All Aboard!

Fellow Traveler,

The stock market ripped higher last week and looks like it wants more! The Dow Jones, S&P 500, Nasdaq, Russel 2000, and Bitcoin all posted solid gains. The S&P 500 and Nasdaq extended their winning streaks to eight consecutive sessions, marking their longest streaks of 2024. The gains were fueled by broad-based gains across sectors, namely technology and consumer discretion stocks.

Key Weekly Performance Stats:

- S&P 500: +1.41%

- Nasdaq 100: +1.05%

- Russel 2000: +3.66%

- Bitcoin: +8.83%

The big news of the week was related to the Fed and Daddy Powell. Chair Powell's speech at the Jackson Hole symposium was the major focal point. He stated that "the time has come for policy to adjust," indicating the Fed will cut interest rates starting in September. Markets are pricing in a high probability of a 0.25% on September 18th.

It should also be noted that there was a steep downward revision in payrolls, which suggested a cooling labor market. I would bet that this influenced the Fed's decision towards dovish monetary policy. Additionally, The University of Michigan's preliminary consumer sentiment index for August was higher than expected. This means there is a more optimistic outlook among consumers.

The market is loving to the possibility of a "soft landing" for the economy. This idea was bolstered by various positive economic reports and optimism heading into Nvidia's earning announcement and various inflation reports -- Details are posted below. As always, keep your risk in control, trade with the trend, and stick to your trading plan. Godspeed.

Until Next Time,

Thicc Kohrs

P.S. The official Goonie Discord is live! (FREE Access w/ code GOONIE: https://bit.ly/GoonieGroup)

Market Events

Monday, August 26th

08:30 AM ET Durable Goods Orders (MoM) (Jul)

02:00 PM ET San Francisco Fed President Daly Speech

Tuesday, August 27th

10:00 AM ET CB Consumer Confidence (Aug)

01:00 PM ET 2-Year Bond Auction

Wednesday, August 28th

10:30 AM ET Crude Oil Inventories

01:00 PM ET 5-Year Bond Auction

06:00 PM ET Atlanta Fed President Bostic Speech

Thursday, August 29th

08:30 AM ET GDP (QoQ) (Q2)

08:30 AM ET Initial Jobless Claims

01:00 PM ET 7-Year Bond Auction

03:30 PM ET Atlanta Fed President Bostic Speech

Friday, August 30th

05:00 AM ET Eurozone CPI (Aug)

08:30 AM ET PCE Price Index (YoY) (Jul)

08:30 AM ET PCE Price Index (MoM) (Jul)

08:30 AM ET Personal Spending

08:30 AM ET Personal Income

09:45 AM ET Chicago PMI (Aug)

10:00 AM ET Consumer Sentiment

Upcoming Earnings

Monday, August 26th

None

Tuesday, August 27th

None

Wednesday, August 28th

Morning: Chewy

Evening: Affirm, CrowdStrike, Nvidia & Salesforce

Thursday, August 29th

Morning: Best Buy & Dollar General

Evening: Dell, Lululemon & Ulta

Friday, August 30th

None

Seasonality Update

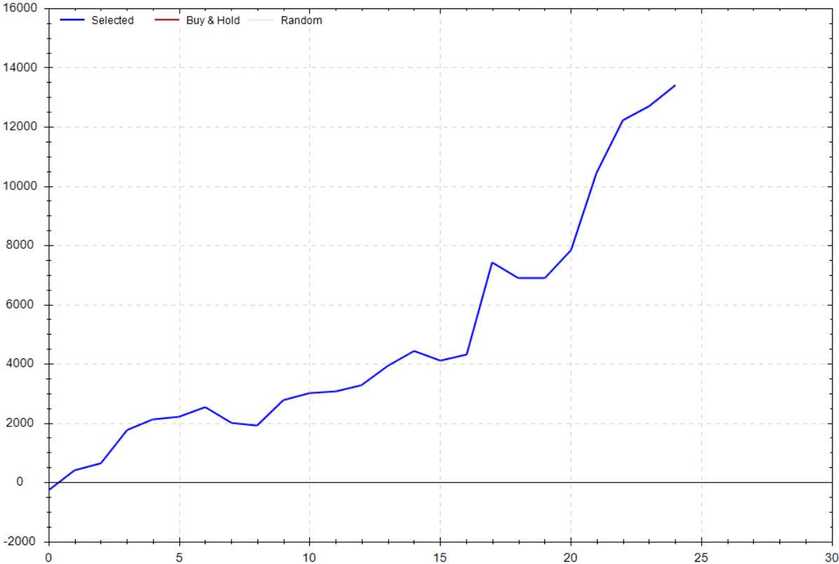

S&P 500 Seasonal Bias (Monday, August 26th)

- Bull Win Percentage: 80%

- Profit Factor: 8.56

- Bias: Bullish

Equity Curve -->

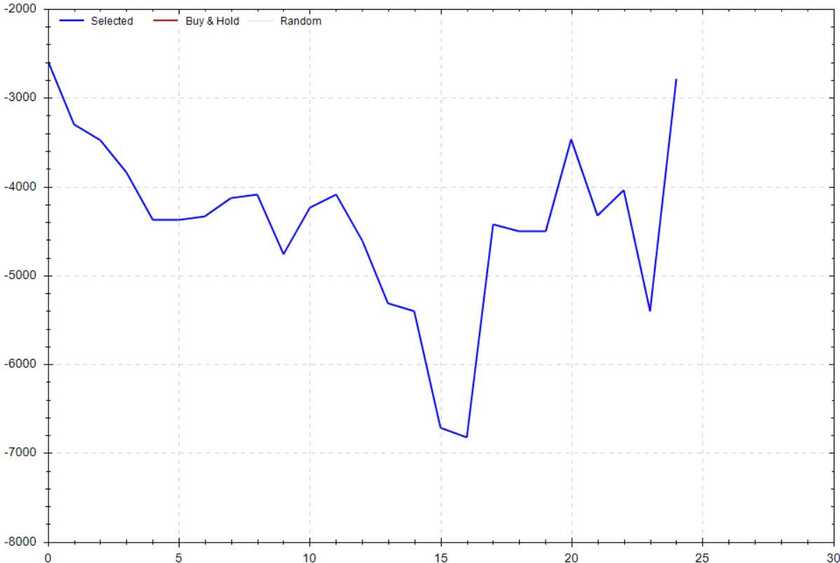

S&P 500 Seasonal Bias (Tuesday, August 27th)

- Bull Win Percentage: 36%

- Profit Factor: 0.72

- Bias: Bearish

Equity Curve -->

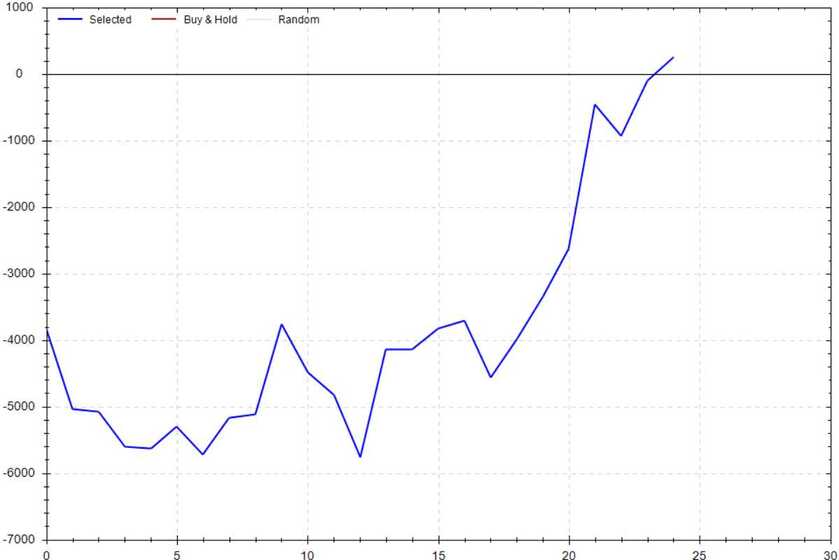

S&P 500 Seasonal Bias (Wednesday, August 28th)

- Bull Win Percentage: 56%

- Profit Factor: 0.66

- Bias: Neutral

Equity Curve -->

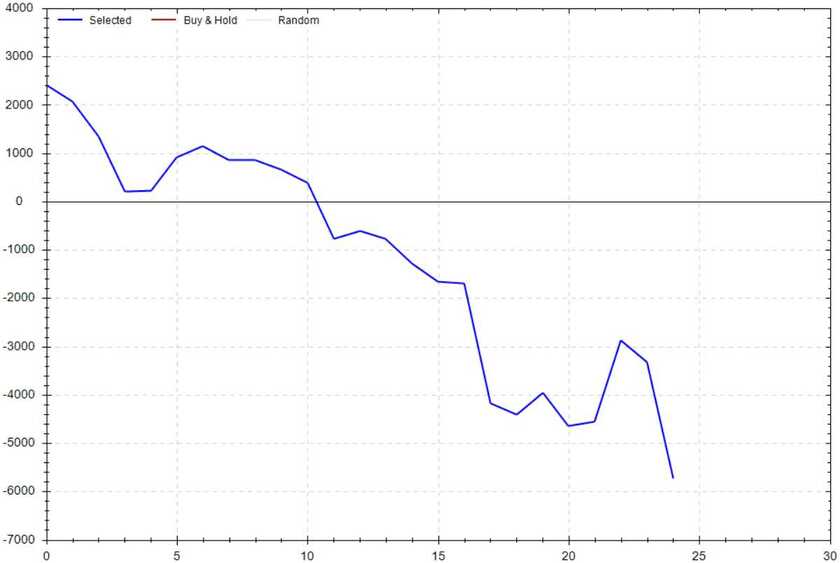

S&P 500 Seasonal Bias (Thursday, August 29th)

- Bull Win Percentage: 52%

- Profit Factor: 1.03

- Bias: Leaning Bullish

Equity Curve -->

S&P 500 Seasonal Bias (Friday, August 30th)

- Bull Win Percentage: 32%

- Profit Factor: 0.50

- Bias: Bearish

Equity Curve -->

Notes: These analytics are derived from the performance of the S&P 500 futures contract over the past 25 years. Additionally, results are computed from the futures market open and close.

Options Strategy Update

The 0 DTE signal hit 8 for 8 times (12 for 12 total units) this past week.

Signal Accuracy: ~100%

Even with this week's price action being crazy, Piper continually proves why she is top dog. I hope she is helping you in your money make adventures.

Piper's Current Signal Streak: 22 Trades

August Record: 56/60 Units

Monday, August 19th

SPY Put Credit Spread (2x Multiple @ $554 / $553) 🟢

QQQ Put Credit Spread (2x Multiple @ $472 / $471) 🟢

Tuesday, August 20th

SPY Call Credit Spread (1x Multiple @ $561 / $562) 🟢

QQQ Call Credit Spread (1x Multiple @ $483 / $484) 🟢

Wednesday, August 21st

No Signal(s) Generated

Thursday, August 22nd

SPY Call Credit Spread (1x Multiple @ $563 / $564) 🟢

QQQ Call Credit Spread (1x Multiple @ $485 / $486) 🟢

Friday, August 23rd

SPY Put Credit Spread (2x Multiple @ $558 / $557) 🟢

QQQ Put Credit Spread (2x Multiple @ $477 / $476) 🟢

Times Daddy Powell F'd My Positions

4 (Very painful)*

This data point is from readings over the past week. The reported information should not be taken as an aggregate or cumulative value for any period beyond the most recent week (Sunday through Saturday). Appropriate alterations were made to account for both travel and time zone shifts.

Notes

RISK WARNING: Trading involves HIGH RISK and YOU CAN LOSE a lot of money. Do not risk any money you cannot afford to lose. Trading is not suitable for all investors. We are not registered investment advisors. We do not provide trading or investment advice. We provide research and education through the issuance of statistical information containing no expression of opinion as to the investment merits of a particular security. Information contained herein should not be considered a solicitation to buy or sell any security or engage in a particular investment strategy. Past performance is not necessarily indicative of future results. Links above include affiliate commission or referrals. I'm part of an affiliate network and I receive compensation from partnering websites.

Both of these trades hit if held until close -- 6 total units!

Both of these trades hit if held until close -- 6 total units! These PCS's were sold at $1.05/ea and were bought back at $0.20/ea -- THIS MEANS MY REALIZED GAIN WAS $!

These PCS's were sold at $1.05/ea and were bought back at $0.20/ea -- THIS MEANS MY REALIZED GAIN WAS $!