Goodbye February, Hello March

Key Weekly Performance Stats:

- S&P 500: -0.44%

- Nasdaq 100: -0.21%

- Russel 2000: -1.33%

- Bitcoin: -3.12%

- Gold: +3.24%

- Silver: +10.75%

Last week, stocks were choppy with traders bouncing between AI optimism and renewed inflation nerves. By Friday, sellers were in control. The Dow dropped about 1.3% on the week, the Nasdaq fell roughly 1%, and the S&P 500 slipped around 0.4%. A hotter inflation read late in the week didn’t help, and you could feel positioning getting a little more cautious into the close.

The economic calendar wasn’t packed, but it packed a punch. Consumer confidence from the Conference Board improved slightly, showing households aren’t rolling over just yet. The bigger story came Friday with January PPI, which ran hotter than expected and reminded everyone that inflation is still sticky. A few other delayed data releases reinforced the same theme: growth is holding up, but price pressures are not fading as quickly as the market would like.

Looking ahead to next week, it's much more straightforward and potentially more market-moving. Monday brings ISM Manufacturing along with the final S&P Global manufacturing PMI. Midweek we get ISM Services and the final S&P services read. Thursday includes Productivity and Import and Export Prices. Then Friday is the main event with the February jobs report. No NYSE holidays, just a full week of trading and plenty of chances for volatility if the data surprises. As always, stick to your trading plan and respect your risk.

Thicc Kohrs

P.S. The official Goonie Discord is live! (FREE Access w/ code GOONIE: https://bit.ly/GoonieGroup)

Earnings

Monday, Mar 2nd

Morning: Berkshire Hathaway & Norwegian Cruise Line

Evening: Riot

Tuesday, Mar 3rd

Morning: Best Buy & Target

Evening: CrowdStrike & GitLab

Wednesday, Mar 4th

Morning: Abercrombie

Evening: Broadcom, Rigetti & WeBull

Thursday, Mar 5th

Morning: Kroger

Evening: Costco

Friday, Mar 6th

None

Market Events

Monday, Mar 2nd

09:45 AM ET S&P Global Manufacturing PMI (Feb)

10:00 AM ET ISM Manufacturing PMI & Prices (Feb)

Tuesday, Mar 3rd

05:00 AM ET Eurozone CPI MoM & YoY (Feb)

Wednesday, Mar 4th

08:15 AM ET ADP Nonfarm Employment Change (Feb)

09:45 AM ET S&P Global Services PMI (Feb)

10:00 AM ET ISM Non-Manufacturing PMI & Prices (Feb)

Thursday, Mar 5th

08:30 AM ET Initial Jobless Claims

Friday, Mar 6th

08:30 AM ET Unemployment Rate (Feb)

08:30 AM ET Nonfarm Payrolls (Feb)

Seasonality Update

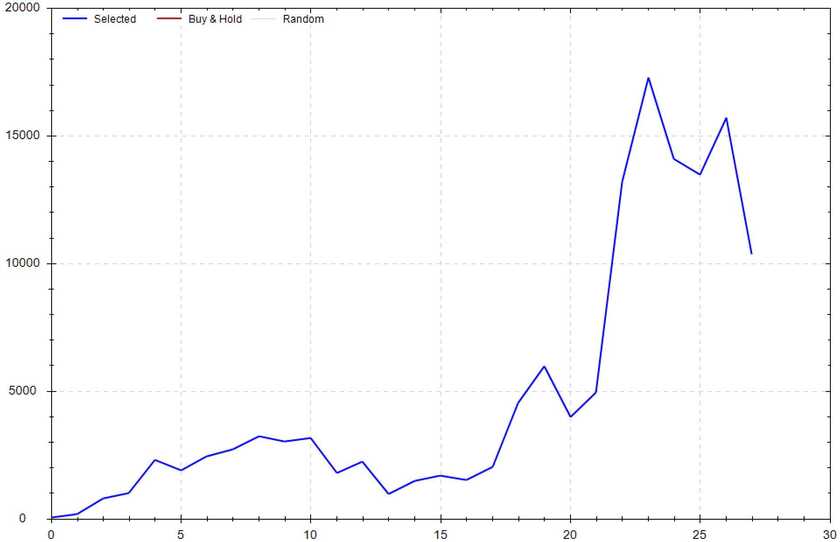

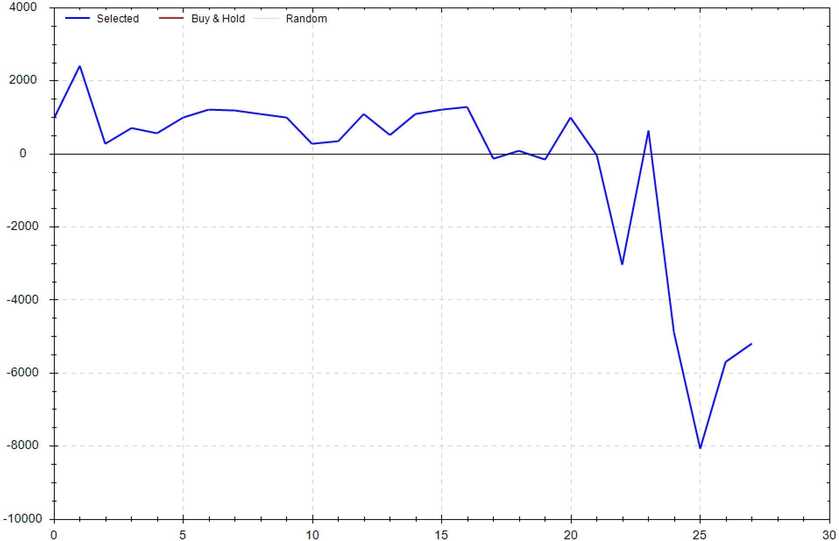

S&P 500 Seasonal Bias (Monday, Mar 2nd)

- Bull Win Percentage: 68%

- Profit Factor: 1.71

- Bias: Bullish

Equity Curve -->

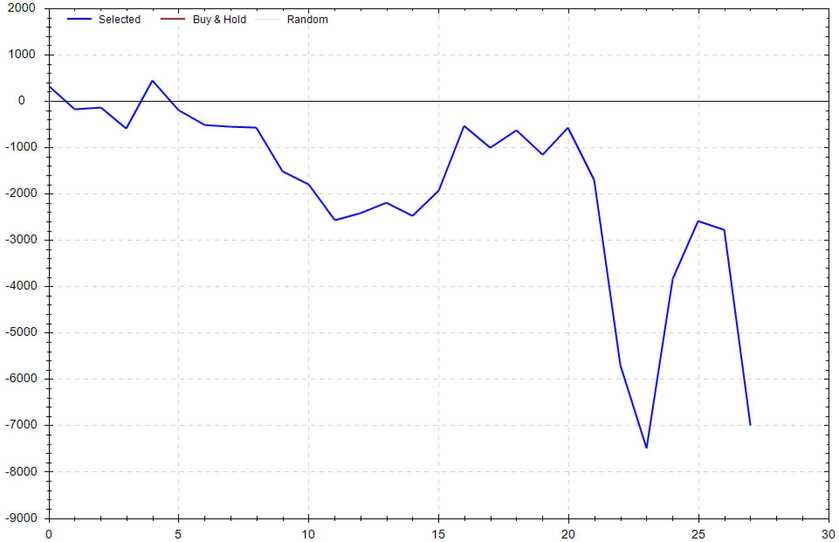

S&P 500 Seasonal Bias (Tuesday, Mar 3rd)

- Bull Win Percentage: 39%

- Profit Factor: 0.58

- Bias: Bearish

Equity Curve -->

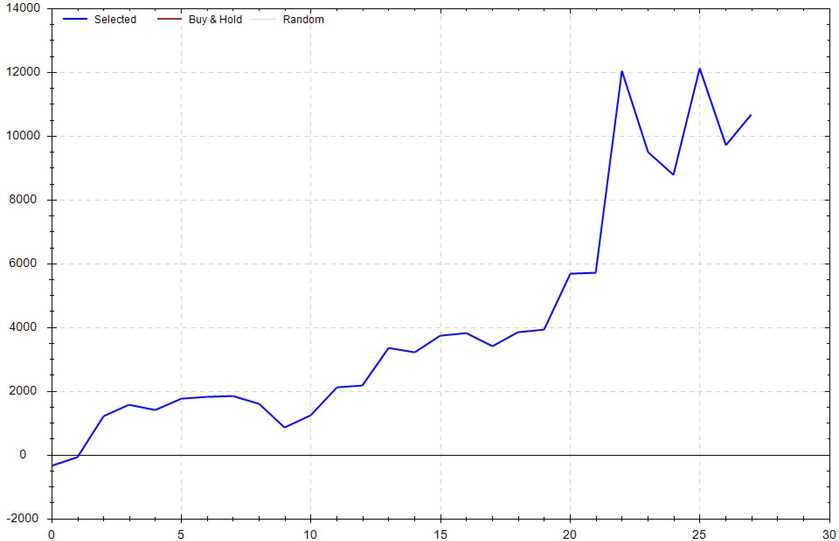

S&P 500 Seasonal Bias (Wednesday, Mar 4th)

- Bull Win Percentage: 68%

- Profit Factor: 2.38

- Bias: Bullish

Equity Curve -->

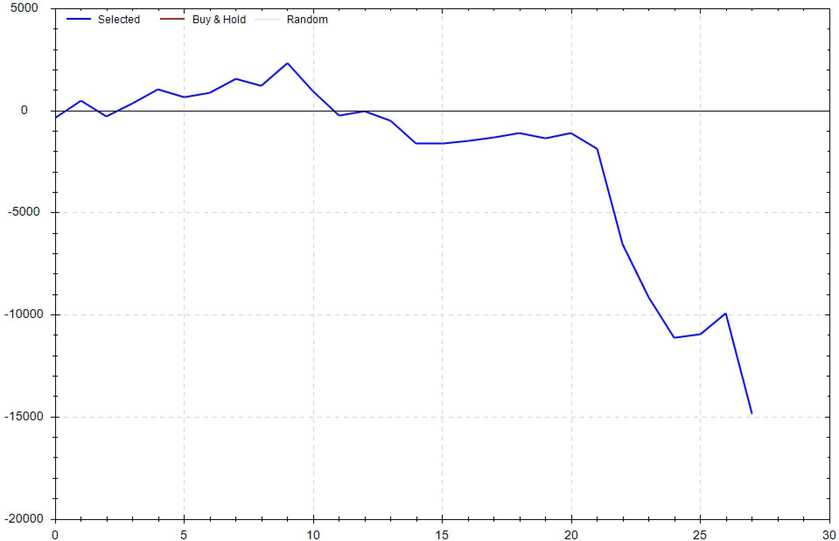

S&P 500 Seasonal Bias (Thursday, Mar 5th)

- Bull Win Percentage: 46%

- Profit Factor: 0.30

- Bias: Bearish

Equity Curve -->

S&P 500 Seasonal Bias (Friday, Mar 6th)

- Bull Win Percentage: 54%

- Profit Factor: 0.71

- Bias: Leaning Bearish

Equity Curve -->

Notes: These analytics are derived from the performance of the S&P 500 futures contract over the past +25 years. Additionally, results are computed from the futures market open and close.

Options Strategy Update

The 0 DTE signal hit 10 for 10 times (20 for 20 total units) this past week.

Signal Accuracy: ~100%

Note: These signals are posted in real-time in the Goonie Trading Discord. You can join the Goonie Discord for FREE w/ code GOONIE (Click Here!)!!!

Piper's Current Signal Streak: 24 Trades

February Record: 70/74 Units

Monday, Feb 23rd

SPY Call Credit Spread (2x Multiple @ $690 / $691) 🟢

QQQ Call Credit Spread (2x Multiple @ $608 / $609) 🟢

Tuesday, Feb 24th

SPY Put Credit Spread (2x Multiple @ $680 / $679) 🟢

QQQ Put Credit Spread (2x Multiple @ $599 / $598) 🟢

Wednesday, Feb 25th

SPY Put Credit Spread (2x Multiple @ $689 / $688) 🟢

QQQ Put Credit Spread (2x Multiple @ $611 / $610) 🟢

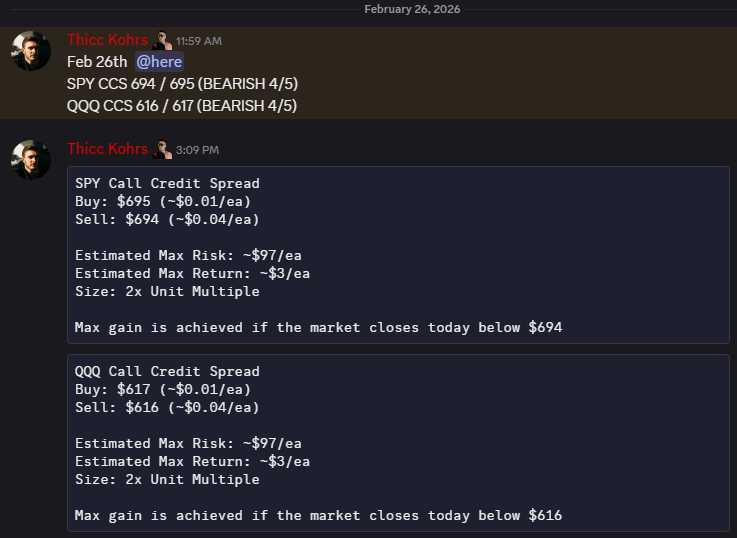

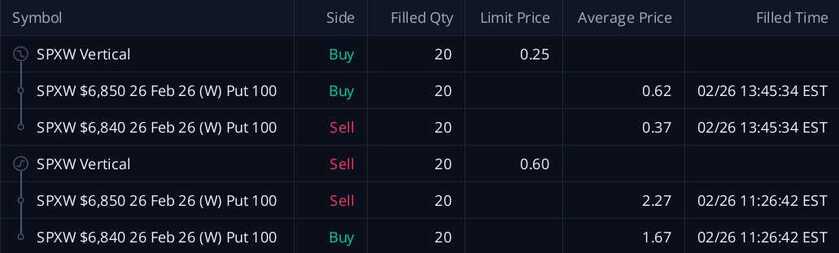

Thursday, Feb 26th

SPY Call Credit Spread (2x Multiple @ $694 / $695) 🟢

QQQ Call Credit Spread (2x Multiple @ $616 / $17) 🟢

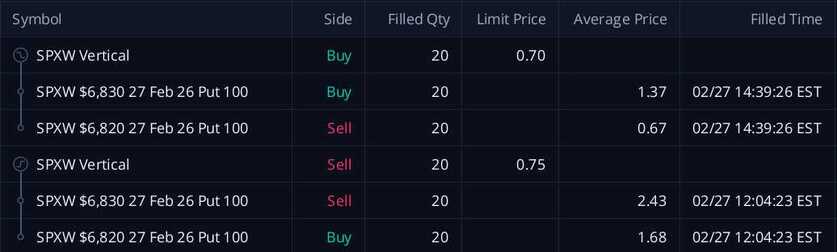

Friday, Feb 27th

SPY Put Credit Spread (2x Multiple @ $681 / $680) 🟢

QQQ Put Credit Spread (2x Multiple @ $602 / $601) 🟢

Times Yelled At Me About My Lighting

11 *

* This data point is from readings over the past week. The reported information should not be taken as an aggregate or cumulative value for any period beyond the most recent week (Sunday through Saturday). Appropriate alterations were made to account for both travel and time zone shifts.

Notes

RISK WARNING: Trading involves HIGH RISK and YOU CAN LOSE a lot of money. Do not risk any money you cannot afford to lose. Trading is not suitable for all investors. We are not registered investment advisors. We do not provide trading or investment advice. We provide research and education through the issuance of statistical information containing no expression of opinion as to the investment merits of a particular security. Information contained herein should not be considered a solicitation to buy or sell any security or engage in a particular investment strategy. Past performance is not necessarily indicative of future results. Links above include affiliate commission or referrals. I'm part of an affiliate network and I receive compensation from partnering websites.

Both of these trades missed. Both of these trades hit if held until close -- 4 total units!

Both of these trades missed. Both of these trades hit if held until close -- 4 total units! These PCS's were sold at $0.75/ea and were bought back at $0.70/ea -- THIS MEANS MY REALIZED GAIN WAS $0!

These PCS's were sold at $0.75/ea and were bought back at $0.70/ea -- THIS MEANS MY REALIZED GAIN WAS $0!

Both of these trades missed. Both of these trades hit if held until close -- 4 total units!

Both of these trades missed. Both of these trades hit if held until close -- 4 total units! These PCS's were sold at $0.60/ea and were bought back at $0.25/ea -- THIS MEANS MY REALIZED GAIN WAS $700!

These PCS's were sold at $0.60/ea and were bought back at $0.25/ea -- THIS MEANS MY REALIZED GAIN WAS $700!