Pure Market Chaos

TODAY'S GAIN: -$40,000

My posted, REAL-TIME TRADES WERE... The opposite of good :(

I was a little too cocky from my gain last week. I wasn't reading the price action well. And to top it all off, I was too slow in letting go of my losers. As you can imagine when you put all of these ingredients together, it makes a pretty horrible tendie dish.

You can join the Goonie Discord for FREE w/ code GOONIE (Click Here!)

Piper's Picks

A BULLISH signal, 3/5 strength, was generated at 10:20am ET by Piper. The signal was used with various advanced options strategies to score (don't worry, I'll teach you every aspect of the strategy). Both of these trades hit if held until close -- 2 total units!

Both of these trades hit if held until close -- 2 total units!

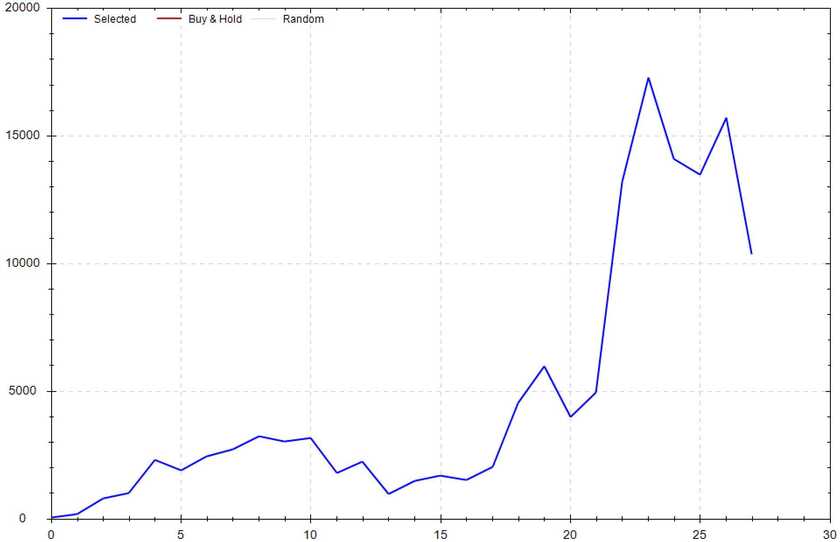

SPY Return: +$15 (+100%) per $85 signal cost

QQQ Return: +$8 (+100%) per $92 signal cost

Total Return: +$23 (+100%) -- This could easily be scaled per $177 signal cost

Thicc Matt's Personal Trades

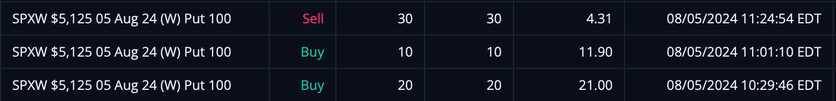

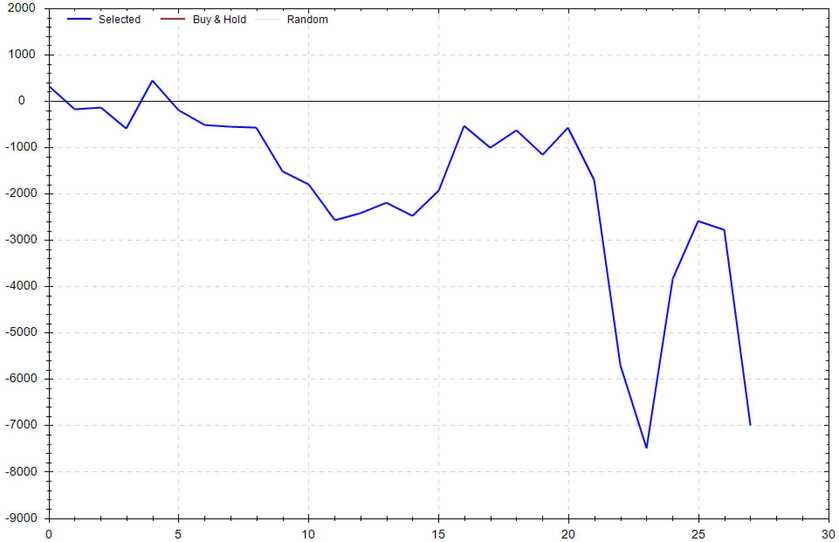

Trade One: 30 SPX 5125 Puts (Degen Yolo) Even though this trade was a huge loss, I don't hate it. I waited for a smalled timeframe reversion to once againg align with the overall trend. The entry doesn't bother me at all. I ended up being early, which is going to happen a lot the more you trade. My issue was the oversizing, which prompted me to holder onto this loser longer than I should have. By the time everything settled, my average entry was $17.97/ea, and my average exit was $4.31/ea -- This means my realized loss was $40,970.

Even though this trade was a huge loss, I don't hate it. I waited for a smalled timeframe reversion to once againg align with the overall trend. The entry doesn't bother me at all. I ended up being early, which is going to happen a lot the more you trade. My issue was the oversizing, which prompted me to holder onto this loser longer than I should have. By the time everything settled, my average entry was $17.97/ea, and my average exit was $4.31/ea -- This means my realized loss was $40,970.

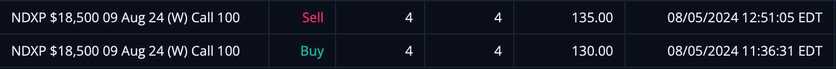

Trade Two: 4 NDX 18,500 Calls (Revenge Degen Yolo) In an effort to make my loss back quickly, I made to stupid decision to revenge trade. Fortunately, this one didn't cost me anything. I got lucky. My average entry was $130.00/ea, and my average exit was $135.00/ea -- This means my REALIZED GAIN WAS $2,000.

In an effort to make my loss back quickly, I made to stupid decision to revenge trade. Fortunately, this one didn't cost me anything. I got lucky. My average entry was $130.00/ea, and my average exit was $135.00/ea -- This means my REALIZED GAIN WAS $2,000.

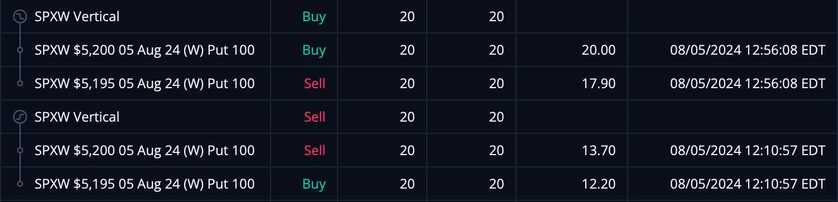

Trade Three: 30 x SPX 5200/5195 Put Credit Spread (Scalp Strategy Trade) I'm not sure what in the world I was thinking, but I randomly decided to excute my normal scalp strategy today. It was illogical and clearly cost me. My average entry was $1.50/ea, and my average exit was $2.10/ea -- This means my realized loss was $1,200.

I'm not sure what in the world I was thinking, but I randomly decided to excute my normal scalp strategy today. It was illogical and clearly cost me. My average entry was $1.50/ea, and my average exit was $2.10/ea -- This means my realized loss was $1,200.

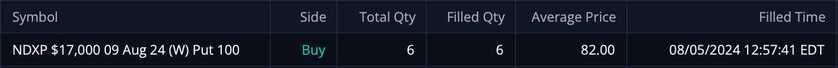

Trade Four: 6 NDX 17,000 Puts (Reasonable Trend Swing Trade) I'm a fan of this trade, but it has not been closed out. It's up to the Market Gods if I make money or not. Godspeed.

I'm a fan of this trade, but it has not been closed out. It's up to the Market Gods if I make money or not. Godspeed.

Trade One Return: -$40,970

Trade Two Return: +$2,000

Trade Three Return: -$1,200

Trade Four Return: Unknown

Total Return: -$40,170 (before fees)

How To Join The Goonie Discord (For FREE)

Join the Goonie Discord if you want access to any of the following:

- My Live Trades & Thoughts

- Weekly Teaching Sessions

- Weekly Newsletter

- Trading Competitions

- Texas Roadhouse Talk

Remember you can join the Discord for FREE with the code GOONIE (Click Here!). This code will allow to become a Locals "supporter". Supporters get full access to the entire Locals Community & Goonie Discord server.

Discord Link: https://discord.gg/3dxBRVrgGG

(Allow up to 24hrs to process after you've become a "supporter". If you have any issues, don't hesitate to reach out -- Feel free to DM on Discord or Twitter.)

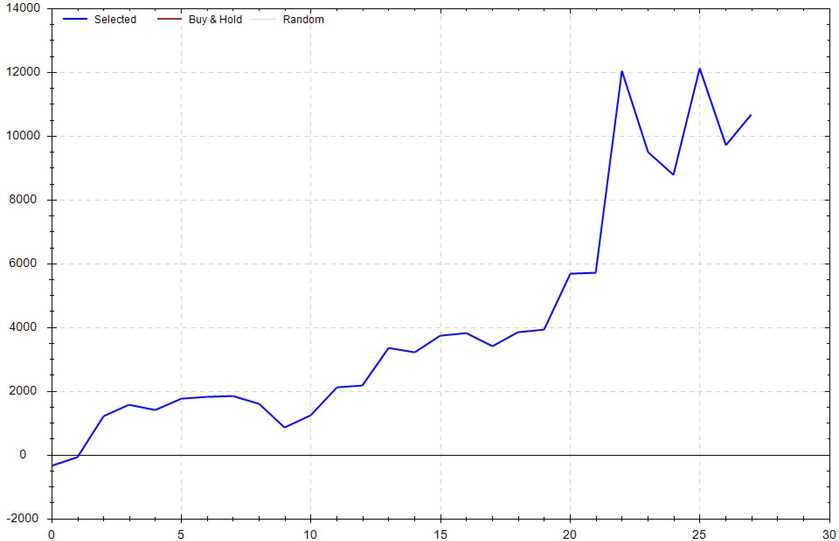

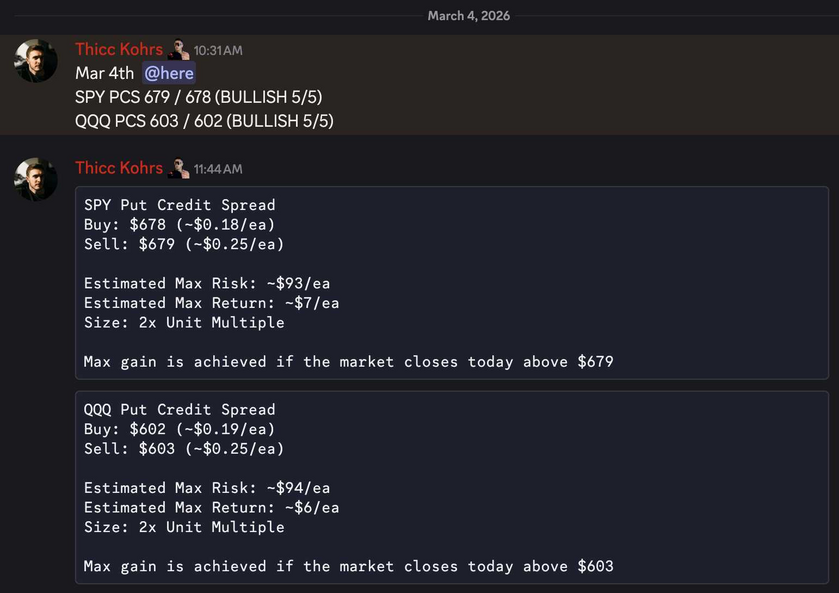

Both of these trades missed. Both of these trades hit if held until close -- 4 total units!

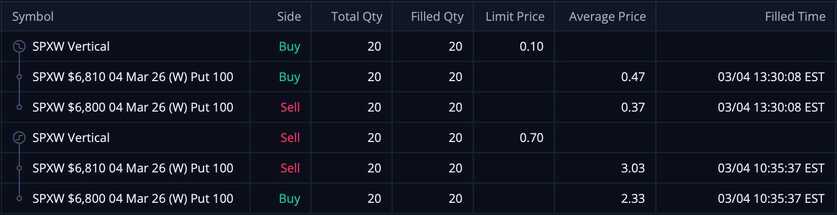

Both of these trades missed. Both of these trades hit if held until close -- 4 total units! These PCS's were sold at $0.70/ea and were bought back at $0.10/ea -- THIS MEANS MY REALIZED GAIN WAS $1,200!

These PCS's were sold at $0.70/ea and were bought back at $0.10/ea -- THIS MEANS MY REALIZED GAIN WAS $1,200!

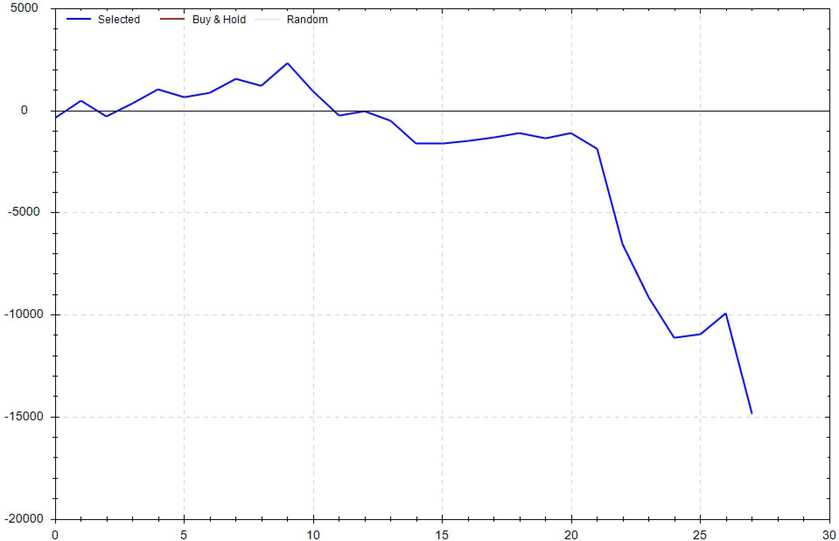

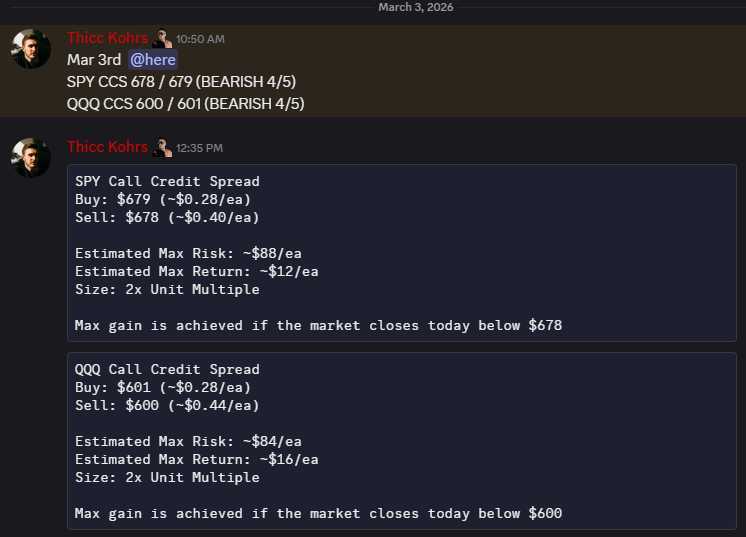

Both missed :(

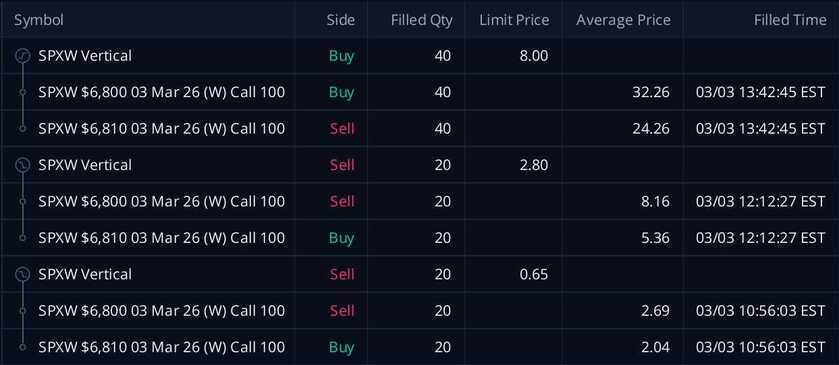

Both missed :( These CCS's were sold at $1.73/ea and were bought back at $8.00/ea -- This means tilted, revenge trading cost me $25,080.

These CCS's were sold at $1.73/ea and were bought back at $8.00/ea -- This means tilted, revenge trading cost me $25,080.