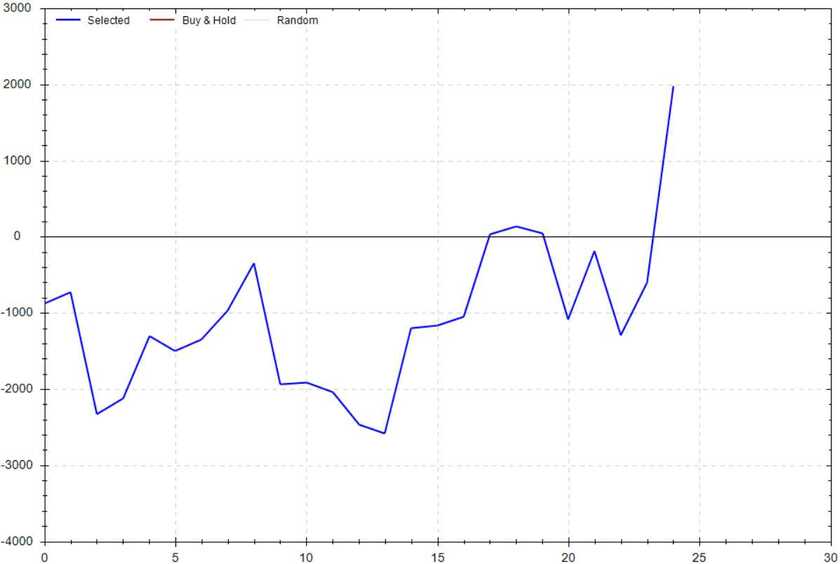

S&P 500 Seasonal Bias (Thursday, July 25th)

- Bull Win Percentage: 48%

- Profit Factor: 1.21

- Bias: Leaning Bullish

Equity Curve -->

S&P 500 Seasonal Bias (Friday, July 26th)

- Bull Win Percentage: 60%

- Profit Factor: 1.27

- Bias: Bullish

Equity Curve -->

Notes: These analytics are derived from the performance of the S&P 500 futures contract over the past 25 years. Additionally, results are computed from the futures market open and close.

Options Strategy Update

The 0 DTE signal hit 7 for 10 times (18 for 24 total units) this past week.

Signal Accuracy: ~70%

Piper had a rough week. If the underperformance continues, I'll rework to the system to better reflect the current market conditions. There is a chance the results were simply caused by bad luck. I'll be watching closely over the next couple weeks to determine if anything should be updated. Stay tuned!

Piper's Current Signal Streak: 2 Trades

July Record: 49/61 Units

Monday July 15th

SPY Put Credit Spread (2x Multiple @ $561 / $560) 🟢

QQQ Put Credit Spread (2x Multiple @ $495 / $494) 🟢

Tuesday July 16th

SPY Call Credit Spread (2x Multiple @ $564 / $565) 🔴

QQQ Call Credit Spread (2x Multiple @ $499 / $500) 🟢

Wednesday July 17th

SPY Call Credit Spread (3x Multiple @ $561 / $562) 🟢

QQQ Call Credit Spread (3x Multiple @ $489 / $490) 🟢

Thursday July 18th

SPY Put Credit Spread (2x Multiple @ $557 / $556) 🔴

QQQ Put Credit Spread (2x Multiple @ $481 / $480) 🔴

Friday July 19th

SPY Call Credit Spread (3x Multiple @ $555 / $556) 🟢

QQQ Call Credit Spread (3x Multiple @ $482 / $483) 🟢

Historic Trades Made

1 (Let the history books know!) *

This data point is from readings over the past week. The reported information should not be taken as an aggregate or cumulative value for any period beyond the most recent week (Sunday through Saturday). Appropriate alterations were made to account for both travel and time zone shifts.

Notes

RISK WARNING: Trading involves HIGH RISK and YOU CAN LOSE a lot of money. Do not risk any money you cannot afford to lose. Trading is not suitable for all investors. We are not registered investment advisors. We do not provide trading or investment advice. We provide research and education through the issuance of statistical information containing no expression of opinion as to the investment merits of a particular security. Information contained herein should not be considered a solicitation to buy or sell any security or engage in a particular investment strategy. Past performance is not necessarily indicative of future results. Links above include affiliate commission or referrals. I'm part of an affiliate network and I receive compensation from partnering websites.

Both of these trades hit if held until close -- 6 total units!

Both of these trades hit if held until close -- 6 total units! These PCS's were sold at $1.05/ea and were bought back at $0.20/ea -- THIS MEANS MY REALIZED GAIN WAS $!

These PCS's were sold at $1.05/ea and were bought back at $0.20/ea -- THIS MEANS MY REALIZED GAIN WAS $!