Going For Gold

What's Up, Degens!

What an absolutely wild week! I'm well aware there is a considerable amount of renewed bearish sentiment, but that's not always a bad thing. If anything, I could argue we are being presented with a surplus of trading opportunities. In case you missed it, the Goonie Trading Discord has been crushing! I was fortunate enough to have my best trading week of the year -->

Making $73,000: https://mattkohrs.locals.com/post/5951471/weekly-degen-trade-report-73-000-trade-with-me-for-free

Key Weekly Performance Stats:

- S&P 500: -2.12%

- Nasdaq 100: -3.07%

- Russel 2000: -6.82%

- Bitcoin: -9.58%

As you can see, the market's tune has really changed. The days of an easy bullish grind to the upside might be behind us. There were two major macroeconomic events last week. The Fed's interest rate decision was announced on Wednesday. There was no change to the rate, but it is now all but guaranteed that we will be getting our first rate cut in September. The market is currently betting that the rate cut will be in the form of 25bps. To conclude the week, we got an updated Unemployment Report. This unfortunately came in higher than expected (4.3% vs 4.1%).

There are many thoughts and opinions as to why the market reacted the way it did, but it doesn't change our overall plan. We are traders not investors. Investing is the game of prediction. Trading is the game of reaction. There is a time and place for both, but never conflate the two. As traders, we take what the market gives us. For whatever timeframe is your favorite, you ride the trend that is evident while taking acceptable risk. Fortunately, the upcoming week (details below) doesn't have an overwhelming number of announcements. This means price action will rule the roost. Stick to your plan -- Never deviate. Godspeed.

Peace,

Thicc Kohrs

P.S. The official Goonie Discord is live! (FREE Access w/ code GOONIE: https://bit.ly/GoonieGroup)

Market Events

Monday, August 5th

09:45 AM ET S&P Global Services PMI (Jul)

10:00 AM ET ISM Non-Manufacturing PMI (Jul)

10:00 AM ET ISM Non-Manufacturing Prices (Jul)

Tuesday, August 6th

12:30 AM ET RBA Interest Rate Decision (Aug)

01:00 PM ET 3-Year Bond Auction

Wednesday, August 7th

01:00 PM ET 10-Year Bond Auction

03:00 PM ET Consumer Credit (Jun)

Thursday, August 8th

08:30 AM ET Initial Jobless Claims

10:00 AM ET Wholesale Inventories

01:00 PM ET 30-Year Bond Auction

03:00 PM ET Richmond Fed President Tom Barkin Speaks

Friday, August 9th

None Scheduled

Upcoming Earnings Monday, August 5th

Monday, August 5th

Morning: Berkshire Hathaway

Evening: Lucid & Palantir

Tuesday, August 6th

Morning: Caterpillar, Celsius, Marathon & Uber

Evening: Airbnb, Devon, Reddit, Rivian & Wynn

Wednesday, August 7th

Morning: CVS, Disney, Lyft, Novo Nordisk, Shopify & Sony

Evening: Oxy & Robinhood

Thursday, August 8th

Morning: Eli Lilly

Evening: Paramount & Unity

Friday, August 9th

Morning: Canopy Growth

Seasonality Update

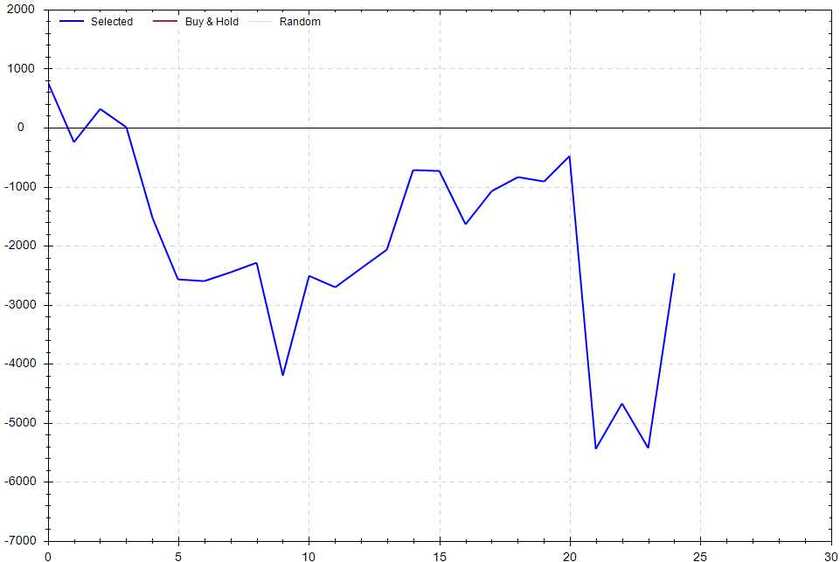

S&P 500 Seasonal Bias (Monday, August 5th)

- Bull Win Percentage: 52%

- Profit Factor: 0.81

- Bias: Leaning Bearish

Equity Curve -->

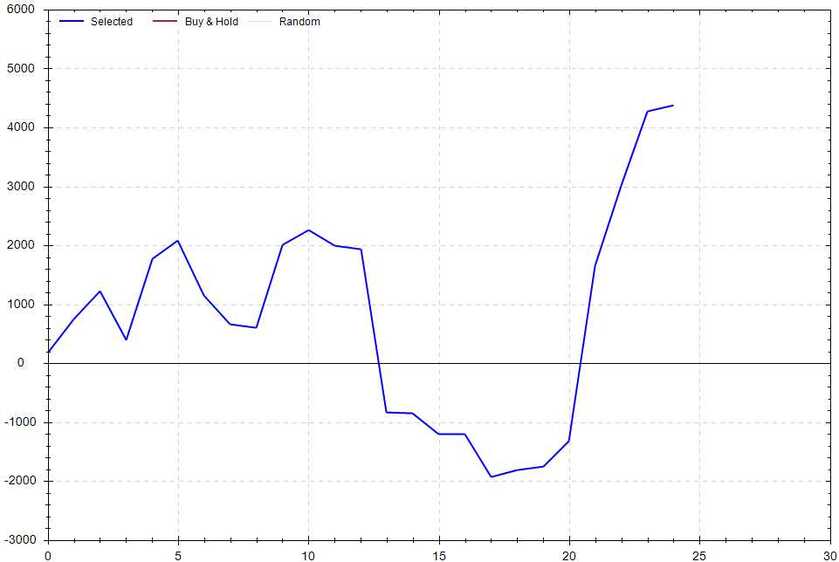

S&P 500 Seasonal Bias (Tuesday, August 6th)

- Bull Win Percentage: 56%

- Profit Factor: 1.67

- Bias: Leaning Bullish

Equity Curve -->

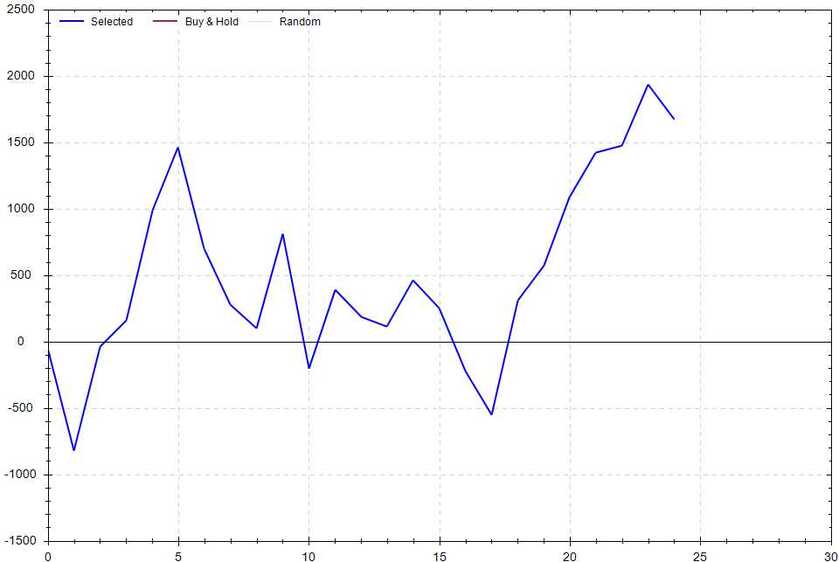

S&P 500 Seasonal Bias (Wednesday, August 7th)

- Bull Win Percentage: 52%

- Profit Factor: 1.35

- Bias: Leaning Bullish

Equity Curve -->

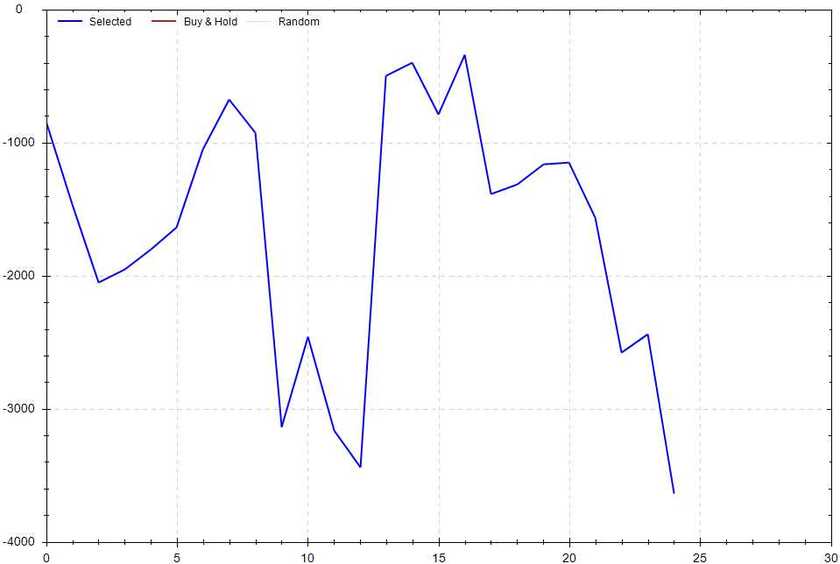

S&P 500 Seasonal Bias (Thursday, August 8th)

- Bull Win Percentage: 52%

- Profit Factor: 1.84

- Bias: Bullish

Equity Curve -->

S&P 500 Seasonal Bias (Friday, August 9th)

- Bull Win Percentage: 52%

- Profit Factor: 0.62

- Bias: Leaning Bearish

Equity Curve -->

Notes: These analytics are derived from the performance of the S&P 500 futures contract over the past 25 years. Additionally, results are computed from the futures market open and close.

Options Strategy Update

The 0 DTE signal hit 8 for 8 times (14 for 14 total units) this past week.

Signal Accuracy: ~100%

Piper is back to her dominating ways -- I hope you're enjoying, and more importantly, getting yours!

Piper's Current Signal Streak: 15 Trades

July Record: 79/93 Units

August Record: 4/4 Units

Monday, July 29th

SPY Call Credit Spread (2x Multiple @ $547 / $548) 🟢

QQQ Call Credit Spread (2x Multiple @ $468 / $469) 🟢

Tuesday, July 30th

SPY Call Credit Spread (2x Multiple @ $548 / $549) 🟢

QQQ Call Credit Spread (2x Multiple @ $466 / $467) 🟢

Wednesday, July 31st

SPY Put Credit Spread (1x Multiple @ $547 / $546) 🟢

QQQ Put Credit Spread (1x Multiple @ $466 / $465) 🟢

Thursday, August 1st

No signal(s) generated

Friday, August 2tnd

SPY Call Credit Spread (2x Multiple @ $537 / $538) 🟢

QQQ Call Credit Spread (2x Multiple @ $454 / $455) 🟢

Gold Medal Trading Performances

2 *

This data point is from readings over the past week. The reported information should not be taken as an aggregate or cumulative value for any period beyond the most recent week (Sunday through Saturday). Appropriate alterations were made to account for both travel and time zone shifts.

Notes

RISK WARNING: Trading involves HIGH RISK and YOU CAN LOSE a lot of money. Do not risk any money you cannot afford to lose. Trading is not suitable for all investors. We are not registered investment advisors. We do not provide trading or investment advice. We provide research and education through the issuance of statistical information containing no expression of opinion as to the investment merits of a particular security. Information contained herein should not be considered a solicitation to buy or sell any security or engage in a particular investment strategy. Past performance is not necessarily indicative of future results. Links above include affiliate commission or referrals. I'm part of an affiliate network and I receive compensation from partnering websites.

Both of these trades hit if held until close -- 6 total units!

Both of these trades hit if held until close -- 6 total units! These PCS's were sold at $1.05/ea and were bought back at $0.20/ea -- THIS MEANS MY REALIZED GAIN WAS $!

These PCS's were sold at $1.05/ea and were bought back at $0.20/ea -- THIS MEANS MY REALIZED GAIN WAS $!