It's Game Time!

Team,

The market saw a significant downturn, with all major indices recording losses. The show is far from being over...

Key Weekly Performance Stats:

- S&P 500: -4.14%

- Nasdaq 100: -5.79%

- Russel 2000: -5.53%

- Bitcoin: -8.73%

The main thing you're probably thinking is "Why?". Why did the market take such a hit? The release of the August jobs report showed that the U.S. added 142,000 jobs, which was lower than expected. Additionally, the previous jobs reports were revised lower. A weakening labor market is no bueno. The Unemployment Rate fell to 4.2%, which will most likely have mixed implications for monetary policy expectations. As I'm writing this, we know the Fed will cut rates at the next FOMC meeting, but it's unclear if it will be 25bps or 50bps. Remember: The market hates unknowns.

The market's reaction, especially the increase in volatility index, suggests heightened concern among investors. It should also be noted that the market, specifically the S&P 500, dropped into a deep negative gamma territory. This creates an environment where the directional move is commonly amplified.

As things progress, please be careful. Bonds are ripping. The USDJPY is falling. The price movement in oil is seemingly insane. The overall market resembles a dagger. My point is things are a bit froggy. If you're on the right side of the trend, you can make big money. We are not in a stable (mean reverting) environment. We are in a trending phase. This means you're being presented with opportunity. Respect your risk and stick to your plan. The upcoming week will showcase various inflation reports -- Details below. The fireworks are far from being over. Godspeed.

Fight on,

Thicc Kohrs

P.S. The official Goonie Discord is live! (FREE Access w/ code GOONIE: https://bit.ly/GoonieGroup)

Market Events

Monday, September 9th

10:00 AM ET Wholesale Inventories

03:00 PM ET Consumer Credit

Tuesday, September 10th

01:00 PM ET 3-Year Note Auction

Wednesday, September 11th

08:30 AM ET CPI (YoY) (Aug)

08:30 AM ET CPI (MoM) (Aug)

10:30 AM ET Crude Oil Inventories

01:00 PM ET 10-Year Note Auction

Thursday, September 12th

08:15 AM ET ECB Interest Rate Decision

08:30 AM ET PPI (YoY) (Aug)

08:30 AM ET PPI (MoM) (Aug)

08:30 AM ET Initial Jobless Claims

08:45 AM ET ECB Press Conference

01:00 PM ET 30-Year Bond Auction

Friday, September 13th

10:00 AM ET Consumer Sentiment

Upcoming Earnings

Monday, September 9th

Evening: Oracle

Tuesday, September 10th

Evening: GameStop

Wednesday, September 11th

None

Thursday, September 12th

Evening: Adobe

Friday, September 13th

None

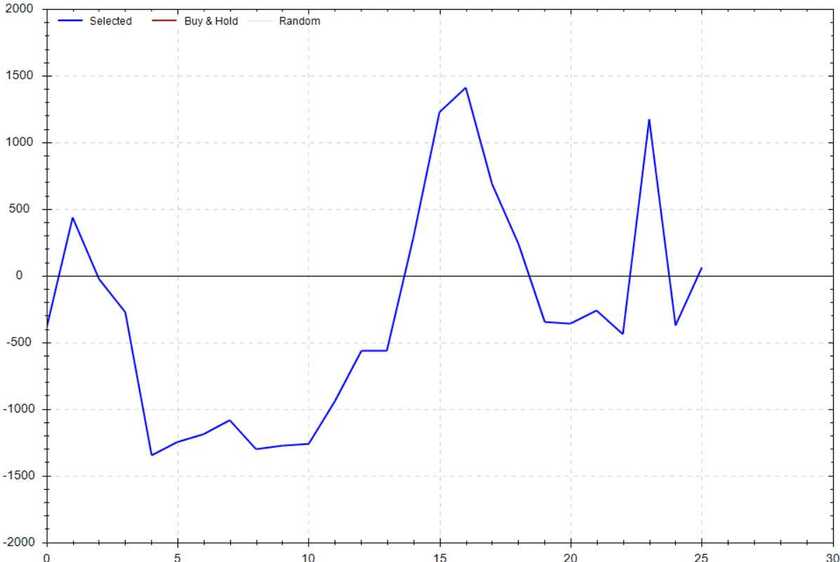

Seasonality Update

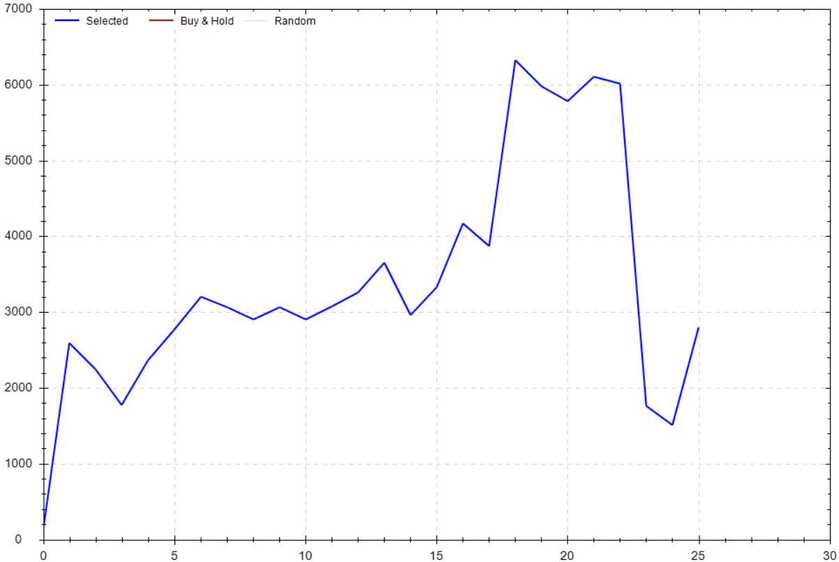

S&P 500 Seasonal Bias (Monday, September 9th)

- Bull Win Percentage: 54%

- Profit Factor: 1.38

- Bias: Neutral

Equity Curve -->

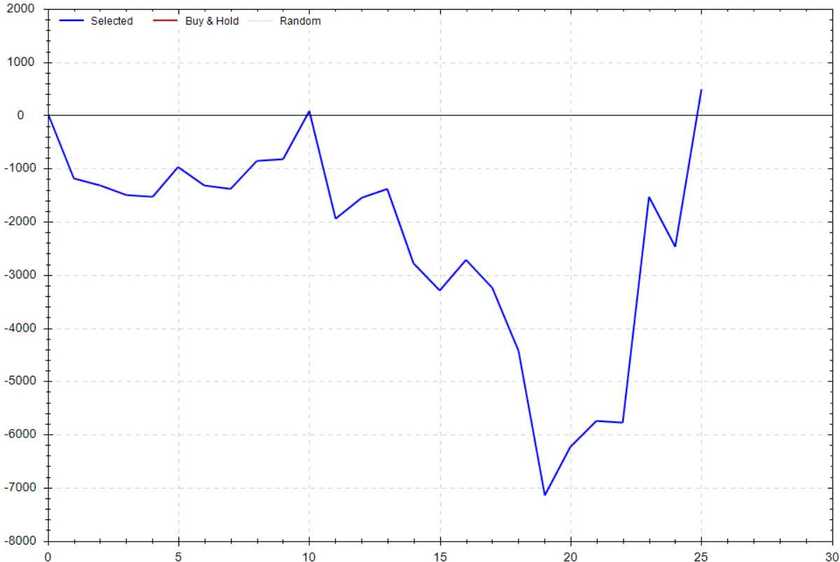

S&P 500 Seasonal Bias (Tuesday, September 10th)

- Bull Win Percentage: 46%

- Profit Factor: 1.04

- Bias: Neutral

Equity Curve -->

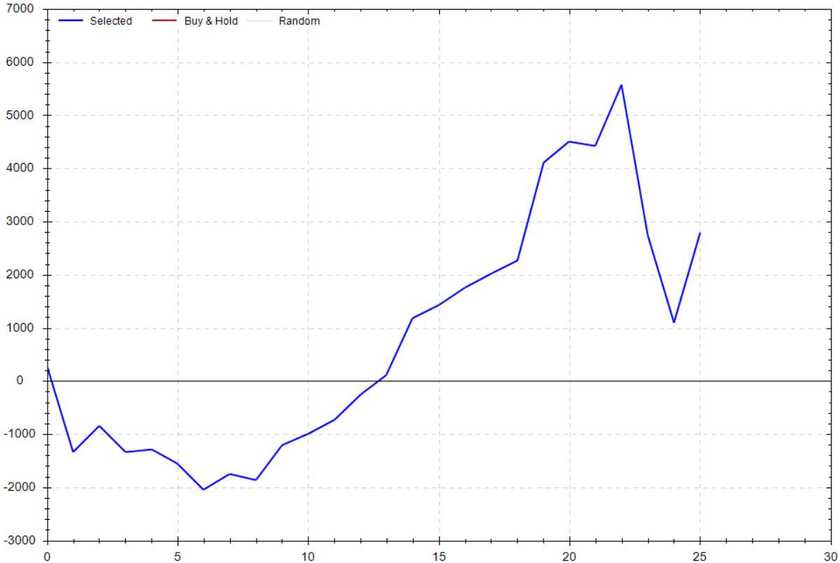

S&P 500 Seasonal Bias (Wednesday, September 11th)

- Bull Win Percentage: 69%

- Profit Factor: 1.37

- Bias: Bullish

Equity Curve -->

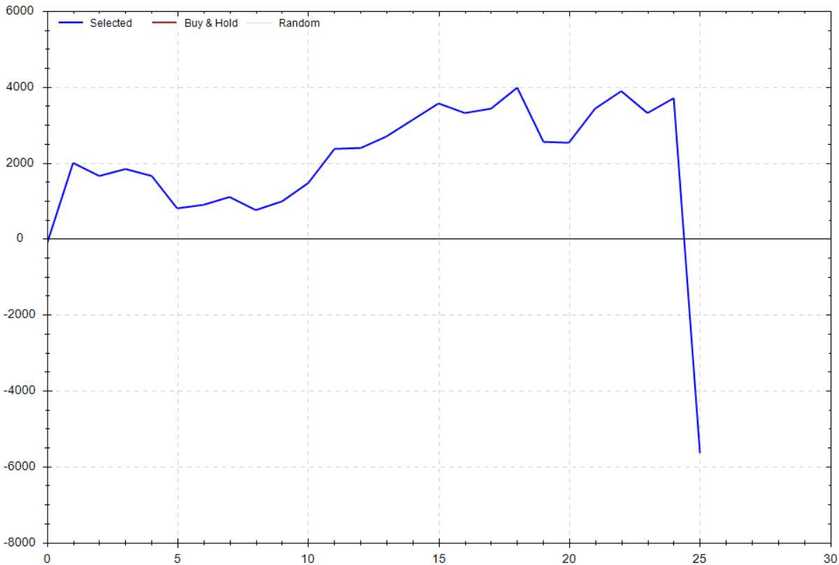

S&P 500 Seasonal Bias (Thursday, September 12th)

- Bull Win Percentage: 61%

- Profit Factor: 0.58

- Bias: Leaning Bearish

Equity Curve -->

S&P 500 Seasonal Bias (Friday, September 13th)

- Bull Win Percentage: 54%

- Profit Factor: 1.01

- Bias: Neutral

Equity Curve -->

Notes: These analytics are derived from the performance of the S&P 500 futures contract over the past 25 years. Additionally, results are computed from the futures market open and close.

Options Strategy Update

The 0 DTE signal hit 7 for 8 times (14 for 16 total units) this past week.

Signal Accuracy: ~87.5%

Piper's Current Signal Streak: 3 Trades

September Record: 14/16 Units

Monday, September 3rd

Market Closed

Tuesday, September 3rd

SPY Call Credit Spread (2x Multiple @ $561 / $562) 🟢

QQQ Call Credit Spread (2x Multiple @ $474 / $475) 🟢

Wednesday, September 4th

SPY Put Credit Spread (1x Multiple @ $550 / $549) 🟢

QQQ Put Credit Spread (1x Multiple @ $457 / $456) 🟢

Thursday, September 5th

SPY Put Credit Spread (2x Multiple @ $550 / $549) 🔴

QQQ Put Credit Spread (2x Multiple @ $459 / $458) 🟢

Friday, September 6th

SPY Call Credit Spread (3x Multiple @ $552 / $553) 🟢

QQQ Call Credit Spread (3x Multiple @ $461 / $462) 🟢

Heart Rate After Hitting A $75k Trade

400 bpm*

This data point is from readings over the past week. The reported information should not be taken as an aggregate or cumulative value for any period beyond the most recent week (Sunday through Saturday). Appropriate alterations were made to account for both travel and time zone shifts.

Notes

RISK WARNING: Trading involves HIGH RISK and YOU CAN LOSE a lot of money. Do not risk any money you cannot afford to lose. Trading is not suitable for all investors. We are not registered investment advisors. We do not provide trading or investment advice. We provide research and education through the issuance of statistical information containing no expression of opinion as to the investment merits of a particular security. Information contained herein should not be considered a solicitation to buy or sell any security or engage in a particular investment strategy. Past performance is not necessarily indicative of future results. Links above include affiliate commission or referrals. I'm part of an affiliate network and I receive compensation from partnering websites.

Both of these trades hit if held until close -- 6 total units!

Both of these trades hit if held until close -- 6 total units! These PCS's were sold at $1.05/ea and were bought back at $0.20/ea -- THIS MEANS MY REALIZED GAIN WAS $!

These PCS's were sold at $1.05/ea and were bought back at $0.20/ea -- THIS MEANS MY REALIZED GAIN WAS $!