Hopping Into More Chaos

Hey,

Key Weekly Performance Stats:

- S&P 500: -1.50%

- Nasdaq 100: -2.31%

- Russel 2000: +1.64%

- Bitcoin: +1.30%

Last week, stocks once again experienced significant volatility, largely driven by President Trump’s tariff policies. A brief rally on April 14 followed signals from the administration that consumer electronics and auto parts might receive exemptions. However, the relief was short-lived, as markets tumbled mid-week amid renewed tariff uncertainty and Fed Chair Powell’s warnings about a potential economic slowdown and rising inflation. On April 16, the S&P 500 and Nasdaq dropped 2.2% and 3.1%, respectively, with tech stocks—particularly Nvidia—hit hard by new restrictions on chip exports to China. By week’s end, uncertainty remained elevated, reflecting persistent investor concerns over tariffs and the Fed’s cautious stance on rate cuts.

Economic indicators delivered mixed signals. Retail sales rose a robust 1.4% month-over-month in March, driven by strength in autos and food services—suggesting consumers may be front-running purchases ahead of anticipated tariffs. However, housing starts fell 11% in March, indicating homebuilder caution in the face of policy uncertainty. The Fed’s decision to hold rates steady, along with Powell’s comments warning that tariffs could push inflation to 3.5–4%, reinforced a wait-and-see approach. Gold prices remained elevated, up over 25% year-to-date, as investors sought safety amid the turmoil.

Looking ahead, keep an eye on earnings reports—especially from tech and consumer goods companies—for insights into tariff-related cost pressures and forward guidance. Key economic data, including PMI releases and new home sales, will offer further clues on the state of economic momentum. The Fed’s next moves will be crucial, as markets closely watch for any signals of rate cuts in response to inflationary pressure from tariffs. Developments in U.S.-China trade relations, including potential Chinese stimulus measures, could also spark fresh volatility. As always, stick to your trading plan, manage your risk, and Godspeed.

Best,

Thicc Kohrs

P.S. The official Goonie Discord is live! (FREE Access w/ code GOONIE: https://bit.ly/GoonieGroup)

Earnings

Monday, April 21st

None

Tuesday, April 22nd

Morning: Halliburton, Lockheed Martin & Verizon

Evening: Capital One, SAP & Tesla

Wednesday, April 23rd

Morning: AT&T, Boeing & Virtu

Evening: Chipotle & IBM

Thursday, April 24th

Morning: American Airlines, Merck, Pepsico & Southwest

Evening: Alphabet, Intel & T Mobile

Friday, April 25th

Morning: Phillips 66 & SLB

Market Events

Monday, April 21st

10:00 AM ET US Leading Economic Indicators (Mar)

Tuesday, April 22nd

09:30 AM ET Philadelphia Fed President Harker Speaks

02:00 PM ET Minneapolis Fed President Kashkari Speaks

02:30 PM ET Richmond Fed President Barking Speaks

Wednesday, April 23rd

09:45 AM ET S&P Global Manufacturing & Services PMI (Apr)

10:00 AM ET New Home Sales (Mar)

10:30 AM ET Crude Oil Inventories

02:00 PM ET Fed Beige Book

Thursday, April 24th

08:30 AM ET Durable Goods Orders (Mar)

08:30 AM ET Initial Jobless Claims

10:00 AM ET Existing Home Sales (Mar)

05:00 PM ET Minneapolis Fed President Kashkari Speaks

Friday, April 25th

10:00 AM ET Consumer Sentiment

Seasonality Update

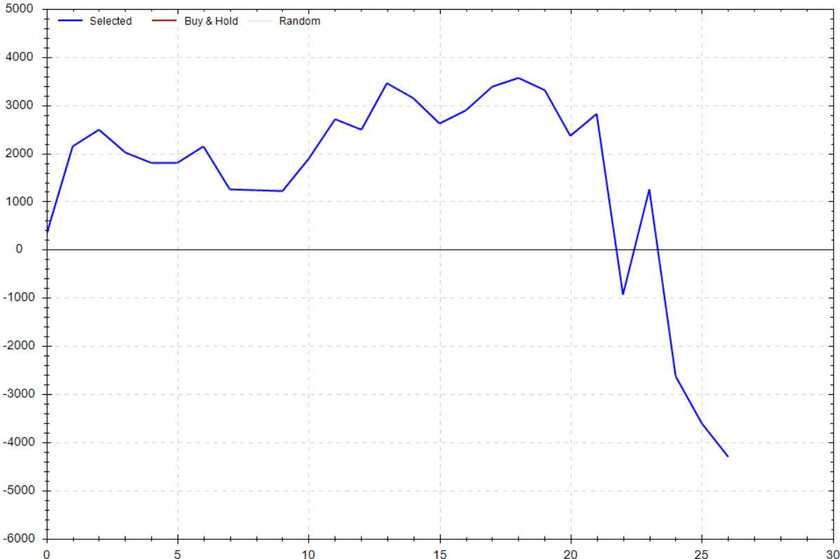

S&P 500 Seasonal Bias (Monday, April 21st)

- Bull Win Percentage: 44%

- Profit Factor: 0.67

- Bias: Bearish

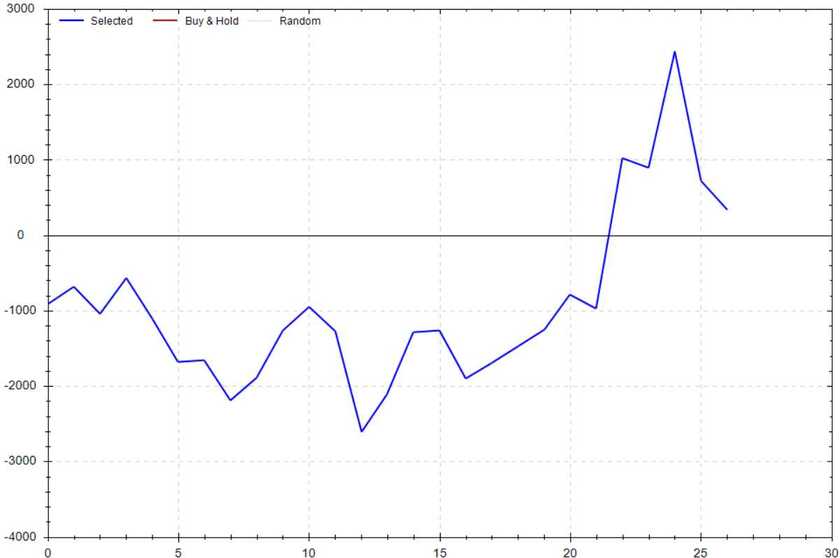

Equity Curve -->

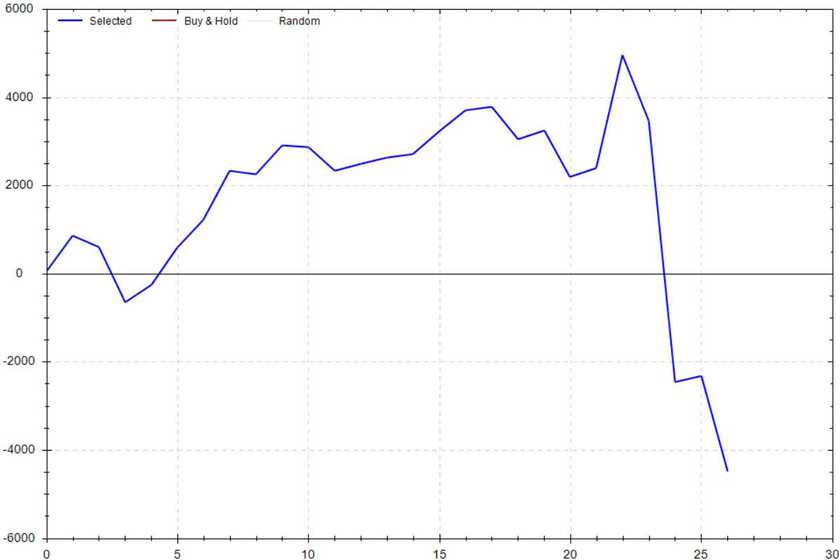

S&P 500 Seasonal Bias (Tuesday, April 22nd)

- Bull Win Percentage: 63%

- Profit Factor: 0.67

- Bias: Bearish

Equity Curve -->

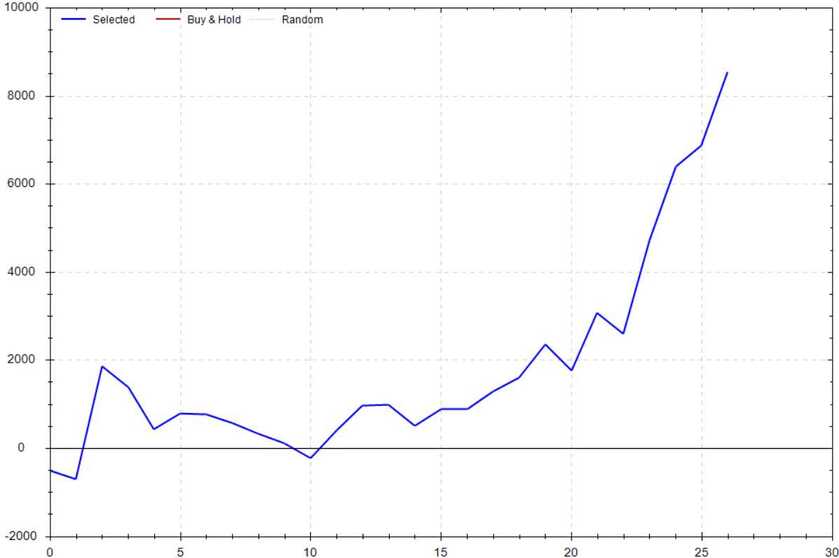

S&P 500 Seasonal Bias (Wednesday, April 23rd)

- Bull Win Percentage: 52%

- Profit Factor: 2.82

- Bias: Bullish

Equity Curve -->

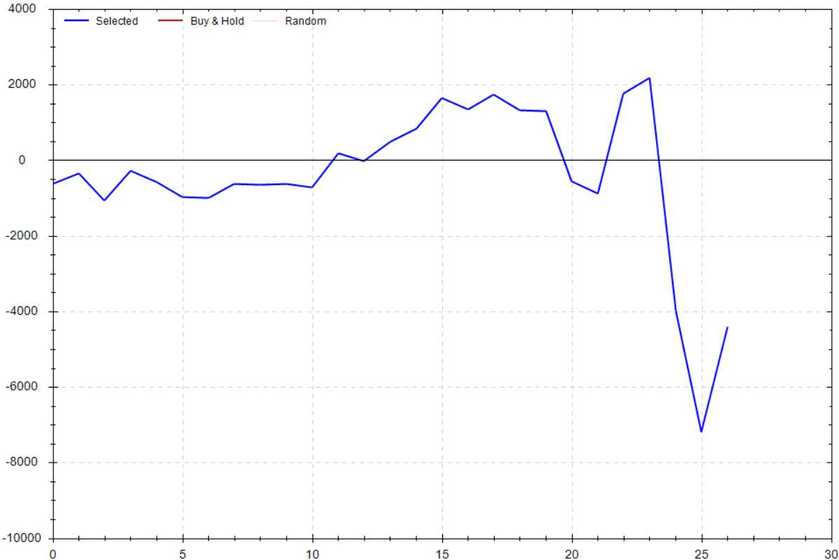

S&P 500 Seasonal Bias (Thursday, April 24th)

- Bull Win Percentage: 44%

- Profit Factor: 0.70

- Bias: Bearish

Equity Curve -->

S&P 500 Seasonal Bias (Friday, April 25th)

- Bull Win Percentage: 56%

- Profit Factor: 1.04

- Bias: Leaning Bullish

Equity Curve -->

Notes: These analytics are derived from the performance of the S&P 500 futures contract over the past 25 years. Additionally, results are computed from the futures market open and close.

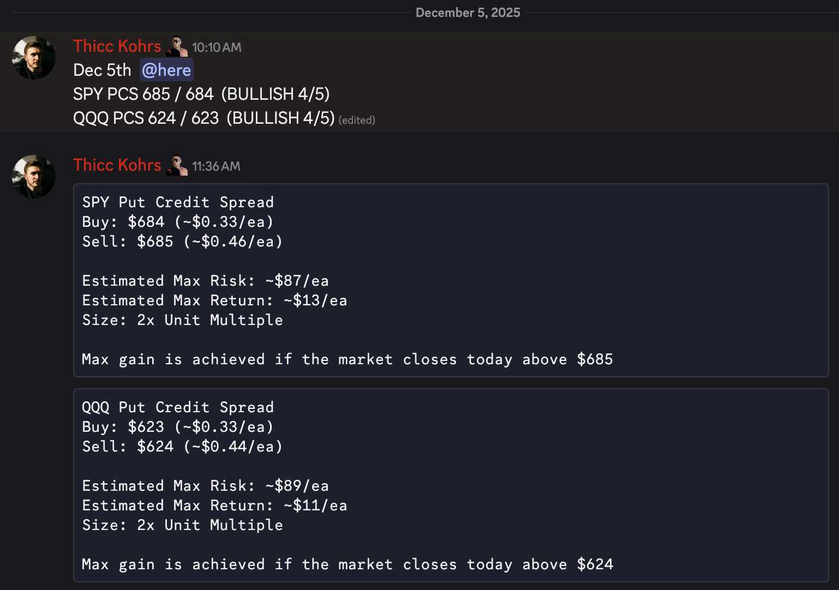

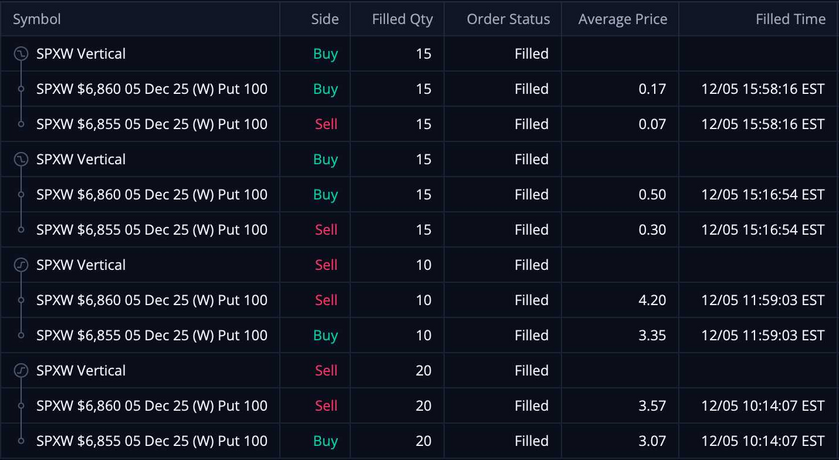

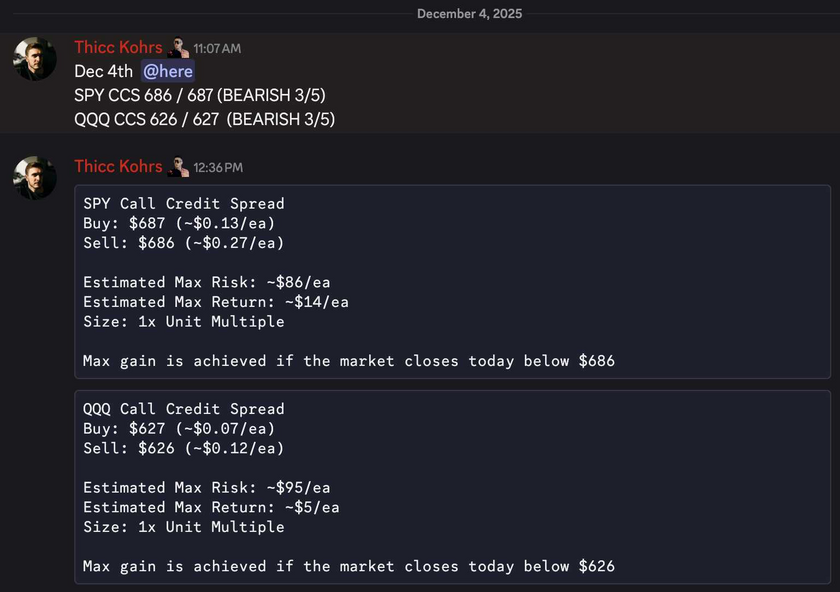

Options Strategy Update

The 0 DTE signal hit 6 for 6 times (14 for 14 total units) this past week.

Signal Accuracy: ~100%

Note: These signals are posted in real-time in the Goonie Trading Discord. You can join the Goonie Discord for FREE w/ code GOONIE (Click Here!)!!!

Piper's Current Signal Streak: 22 Trades

April Record: 20/20 Units

Monday, April 14th

SPY Call Credit Spread (2x Multiple @ $545 / $546) 🟢

QQQ Call Credit Spread (2x Multiple @ $466 / $467) 🟢

Tuesday, April 15th

SPY Put Credit Spread (3x Multiple @ $537 / $536) 🟢

QQQ Put Credit Spread (3x Multiple @ $456 / $455) 🟢

Wednesday, April 16th

No Signal Produced

Thursday, April 17th

SPY Call Credit Spread (2x Multiple @ $531 / $532) 🟢

QQQ Call Credit Spread (2x Multiple @ $449 / $450) 🟢

Friday, April 18th

No Signal Produced (Market Closed)

Easter Eggs Found

0 *

* This data point is from readings over the past week. The reported information should not be taken as an aggregate or cumulative value for any period beyond the most recent week (Sunday through Saturday). Appropriate alterations were made to account for both travel and time zone shifts.

Notes

RISK WARNING: Trading involves HIGH RISK and YOU CAN LOSE a lot of money. Do not risk any money you cannot afford to lose. Trading is not suitable for all investors. We are not registered investment advisors. We do not provide trading or investment advice. We provide research and education through the issuance of statistical information containing no expression of opinion as to the investment merits of a particular security. Information contained herein should not be considered a solicitation to buy or sell any security or engage in a particular investment strategy. Past performance is not necessarily indicative of future results. Links above include affiliate commission or referrals. I'm part of an affiliate network and I receive compensation from partnering websites.

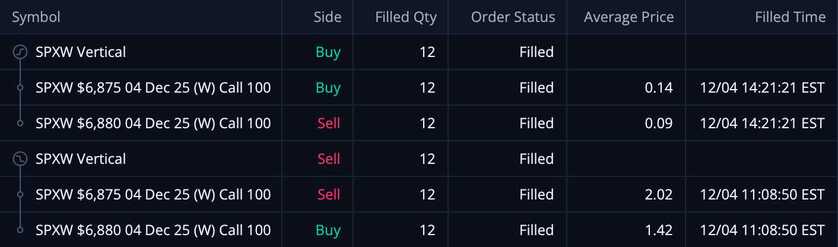

Both of these trades hit if held until close -- 4 total units!

Both of these trades hit if held until close -- 4 total units! These CCS's were sold at an average of $0.62/ea and were bought back at an average $0.15/ea -- THIS MEANS MY REALIZED GAIN WAS $1,400!

These CCS's were sold at an average of $0.62/ea and were bought back at an average $0.15/ea -- THIS MEANS MY REALIZED GAIN WAS $1,400!

Both of these trades hit if held until close -- 2 total units!

Both of these trades hit if held until close -- 2 total units! These CCS's were sold at $0.60/ea and were bought back at $0.05/ea -- THIS MEANS MY REALIZED GAIN WAS $660!

These CCS's were sold at $0.60/ea and were bought back at $0.05/ea -- THIS MEANS MY REALIZED GAIN WAS $660!

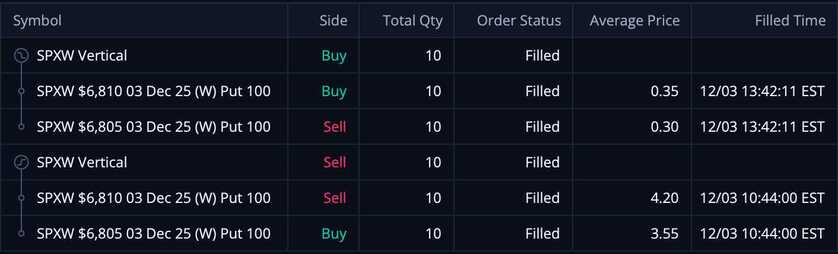

Both of these trades hit if held until close -- 4 total units!

Both of these trades hit if held until close -- 4 total units! These PCS's were sold at $0.65/ea and were bought back at $0.05/ea -- THIS MEANS MY REALIZED GAIN WAS $600!

These PCS's were sold at $0.65/ea and were bought back at $0.05/ea -- THIS MEANS MY REALIZED GAIN WAS $600!