Market Insanity Incoming!

Howdy,

We just had the BEST week of 2024! I hope you got your ticket to ride the gains train.

Key Weekly Performance Stats:

- S&P 500: +4.01%

- Nasdaq 100: +5.94%

- Russel 2000: +4.30%

- Bitcoin: +12.22%

This week the stock market experienced a complicated mix of strong gains and growing uncertainty, with the S&P 500 closing up by 4%. This officially puts us withing reach of new all-time highs. However, it should be noted that there was a downturn in bank stocks following warnings of weaker current-quarter performance. Energy stocks also took a hit. Fortunately for us, the tech sector exploded to the high heavens, which kept most of us in the deep green.

The market's pulse is on the Federal Reserve's next moves. Speculation is running rampant about whether the Fed will opt for a 25 or 50 basis points rate cut this upcoming week. This speculation is being fueled by economic indicators like employment and inflation, with the market pricing in expectations of monetary policy adjustments to combat economic slowdown. The CPI & PPI inflation report offered us contradictory signals, suggesting inflation might not be as tamed as hoped. Here's to hoping Powell can clean up the convoluted mess we are all facing.

So, what does this all really mean? I would argue this all adds up to one thing. Next week is going to be wild. Not only are we about to get our first rate cut of the cycle, but the market has no clue how big the cut is going to be. This uncertainty will undoubtedly fuel large swings and heightened volatility. As a trader, don't focus on predicting a bullish or bearish outcome. Take what the market gives you -- Ride the trend. Your job is to react to the changing market dynamics and hunt for optimal risk to reward setups. Godspeed.

Warm Regards,

Thicc Kohrs

P.S. The official Goonie Discord is live! (FREE Access w/ code GOONIE: https://bit.ly/GoonieGroup)

Market Events

Monday, September 16th

None

Tuesday, September 17th

08:30 AM ET Retail Sales (MoM) (Aug)

01:00 PM ET 20-Year Bond Auction

Wednesday, September 18th

05:00 AM ET Eurozone CPI (MoM) (Aug)

08:30 AM ET Housing Starts (Aug)

08:30 AM ET Building Permits (Aug)

10:30 AM ET Crude Oil Inventories

02:00 PM ET Fed Interest Rate Decision

02:30 PM ET Chair Powell Press Conference

Thursday, September 19th

08:30 AM ET Initial Jobless Claims

08:30 AM ET Philadelphia Fed Manufacturing Index (Sept)

10:00 AM ET Existing Home Sales (Aug)

10:00 AM ET US Leading Economic Indicators (Aug)

01:00 PM ET 10-Year TIPS Auction

Friday, September 20th

None

Upcoming Earnings

Monday, September 16th

None

Tuesday, September 17th

None

Wednesday, September 18th

Morning: General Mills

Thursday, September 19th

Morning: Cracker Barrel & Darden Restaurants

Evening: FedEx

Friday, September 20th

None

Seasonality Update

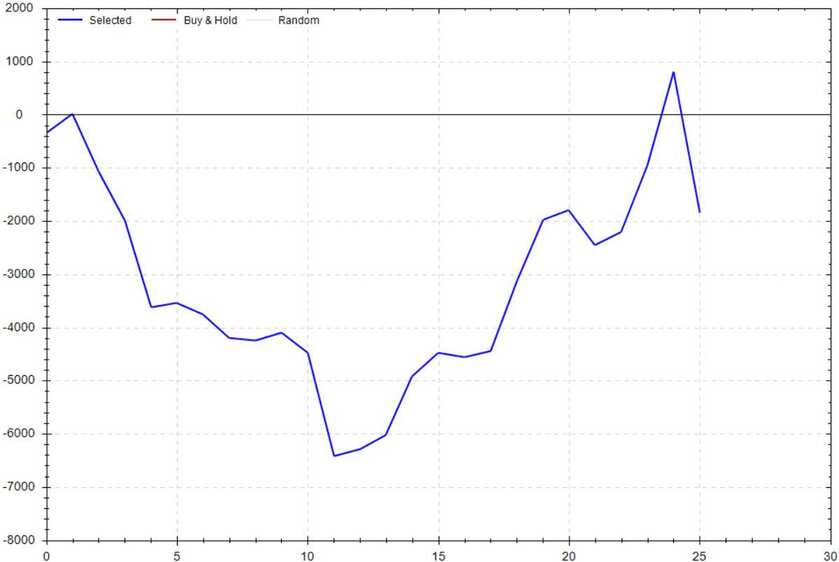

S&P 500 Seasonal Bias (Monday, September 16th)

- Bull Win Percentage: 54%

- Profit Factor: 0.82

- Bias: Neutral

Equity Curve -->

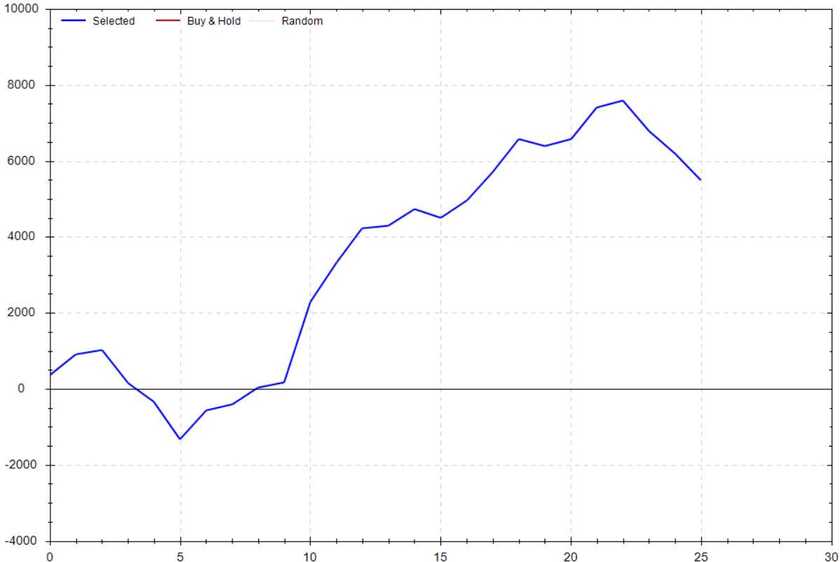

S&P 500 Seasonal Bias (Tuesday, September 17th)

- Bull Win Percentage: 69%

- Profit Factor: 2.12

- Bias: Bullish

Equity Curve -->

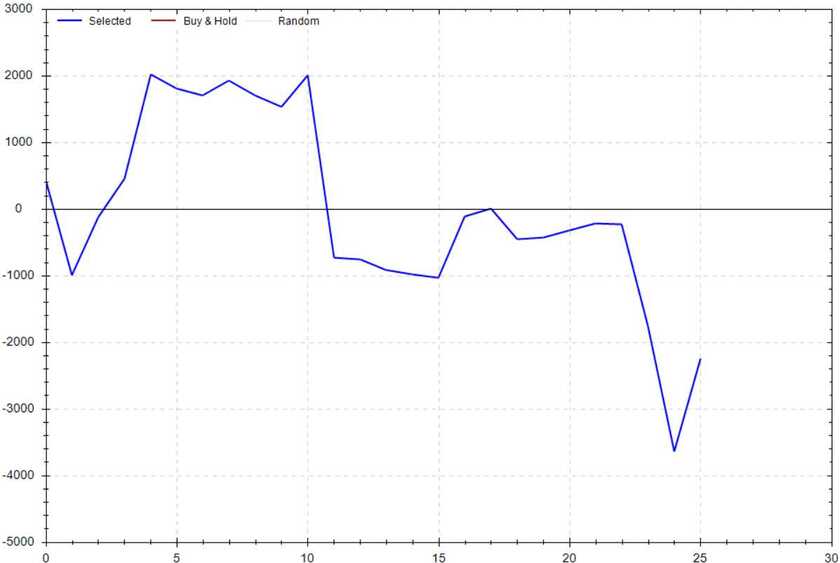

S&P 500 Seasonal Bias (Wednesday, September 18th)

- Bull Win Percentage: 46%

- Profit Factor: 0.75

- Bias: Leaning Bearish

Equity Curve -->

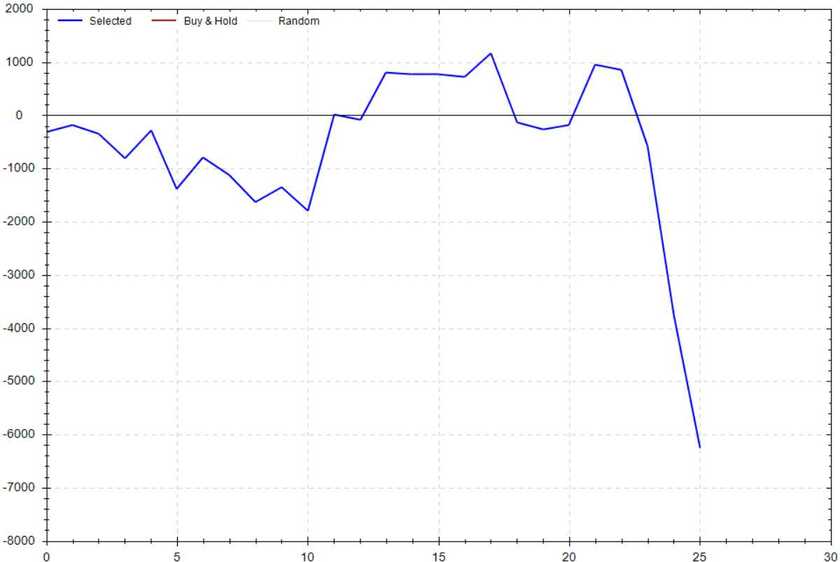

S&P 500 Seasonal Bias (Thursday, September 19th)

- Bull Win Percentage: 35%

- Profit Factor: 0.49

- Bias: Bearish

Equity Curve -->

S&P 500 Seasonal Bias (Friday, September 20th)

- Bull Win Percentage: 38%

- Profit Factor: 0.40

- Bias: Bearish

Equity Curve -->

Notes: These analytics are derived from the performance of the S&P 500 futures contract over the past 25 years. Additionally, results are computed from the futures market open and close.

Options Strategy Update

The 0 DTE signal hit 7 for 10 times (15 for 20 total units) this past week.

Signal Accuracy: ~70%

Piper's Current Signal Streak: 4 Trades

September Record: 29/36 Units

Monday, September 9th

SPY Call Credit Spread (1x Multiple @ $547 / $548) 🟢

QQQ Call Credit Spread (1x Multiple @ $456 / $457) 🟢

Tuesday, September 10th

SPY Call Credit Spread (1x Multiple @ $549 / $550) 🔴

QQQ Call Credit Spread (1x Multiple @ $458 / $459) 🟢

Wednesday, September 11th

SPY Call Credit Spread (2x Multiple @ $549 / $550) 🔴

QQQ Call Credit Spread (2x Multiple @ $460 / $461) 🔴

Thursday, September 12th

SPY Put Credit Spread (3x Multiple @ $552 / $551) 🟢

QQQ Put Credit Spread (3x Multiple @ $466 / $465) 🟢

Friday, September 13th

SPY Put Credit Spread (3x Multiple @ $559 / $558) 🟢

QQQ Put Credit Spread (3x Multiple @ $472 / $471) 🟢

Count of Spanish Words Known By Piper

Cuatro *

This data point is from readings over the past week. The reported information should not be taken as an aggregate or cumulative value for any period beyond the most recent week (Sunday through Saturday). Appropriate alterations were made to account for both travel and time zone shifts.

Notes

RISK WARNING: Trading involves HIGH RISK and YOU CAN LOSE a lot of money. Do not risk any money you cannot afford to lose. Trading is not suitable for all investors. We are not registered investment advisors. We do not provide trading or investment advice. We provide research and education through the issuance of statistical information containing no expression of opinion as to the investment merits of a particular security. Information contained herein should not be considered a solicitation to buy or sell any security or engage in a particular investment strategy. Past performance is not necessarily indicative of future results. Links above include affiliate commission or referrals. I'm part of an affiliate network and I receive compensation from partnering websites.

Both of these trades hit if held until close -- 6 total units!

Both of these trades hit if held until close -- 6 total units! These PCS's were sold at $1.05/ea and were bought back at $0.20/ea -- THIS MEANS MY REALIZED GAIN WAS $!

These PCS's were sold at $1.05/ea and were bought back at $0.20/ea -- THIS MEANS MY REALIZED GAIN WAS $!