Is The Pain Over???

What's Up, Brother!

Key Weekly Performance Stats:

- S&P 500: +0.02%

- Nasdaq 100: +0.37%

- Russel 2000: -1.18%

- Bitcoin: -0.91%

As wild as the start of the week felt, we technically closed things out in the green! Wild! There were no major macroeconomic announcements or updates in the US that prompted the spike in volatility, but there was some sus stuff going down in Japan. In the span of two trading days, the Bank of Japan dramatically went from being hawkish to dovish. The posturing had considerable implications on the Yen Carry Trade, which I discussed in detail in the Monday's update video. The major thing you should know is that there is a lot of money in an overleveraged position that will blowup if the USDJPY pairing dives. The entire situation becomes more complicated when you realize various measures of the US economy are trending in the bearish direction.

How bad will it all get? I have no clue. To be honest, I really don't care. If the market were to crash, we would be given a golden opportunity to add to our long-term accounts. For our short-term accounts, we are simply trading with the prevailing trend. Bullish or bearish doesn't matter. We want sizeable ranges of which we can take advantage. I've said this a million times, but please don't conflate investing and trading. They are wildly different things and should never be confused.

The upcoming week will be a very interesting one. As the BoJ news is being digested, we will be getting a new set of inflation data (details below). I have no clue which way this will all break -- It's truly a 50/50 bet. What I am confident about is the volatility is here to stay for a bit. As always, respect your risk and stick to your trading plan. Godspeed.

Later Skater,

Thicc Kohrs

P.S. The official Goonie Discord is live! (FREE Access w/ code GOONIE: https://bit.ly/GoonieGroup)

Market Events

Monday, August 12th

None

Tuesday, August 13th

08:30 AM ET PPI (YoY) (Jul)

08:30 AM ET PPI (MoM) (Jul)

Wednesday, August 14th

08:30 AM ET CPI (YoY) (Jul)

08:30 AM ET CPI (MoM) (Jul)

Thursday, August 15th

08:30 AM ET Retail Sales (MoM) (Jul)

08:30 AM ET Initial Jobless Claims

08:30 AM ET Philadelphia Fed Manufacturing Index (Aug)

Friday, August 16th

08:30 AM ET Housing Starts (Jul)

08:30 AM ET Building Permits (Jul)

10:00 AM ET Consumer Sentiment (Aug)

Upcoming Earnings Monday, August 12th

Monday, August 12th

Evening: Rumble

Tuesday, August 13th

Morning: Home Depot & Hut 8

Wednesday, August 14th

Morning: UBS

Evening: Cisco

Thursday, August 15th

Morning: Alibaba, JD, John Deere & Walmart

Friday, August 16th

None

Seasonality Update

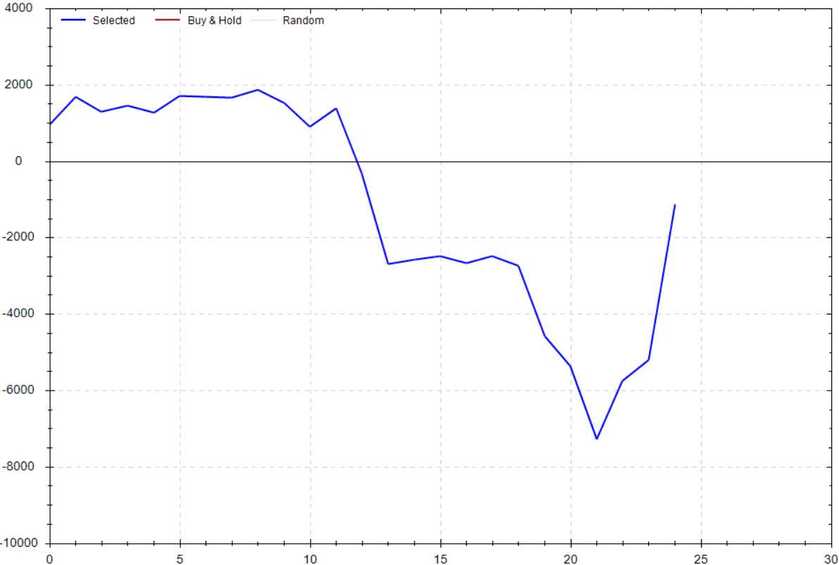

S&P 500 Seasonal Bias (Monday, August 12th)

- Bull Win Percentage: 48%

- Profit Factor: 0.89

- Bias: Neutral

Equity Curve -->

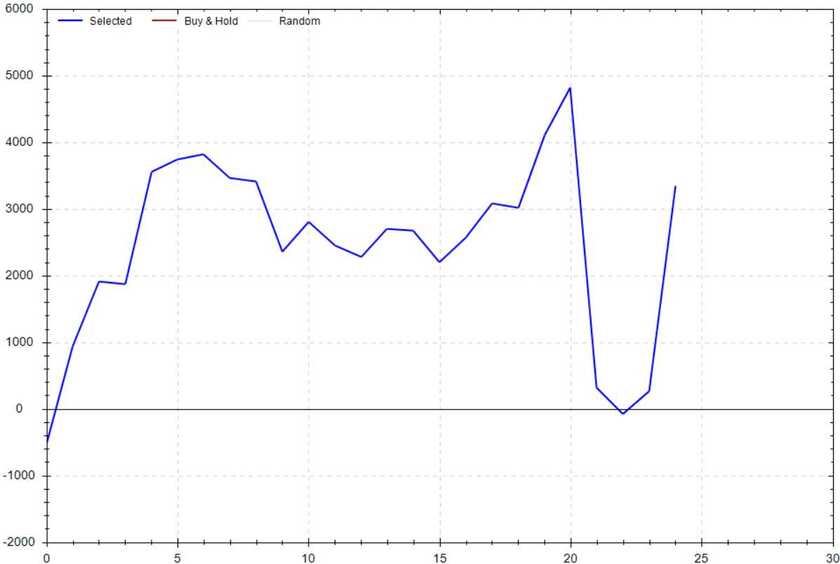

S&P 500 Seasonal Bias (Tuesday, August 13th)

- Bull Win Percentage: 52%

- Profit Factor: 2.12

- Bias: Bullish

Equity Curve -->

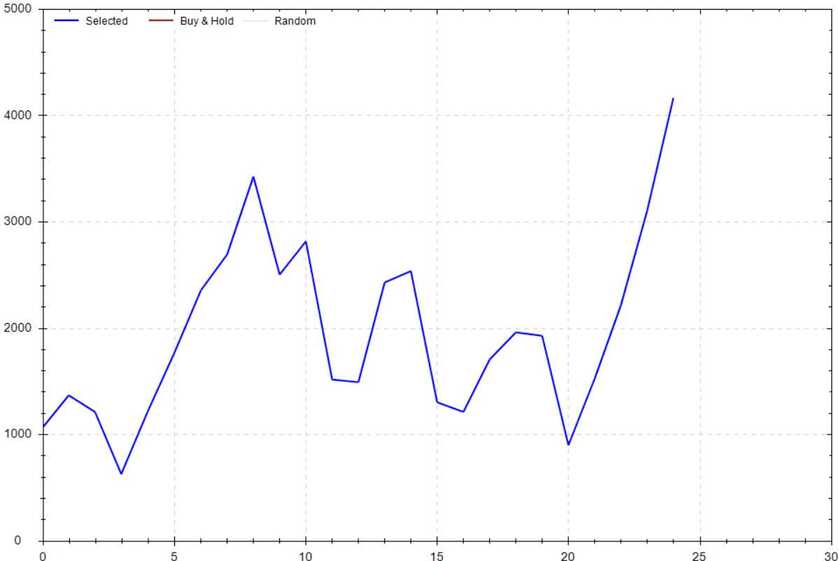

S&P 500 Seasonal Bias (Wednesday, August 14th)

- Bull Win Percentage: 52%

- Profit Factor: 1.42

- Bias: Neutral

Equity Curve -->

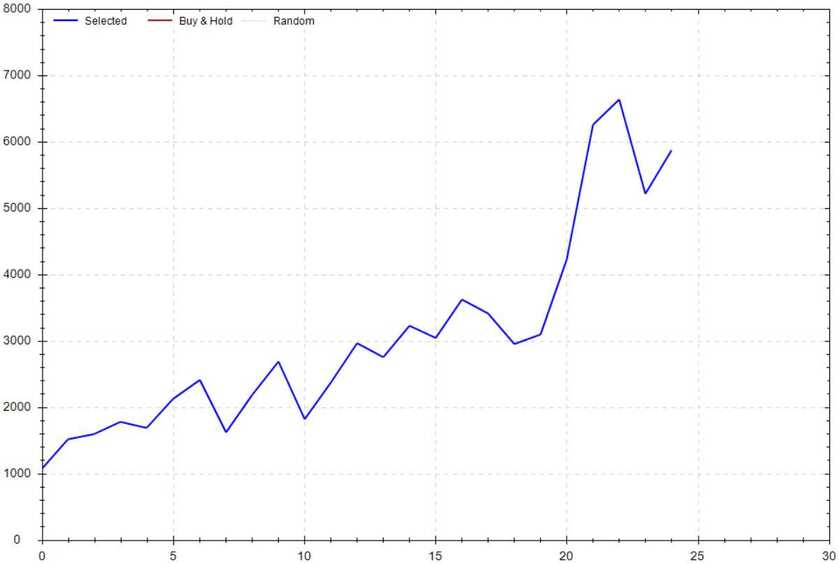

S&P 500 Seasonal Bias (Thursday, August 15th)

- Bull Win Percentage: 64%

- Profit Factor: 1.77

- Bias: Bullish

Equity Curve -->

S&P 500 Seasonal Bias (Friday, August 16th)

- Bull Win Percentage: 68%

- Profit Factor: 2.38

- Bias: Very Bullish

Equity Curve -->

Notes: These analytics are derived from the performance of the S&P 500 futures contract over the past 25 years. Additionally, results are computed from the futures market open and close.

Options Strategy Update

The 0 DTE signal hit 8 for 10 times (20 for 24 total units) this past week.

Signal Accuracy: ~80%

Piper is unabashedly continuing her reign over the market. May you enjoy your stay in her degen fiefdom!

Piper's Current Signal Streak: 4 Trades

August Record: 20/24 Units

Monday, August 5th

SPY Put Credit Spread (1x Multiple @ $510 / $509) 🟢

QQQ Put Credit Spread (1x Multiple @ $423 / $422) 🟢

Tuesday, August 6th

SPY Put Credit Spread (2x Multiple @ $518 / $517) 🟢

QQQ Put Credit Spread (2x Multiple @ $435 / $434) 🟢

Wednesday, August 7th

SPY Put Credit Spread (2x Multiple @ $527 / $526) 🔴

QQQ Put Credit Spread (2x Multiple @ $446 / $445) 🔴

Thursday, August 8th

SPY Call Credit Spread (2x Multiple @ $531 / $532) 🟢

QQQ Call Credit Spread (2x Multiple @ $449 / $450) 🟢

Friday, August 9th

SPY Put Credit Spread (3x Multiple @ $528 / $527) 🟢

QQQ Put Credit Spread (3x Multiple @ $445/ $444) 🟢

Running Count of Breaking My Trading Rules

18,449 *

This data point is from readings over the past week. The reported information should not be taken as an aggregate or cumulative value for any period beyond the most recent week (Sunday through Saturday). Appropriate alterations were made to account for both travel and time zone shifts.

Notes

RISK WARNING: Trading involves HIGH RISK and YOU CAN LOSE a lot of money. Do not risk any money you cannot afford to lose. Trading is not suitable for all investors. We are not registered investment advisors. We do not provide trading or investment advice. We provide research and education through the issuance of statistical information containing no expression of opinion as to the investment merits of a particular security. Information contained herein should not be considered a solicitation to buy or sell any security or engage in a particular investment strategy. Past performance is not necessarily indicative of future results. Links above include affiliate commission or referrals. I'm part of an affiliate network and I receive compensation from partnering websites.

Both of these trades hit if held until close -- 6 total units!

Both of these trades hit if held until close -- 6 total units! These PCS's were sold at $1.05/ea and were bought back at $0.20/ea -- THIS MEANS MY REALIZED GAIN WAS $!

These PCS's were sold at $1.05/ea and were bought back at $0.20/ea -- THIS MEANS MY REALIZED GAIN WAS $!